Market Morsel: It’s a rare sight to see a wheat market like this.

Market Morsel

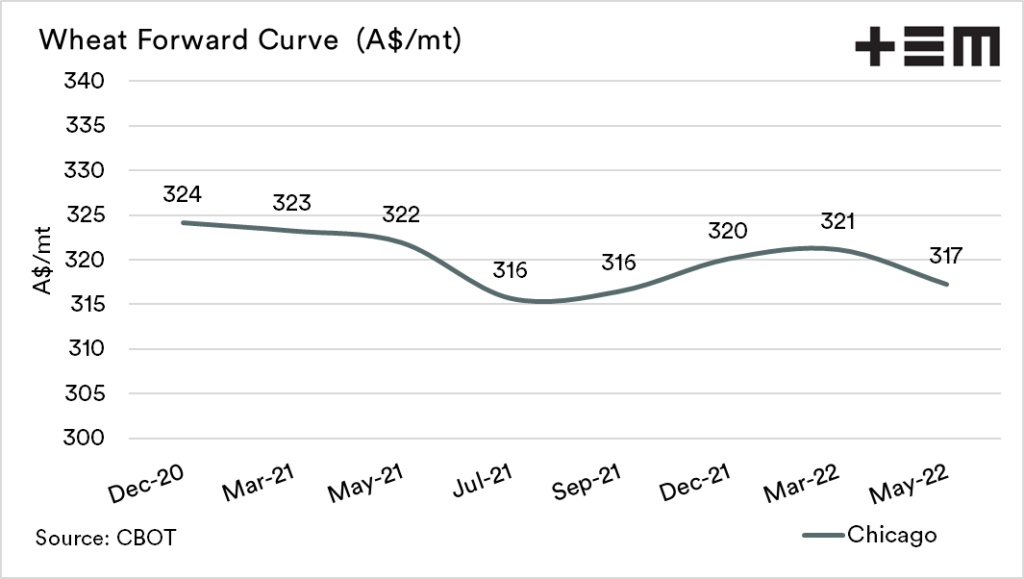

In an early piece on EP3, I wrote about the forward curve and how it is a vital chart to review when marketing grain (see here). This is especially so for producers, as the futures market tends to operate in contango, which means you effectively get paid a premium (or carry) for locking in further down the curve.

I highlighted ‘tends’ in the previous paragraph as the market has gone into a slight backwardation. At present, the market is paying A$324 for December 2020 wheat futures but is discounted to A$316 for July 2021.

The theory is that a forward curve in backwardation is one where the buyers want delivery at once. They, therefore, pay a premium to ensure that they get access to the commodity asap. This occurs when a product is in short supply.

There are some bullish concerns in the market as some countries look to stockpile, and Chinese demand seems robust. On the supply side, there is a little early apprehension of the possibility of the 2021 crop.

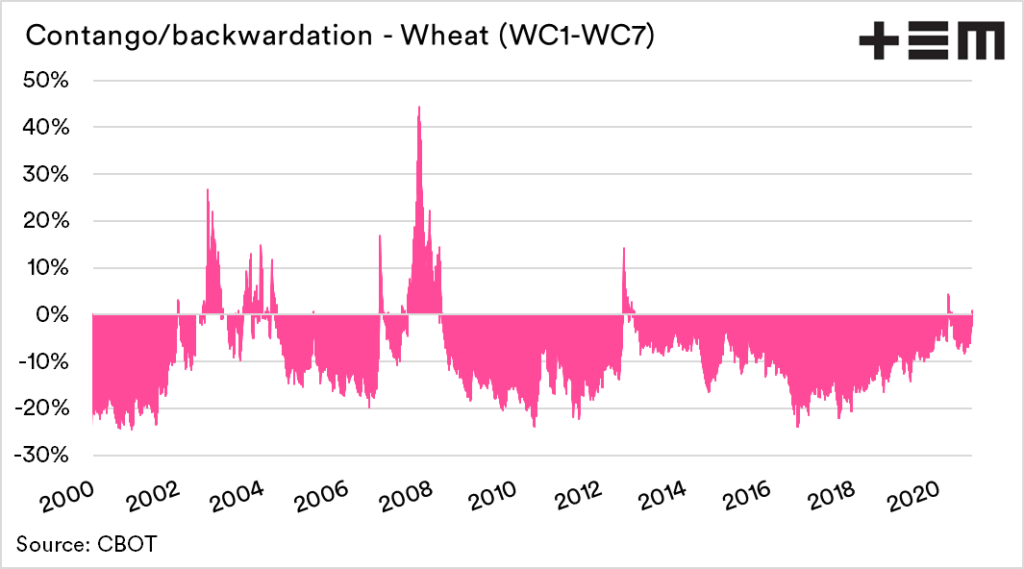

The second chart below shows how often that CBOT wheat futures are in backwardation. This chart represents the difference in price (%) between the spot contract (WC1) and seven contract months ahead (WC7).

In the period 2000-present, the majority of the time the market was in contango and paying a premium for future months.

This year the market went into backwardation in April when the market was spooked by fears of shortages due to COVID. It didn’t last long before a reversal.