Market Morsel: Our wheat premium returning?

Market Morsel

In Australia, our wheat prices typically would trade at a premium to overseas futures (specifically Chicago). This season has been quite different due to the large crop we have produced, leading to Australian wheat pricing trading at a discount.

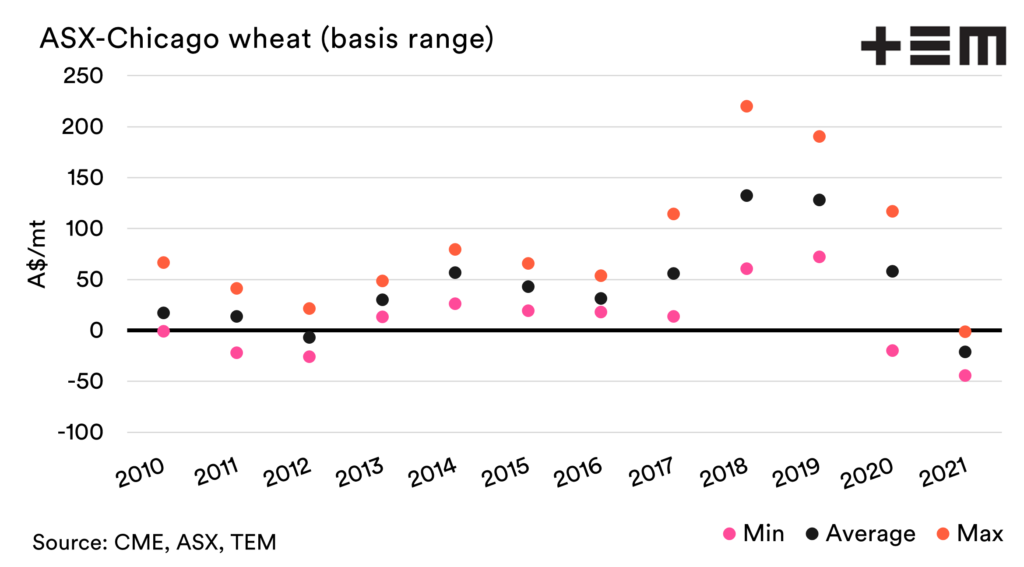

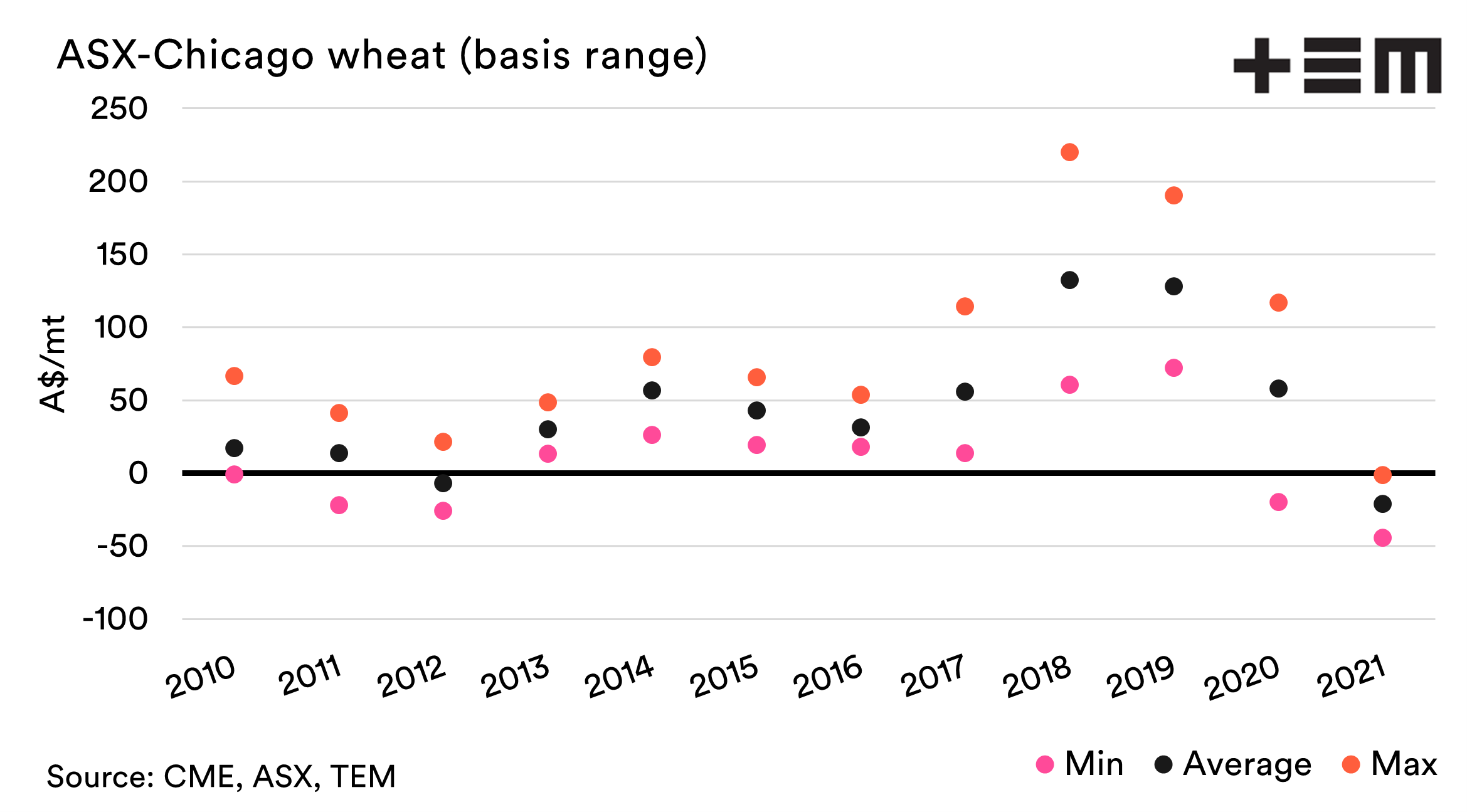

The first chart below shows the basis level between ASX wheat and CBOT from 2010 to present. The minimum, maximum and average basis for each year is shown. As we can see, the majority of the time, the basis level sits as a premium.

The only years when it doesn’t is during years of massive surplus. This year and the coming season are likely to fall into this category.

