Canola: is it a good, bad or fair price?

The Snapshot

- Poor conditions in Canada are driving global canola/rapeseed pricing higher.

- The biggest rise in pricing is in Canada.

- This is logical, as they have big problems at present.

- As Canada is such a big exporter, it has reverberations to all canola markets.

- As they rise in pricing level, we should expect rises (and vice versa). A rising tide lifts all boats.

- We shouldn’t expect for every dollar increase in ICE futures to see that follow through.

- We aren’t being dudded; the Canadians are just getting a very strong drought-driven price.

The Detail

Canola is the big talking point in the grain industry now, and we’ve had a bunch of questions about it. So thought we’d look at it a little more from a different perspective and whether pricing is fair?

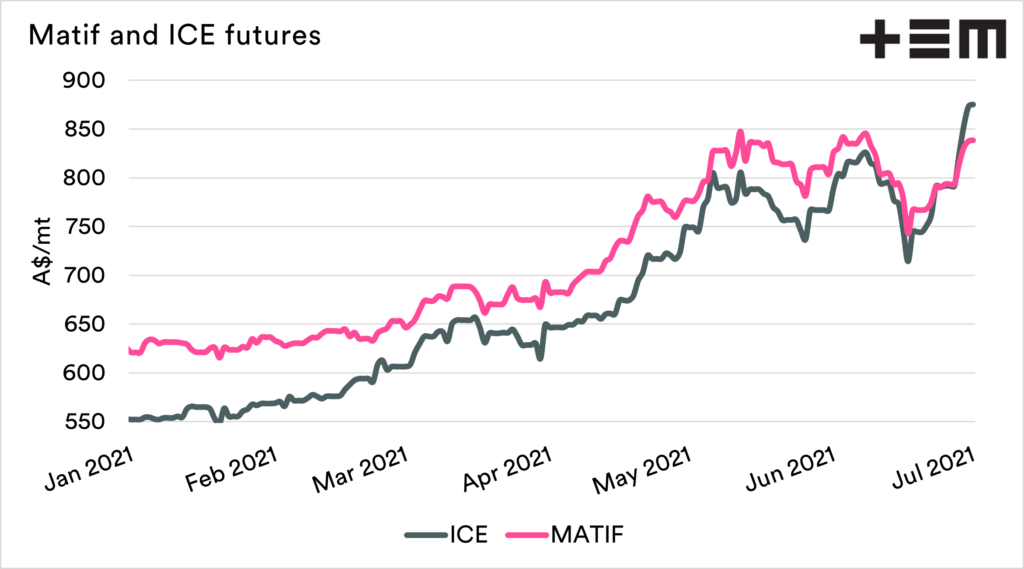

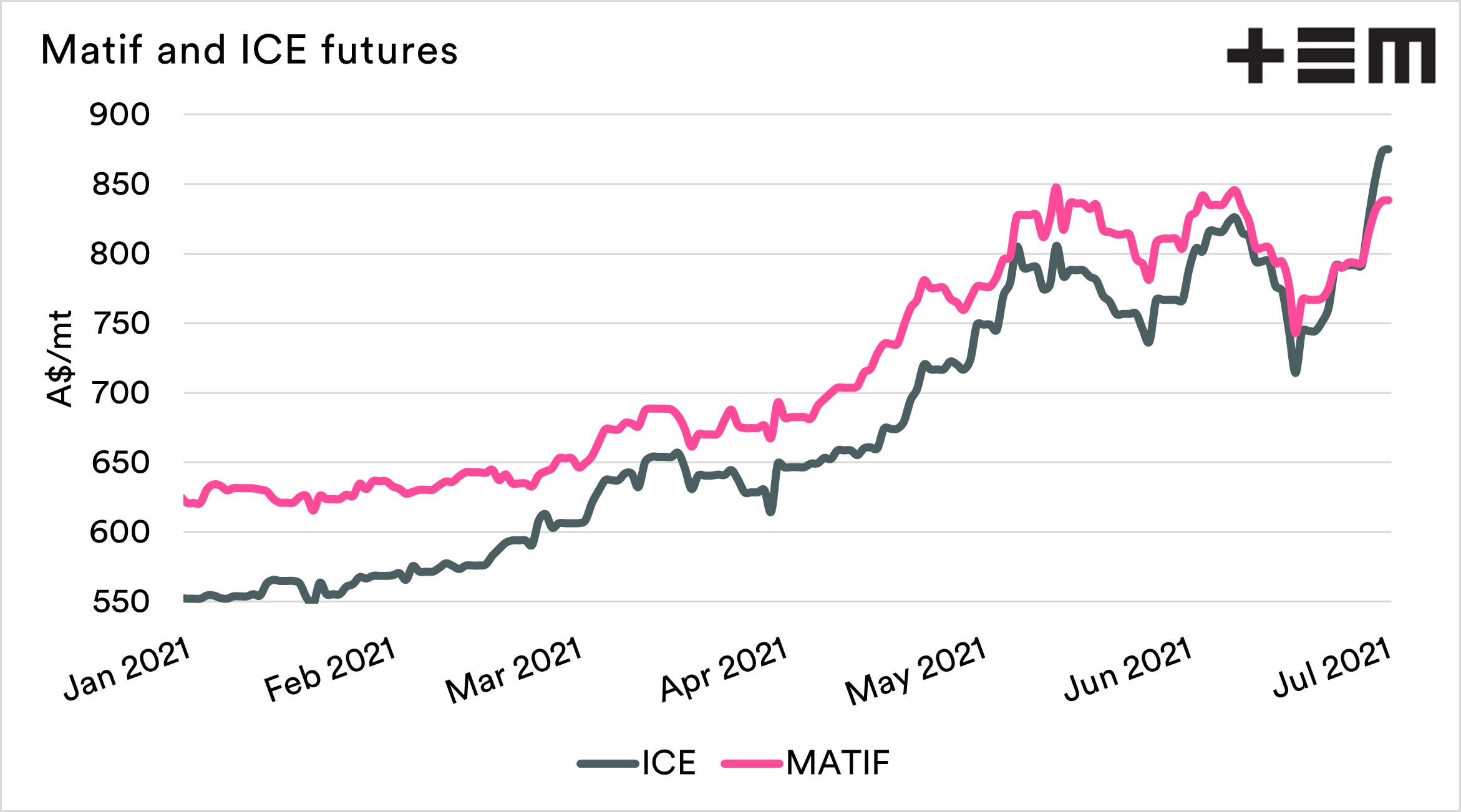

On Tuesday, I wrote about canola and how Canadian futures (Nov contract) had rallied back to A$824. On Thursday evening, they are A$875/mt.

An astronomical rise, and as our canola follows the rest of the world, we should see some carry through to our pricing. But, should we get all the value of this increase?

