Market Morsel: Could speculators give wheat prives a jump?

Market Morsel

Where is the ‘smart’ money on grain? I am a little sarcastic when I use the term smart money for speculators. The speculators in the market are as often wrong as they are right.

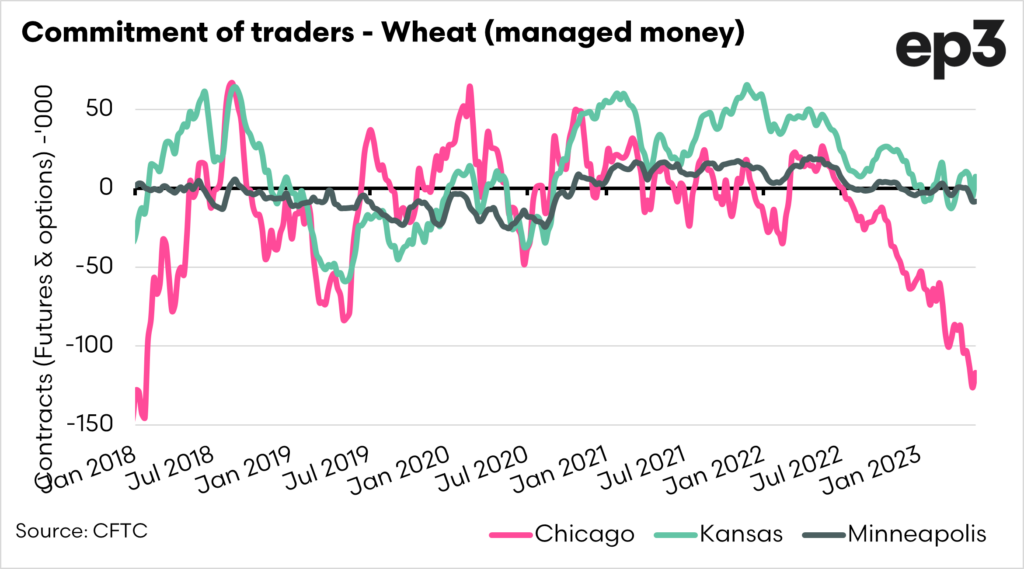

The commitment of traders (COT) report is a valuable tool for understanding how different actors in the grain trade view the market. The main category of interest is managed money, which is considered a proxy for speculators.

If management money is long, i.e. have bought contracts, they are bullish on the market, making money if the market continues to rise. Conversely, if they are short, then they are bearish as they will make money on a falling market.

A more detailed explanation is available here. A series of charts below provide some insights into the COT report and, therefore, the speculator’s thoughts.

Chart 1. This chart shows the net position of the speculators for the three main US wheat contracts. The biggest outlier is the Chicago wheat contract. This contract in recent weeks, has been showing the largest short position since 2018. In effect, a short position is where overall, the speculators in the market are ‘betting’ on prices falling further – they gain from falls in the market.

The other contracts have not seen the market go as short. This could and is most likely due to the conditions in the higher protein markets (see here).

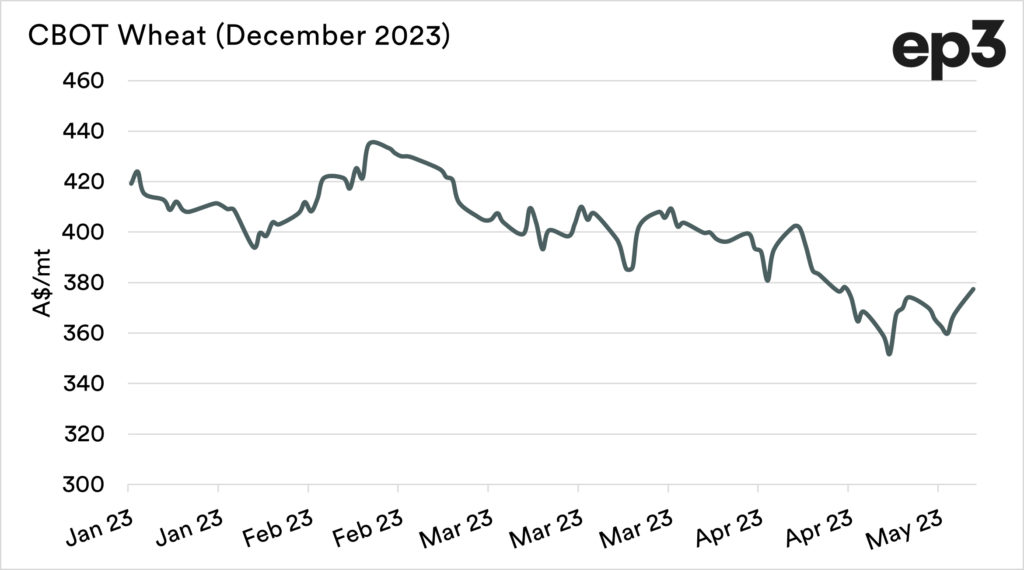

Chart 2. This chart shows the wheat futures contract for the coming harvest (in Australia). We can see that there has recently been a large price jump (A$17 in the past two sessions). The speculators holding short positions will get sweaty looking at a rising market – as they start to lose money.

This can be contagious and result in speculators closing their positions ahead of further losses. In a week where we have the potential of the end of the Ukrainian grain export corridor – there will be some testy conversations going on.

If speculators have to buy into the market in a big way, we can see big (possibly short term) rises in prices.