The American wheat dream turning sour?

The Snapshot

- The US is in worse drought conditions than in 2012.

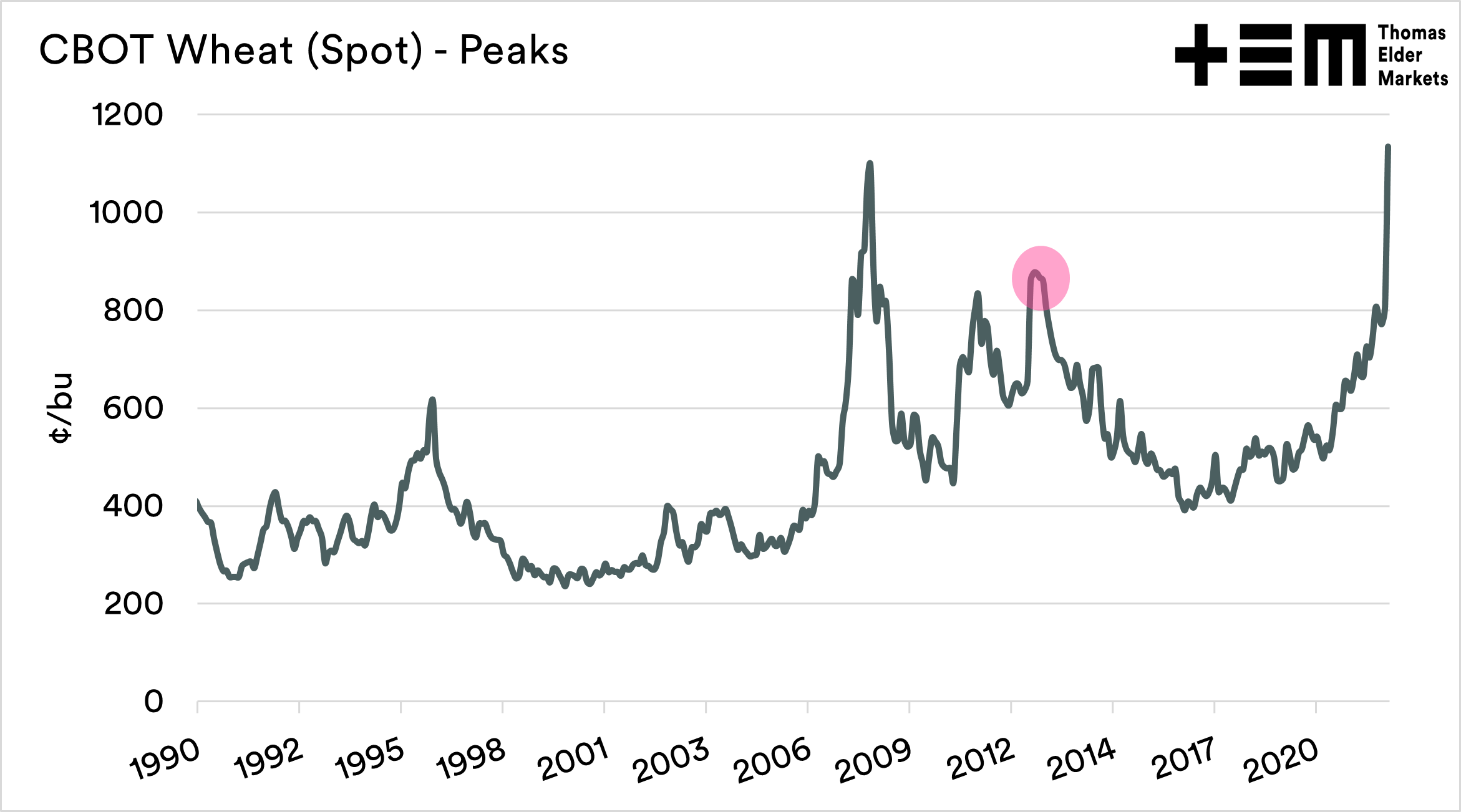

- 2012 was one of five (including present) peak pricing years, due to drought in the US, along with lower export volumes from Russia.

- Even if a ceasefire is called, prices are likely to remain above average.

- A crop failure in the USA (or Europe/Canada) will lead to further increases in price.

- We need to ensure that we don’t remain too fixated on Russia, as the normal northern hemisphere weather market remains in the background.

- It is still too early to write the US off, but their year is not starting off well.

- We are still in a La Nina phase, which can make the US dry.

