Market Morsel: The ‘smart’ money is on wheat (for now)

Market Morsel

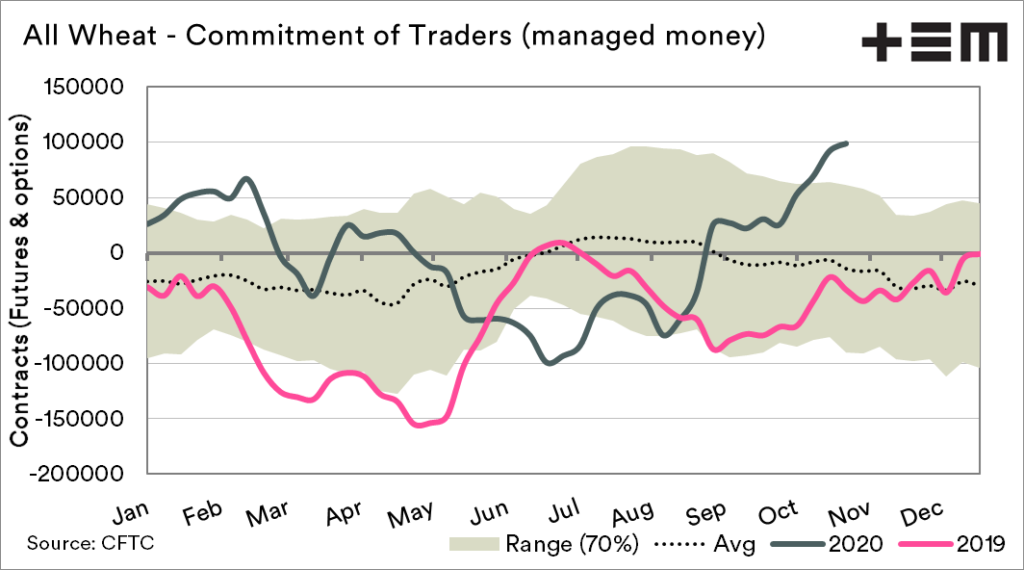

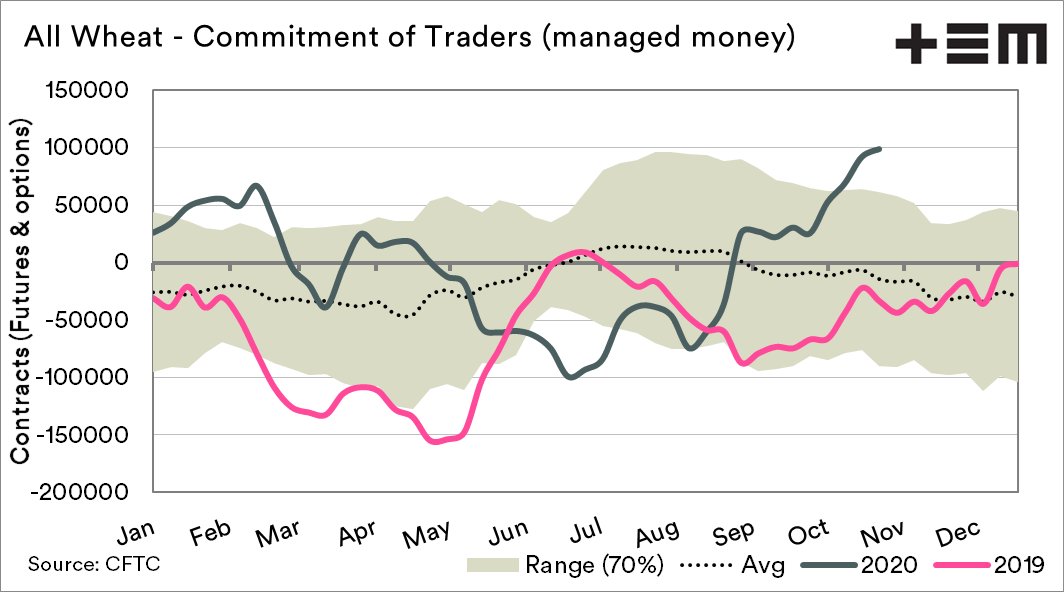

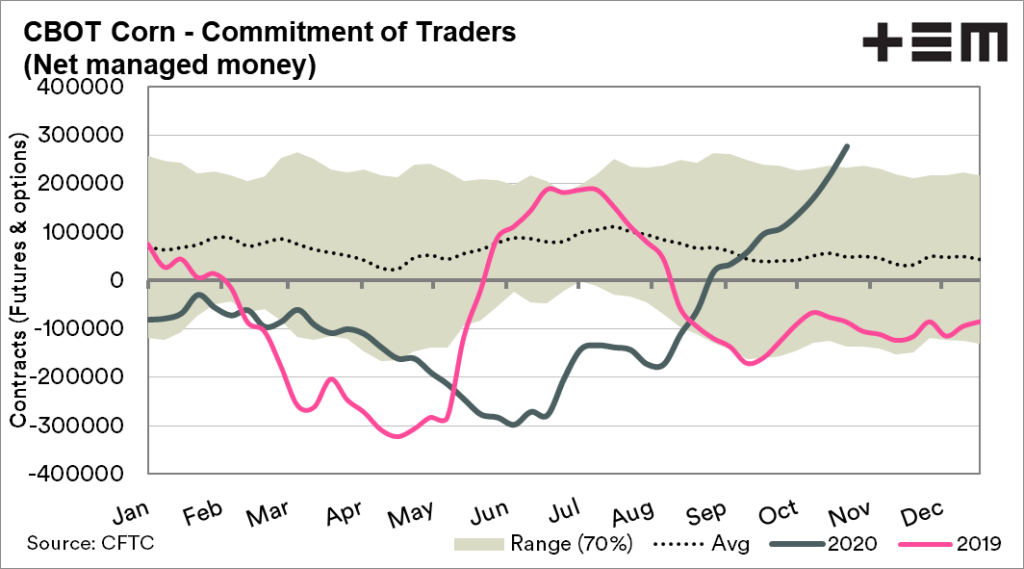

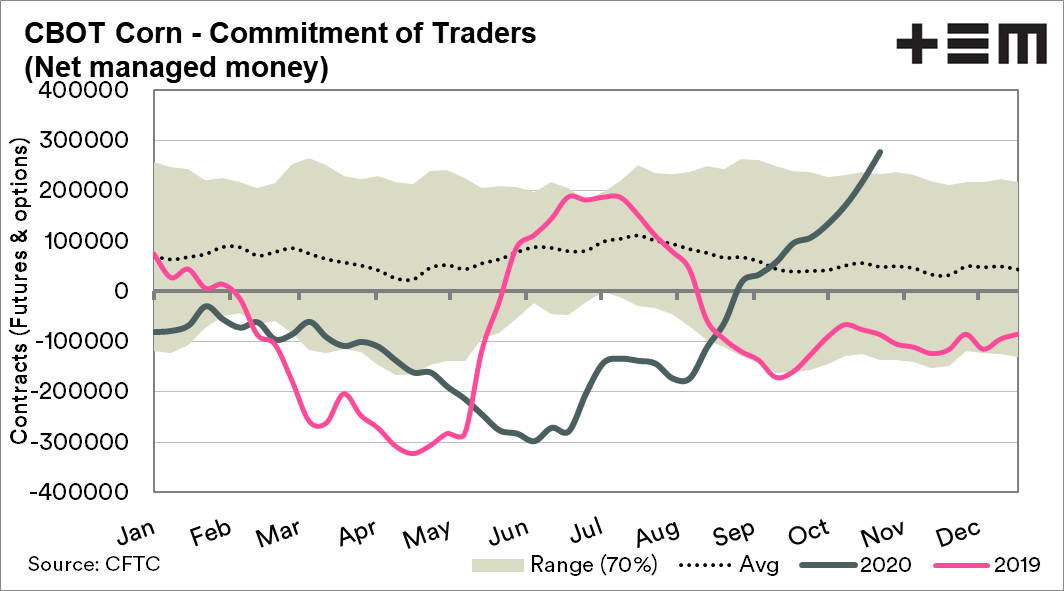

The commitment of traders report is a valuable tool for getting an indication of how different actors in the grain trade view the market. The main category of interest is managed money, which is considered a proxy for speculators.

If management money is long, i.e. have bought contracts they are bullish on the market, as they will make money if the market continues to rise. Conversely, if they are short, then they are bearish as they will make money on a falling market.

A more detailed explanation is available here.

During recent weeks, September and early October, the grains complex experienced a strong rally. Whilst there has been a clawback in the past week, the pricing in Australian terms remains strong.

The fundamental drivers of the wheat market at present were listed here.

The speculators have got in on the act. Seasonally the majority of interest in grain futures tends to occur in July/August. This year the market provided it’s surprised a little later. This has seen an influx of funds money into corn and wheat. In corn, the net long is the highest since 2012, whilst wheat is the highest since 2018.0

The ‘smart money’ is not always that smart, and the past couple of years are littered in periods when funds have been bullish, but the fundamentals have eventually taken over.

At present there are some fundamental bullish factors, but with the weight of most being towards next season. In the short term, there is a risk of long liquidation, which could see a sharp movement in price as funds take their profits.

NB, It is important to understand the COT report is released on a Friday using data as per Tuesday. The fall during the end of last week is likely to see this week’s COT report reduce the speculators long.