Market Morsel: A strategy to reward 2022 canola?

Market Morsel

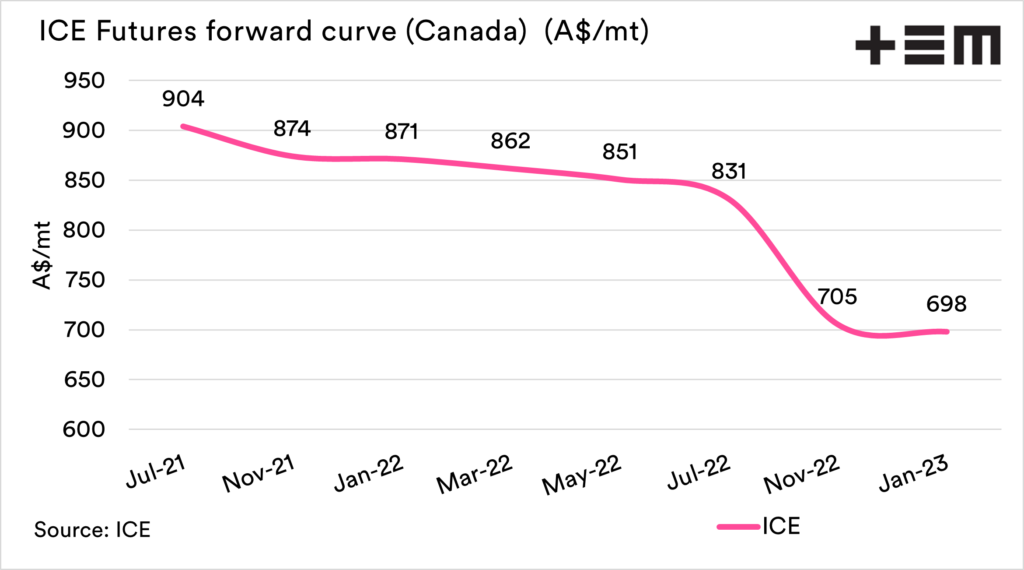

A forward curve is an important tool, as it provides a quick visual of how the forward markets are performing. Importantly it gives an outlook on what you will receive if you lock in pricing further along the horizon.

To learn more detail about the forward curve, click here

Let’s have a look at canola, as I think this offers some decent opportunities for the 2022 harvest.

The current fundamental picture for canola is strong, and it doesn’t take much of a strategy to do well from the coming harvest. What about next year?

At the moment, November 2022, ICE futures are at A$705/mt. A large discount from the spot price of A$904/mt, but maybe this should still be considered?

Why would you lock in such a big discount?