The Detail

It’s getting close to that time of year. The time of excitement in markets as the northern hemisphere weather market starts.

This is a time of great volatility, and the market is normally on jitters, as any weather report has the potential to move the market higher (or lower). If you add in the Russian invasion of Ukraine, there is an added level of extreme concern.

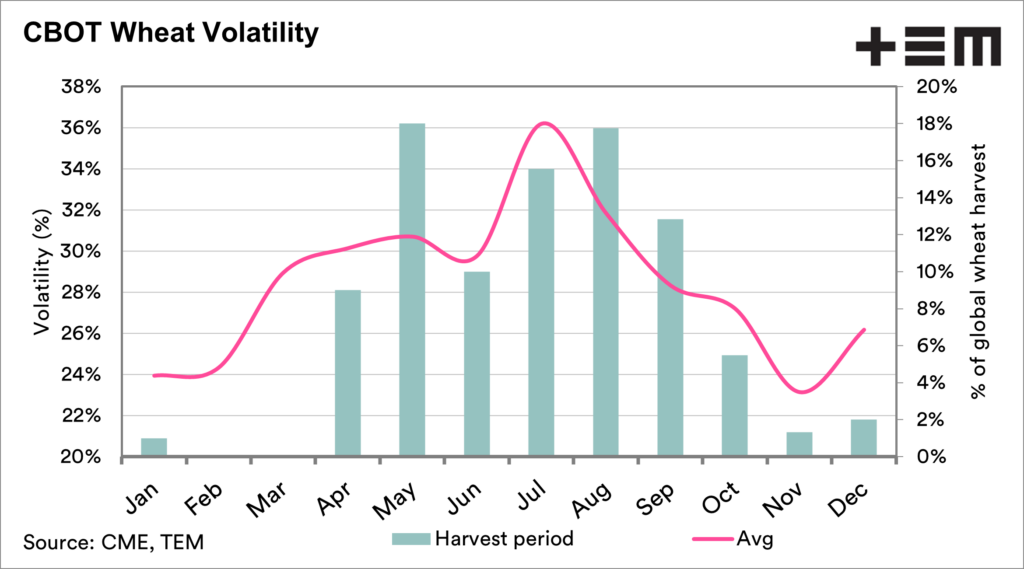

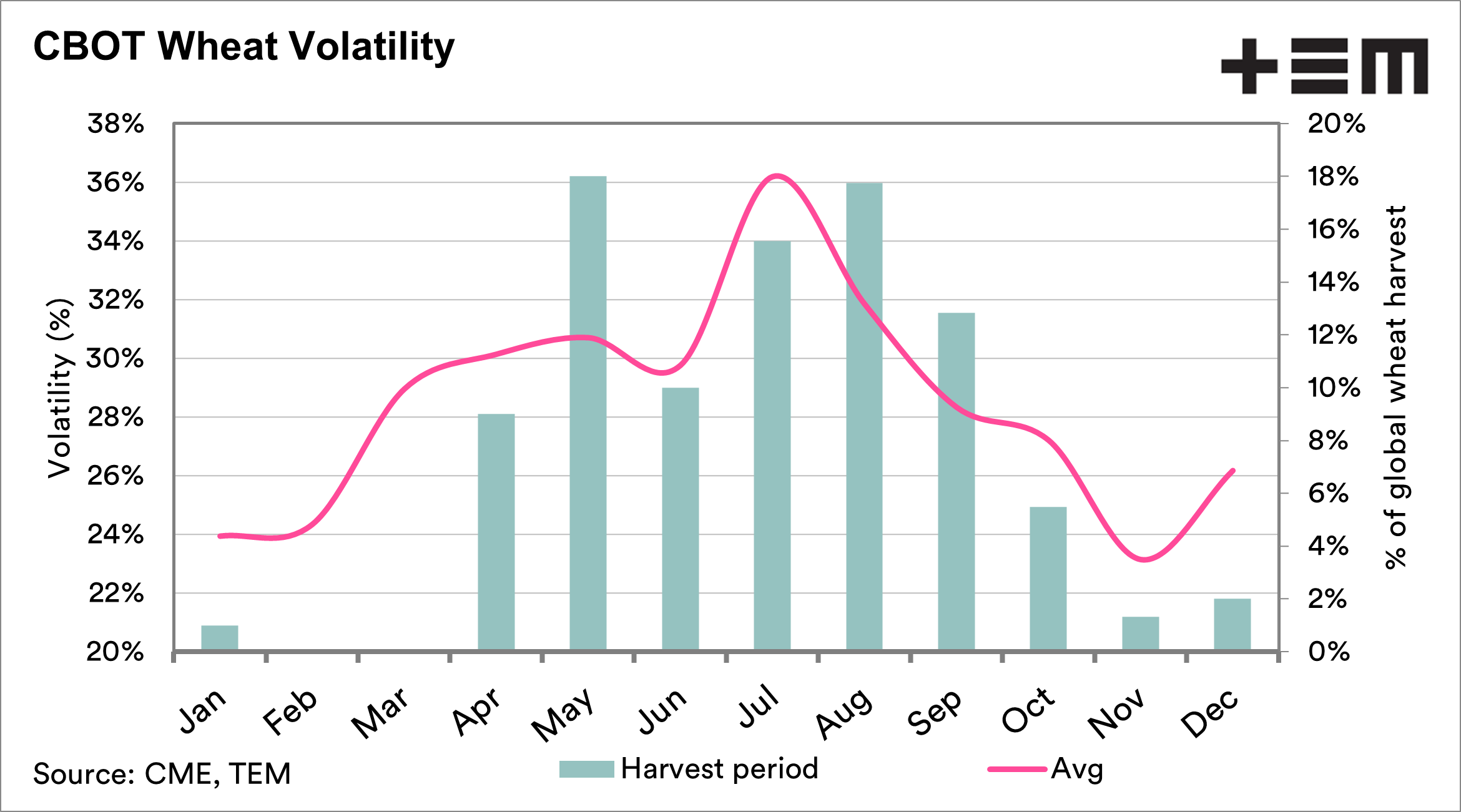

The chart below displays the volatility of wheat futures on a monthly average, with how much wheat is harvested around the world each month. Volatility ramps up during the middle of the year, which matches the bulk of the world’s harvest.