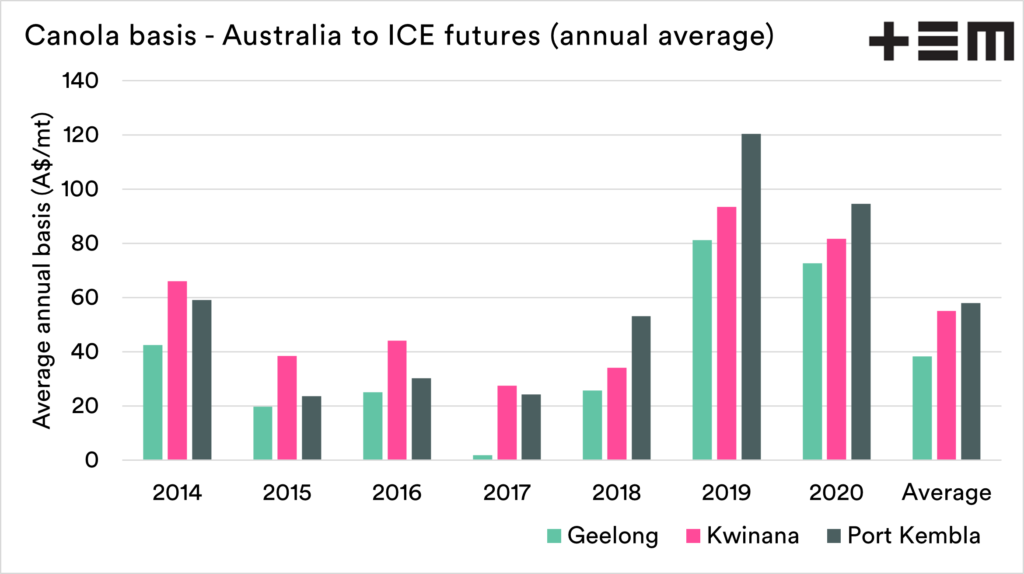

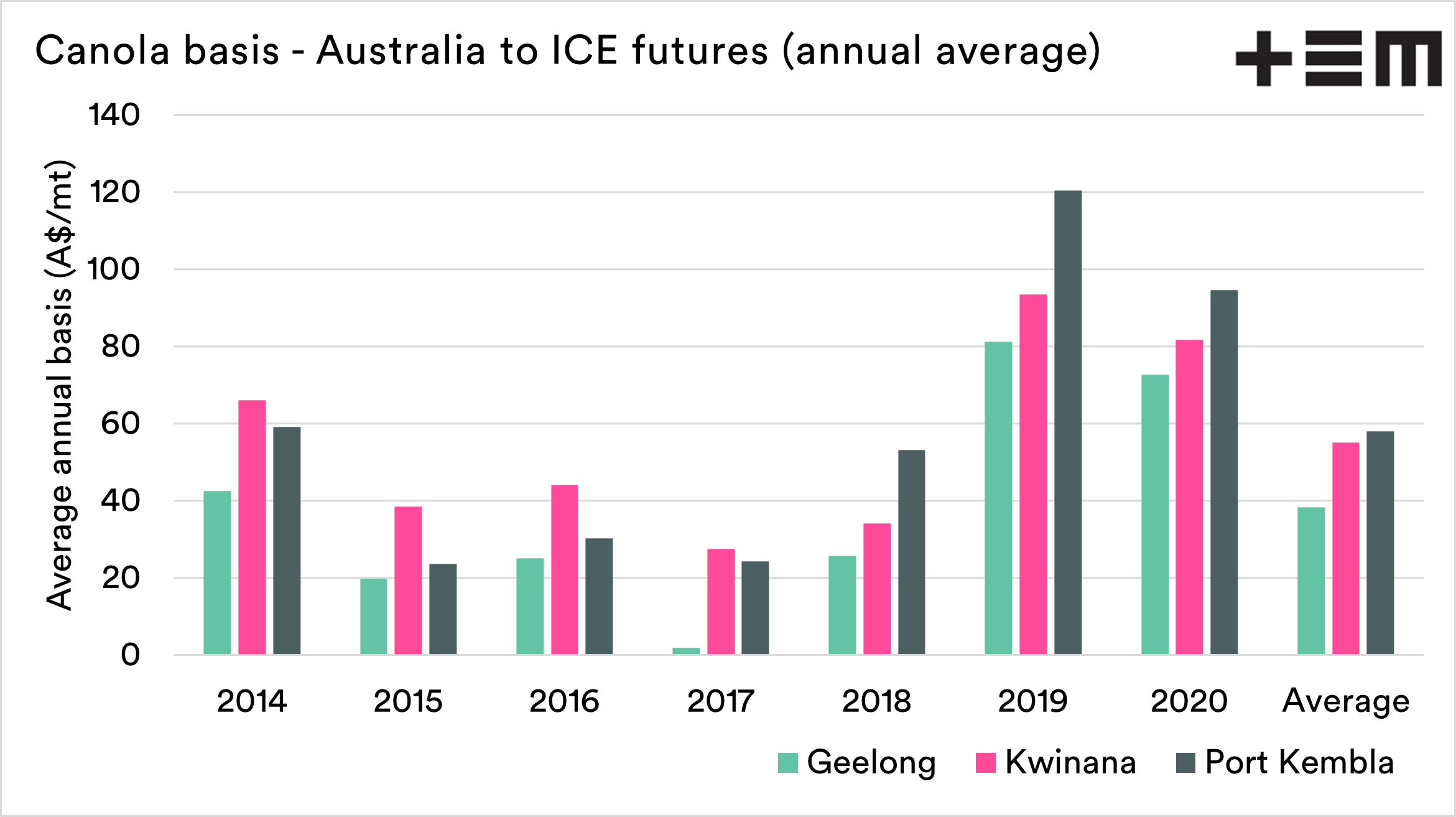

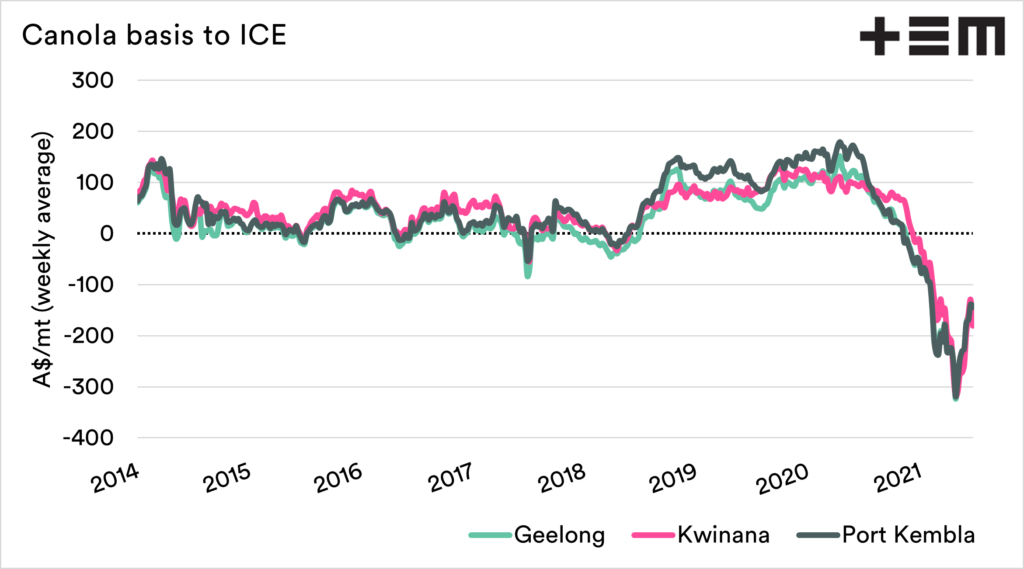

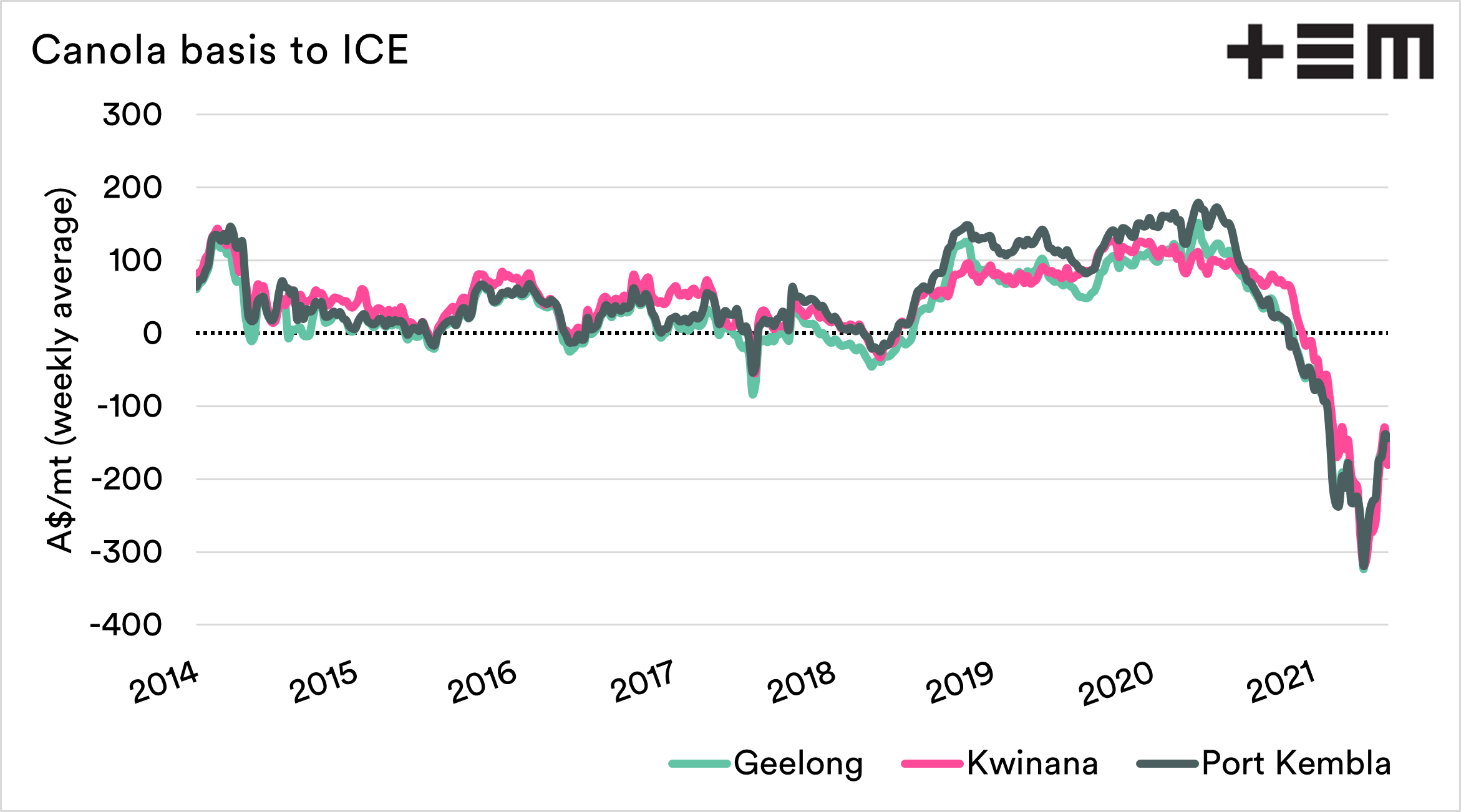

Traditionally, Australian canola trades at a premium to Canadian canola. The chart below shows the average annual basis between spot Australian prices and ICE canola.

We can see in the chart that the basis level increased in the recent years of drought significantly where it most impacted (NSW). The basis level hasn’t dropped into an annual average negative during this time frame.

Whilst the chart above shows the annual, below shows the weekly average. As we can see, it is a little more volatile and has crossed over into the negative, albeit not for long. During recent months, we have experienced our basis levels drop into the negative and stay there.

Why is this occurring?

Two factors are driving our basis levels lower. Firstly, it’s the severe condition of the Canadian crop (see here & here). Our canuck cousins have had it tough last year, and this year is pretty woeful, as we have been covering for the past few months.

On the other hand, we are having a good time of it (see here). A strong local crop has an impact on

So our premium over ICE would have been lower this year anyway, although not to this extent. So it’s a double-barrelled basis blip.

Is a low basis fair?

I was asked on Twitter the question, “When will WA canola hit A$900/mt” (see here). The current top bid for new crop canola is A$815/mt; this is a basis of -A$60. If basis was back to the average levels of +A$55, we would see a price of A$930. Should we be getting A$930?

At its simplest, the basis level is dictated by conditions. The price of canola/rapeseed is rising around the world. This is due to the importance of Canada to global trade. The bulk of the rise is being seen in Canada.

In 2018-2019, we experienced the ASX wheat contract rising massively compared to the rest of the world. The situation is no different to our local drought pricing.

