Russia – New kids on the Bloc (again).

The Snapshot

- Russia now has full access to China for cereals.

- This allows the opportunity for more barley and wheat to head into China.

- Chinese buyers now have access to the worlds largest wheat exporter.

- This move comes at a time when China is buying huge volumes of grain.

- More open doors equal more opportunities for Chinese buyers.

- Russia does little volume into Asia at present. This is in part due to being uncompetitive compared to other origins.

- Russia could start to erode our market share. However, it is more likely during times of drought when we have large deficits and uncompetitive pricing.

- In order to increase market share into China, Russian origin grain will still have to be competitive on price. It will also have to be a better price for traders than current export destinations.

- Barring substantive increased Russian production, any increase to China could lead to opportunities for Australian grain in other destinations.

The Detail

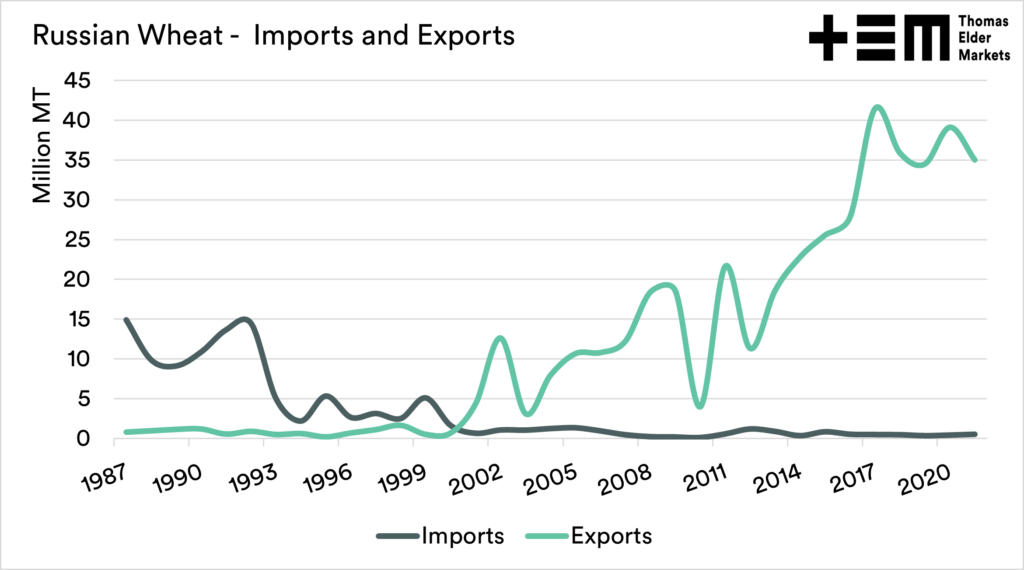

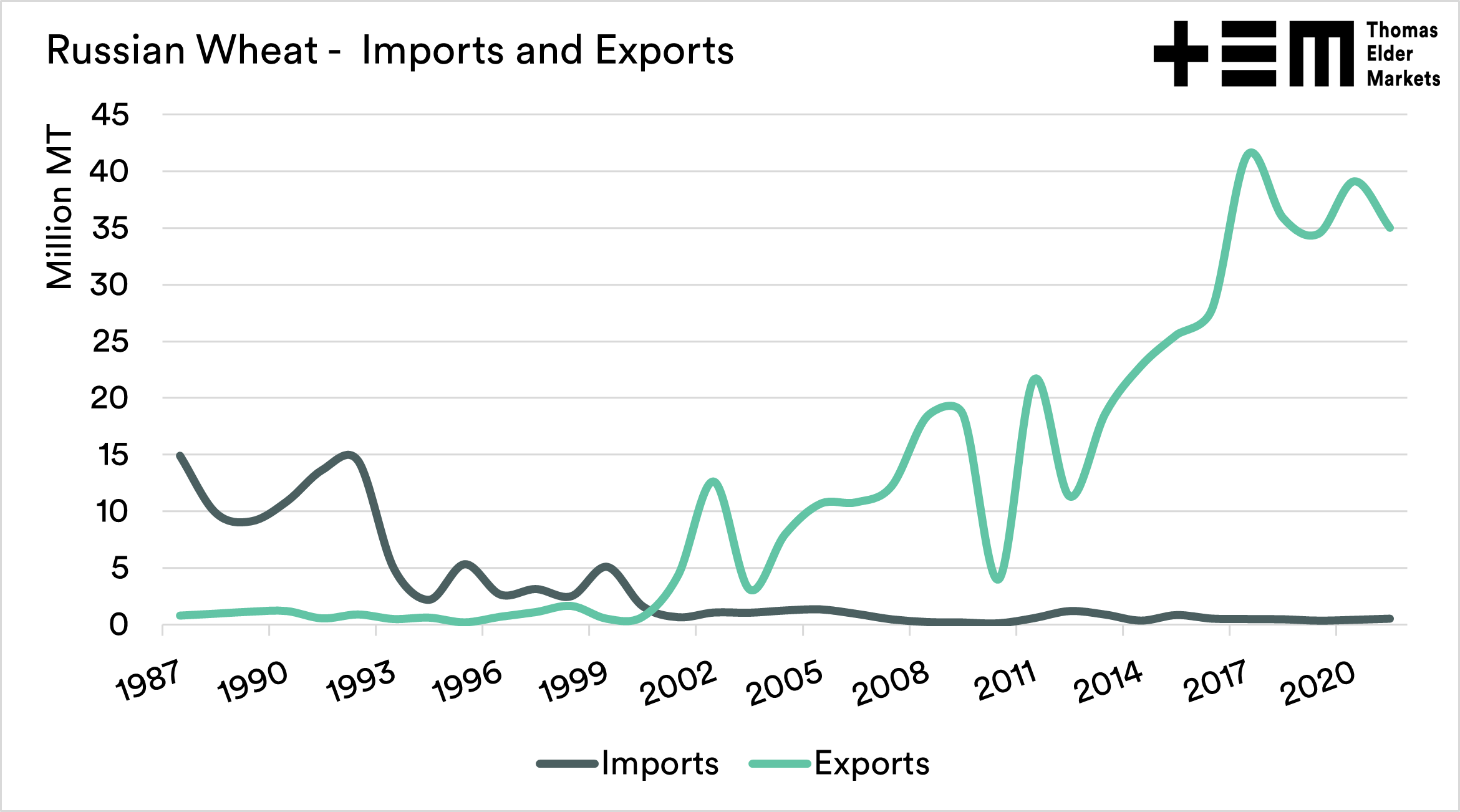

Russia is always in the press when it comes to grains. Russia was once an irrelevance when it came to grain exports; in fact, it was more important as a destination for the world’s wheat. It is phenomenal how quickly they have come to dominate.

Whilst in recent weeks, the focus has been on the ‘will they, won’t they invade Ukraine’. Russian grain hit the headlines again with a factor that will have a long term impact. Russia has gained access to China.

Let’s look at some of the data to see if they will steal our trade.

Let’s start with what the deal is. Putin was in Beijing last week for the opening of the Winter Olympics. At the same time, the two governments announced a raft of new trade deals with the focus largely on gas and grains.

Previously Russian exports to China were limited due to phytosanitary concerns. This will no longer be the case with Russia able to export with fewer restrictions.

So let’s delve into the numbers.