If something goes wrong or right with the major producers in the northern hemisphere, then the market is likely to get volatile.

While most of the analysis and commentary on the wheat market of late has been to do with the Ukraine/Russian situation, there are other issues arising, which we have outlined with trouble in Chinese wheat and the poor state at the start of the season in the US.

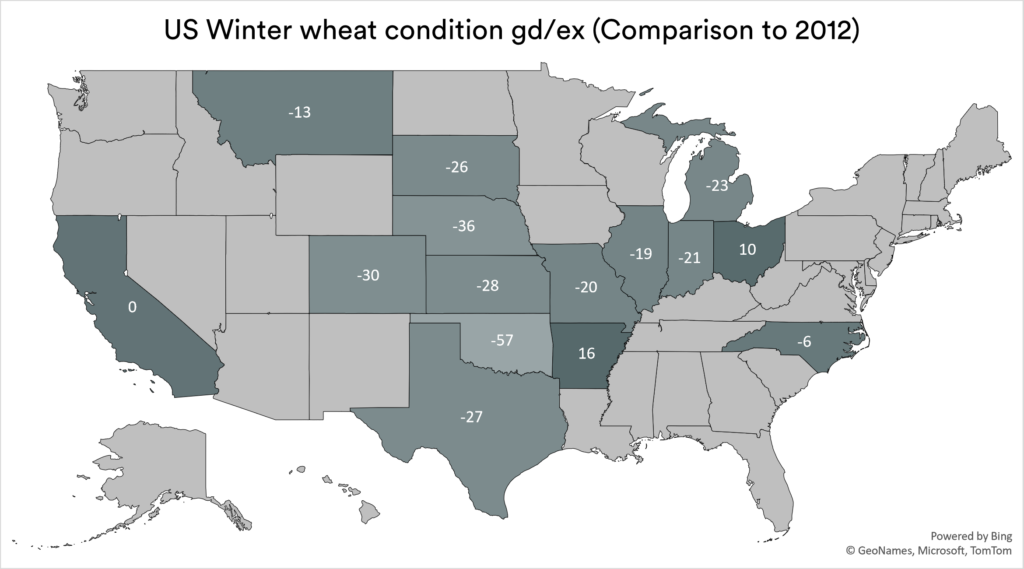

The chart below shows the current drought monitor and the same period in 2012. I don’t pretend to be a meteorologist, but red isn’t good. We can see that the current drought conditions are far worse this year than that year. Why am I focusing on the comparison between these years?

