Market Morsel: Pop-corn.

Market Morsel

This article was initial released on Friday 29th January, subsequent updates to data for Friday evening are included at the bottom. It was decided to update this article as it had not yet been sent on email, and the importance of the data.

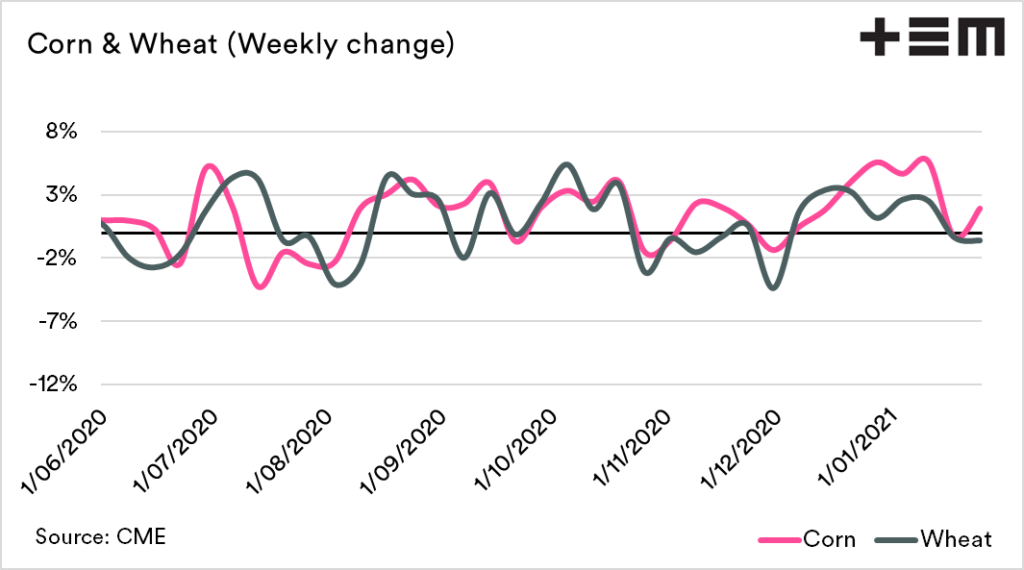

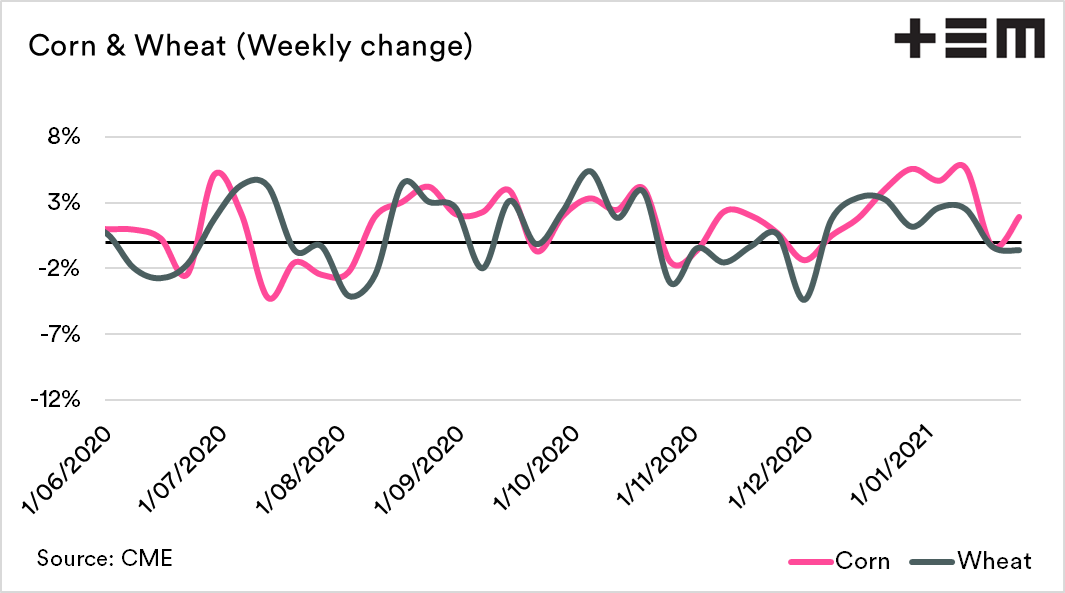

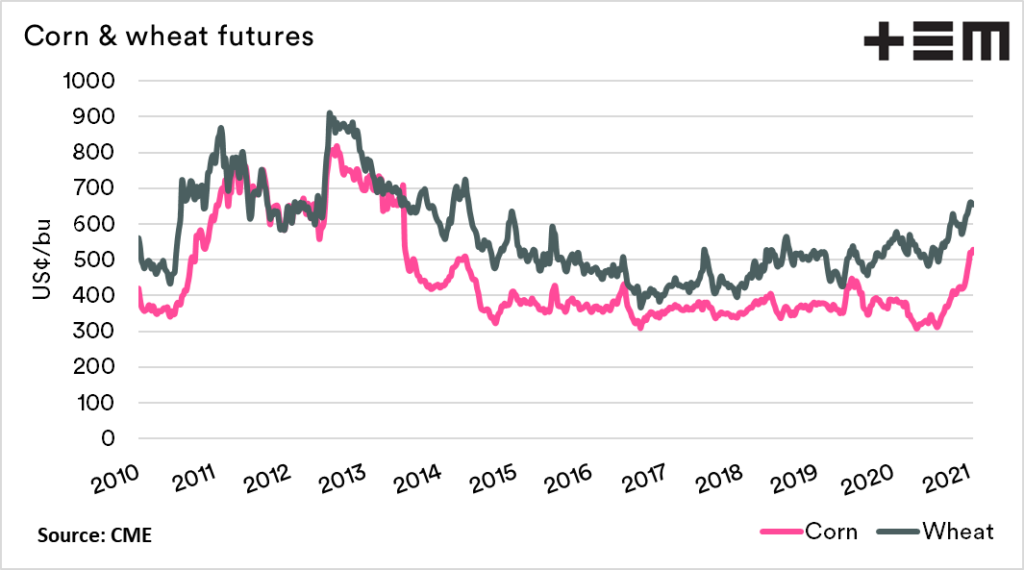

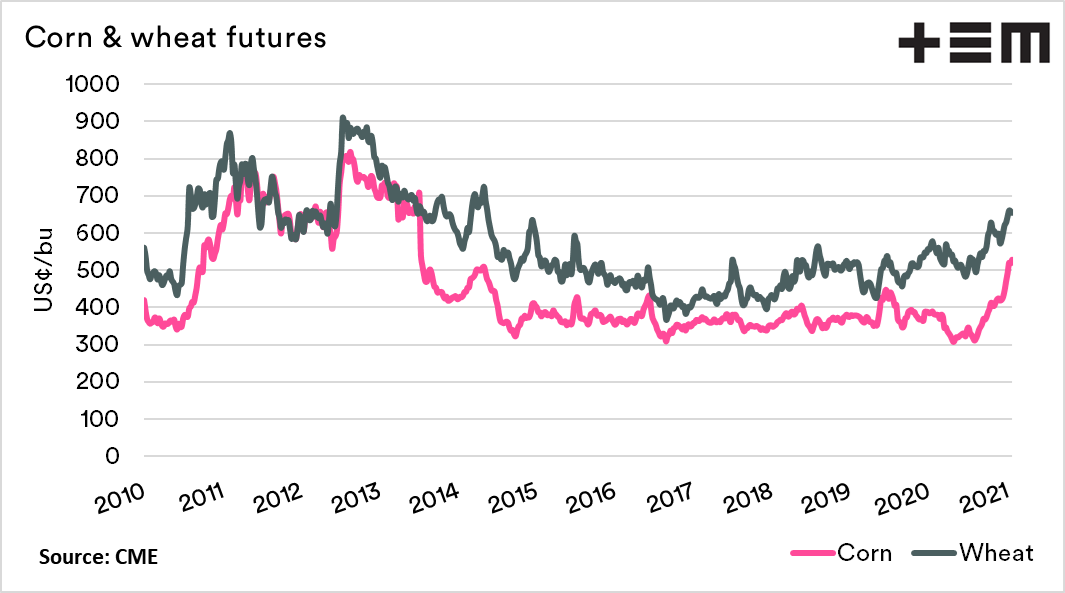

I often discuss the corn market, as even though we don’t produce much corn, global corn pricing movements will influence our wheat price (see here & here). It seems like things are heating up again in the corn market.

