Market Morsel: Aussie barley too competitive?

Market Morsel

Government intervention in markets tends to end up with unintended consequences which cause pain.

- China having a defacto ban on Australian coal has ended up causing an energy crisis there.

- It took years for prices to recover from the wool price reserve scheme.

- Argentinian beef production dropped when they introduced export bans.

- Russian may plant less crops due to export taxes which have been designed to keep local pricing cheap.

These are just a few examples of how, even though well-intentioned, government intervention in markets tends to result in consequences that cause more pain in the long term.

China has an effective ban on Australian barley. A 80.5% tariff will do that. Whilst many believe that we haven’t been impacted we definitely have – most of our malt export market is gone (see here), and other countries are filling the gap with feed and malt (see here).

In Australia, the focus is largely on what the price is doing locally. It is, however, worthwhile to keep a close eye on what is happening within our competitiveness overseas.

We have been working lately with AgFlow, a relatively new entrant into ag data provision based out of Geneva.

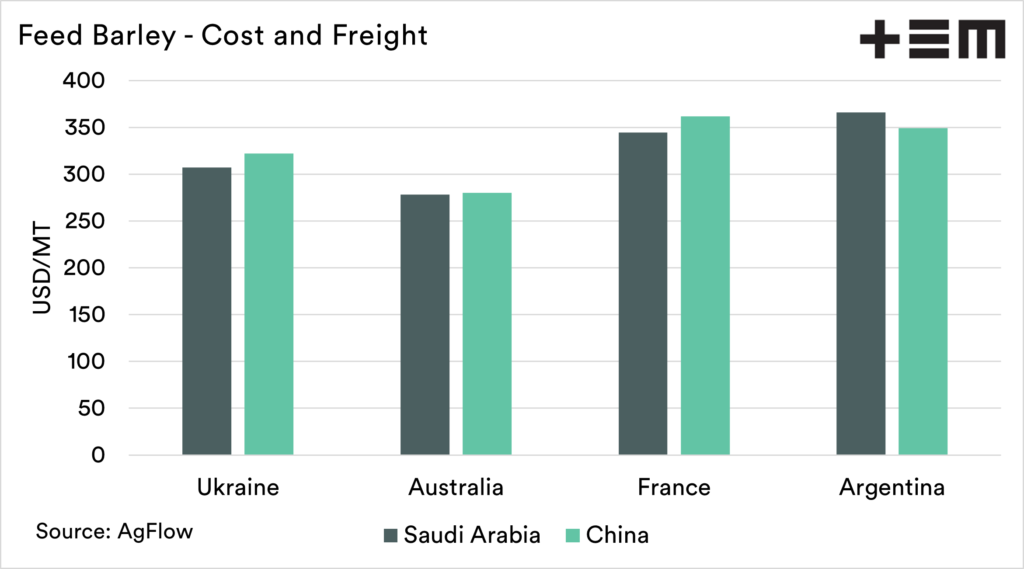

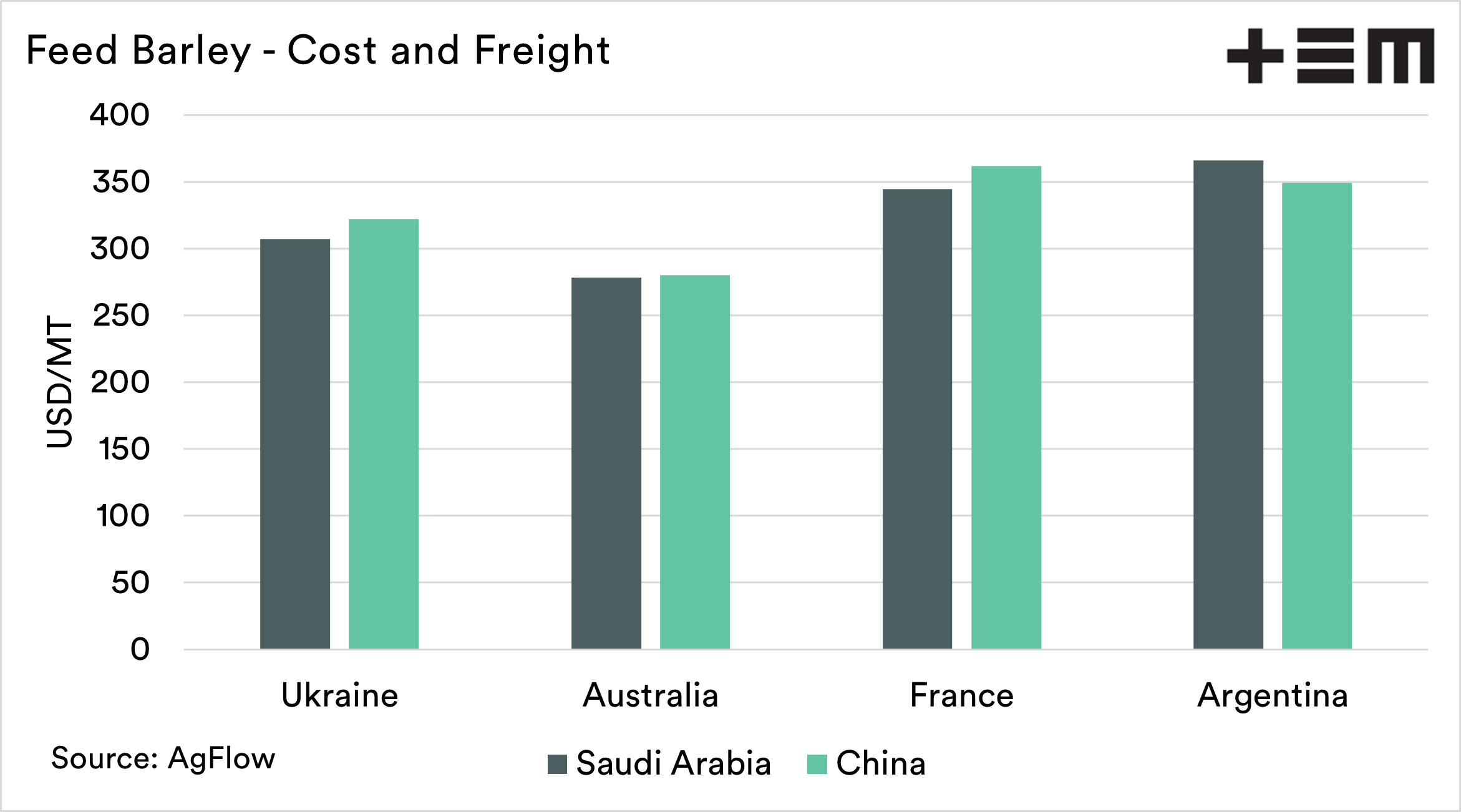

The chart below is a combination of the cost of purchase from the grower, the loading onto a vessel and the freight to the worlds two main barley destinations (Saudi Arabia and China).

This gives an insight into what price it would cost for either Saudi Arabia or China to purchase from the four main origins for this season.

As you can see, the Australian price is substantially lower into both destinations, this is due to our lower purchase price.

Chinese consumers of barley are being forced to buy from origins that are substantially more expensive. If China was open to us, we would be pricing at a higher level, and China would also be paying less than they presently are.

A win-win situation for Australia and China.

Unfortunately, geopolitics doesn’t always operate in a logical fashion. As long as grain prices overall remain strong, it’s hard to notice the impact of ‘lower’ barley pricing in Australia. We are however heavily discounted.

22/10/2021 NB To clarify, the Australian number is a conversion of the grower bid converted to cost & freight destination.