Market Morsel: Lanolin = wool + oil

Market Morsel

Lanolin from the Latin lāna (wool) and oleum (oil). It’s a sign!

Energy is a huge talking point at the moment. We have seen fuel prices rise to record levels in Australia on increasing crude values.

As discussed in many EP3 articles, there are sometimes logical relationships between commodities. Earlier last year, I wrote an article I CU Wool, and later followed up with Wool Comes a Copper. This was a look at the relationship between copper and wool and the logic behind them following quite similar trends.

So with the current rising crude oils, what about the relationship with wool?

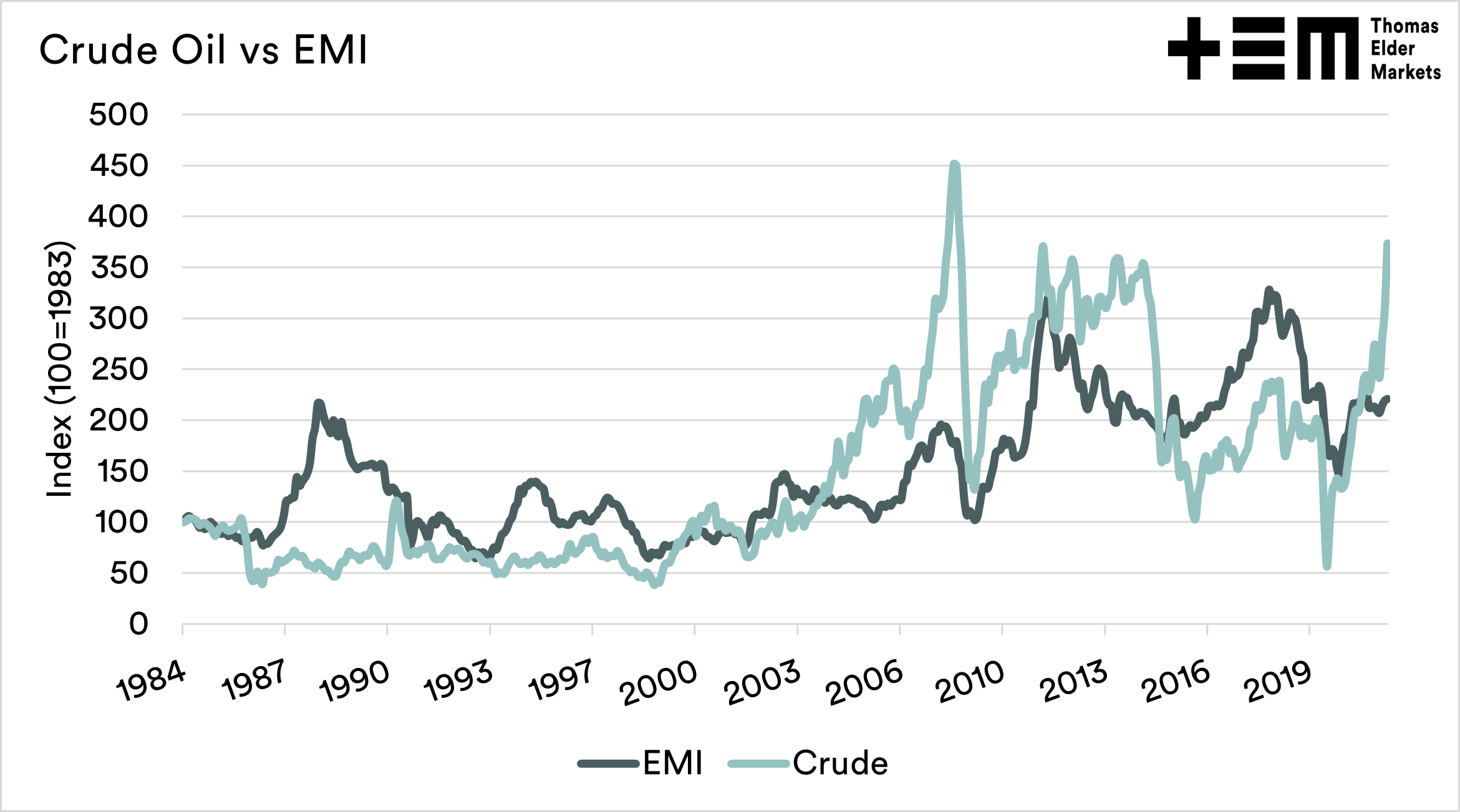

In the first chart below, an index was created for wool (EMI) and crude oil, with 1984 being 100. There is a similar slight trend in movement. We can often see a similar trend in direction, especially in recent years.