Wheat

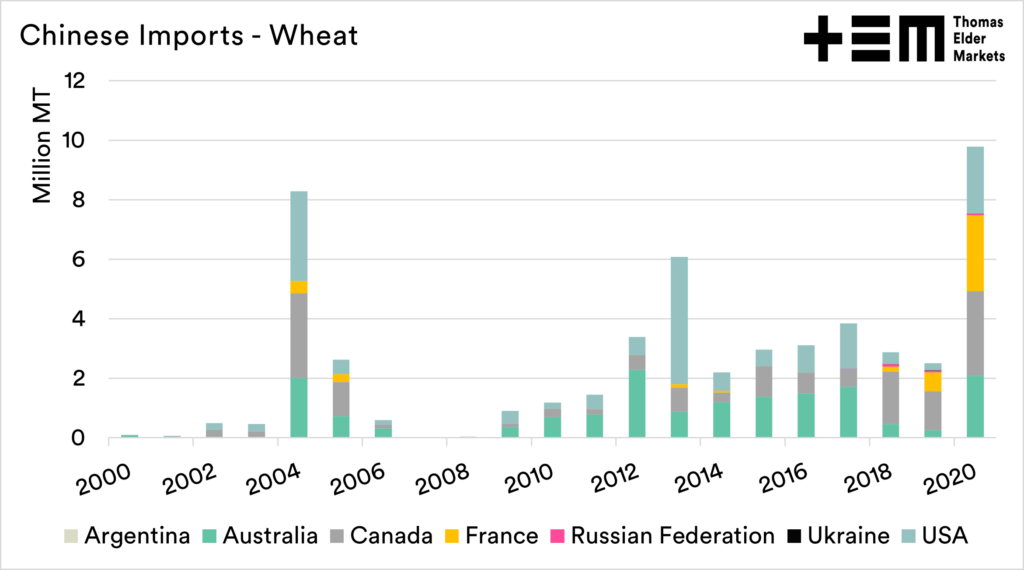

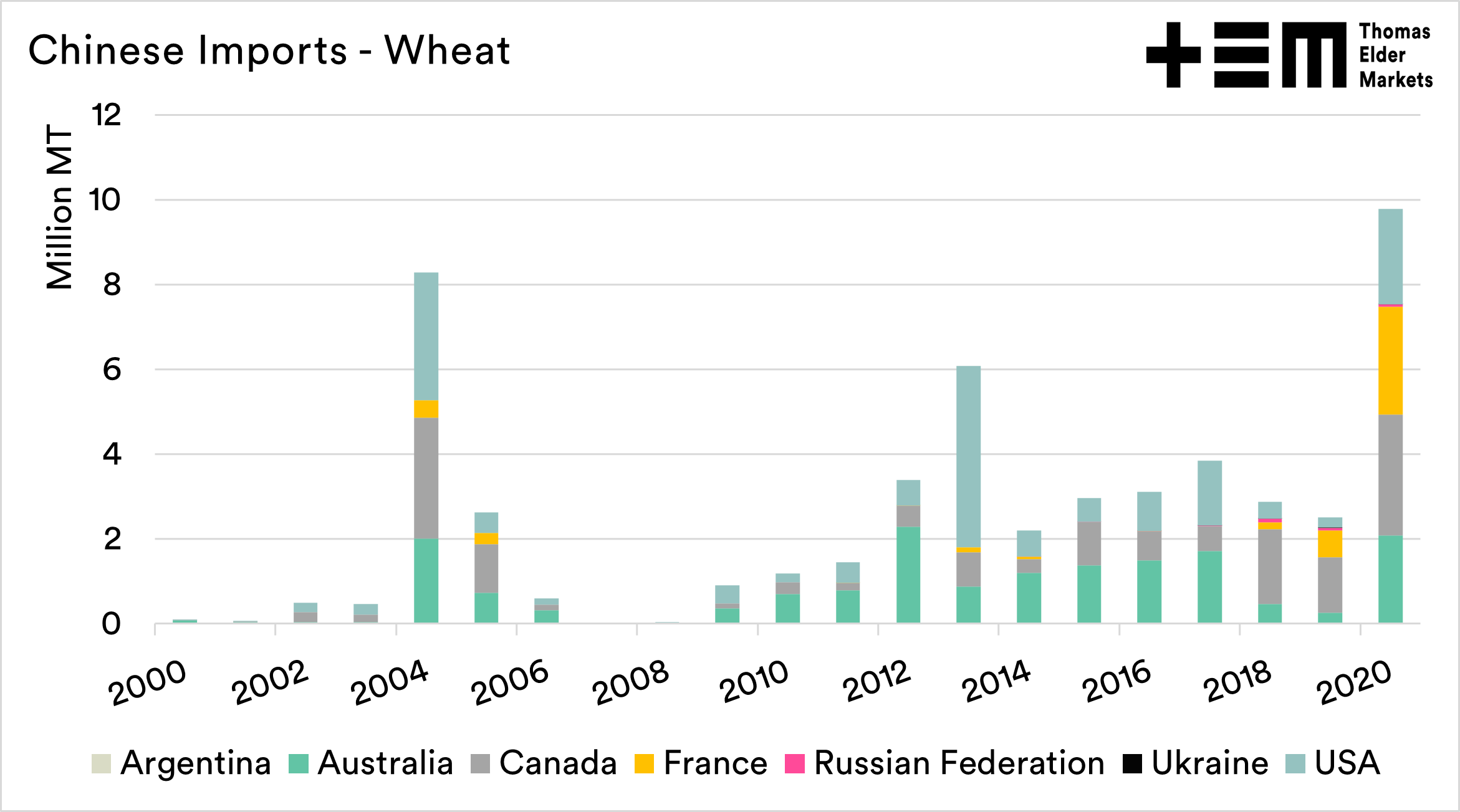

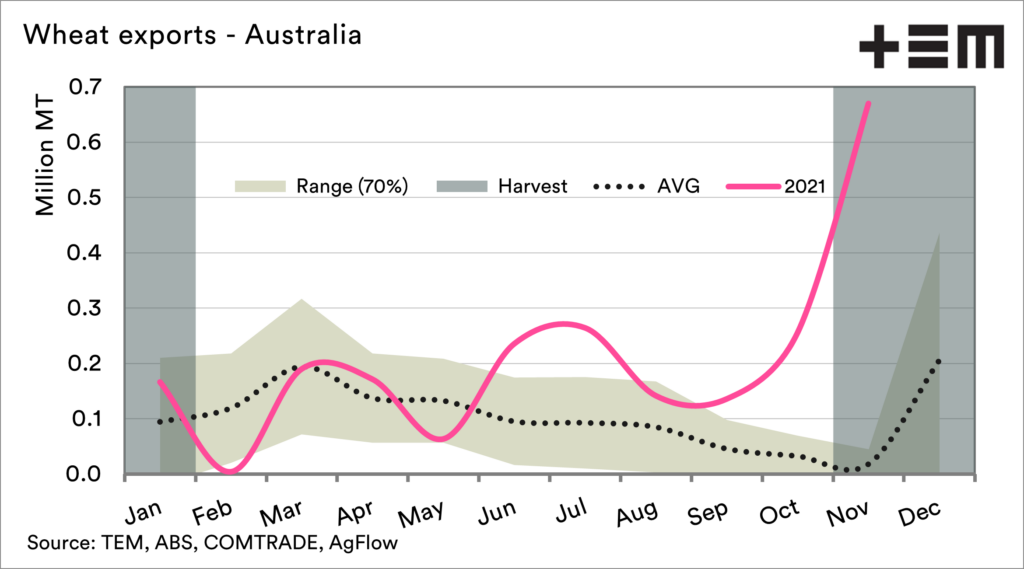

The increase in imports of wheat into China has been huge in recent years (see here). The chart below shows the imports and the major partners from 2000 to 2020, using UN comtrade data. Russia due to restrictions, are barely perceptible on the chart. Australia has been a major player throughout most of the past decade, along with the usual suspects.

It is important to note that Australia did little volume in 2018 and 2019 during the drought. I’ll discuss this a bit more in the end summary.

In 2021 and so far in 2022, Australia has been doing large volumes into China. This is due to our competitiveness after the large crops.

