Grain Prices: In a volatile market, prices go both ways.

Pricing Update

As we move throughout the year, we will be focusing on the new crop more and more, and so on a weekly basis, we will be putting an update on what is happening in the local market, with a focus on being quick to read.

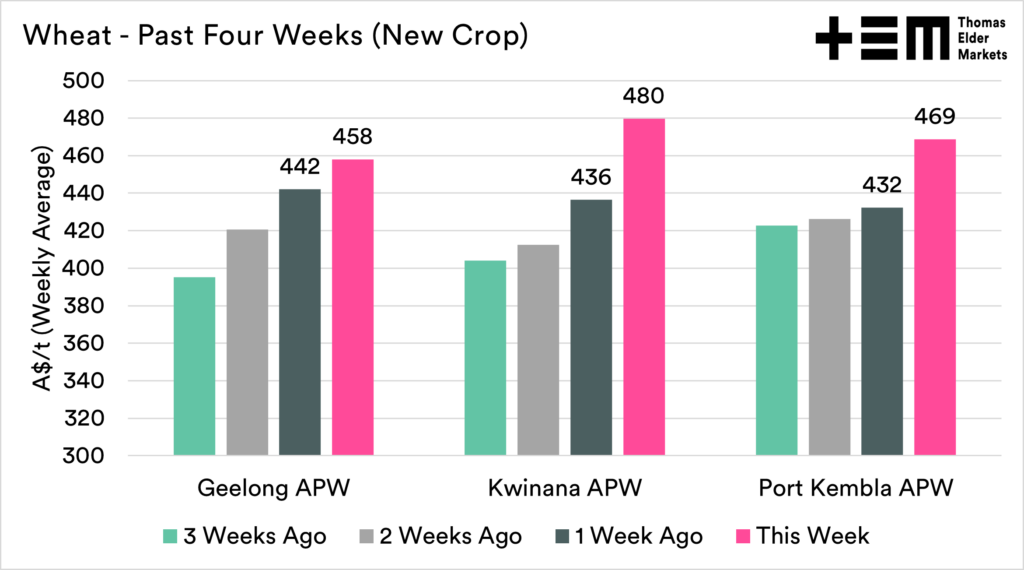

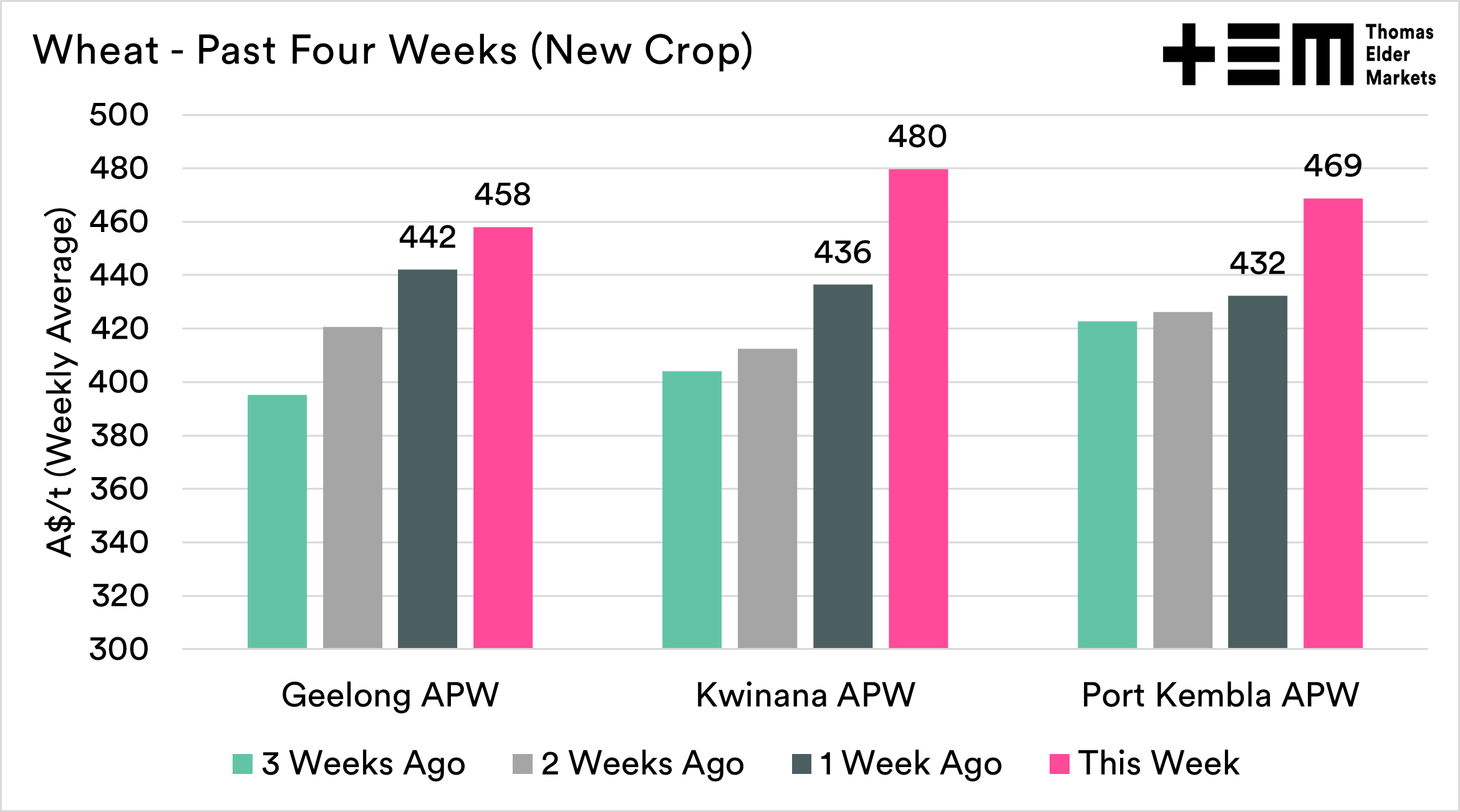

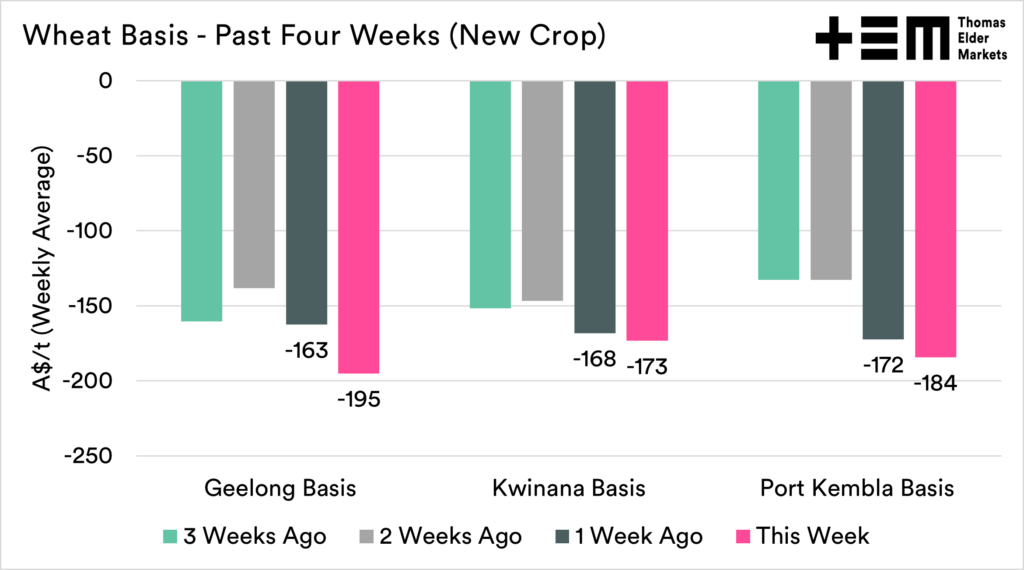

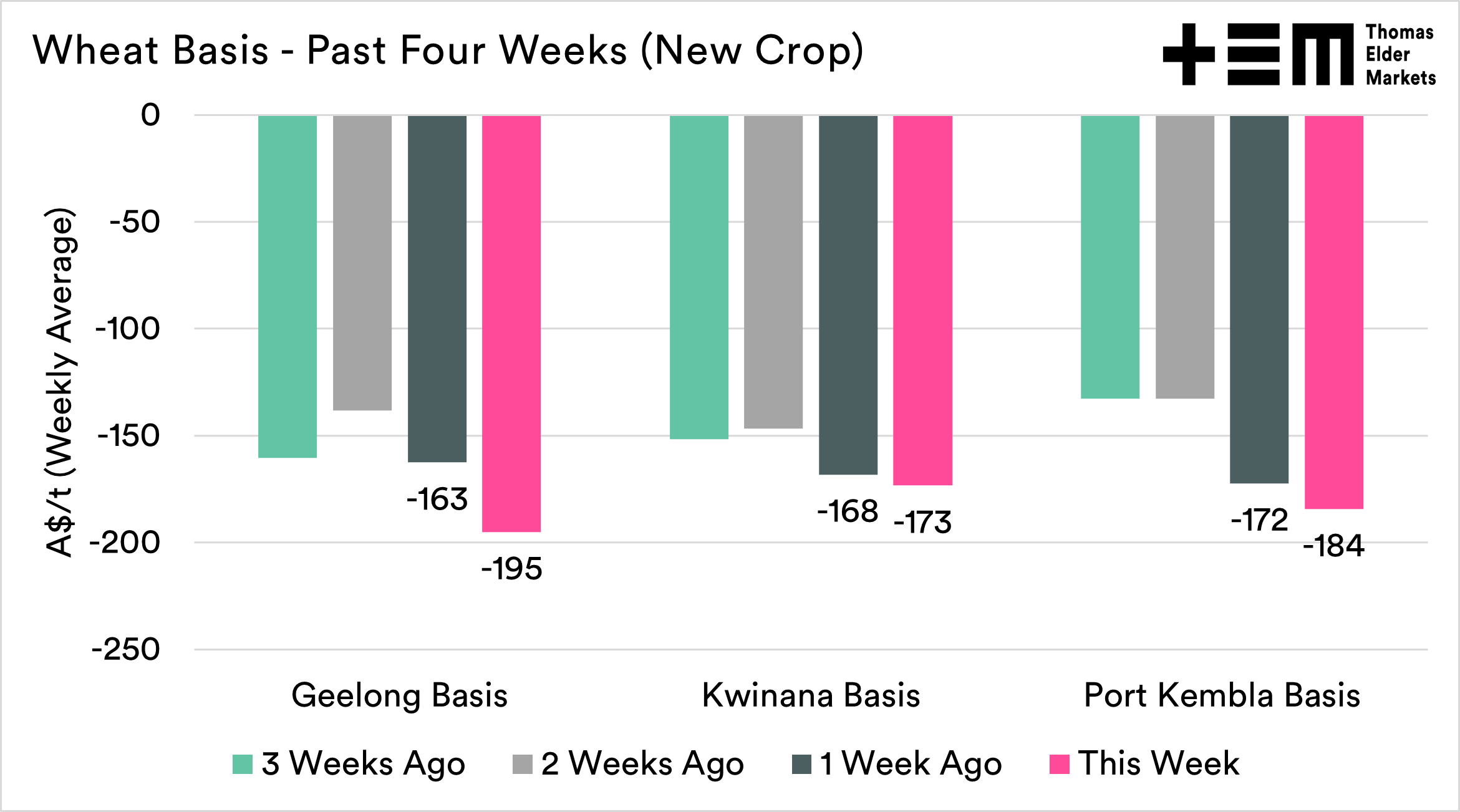

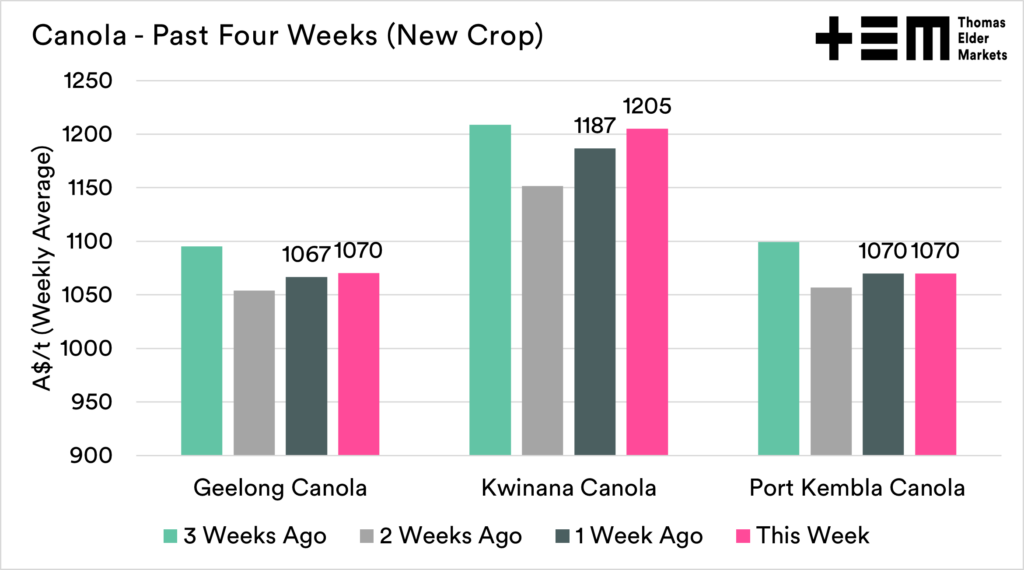

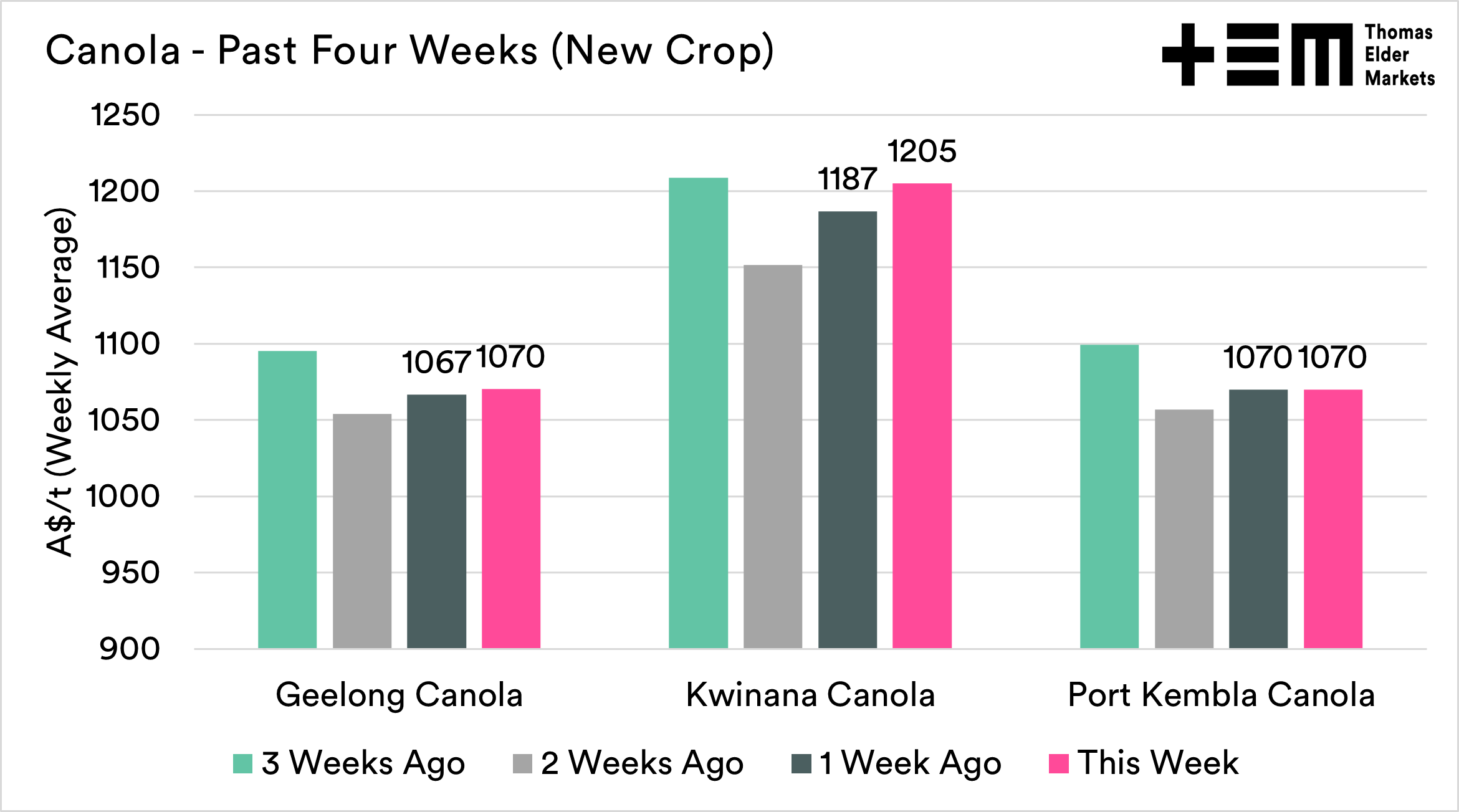

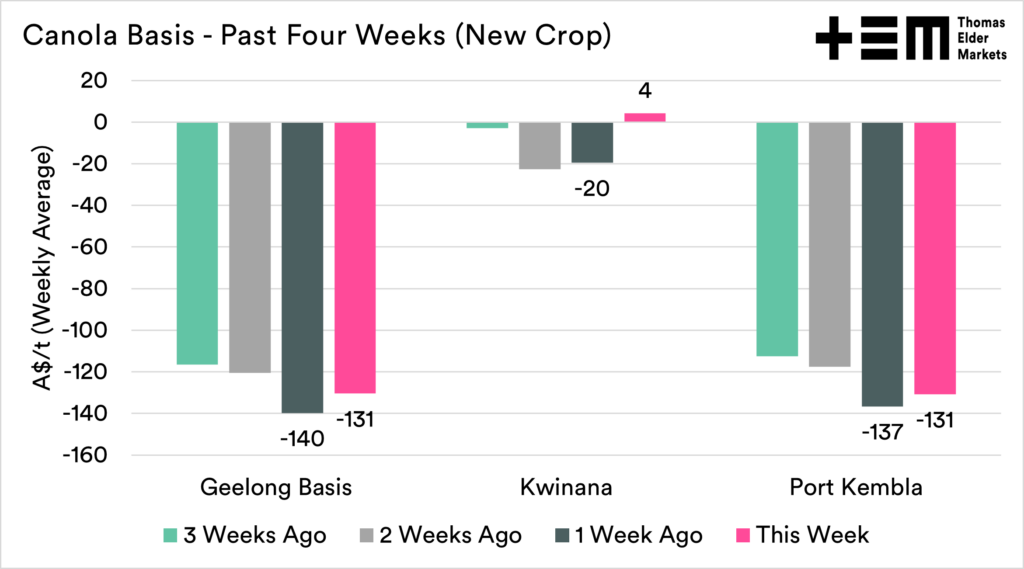

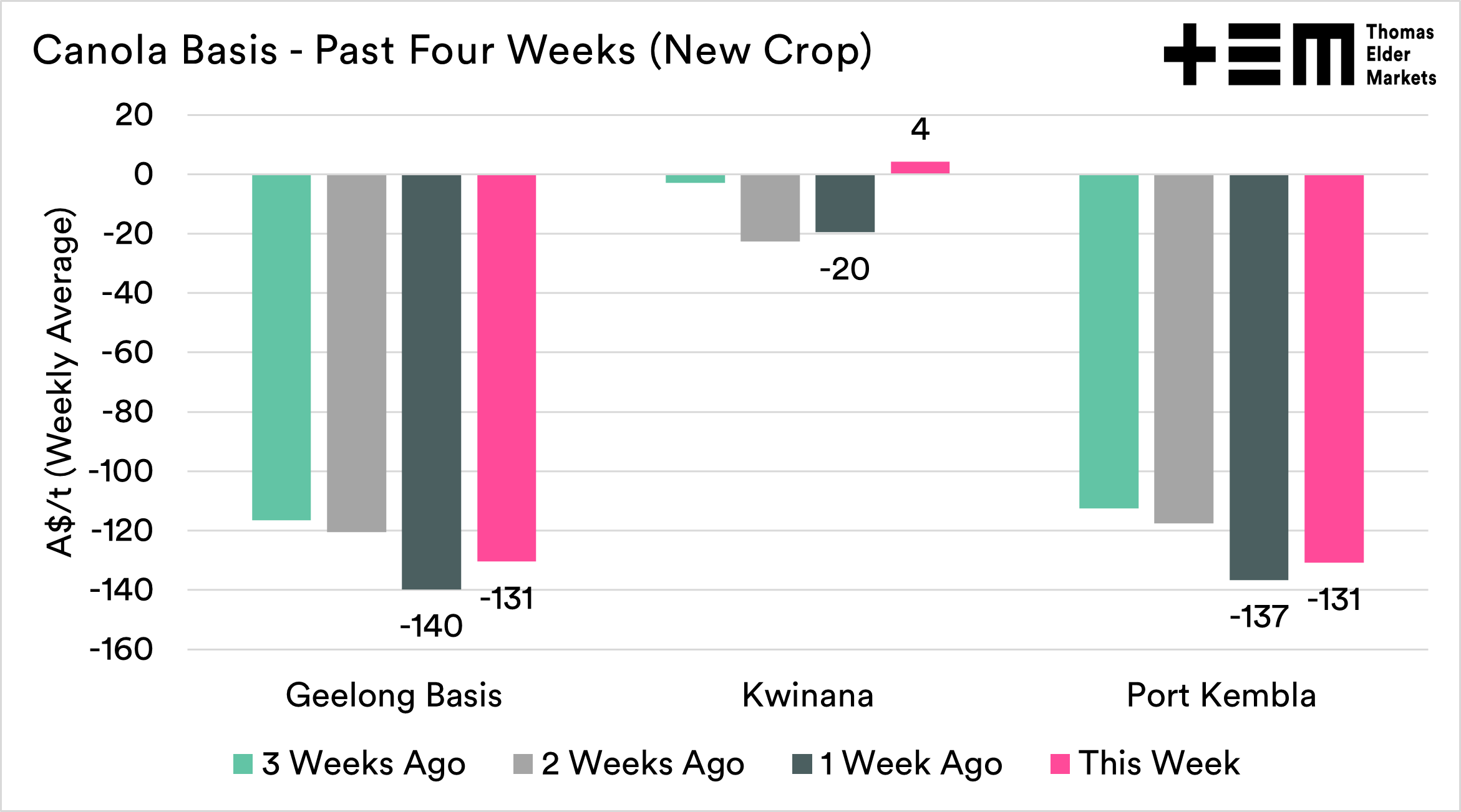