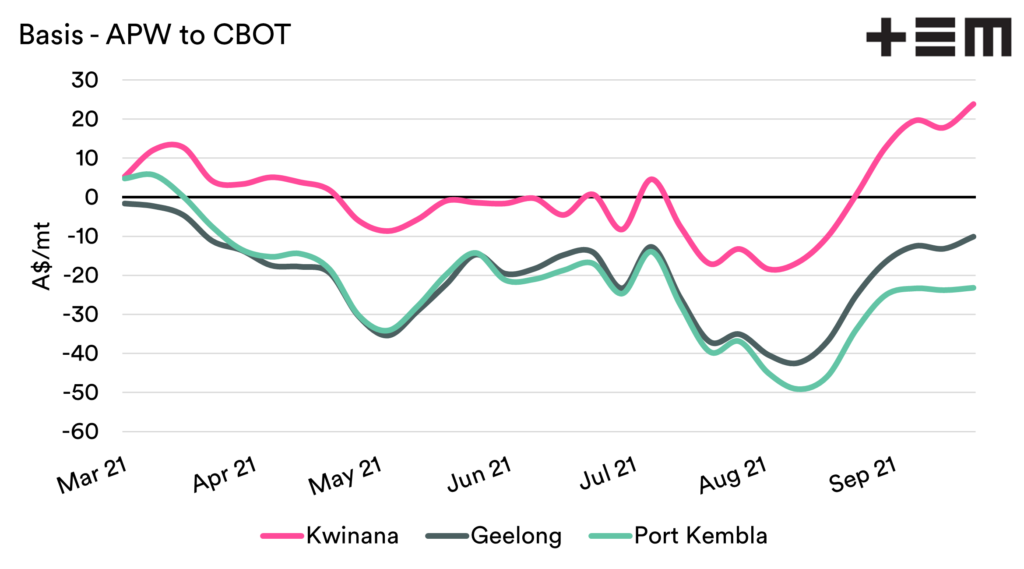

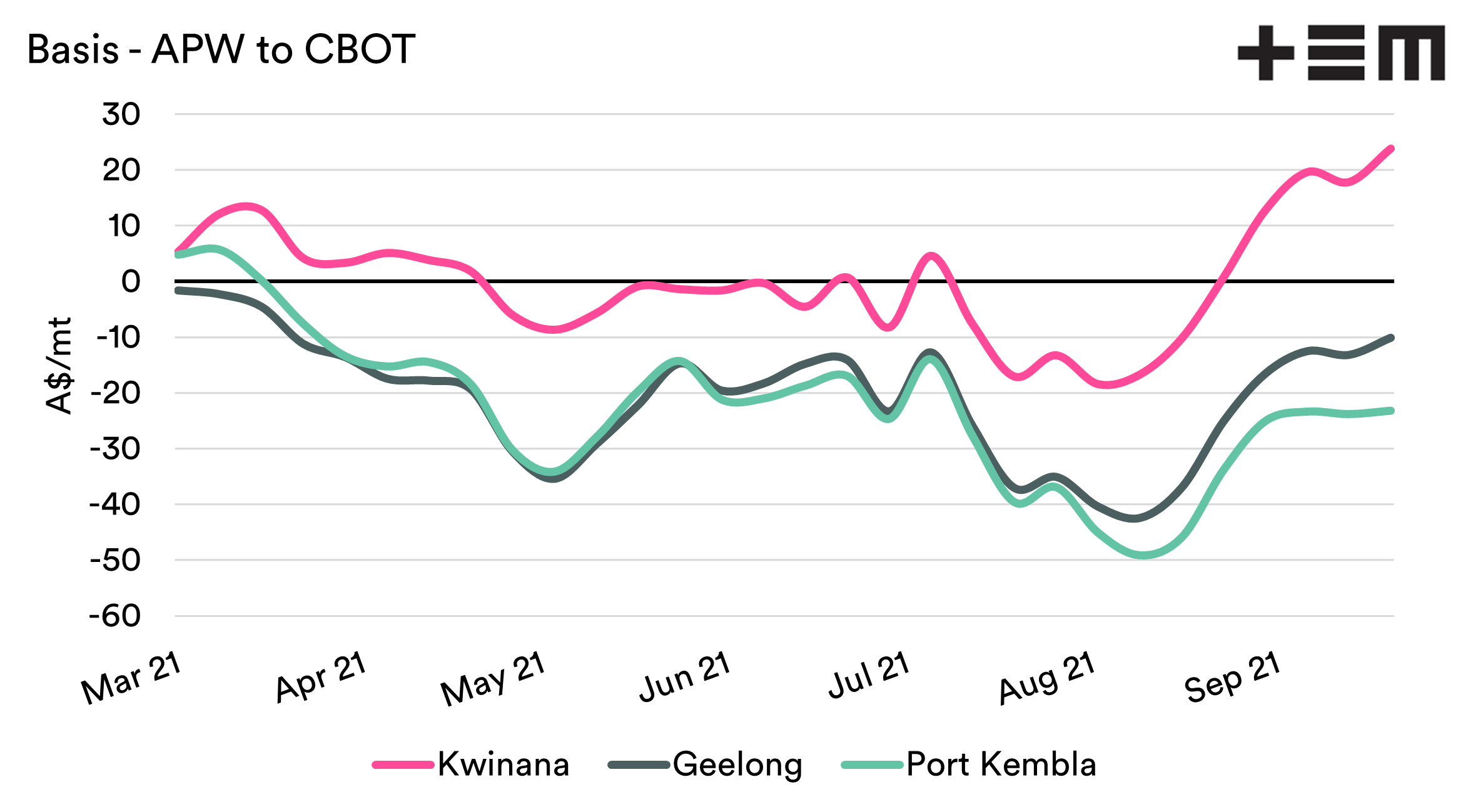

Whilst it’s not unexpected to see basis trading at a discount during a year like this, we have seen some improvements in basis levels around the country.

The chart below shows the basis level for new crop APW1 since march for a selection of port zones. We can see in recent weeks there has been an improvement in basis level. While the east coast is still trading negatively, the west coast has seen basis trading at a premium to Chicago.

For those who locked in futures levels in the high A$300’s back in August, this is a good sign, as this could result in some hefty returns if basis continues to appreciate.

To learn more about basis, read here