Market Morsel: Basis in Australia collapses

Market Morsel

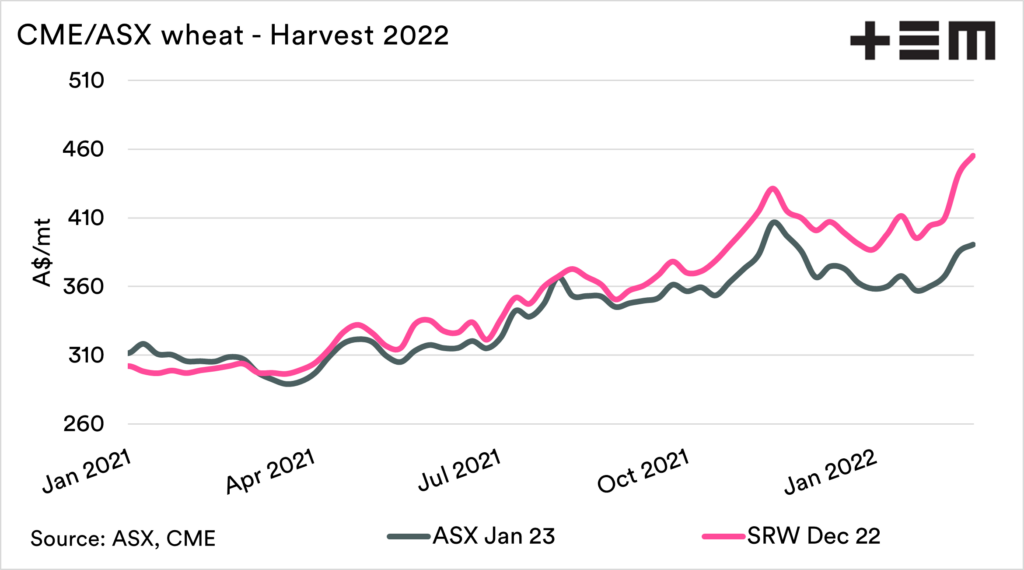

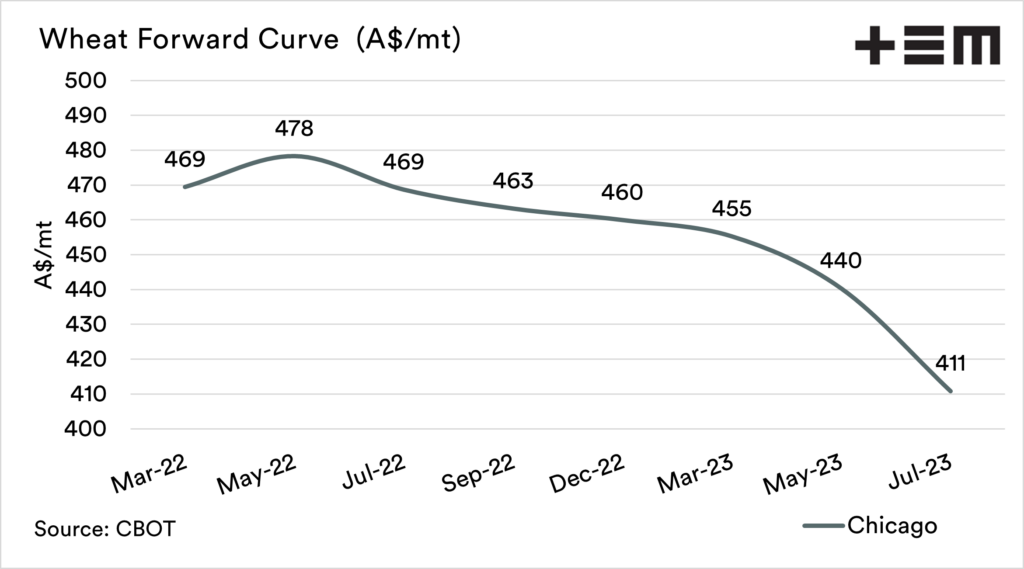

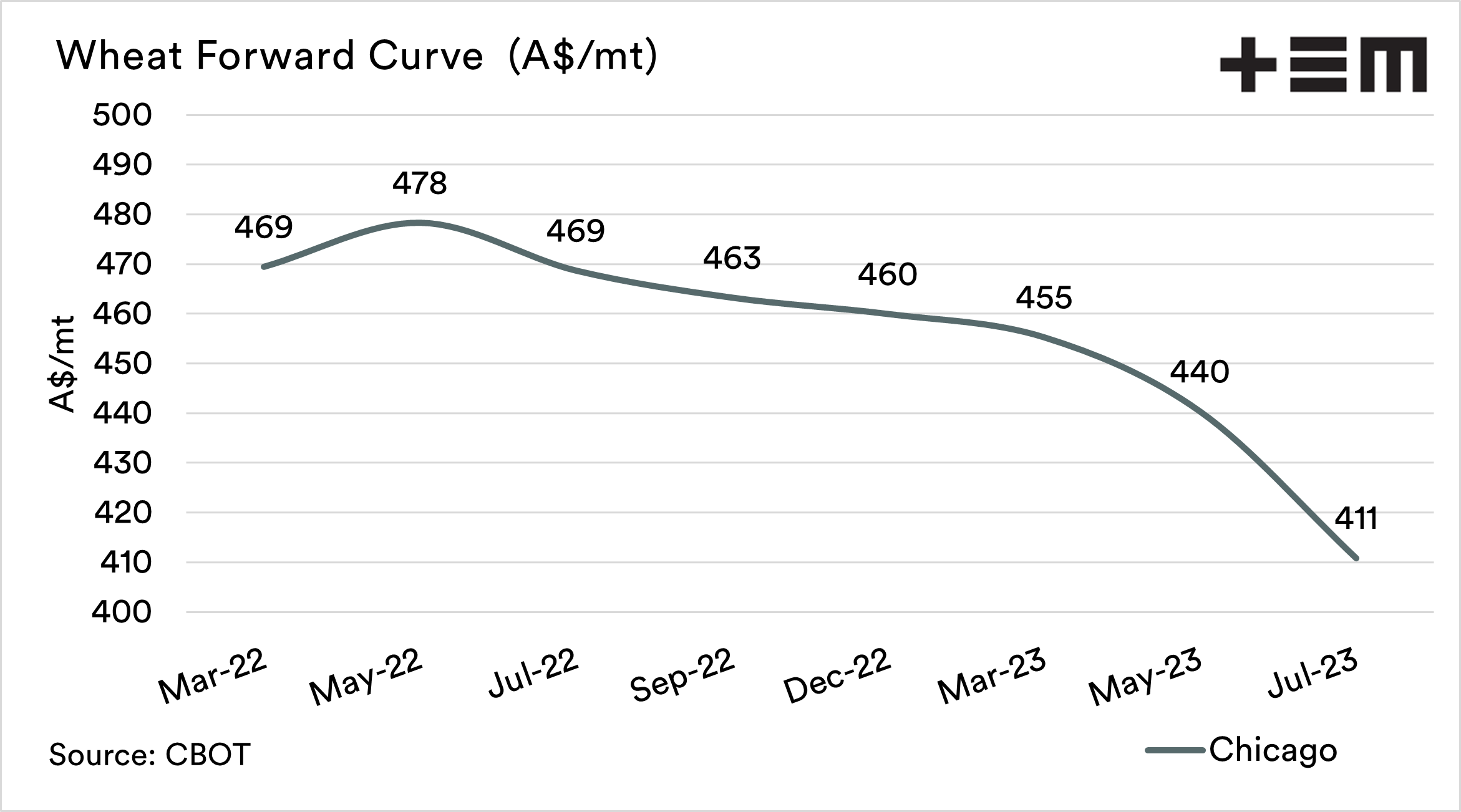

CBOT wheat futures have been turbulent in recent days, albeit are current up at A$469 on the spot contract.

If you were to look at the prices on offer locally for old crop, you’d be forgiven for thinking that nothing had happened overseas.

The most frequent question we are getting at the moment is why is the price locally not following suit? We did briefly cover this last week (see here), but its important to keep an eye on this.

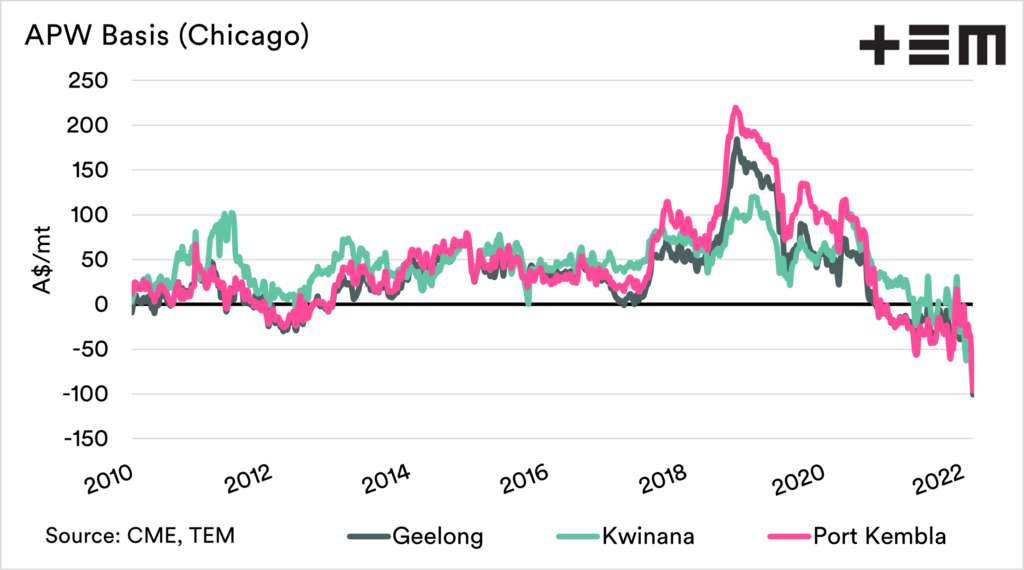

The basis level this week has now reached the largest discount since at least 2010. The increases in the futures market are not flowing through locally.

It is the shipping stems, but also it is hard for a trader to operate in this environment where the futures rally is not necessarily reflecting the physical market. The physical market overseas is also not following the futures market. The volatility in the futures market is one reason that it gets hard for a trader to pass it on.

The old crop is not feeling the effect, and it may take some time to flow through – if at all.

For those looking at the new crop, ASX wheat basis has also declined to A$65. This effectively is the market pricing in a big crop – which may or may not come to fruition. If you book in CBOT at A$460, there is the possibility of basis returning to lower discounts if the crop doesn’t produce a thumper.

At the moment I think the biggest opportunities for Australian farmers will be in the forward market rather than old crop (see here), so keep an eye on the forward curve.