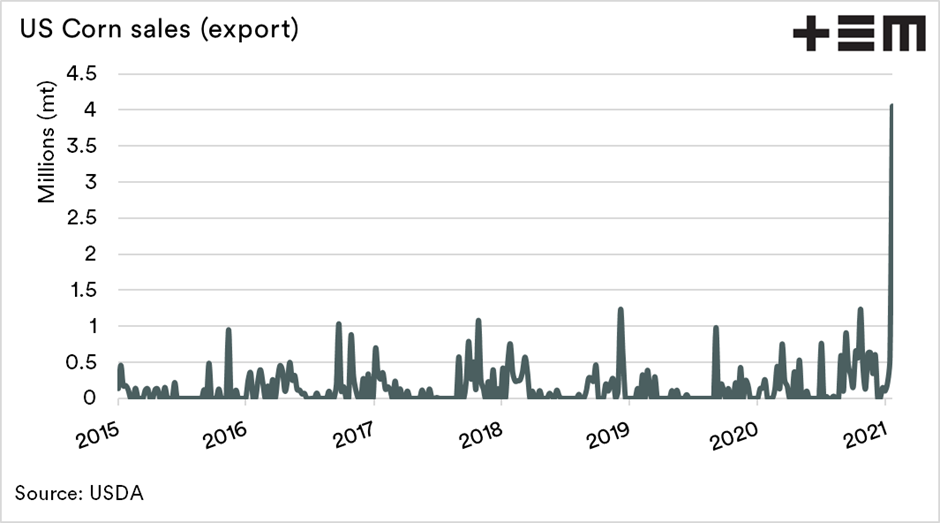

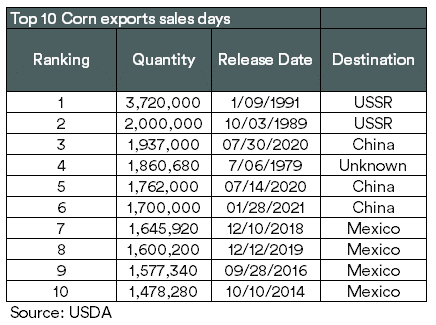

This week US flash sales were huge at 4mmt. The majority (3.7mmt) is destined for China. Yesterday’s purchase was the 6th largest sale day to one nation from the United States.

Expectations from EP3 analysts in early 2020 were that corn exports to China would be up in 2020 & 2021 due to the phase 1 deal (see here). This massive increase in Chinese buying in recent months has seen China at no 3, 5 & 6 all since the middle of last year (see table).

As mentioned above, the wheat and corn market is highly correlated. In recent months we have seen both commodities moving up, albeit with wheat not receiving the same gains.

The sales into China have seen corn prices reached seven-year highs yesterday. While China can be a bit of an unknown, if the substantial purchases continue, this will be positive for pricing. The effect for us in Australia will be a likely flow-on effect on wheat.

Happy days at present.

On Friday, China made a further purchase of 2.1mmt. This was the 2nd largest single day corn purchase since the USDA started recording flash sales. This placed the total purchases for the week at 6.16mmt, with 5.8mmt going to China. To visualise this, that volume equates to 96 panamaxes.