Decile Drop: Barley (May)

Decile Drop - May

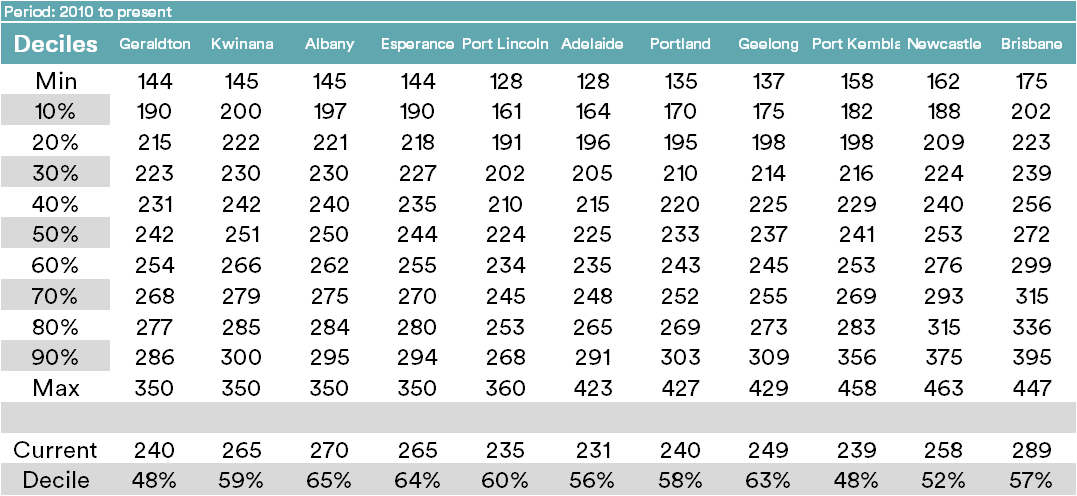

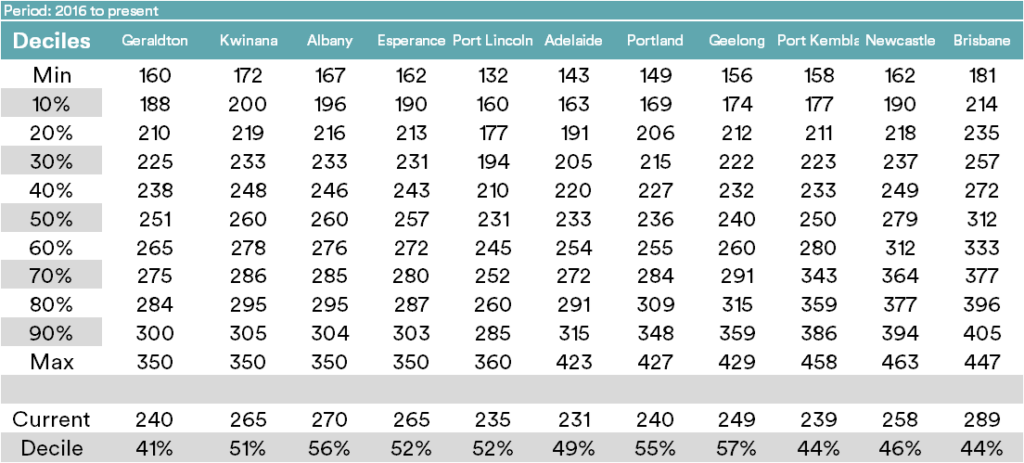

The tables below display the spot F1 price for ports around Australia. Included are two timeframes of deciles, long term from 2010 & 2016 to present.

The tables display nominal prices relevant to each decile range, which can be used to get an understanding of how high (or low) the current price is in relation to historical pricing. A decile table measures how often, historically, prices have fallen above (or below) a particular pricing point.

It gives a brief snapshot of whether a market has more upside or downside and how large this may be.

For example, if a price is at its 40% decile, this means that 40% of the time, prices have been below that value and 60% of prices higher.

Similarly, a 90% decile means that 90% of the time, prices have been lower and higher just 10% of the time. Please note that a price can’t reside outside of the 100 percentile.

At the bottom of each table is the current price and the percentage decile ranking for that price.

Comment:

Despite the actions by China and the large barley crop (silver medal), barley pricing has remained above the 50th percentile for large parts of the country. This has been a result of the overall grain market rising on overseas events. In reality we have a dodged a bullet this year. If supply and demand on a global level hadn’t moved around this year, then our pricing levels would have been substantially lower.

To view wheat futures deciles click here, to view physical wheat deciles click here.