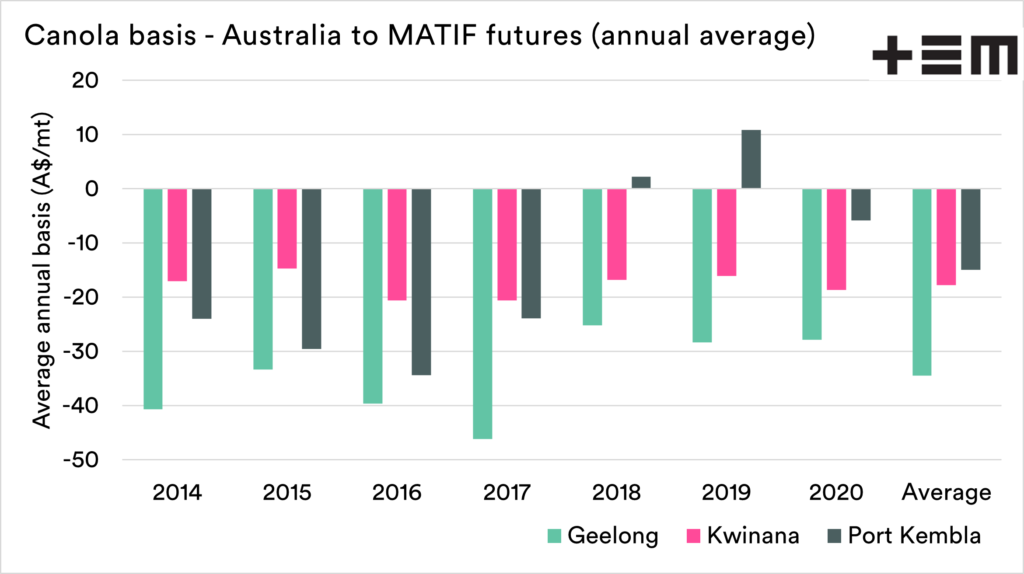

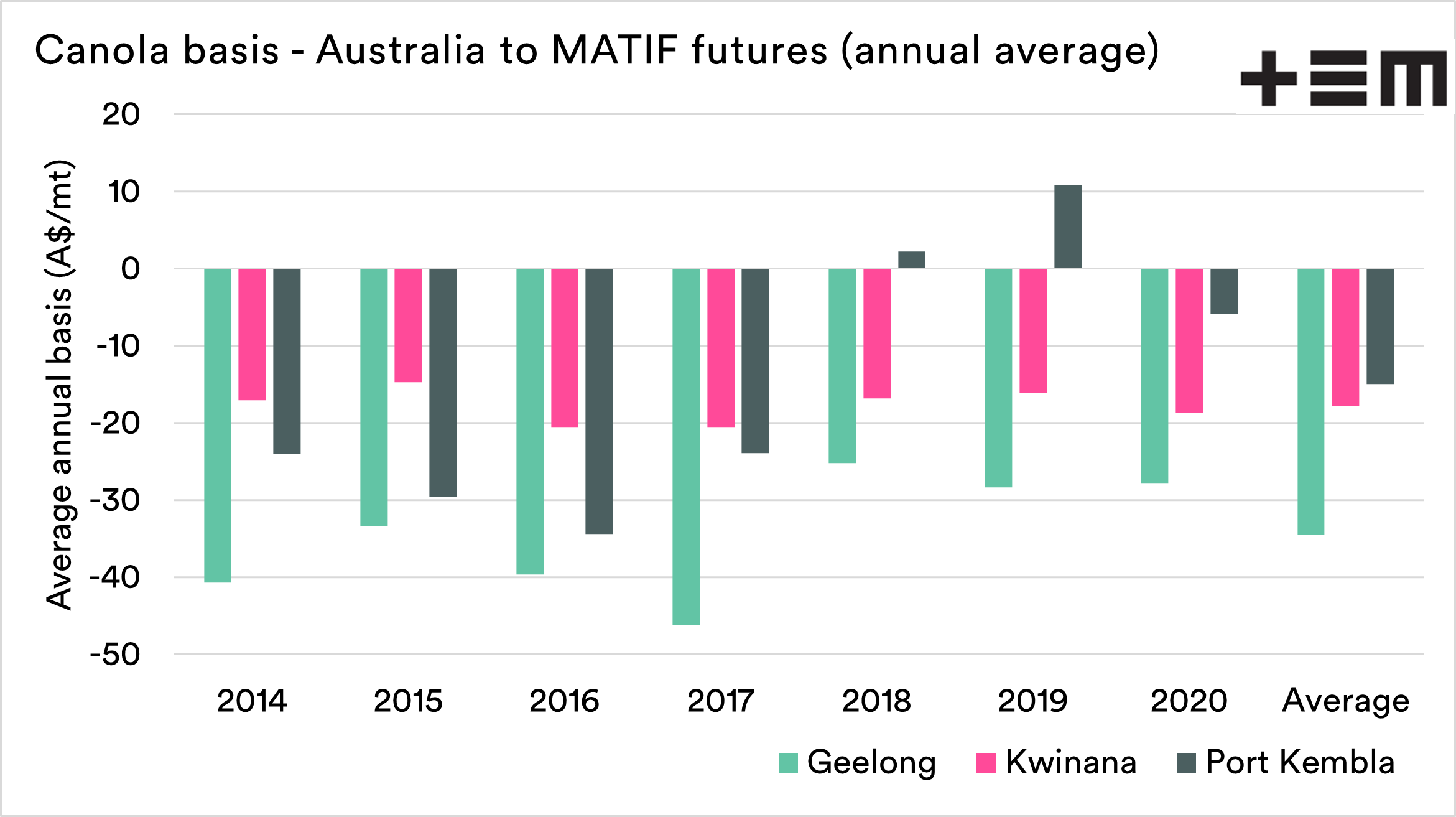

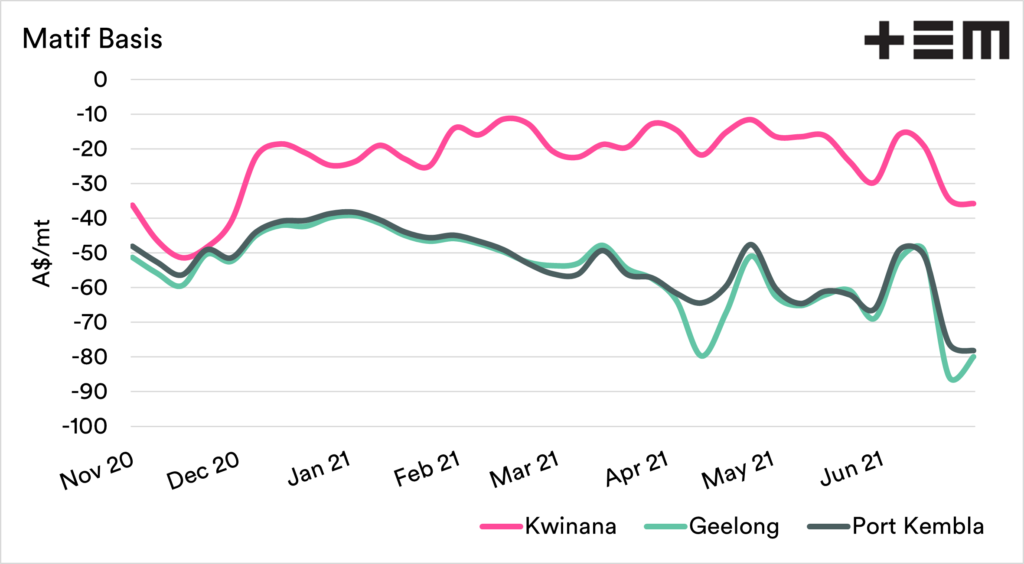

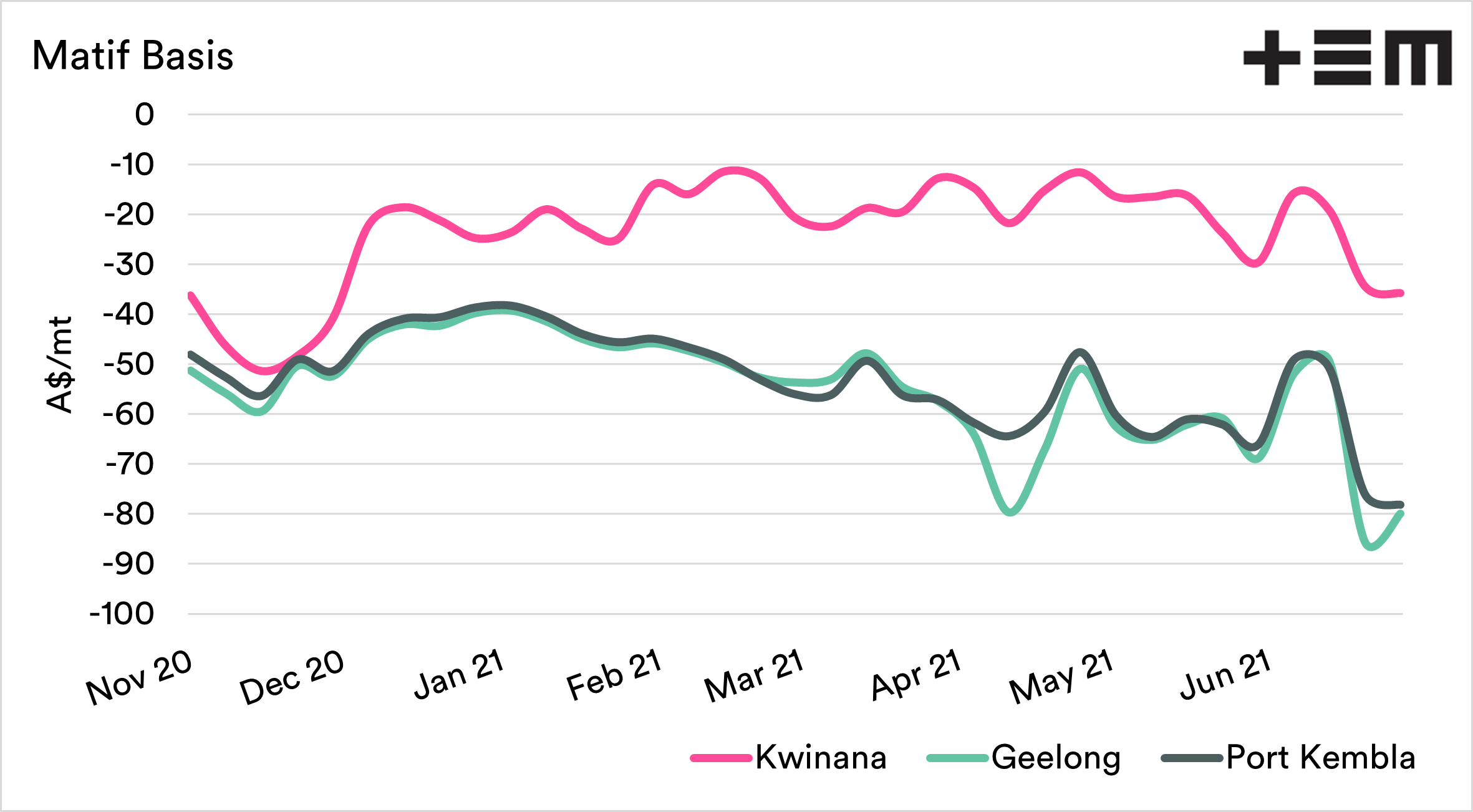

If we compare to Matif, which is French rapeseed the situation is closer. Our basis level between Kwinana and Matif has averaged -A$18. The current basis level is -A$30. This is substantially closer than the current ICE-Kwinana spread to the norm.

This shows that it is not a case of our basis levels being pushed lower to buy cheaper from Australian producers. It is a symptom of the poor Canadian crop.

Does it matter?

Let’s be honest, as a farmer it doesn’t really matter if the price is at a discount to what is normally expected. If you have the canola to sell, and it’s a good price.

The reality is that the Canadian crop is in strife. The old saying ‘a rising tide lifts all boats’ applies; if they continue to have a hard time, that will flow through to us – but don’t expect dollar for dollar rises.