Market Morsel: Speculators fall out of love with wheat

Market Morsel

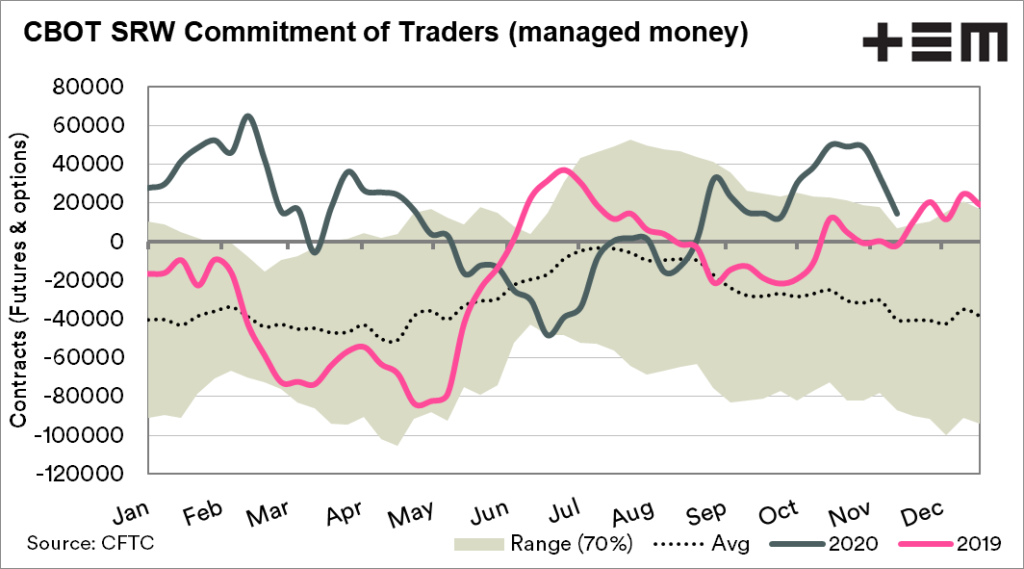

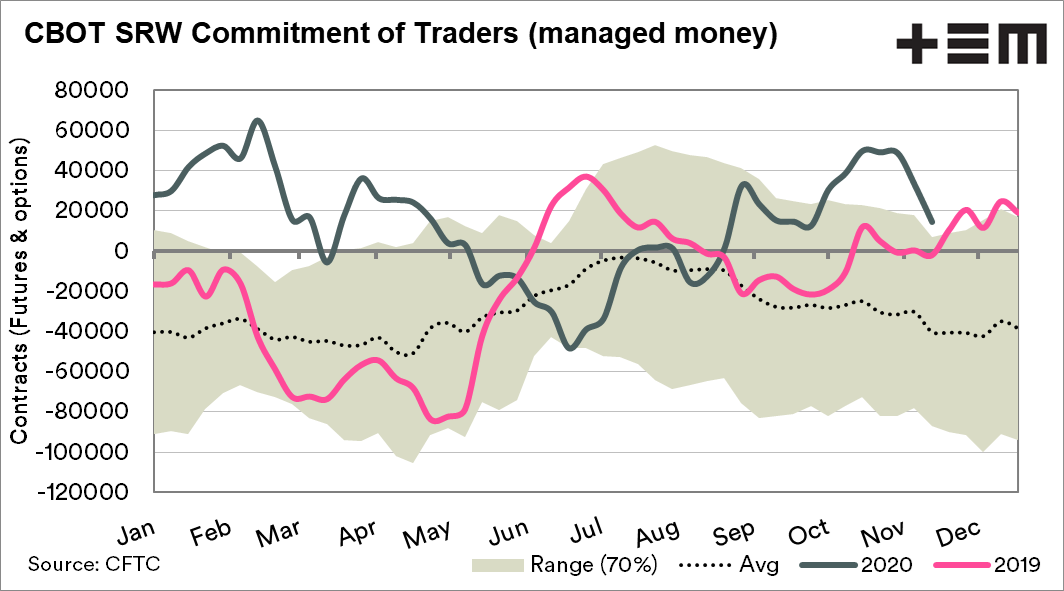

I recently wrote about the commitment of traders report and the ‘smart money’ being on wheat. I commented that it might not last (see here), as the fundamentals were for there for a change in sentiment.

Since that article, the speculators have reduced their net long in wheat. The reduction in positive sentiment coincides with a period of declining wheat prices (Chicago).

