Are farmers getting screwed over on GM canola spread?

The Snapshot

- In dollar terms, the GM canola spread in Western Australia has been at its highest level since 2015.

- In percentage terms, the spread has been at similar levels in 2019 and 2020.

- The non-GM and GM prices tend to follow one another very closely.

- The spread has really blown out since October.

- The spread is currently influenced by a number of factors.

- Europe had the third lowest crop since 2010.

- Concerns about tariffs from China on Canadian GM canola

- Concerns about tariffs from US on Canadian GM canola.

- The spread could be considered a premium to non-GM instead of a discount to GM.

- It’s supply and demand that drives the price.

The Detail

It has been a while since we have reviewed GM canola on EP3 (here), but we have spoken about it on the AgWatchers podcast which you can subscribe to by clicking here.

So let’s get into it. At the moment, there has been a lot of discussion about GM canola and the big price spread to non-GM. There has been the typical speculation that this is due to market manipulation. I don’t agree that it is, in my view. It is supply and demand.

In this quick analysis, I am using Kwinana as the pricing point, as it is the area with the most GM in Australia, and other states are showing similar patterns of large spreads.

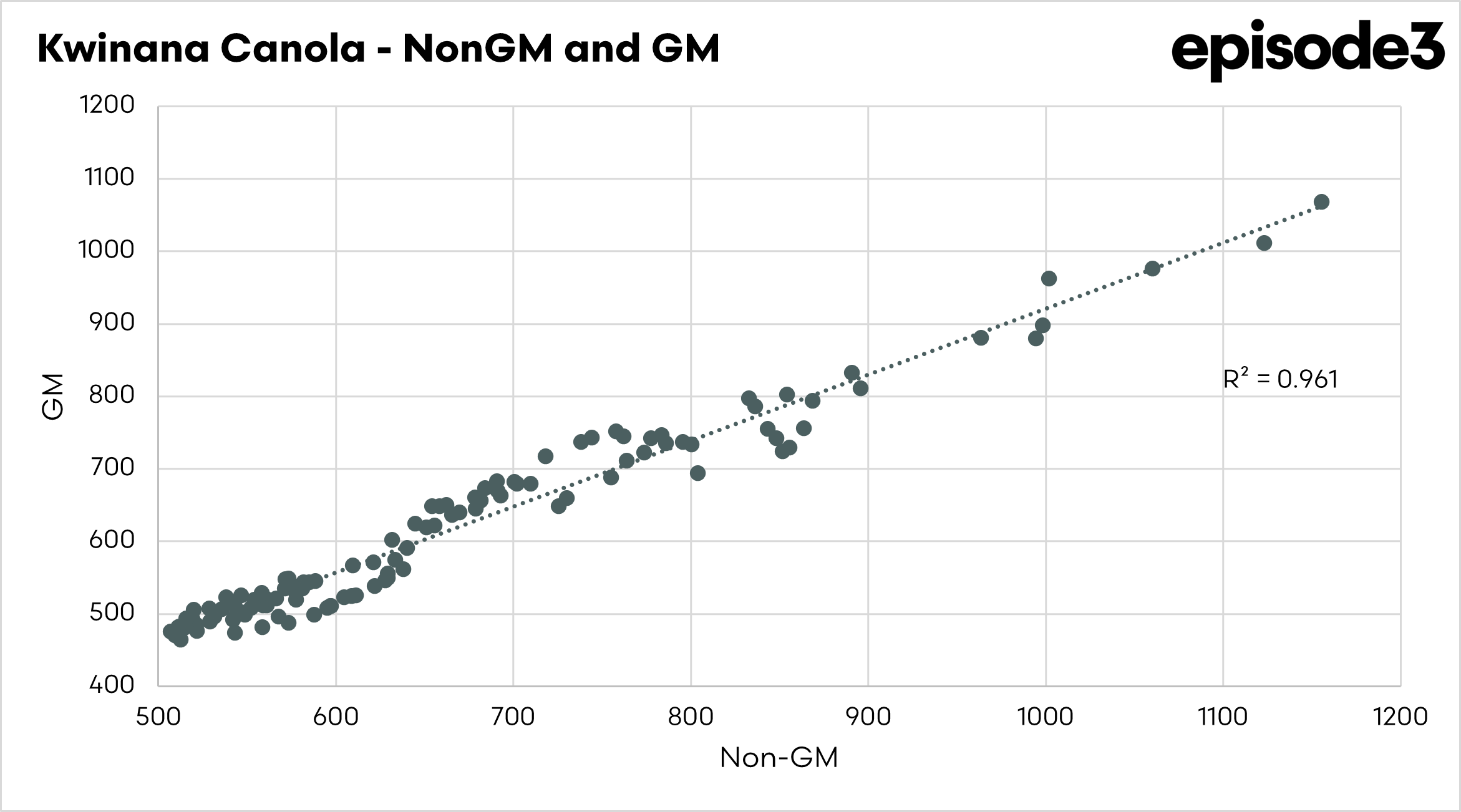

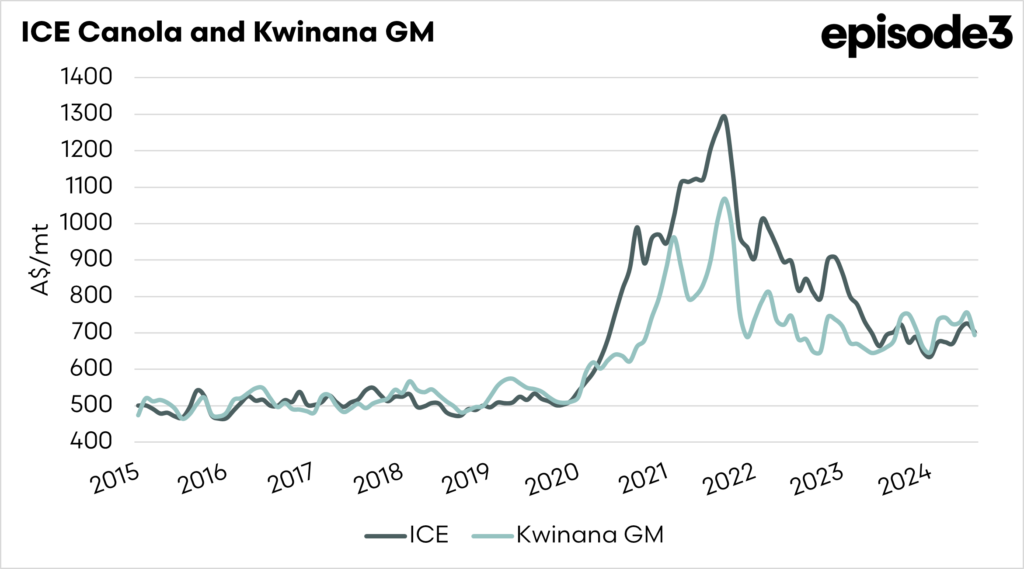

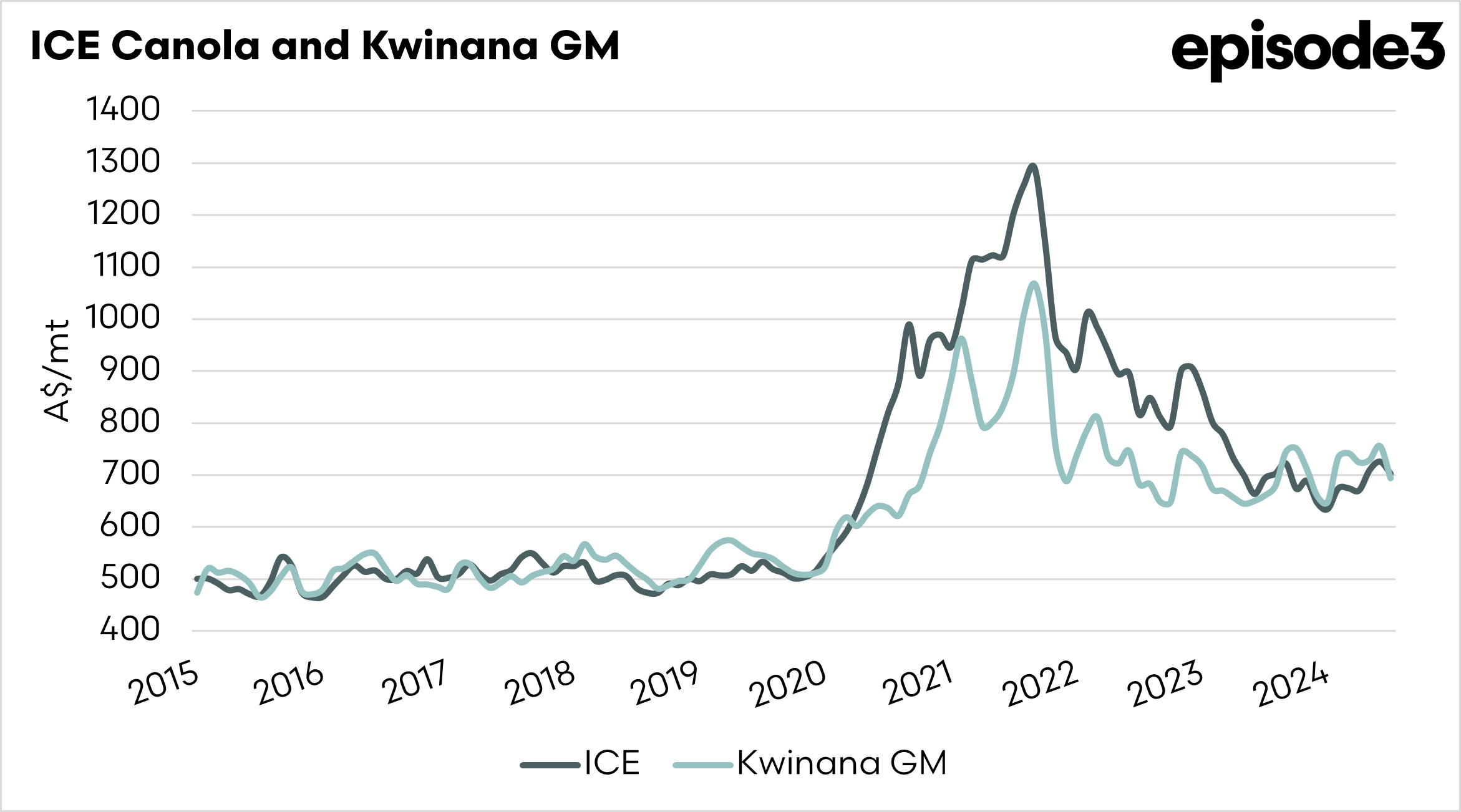

The chart above shows the monthly price of GM and non-GM prices. The correlation between prices is 0.96, with 0 being the no correlation and 1 being the perfect correlation. If we examine the correlation of returns, the correlation drops to 0.90. However, this remains an extremely strong correlation, as returns are generally considered a more effective way of calculating correlations.

This tells us that the prices of non-GM and GM tend to follow each other very closely.