Barley

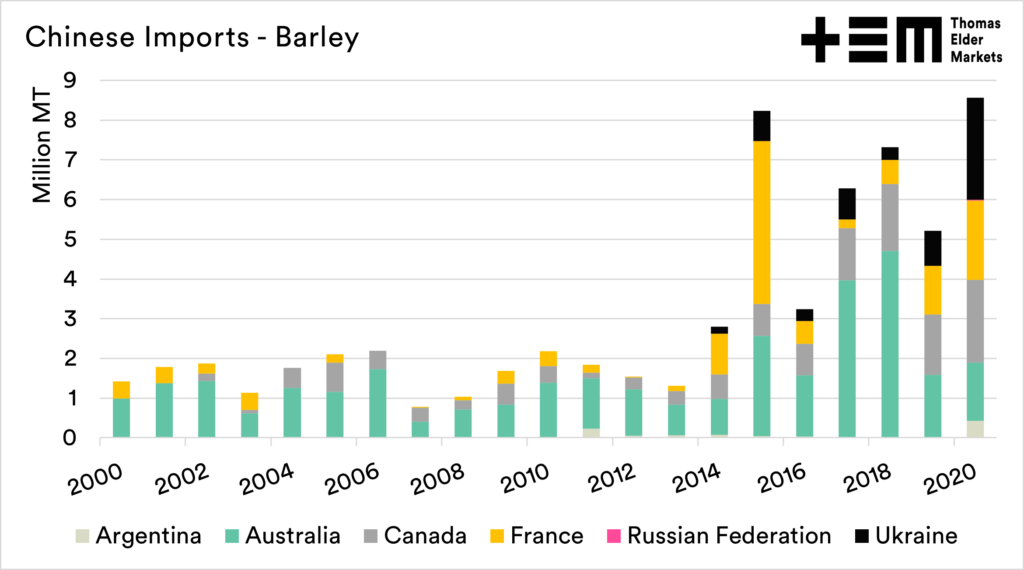

Australia was a major supplier of barley to China up until the anti-dumping tariff was introduced. Since the tariff was introduced, France and Ukraine have been major beneficiaries.

Russia, like in wheat, is insignificant in this chart.

The tariff is likely to persist for some time. China has likely paid more for barley than it would have if the tariff wasn’t in place (see here). The introduction of Russia provides Chinese importers with another source, and as we always say about Australian export trade – ‘The more doors open, the better’. This equally applies if you are an importer.

Russia may be more likely to increase market share, but in competition with other origins such as France/Ukraine.