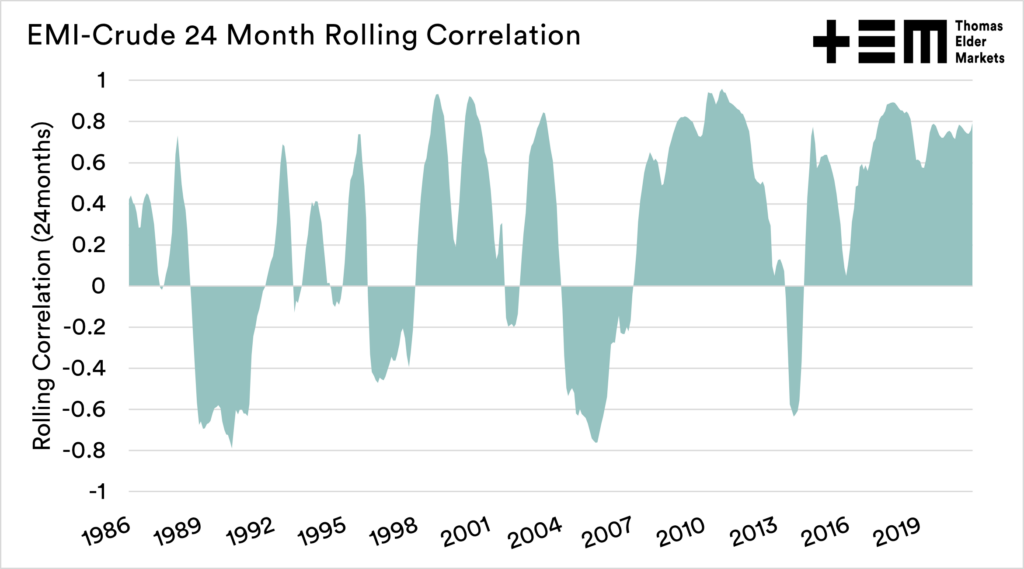

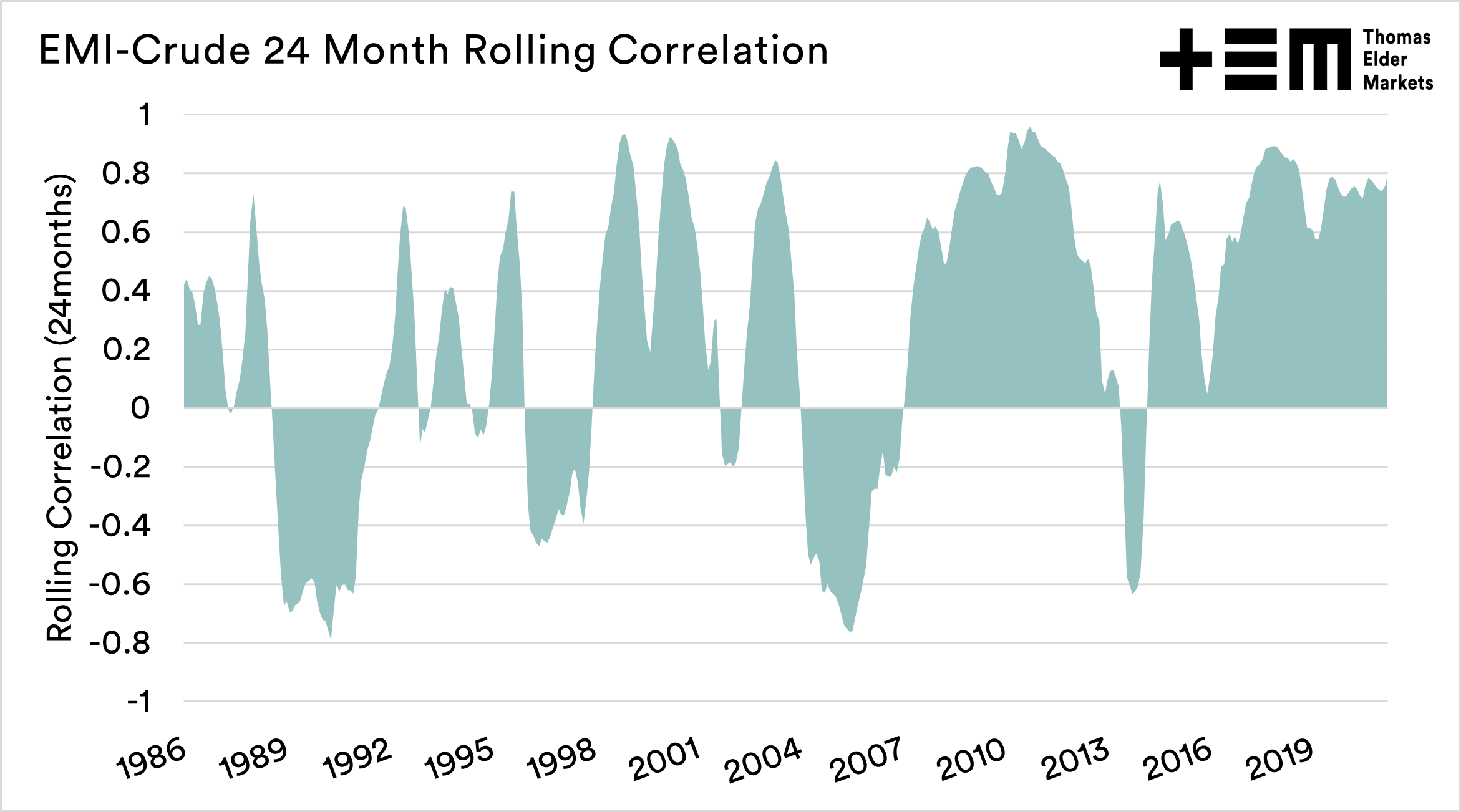

A rolling correlation can be quite helpful to show relationships between pricing points. In the second chart, a 24-month rolling correlation is displayed. A perfect correlation would be 1, no correlation 0, and a negative correlation -1.

For most of 2015 to the present, the correlation between crude and wool has been quite strong. It is important to remember that correlation does not equal causation, but a few thoughts on why crude could impact wool pricing:

- Higher crude oil prices could lead to more expensive artificial fibres (polyester etc.). This could make wool seem a more attractive proposition.

- High crude oil prices can stifle spending as inflation increases. Wool is a high-value discretionary spend. If consumer spending is impacted by inflation, that could impact wool demand.

So one negative and one positive. All in all, wool and crude have had a close relationship in recent years; the recent spike may see that trend separate as the crude oil price takes off into the stratosphere. We have seen that occur in previous crude rallies.