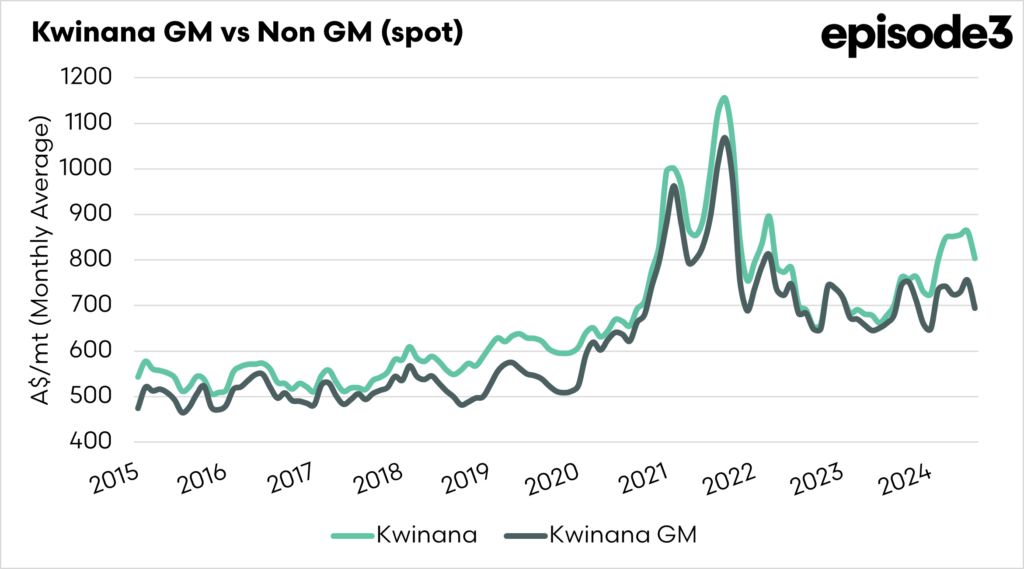

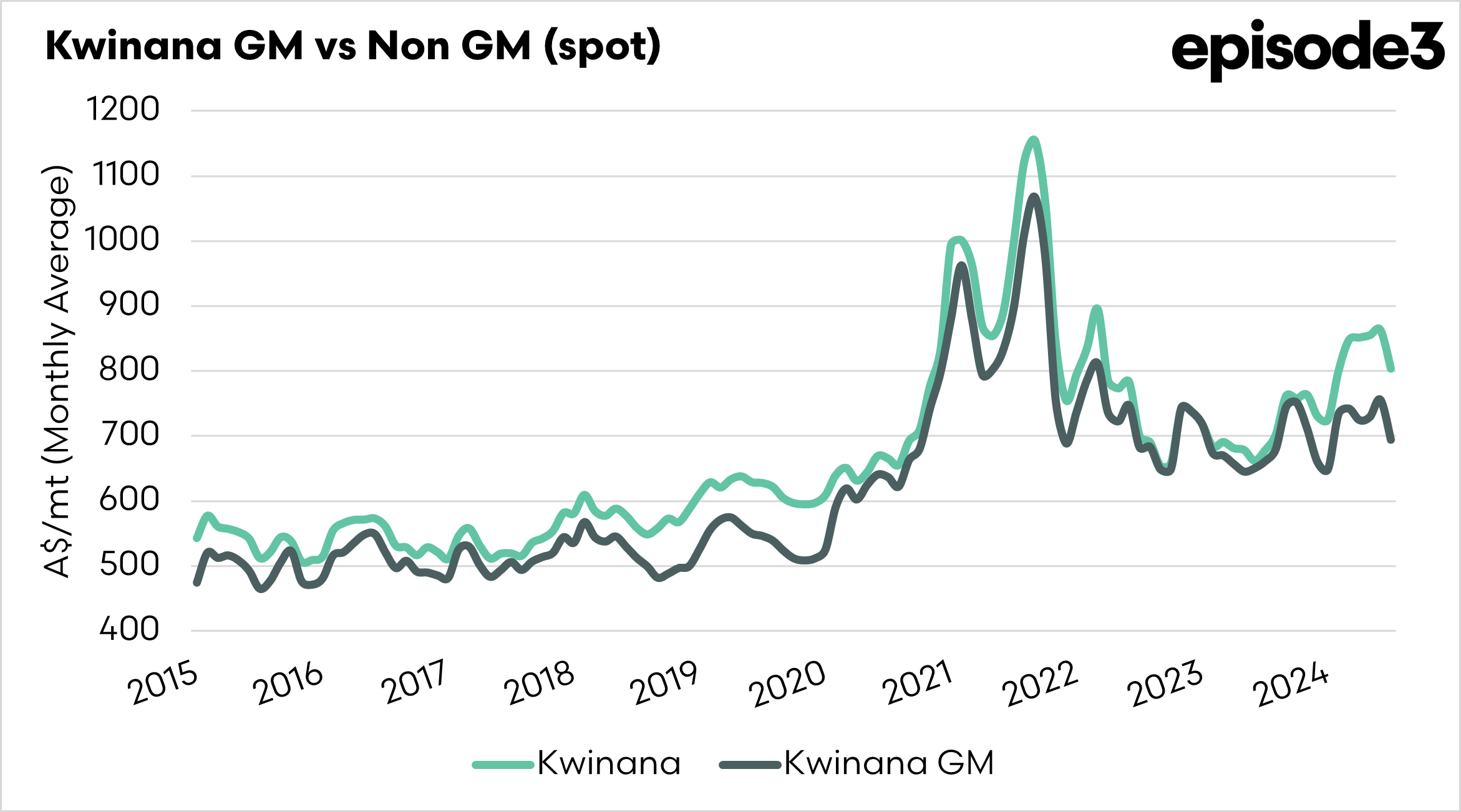

The chart below shows the monthly price of both canolas, and we can see that whilst they are following the same trend, in 2024, since around October, GM canola has had a significant spread to non-GM.

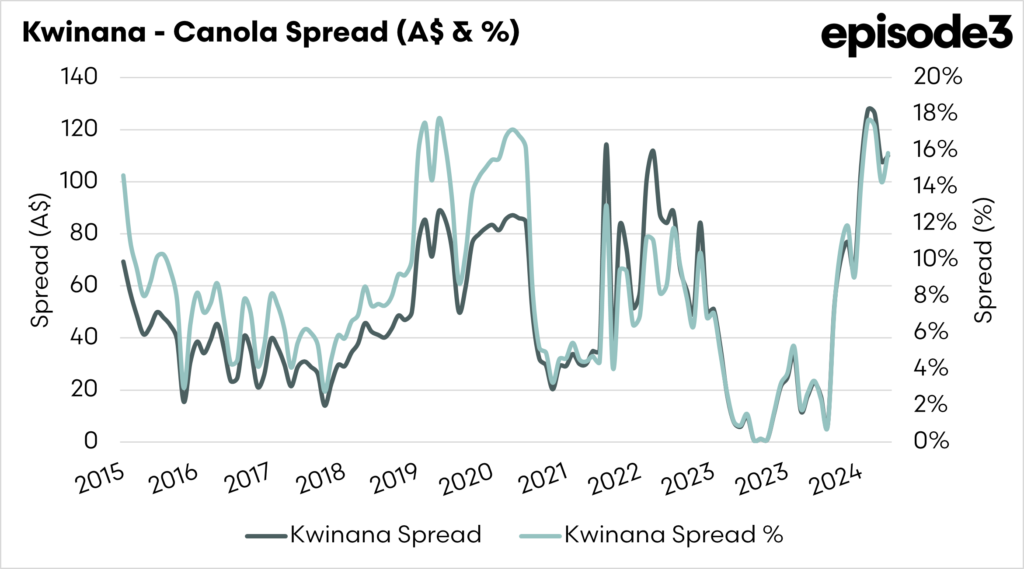

The chart below highlights the spread between non-GM and GM, again on a monthly basis. I have added this in as both an A$ and % spread.

We can see from this that the spread in dollar terms was at its highest level in December and January when it was A$127. In percentage terms, however, it has reached these spread levels in 2019 and 2020.

