Market Morsel: Speculators had their fill?

Market Morsel

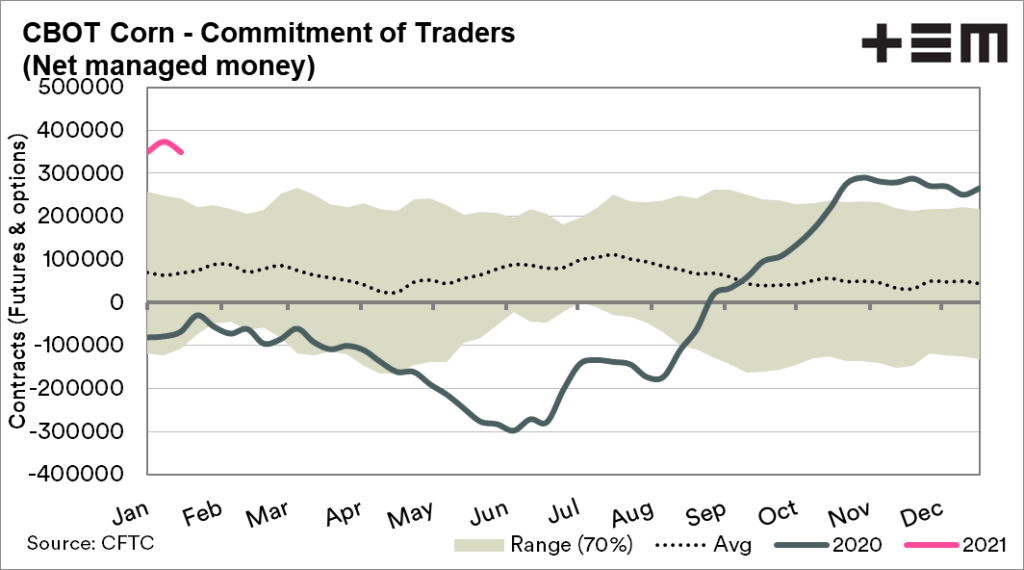

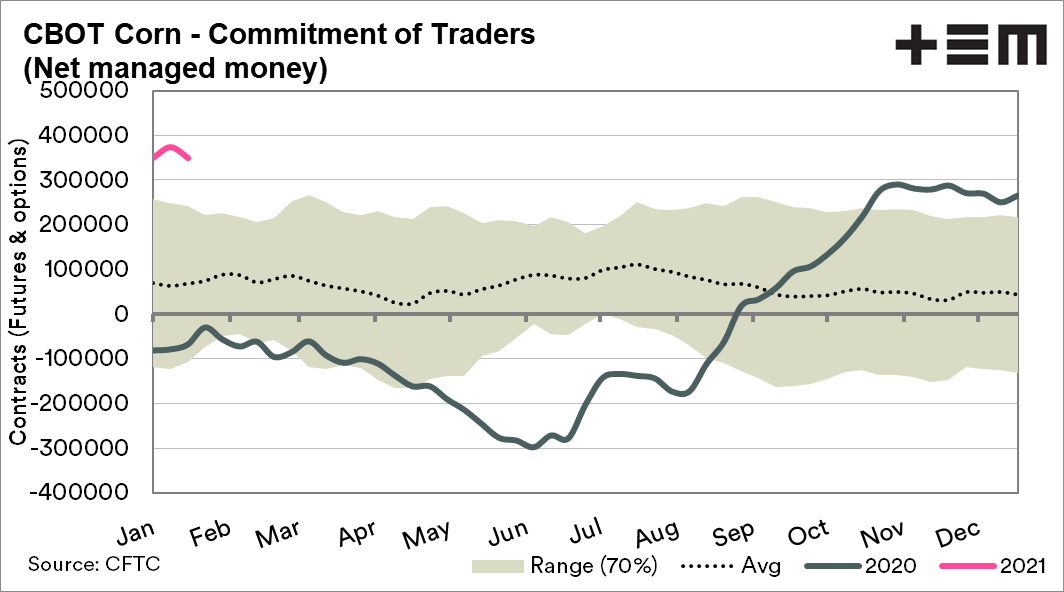

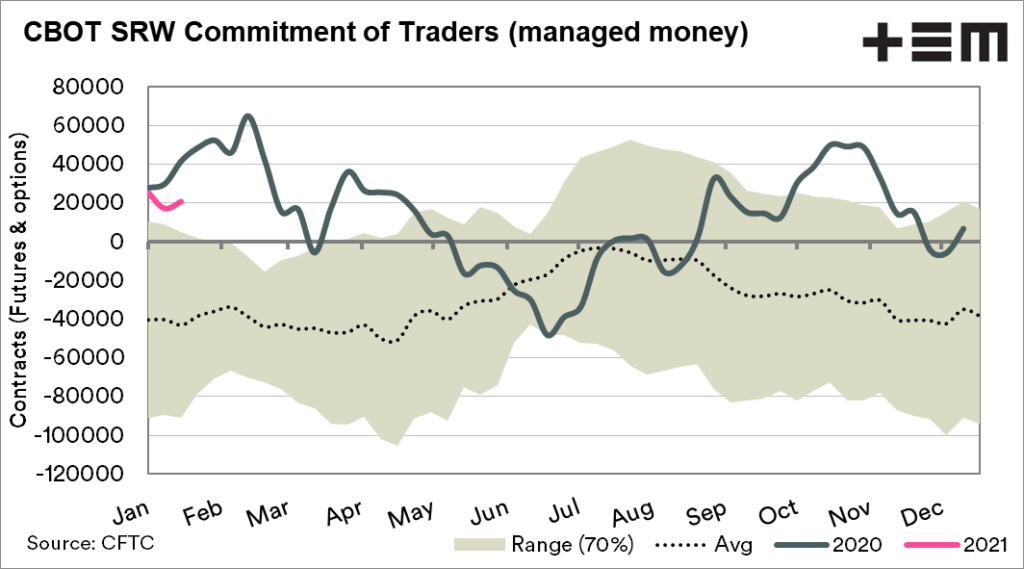

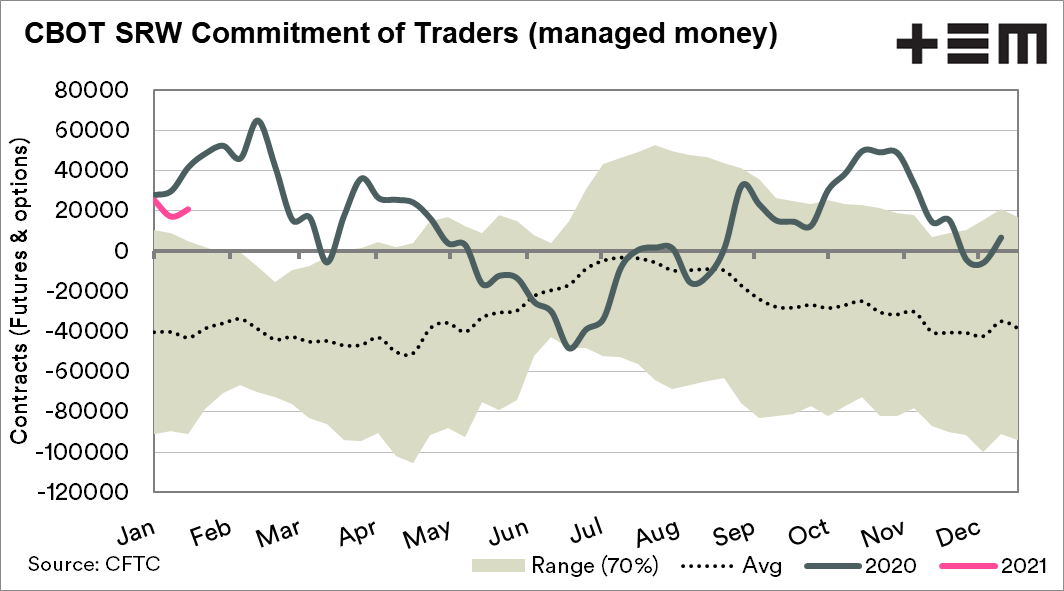

The commitment of traders report provides an important insight into the mind of speculators in the grain market. The main dataset which people examine is the net position of managed money.

When the position is positive (or long), then speculators are ‘betting’ on the market rising further. When they have a negative position (or short), they are expecting the market to fall.

An important term is taking profits. A speculator is generally not in the market for a protracted timeframe. They will want to take their profits (or cut their losses) at some point. When this occurs, we can start to see the market move quickly in the opposite direction.

At times this can be started by moves in the wider market, and the speculators are speeding up the marketplace’s action. This is one of the issues, or benefits of speculators, dependent upon your point of view.

In the last week, we have seen the speculative position of corn drop, albeit from very high levels. The wheat position has gone further long.

Fundamentals drive the market; speculators have provided a part of the action with ‘fear of missing out’ (FOMO – see here) creeping into ag markets recently.

The reality though is that this time of year has very little new data, and markets move on data. The supply and demand picture is potentially set for fireworks this season, but the northern hemisphere as always will be the key (see here).

At the end of last week, we saw futures markets losing some steam, and we will see in this weeks COT report (Saturday) a reduction in the net long position.