Market Morsel: Corn offering some protection

Market Morsel

Last week I discussed the commitment of traders report (See here). In recent weeks speculators have reduced their long/bought position in wheat. At the same time, their position in corn has remained flat.

This shows that speculators are still attracted to corn, and view upside potential. A positive corn market tends to be supportive, or at the least keep a floor on wheat prices.

Why is that so?

The wheat market has a strong correlation with the corn market. This is due to the ability to interchange the commodities. As an example, if one becomes too expensive to feed, then buyers will switch to an alternate.

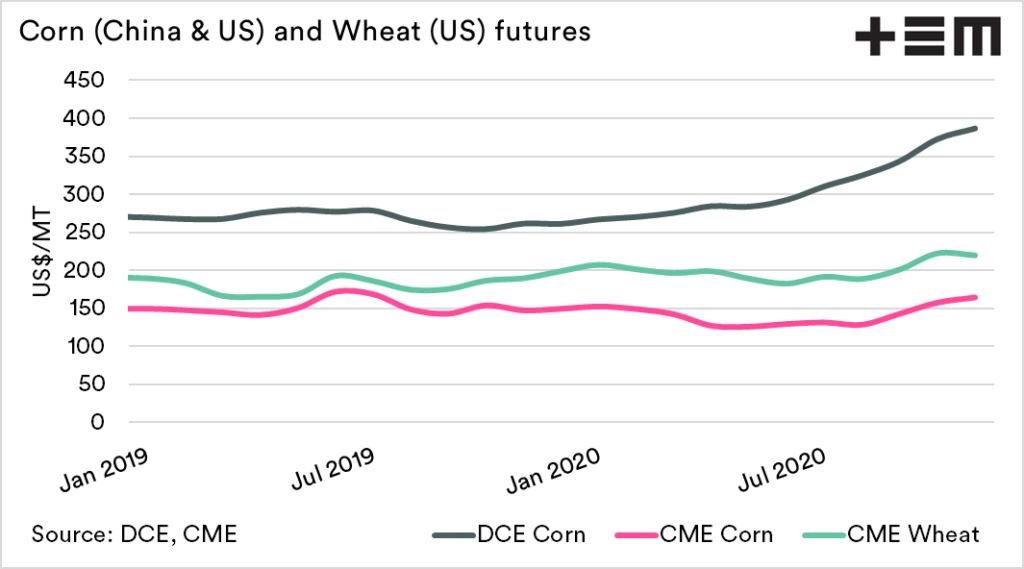

The first chart below shows the monthly average price of corn (in China & USA) and wheat futures. The corn market has rallied due to strong requirements in China, for much of the last six months wheat followed.

At present, the demand for corn has remained strong, with some rumours of import demand in China at extremely high levels (>20mmt).

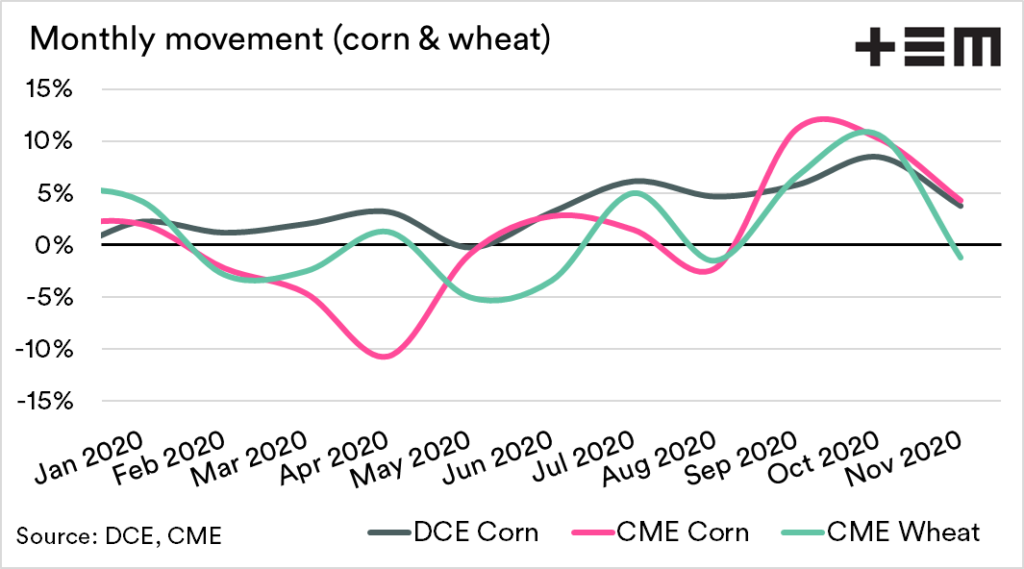

The second chart displays the change in price for the monthly average, and we can see that Chinese and US corn has followed one another closely with a 4% rise during November. At bearish tone for wheat has resulted in prices declining 1%.

If the rising demand for corn in China (see here), and the fallback in production in Iowa (see here) had not occurred during 2020, we would likely see a considerably lower pricing level.