What is causing this spread?

Let’s take a look at what is causing this spread. The majority of our non-GM canola heads to Europe. The European market generally, but not exclusively, imports non-GM. The reason for this is consumer preference.

Whilst there is an argument that most canola from Australia ends up in biodiesel, oil is not the only product. The meal is also an extremely important part of the calculation when valuing canola. Non-GM canola meal also extracts a premium over GM meal.

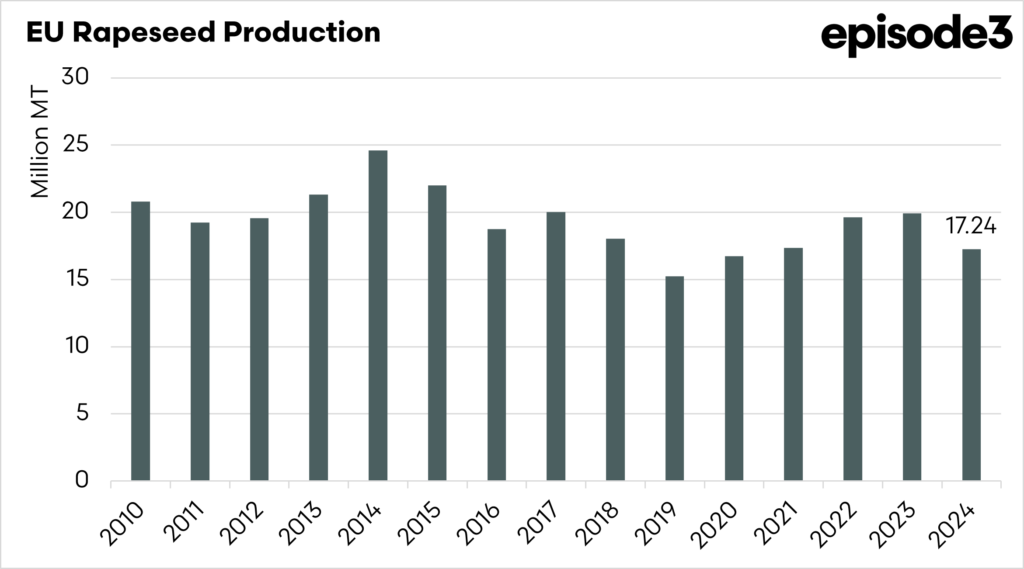

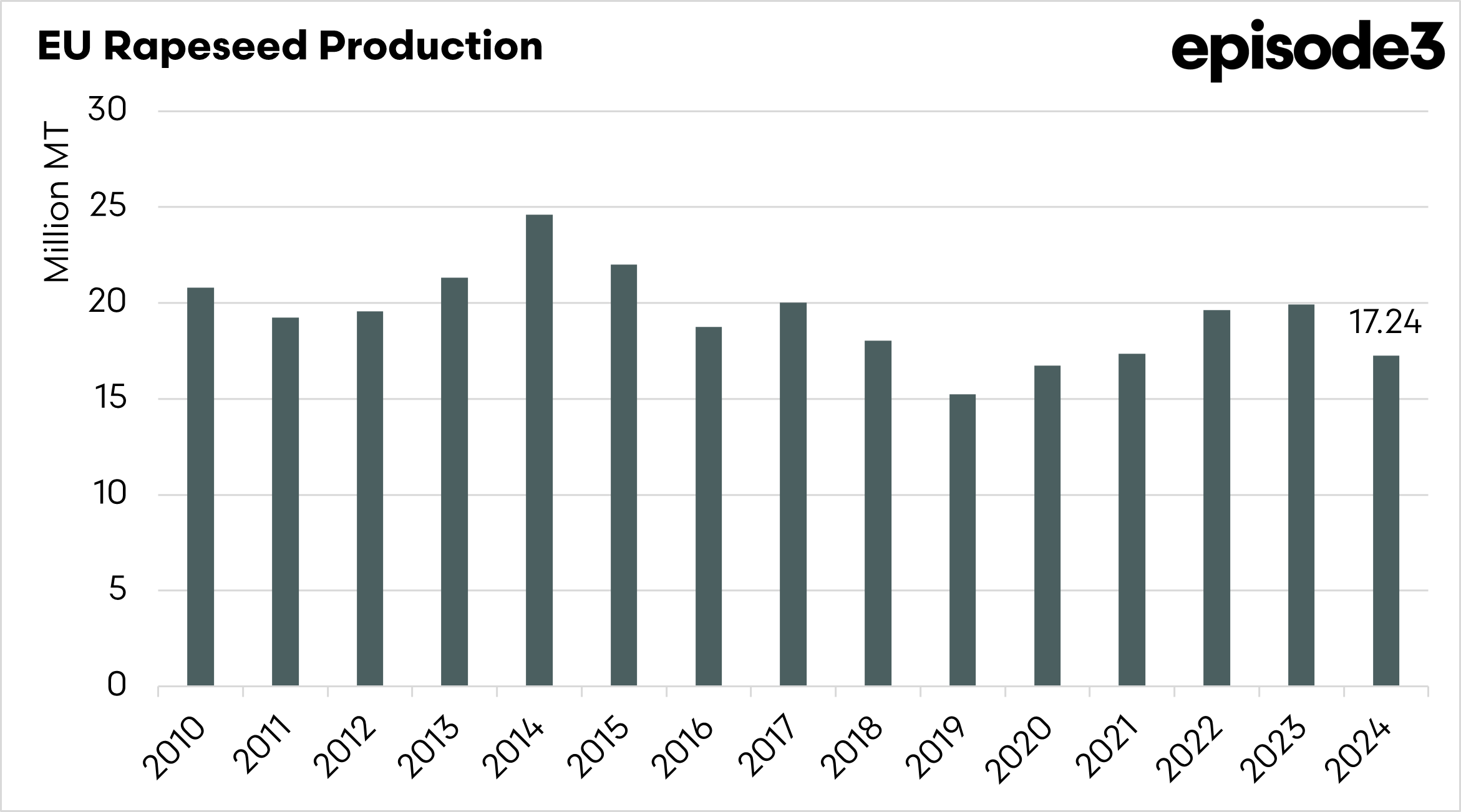

The chart below shows the production of rapeseed (canola) in Europe, and we can see that rapeseed production was low last year at 17.2mmt, down from 19.9mmt in 2023. In 2024, production was the third lowest since 2010. At the same time, domestic consumption in the bloc was the 6th highest.

The Europeans can buy from Canada, but they tend to prefer Australian non-GM.

In September, China announced that it was going to investigate Canada for dumping canola. You can get more details on this here

and here.

This meant that the trade was concerned about potential access to the Chinese market; since then, we have had Trump launch tariffs against Canada, of which a large volume of oil heads across the border into the United States, which you can get more details on here.

If we look at the chart below, the spread between Matif-ICE is displayed next to the Kwinana GM spread. Matif is French non-GM rapeseed, and ICE is Canadian GM canola.

In this chart, we can see that ICE has been falling to a substantial discount. This is a result of the lack of demand for GM canola into Europe and the threats of tariffs impacting Canadian canola.

The current spread to GM and its larger dollar value is a result of a number of factors:

- The strong demand for non-GM in Europe due to their poor crops.

- Concerns about the Canadian (GM) canola demand due to potential tariffs from China.

- Concerns about Canadian (GM) canola demand due to Trump tariffs on all Canadian exports to the USA.

- The spread in percentage terms was the same in the past, but the overall canola price is higher, giving the same % spread a much higher dollar value.

I prefer to think of the GM spread not as a GM discount but as a non-GM premium, which is semantics. The price difference is just basic supply and demand. Our GM pricing largely reflects ICE canola futures.