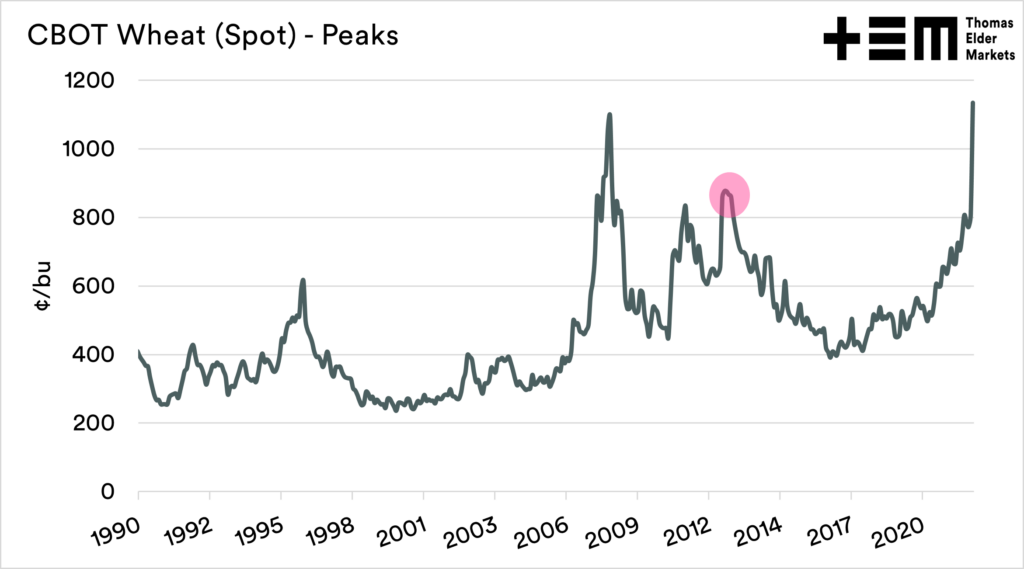

In a previous article, Wheat Peaks and Crashes, I wrote about how there have been a number of peaks (followed by crashes) in the what market since 1990.

One of those peaks was during 2012. At the time, prices rose to the highest price since the commodities boom of 2008.

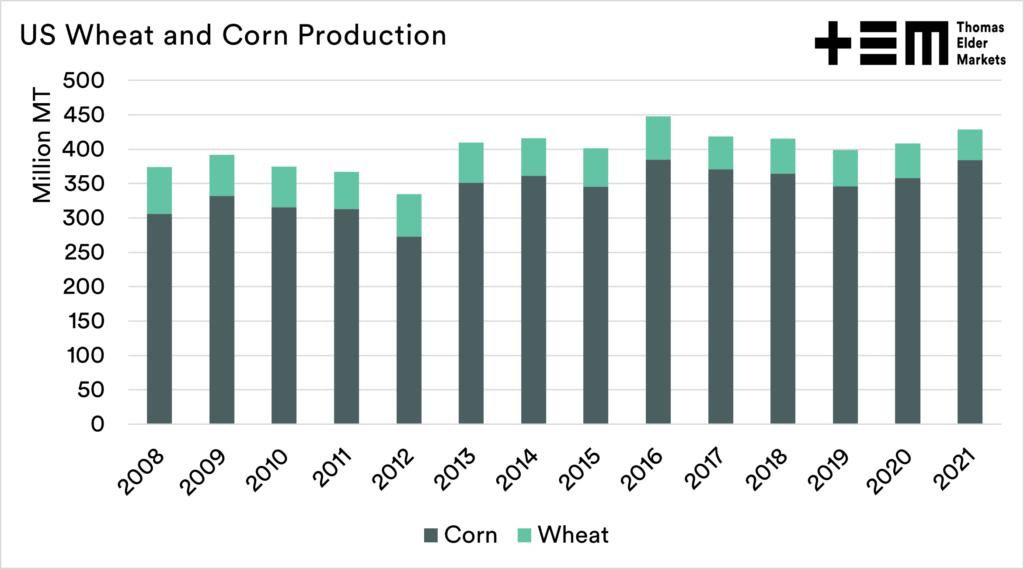

The US wheat crop wasn’t hugely impacted during 2012, with yield and production up. Remember that wheat isn’t the only driver of wheat; corn also has a significant impact. The drought in 2012 started impacting much later on in the season, which impacted Corn crops.

In 2012/13, the average US corn yield dropped from 9.22 t/ha to 7.73t/ha, reducing production compared to previous years.

It wasn’t the only driver of higher pricing; Russia was also a factor. Since the turn of the century, Russia has been a major driver of markets, and in 2012, exports of wheat dropped to 11.3mmt. This was the second-lowest year of exports during the 2010’s.

