Market Morsel: The future is what you make of it.

Market Morsel

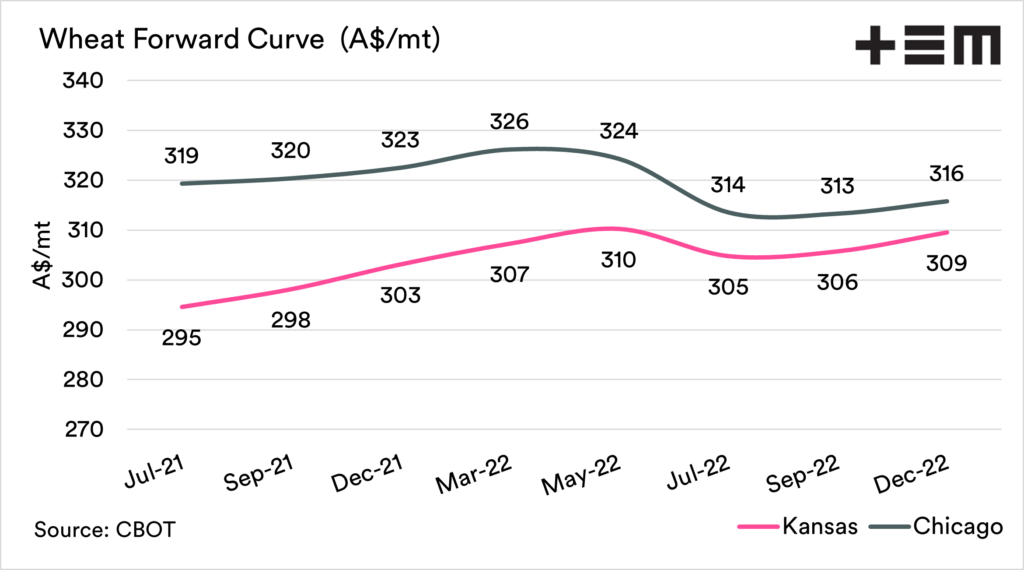

It’s not long since we published on the forward curve (see here), but the change in market levels necessitates an update.

A forward curve is an important tool, as it provides a quick visual of how the forward markets are performing. Importantly it gives an outlook on what you will receive if you lock in pricing further along the horizon.

To learn more detail about the forward curve, click here

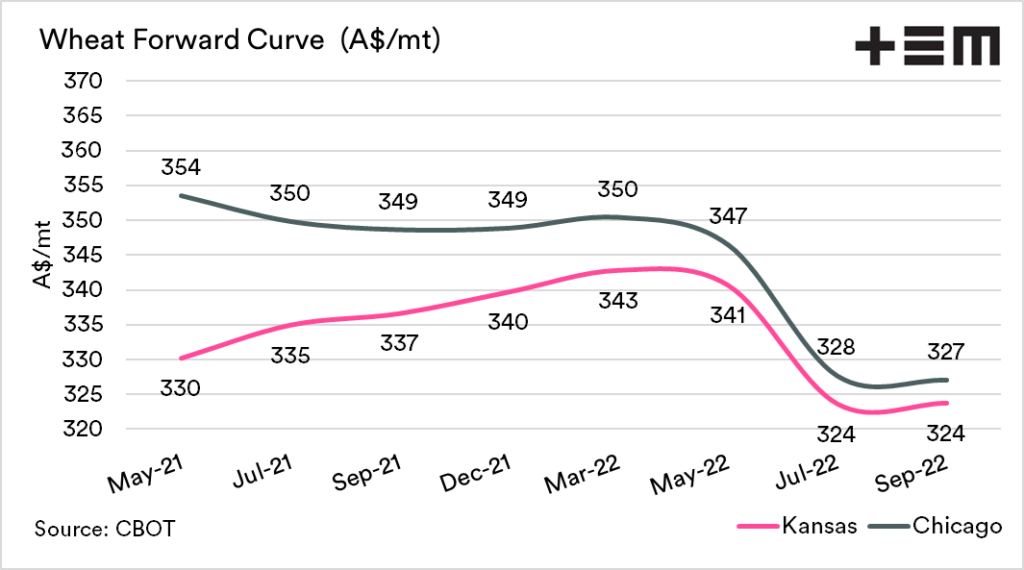

The December contract for Chicago was at A$349 at the last update; at the moment, it has fallen to A$323.

The fall, right along the horizon, has reduced the value of locking in futures. This is in comparison to values at the state of the month. However, they are still relatively strong compared to history.

It is important when looking at the market not to be fixated on the price available at present. It is always a good idea to look forward to seeing if you can lock in strong pricing down the road. The idea is to extend good pricing as long as possible.