The charts in this report are all the weekly averages, so they won’t reflect a particular day but the average of the week as we look towards trends. In this update, we will focus on three zones, Kwinana, Geelong and Port Kembla, as they give a reasonable spread around the country. We may add more in the following updates.

If forward selling, remember that you are replacing price risk with production risk. Be mindful of this when allocating volumes.

Remember to sign up to make sure you don’t miss any of our updates, these are free to access. If you want to support this service, remember to share with your network.

Wheat

The wheat market started off with the news that India had banned wheat exports (see here). This caused the futures market to rally with some strength. My view at the time was that this was more of a soft ban.

The market has started to have the same views, especially as India subsequently agreed to export wheat to Egypt.

In other news, there was further talk of the UN offering some kind of corridor to ensure that the grains could flow from Ukraine. This has caused some easing in the market. In reality, this is likely to require protracted discussions (see here).

On the supply and demand side, the US and French wheat crops have continued to downgrade as a result of dry conditions. Conversely, Russia is set to achieve a record crop.

So one week, and a lot going on. One thing to remember in a volatile market is that moves can occur quickly both ways and sometimes from very little logical information.

CBOT wheat futures for December started the week at A$661, and have since fallen to A$630. The charts below show the weekly averages, which have seen prices in Australia rise with some gusto.

Conversely, it is important to note that price in Australia has not risen at the same level as the futures market, causing basis to decline.

Canola

The oilseed market had its own fair share of news this week as well.

Firstly, biofuels. Plans are being reviewed which would see the use of biofuels in Germany being significantly reduced, starting in 2023, falling to zero by 2030. An audacious target. This placed a bit of pressure on the market as this would cause demand destruction (See here).

In other and fairly unsurprising news, Indonesia has revoked its ban on the exports of cooking oil (see here). It doesn’t surprise me that this ban has been removed, and we have mentioned this a few times; palm is too important to the millions of farmers and the general economy. So as of Monday, they are back into the global market.

In Canada, the next couple of weeks is going to be paramount. I am told that conditions are touch and go in many places, albeit with minimal subsoil moisture. Interestingly, Saskatchewan’s province is split in half between too wet and too dry. The next six weeks is going to be critical.

Canola futures lost a lot of ground this week for our harvest timeframe. ICE (Canada) was down A$74, and Matif (France) exactly the same.

This week, Kwinana saw an increase in bids, with the east coast states remaining more stable. In a reversal to the situation with wheat, Australian canola prices actually gained a stronger basis.