This year Russia is clearly a destabilising force in the market, but a US crop failure could lead to increased volatility.

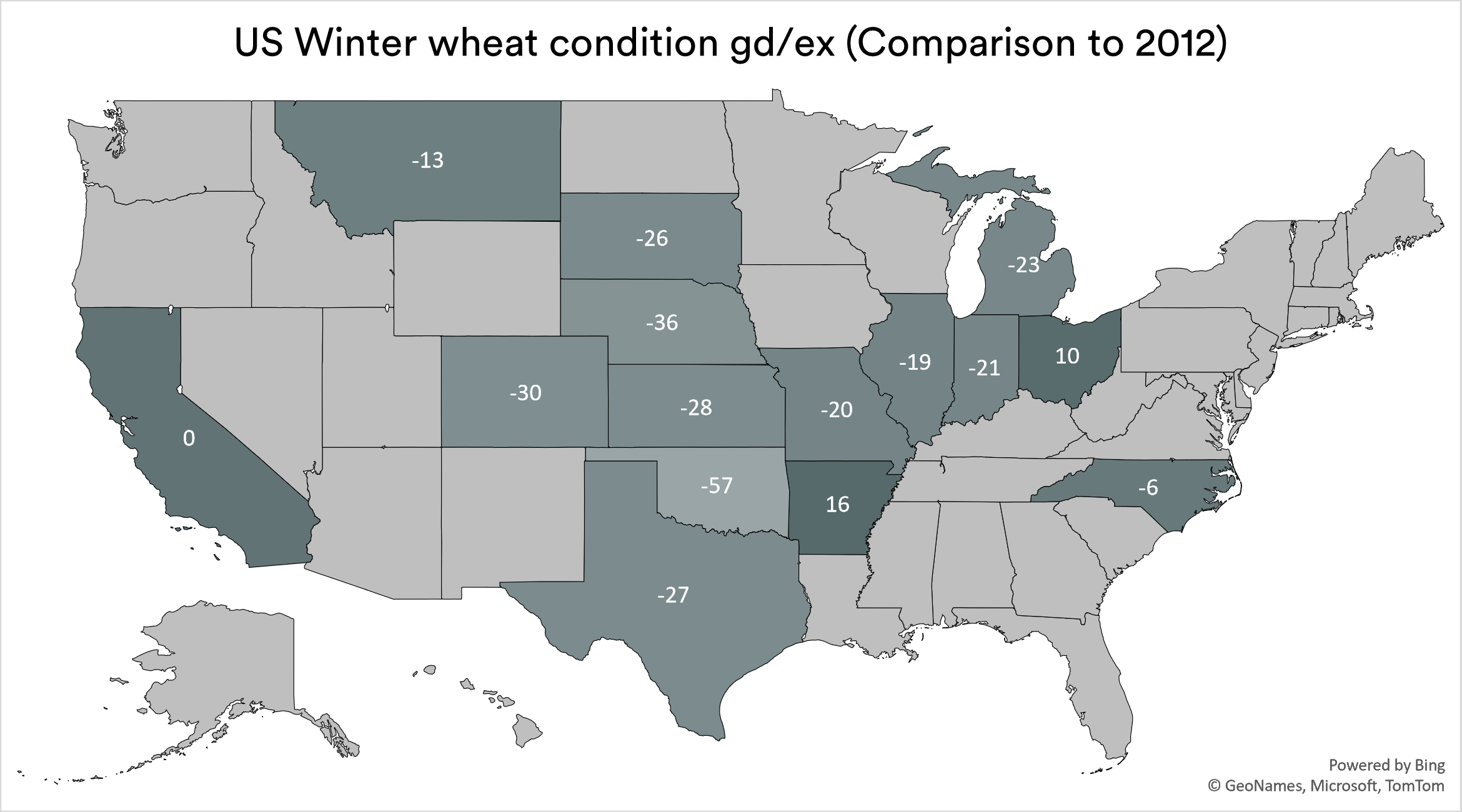

There have been new states added to this week’s condition report. It is currently dry, and the condition reports are showing similar patterns to the drought map earlier in this article.

The map below shows a comparison of states that had available data for this time in 2012, and the current week. We can see that we are at nearly all the states that have available data are in a worse condition than the same period in 2012.

It is too early to write off the US crop, as there is still plenty of time to go, as we mentioned in previous articles. The world is currently in La Nina, which can make the US dry, if there is no improvement, or worsening conditions, then expect fireworks.

We’ll keep an eye on this, so keep checking back, especially as we move into the spring crop.