Market Morsel: Russian tension not flowing through yet?

Market Morsel

I was told two things about the grain trade when I was younger. Firstly, logistics and execution were key. Secondly, physical grain prices are more aligned to reality than the futures market.

Also read Colossal wheat price jump

The logic behind the second one is that the physical grain is less impacted by speculators. Speculators can jump onto futures with no real barrier. Buying a panamax of wheat is a different thing. Generally, my view is that those in the grain trade have a better eye for what is happening than a speculator who may be dabbling in wheat this week and iron ore the next.

We see at the moment that futures are on a huge rally (+10%) since the start of the year, but that our local prices haven’t seen the same levels of rise. Is it just us?

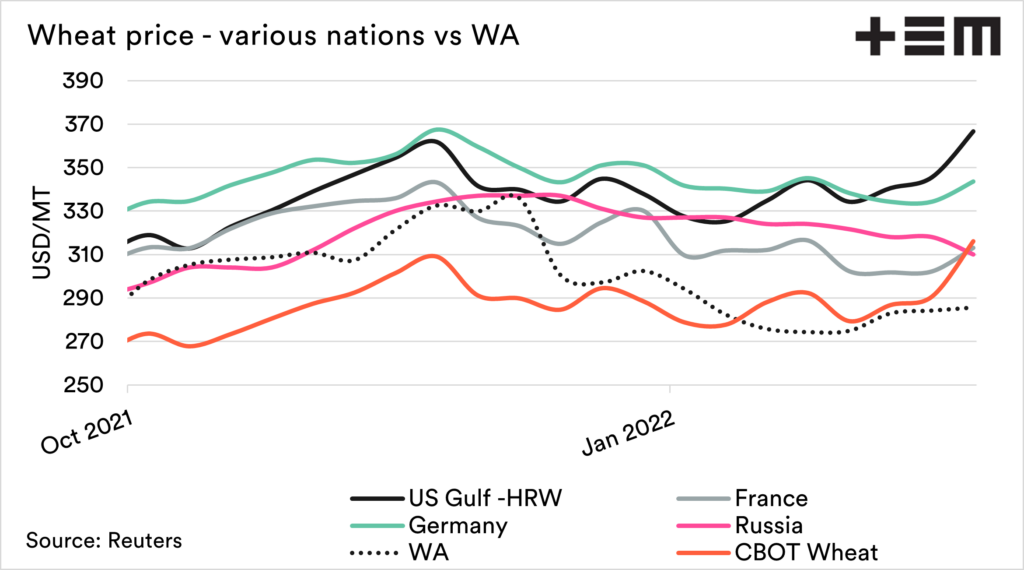

The first chart below shows the price of wheat from a selection of countries around the world. Physical prices, for most, were actually peaking for the period during the end of November. They subsequently lost ground and stabilised. In the past fortnight shows some gains have emerged. Again not to the same levels that the futures market has experienced.

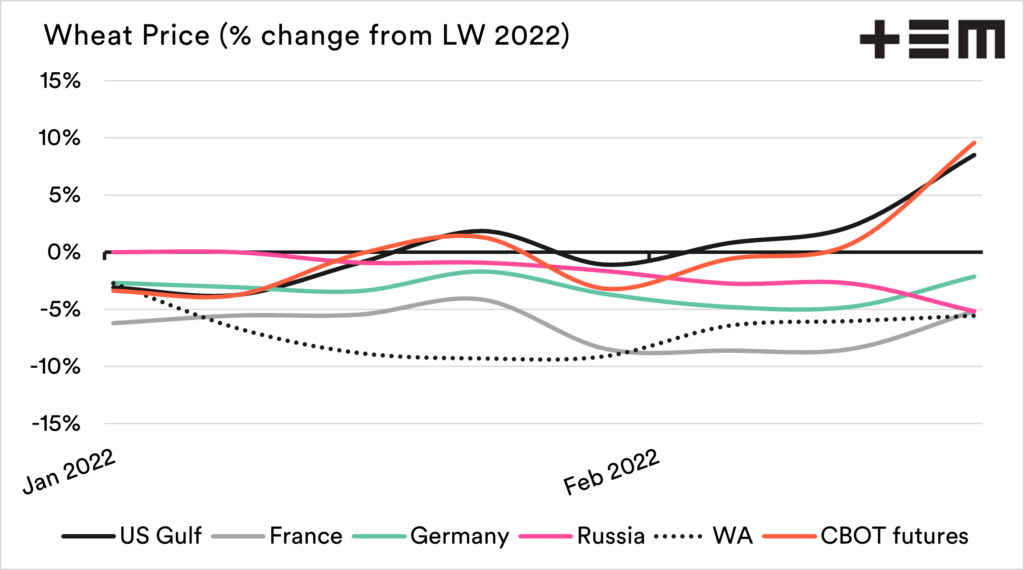

The second chart shows the weekly change in price between the last week of December and now. The majority of countries have lower pricing levels than pre-NYE, despite the issues in Russia.

The exceptions are US values, which hold a close linkage with the futures market. So all in, the world’s physical prices haven’t really kept up with the advance of futures.

Is it logistics, the timing of year or a trade that isn’t too concerned? It will be interesting and important to watch this over the coming week as tensions raise or erode.