A look at basis differently.

The Snapshot

- Soil moisture is an indicator of future production.

- High soil moisture in the June-September generally points towards low basis.

- Basis is largely driven by supply. Too little supply and basis rises.

- Production in recent years has been high causing basis to crash.

- Basis may continue to discounted for sometime.

- The wet crop will see large premiums for protein, and discounts for lower quality.

The Detail

At EP3 (and TEM before), I have discussed basis a lot. We do this as it gives a look at our relative value to other points. This could be against other nations’ physical pricing or futures levels. Over this weekend, I thought I would look at it a bit further after comments from readers on this recent article (see here).

One of the first articles we wrote when we established this venture back in 2020 was on basis (see here). This was a quick primer on what basis is, and I recommend giving it a quick read.

Soil Moisture

For the most part, I like to stay in my lane as a market analyst; other analysts like to play pretend agronomist. However, soil moisture clearly has an impact on production, so that is a good place to start.

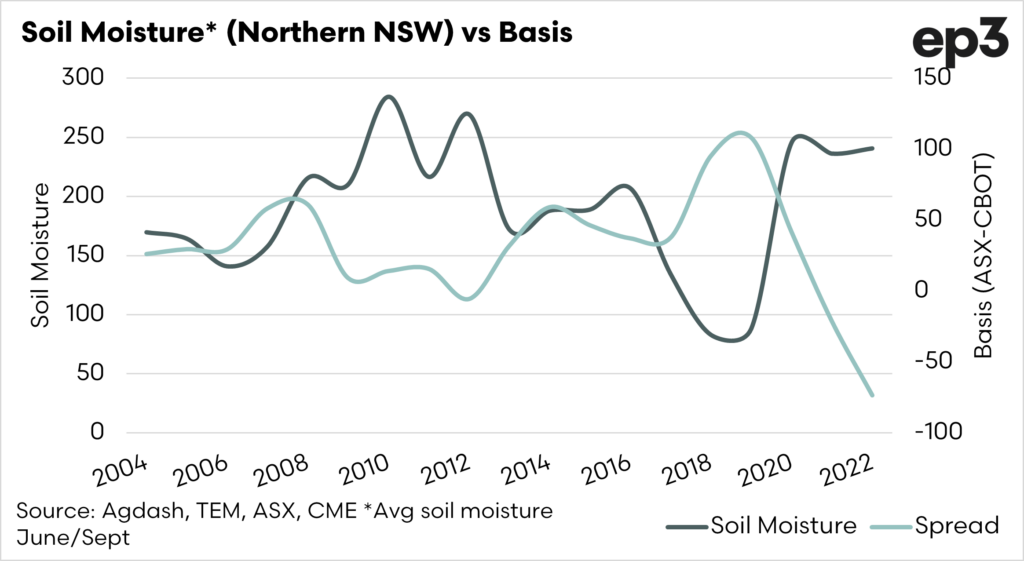

The chart below displays soil moisture for northern NSW vs ASX to CBOT basis. The soil moisture is averaged from June to September.

The Northern NSW region is important for basis due to the great domestic demand. This region has a significant concentration of mouths (pigs and cattle). In the event of a dry season in this region, the grain must be carted further from the south or in dire circumstances SA/WA.

We can see that the basis level is significantly lower than it has previously been, even when moisture levels for the growing season were higher.

Production vs basis

Basis is driven largely by two factors – supply and demand. The factor that drives it most in Australia, as an export nation, is supply.

At its most basic, when supply is low, domestic consumers have to pay more to keep the grain from flowing overseas. We saw this in the recent drought.

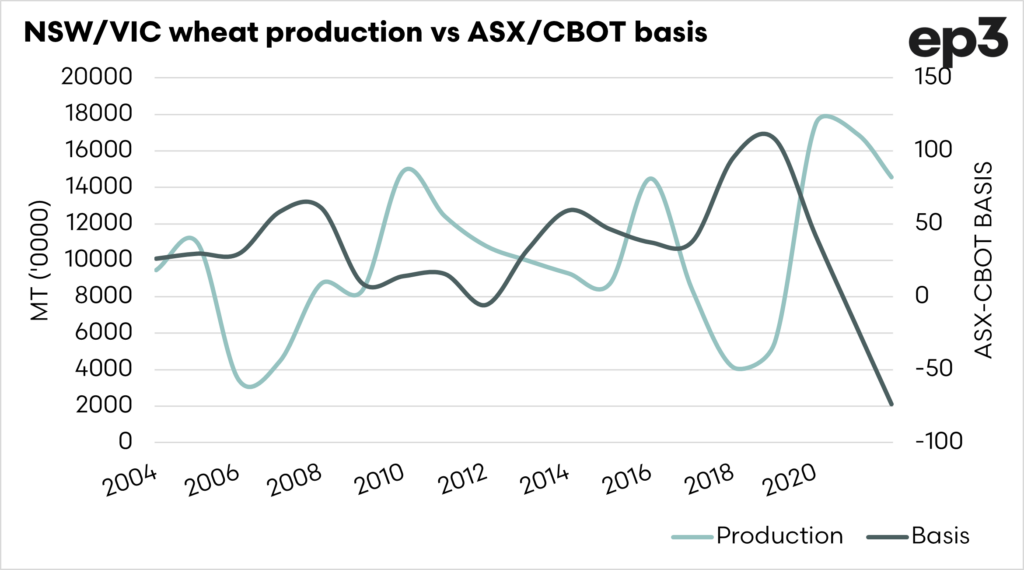

The converse occurs during a big year of production. The chart below shows the relationship between production and ASX basis (to CBOT). The period chosen for the basis is December, as this is when the majority of grain will be sold, for 2022, we have chosen the current month.

What we can see in this case is that the current discount for Australian wheat is low, compared to previous large years. This is partially attributed to the high carryover.

Another factor we regularly point towards as a market driver is behaviour (see here). In the case of large crops, there is no fear by buyers (other than floods) that they will get access to the grain they require. So no one fears missing out, which helps keep pricing levels down.