Long liquidation or ‘profit-taking’ is a big concern when speculators take large positions. The speculators have to close their positions to take profits. This leads to sharp changes in the market.

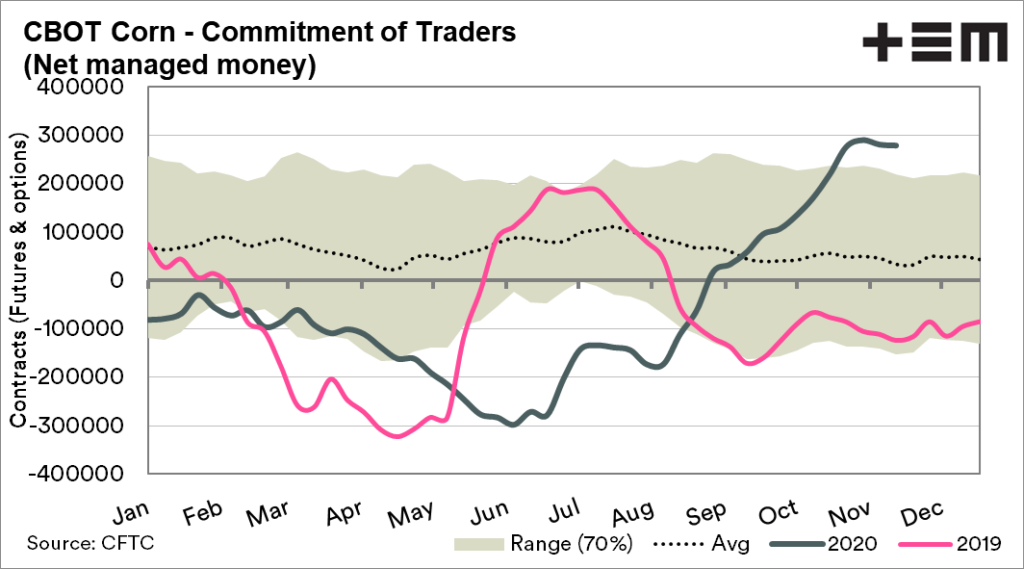

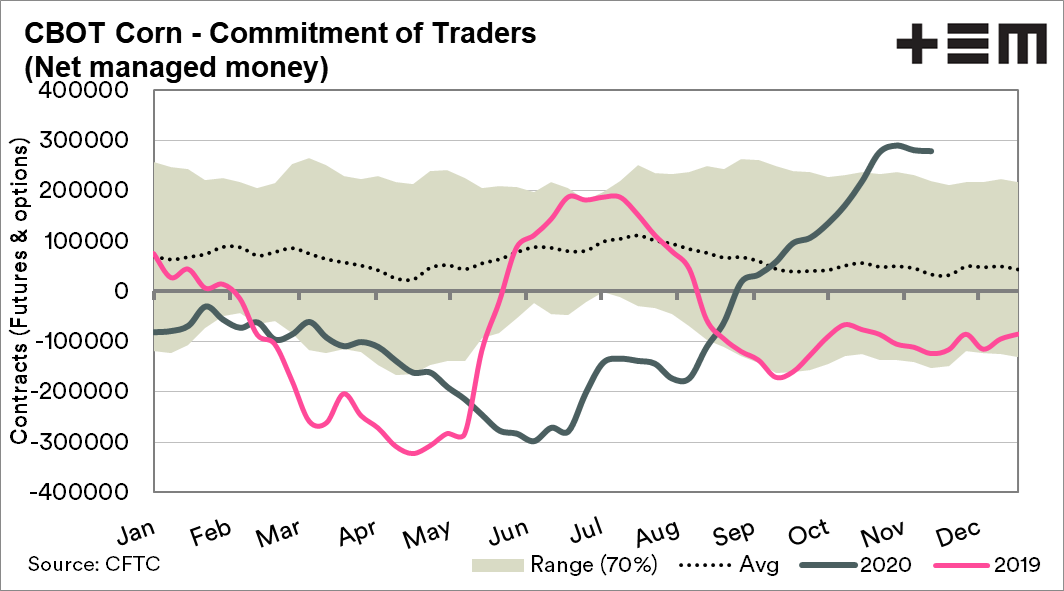

Their position on corn has remained buoyant in recent weeks, with their net position remaining relatively static. This is due to the bullish data on corn continuing, whilst wheat has turned neutral.

As we have mentioned in many articles, corn and wheat tend to follow one another, and positive sentiment on corn is generally supportive of wheat.

A more detailed explanation of the commitment of traders report is available here.