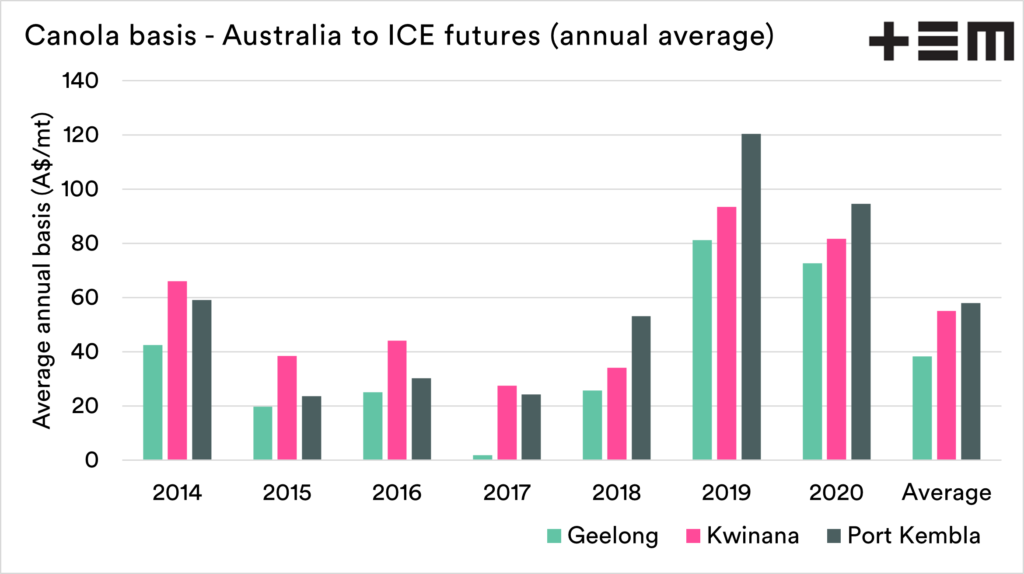

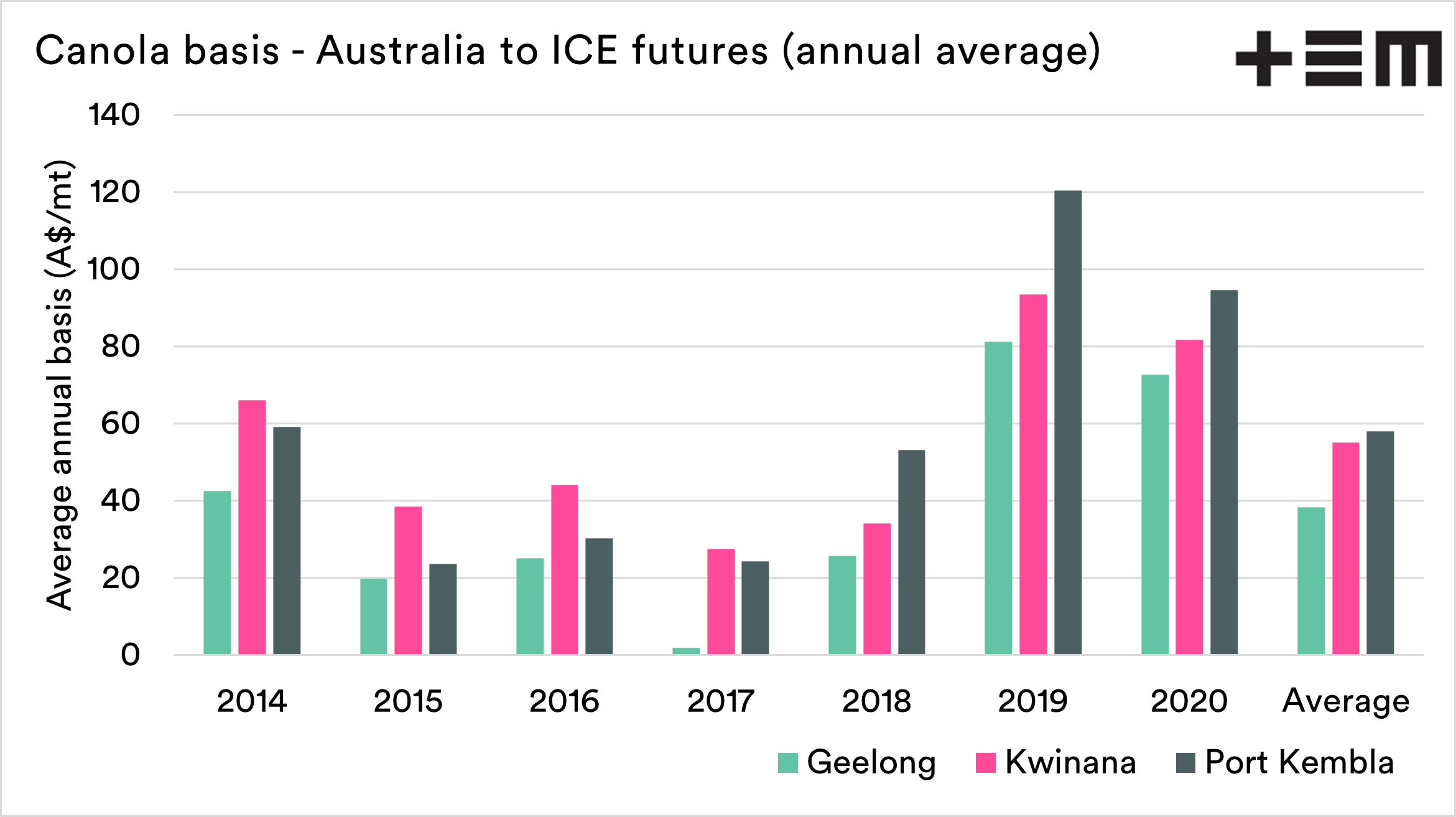

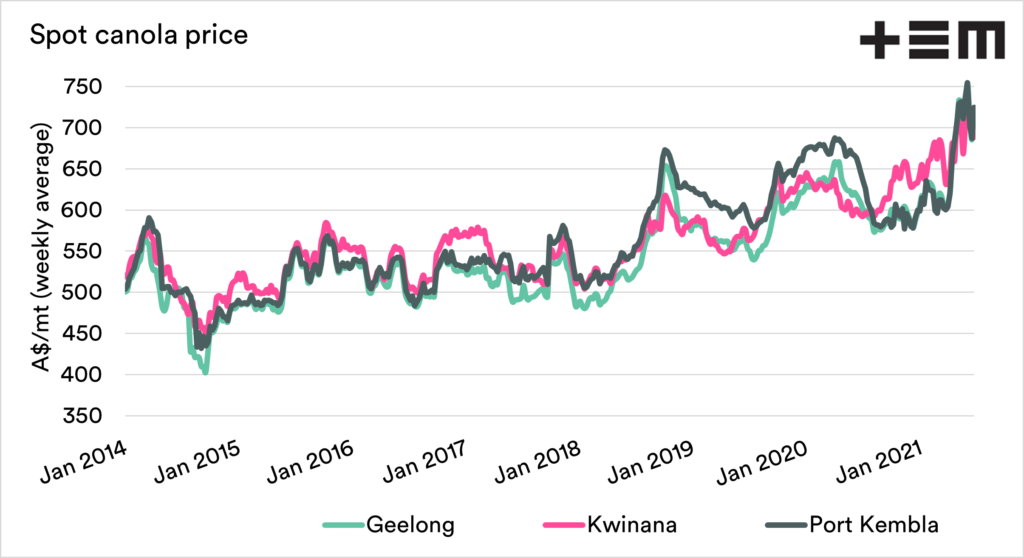

In recent canola articles, I have discussed the basis levels between Australia and ICE canola (see here). In summary, Australian prices are trading at a discount compared to our normal premium. A price of A$705/mt excludes basis, and Kwinana, as an example, has averaged +A$55 since 2014.

If basis levels reverted to average, then the overall price received for the 2022 harvest would be A$760/mt (Futures + basis). I don’t know about you, but that is a good price, and well above the long term average.

We know that this year is looking bad in Canada, but we have no idea what next year will bring to them. When managing price risk, it’s a good idea to ‘kick the can’ down the road as far as possible.

Here are some scenarios:

Scenario 1: Canada has another bad year in 2022

If Canada has another poor year (3 in a row?), then the price would likely continue to stay at current levels. This would mean that the A$705, would be less attractive. However, if only doing a small chunk, then you’d still participate in the higher market point.

The basis level in this scenario would likely continue to be negative, resulting in an overall price below A$705.

Scenario 2: Canada returns to normal

If Canada returns to normal, then likely futures would fall. The Australian basis level would revert to more normal levels.

You would close out your futures position, lock in your basis, and receive a price of A$705+.