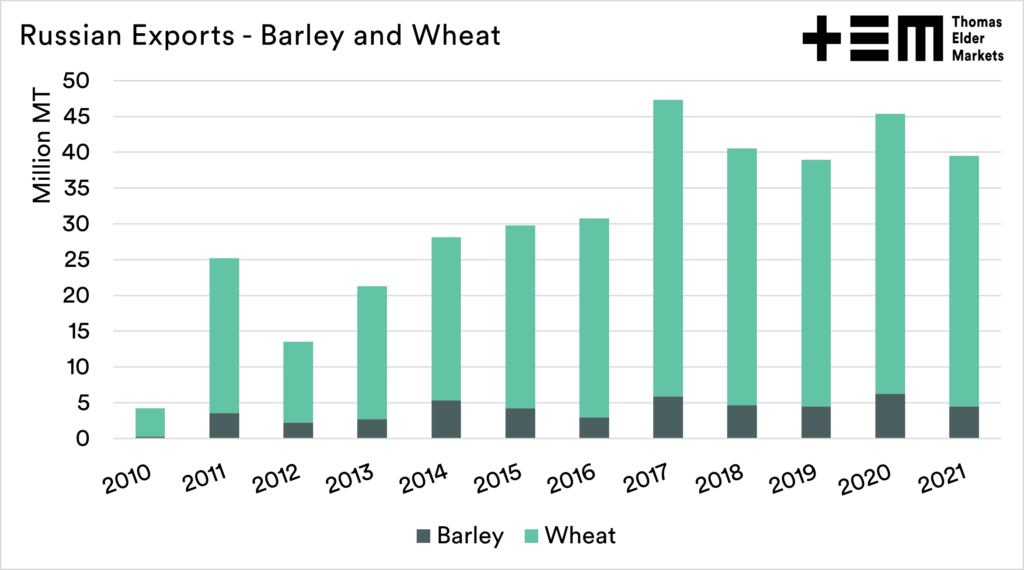

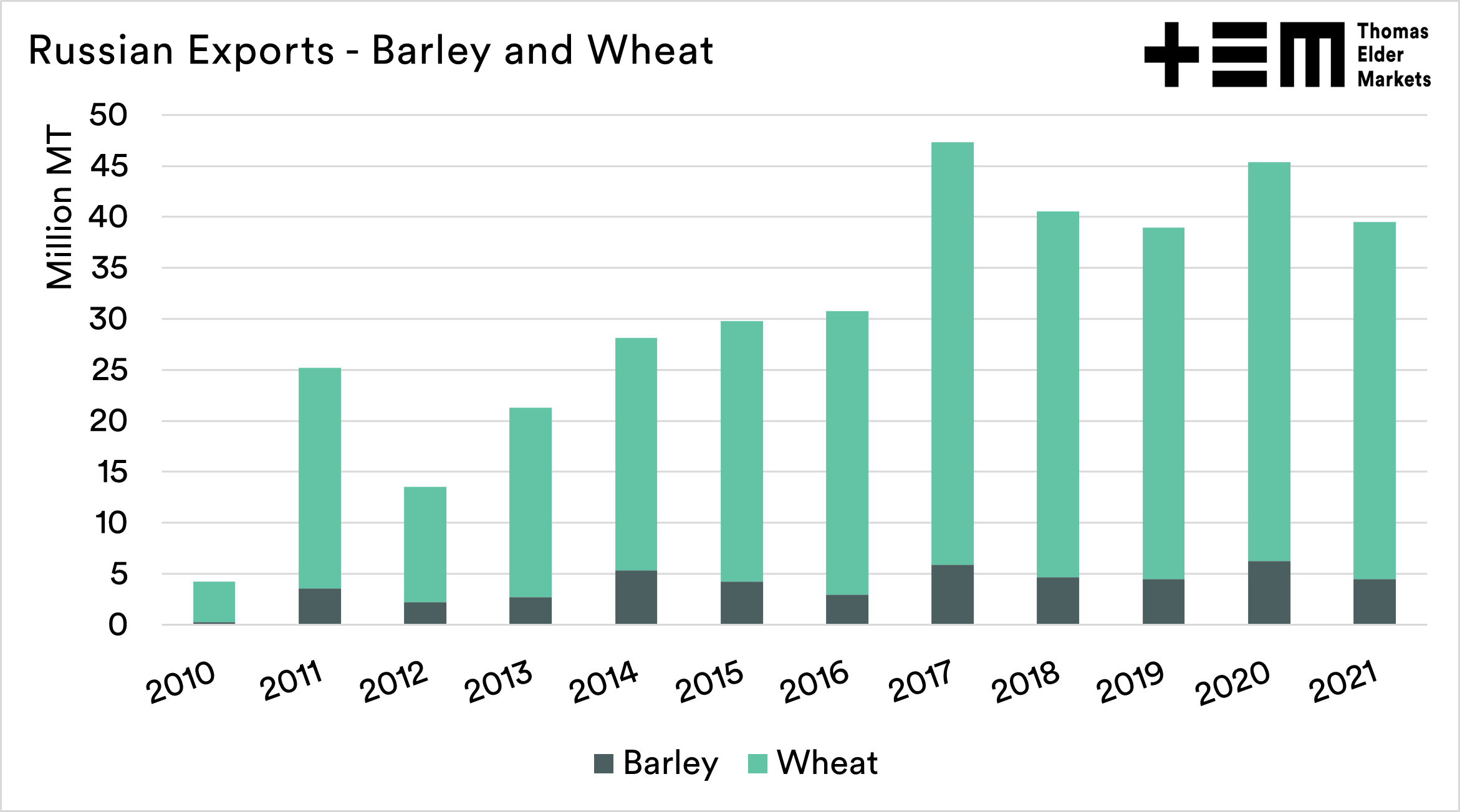

Russian Markets for Barley and Wheat

It is important to look into Russia and where they trade to. If Russia is already trading large volumes into other Asian nations, then that will give an insight into their competitiveness.

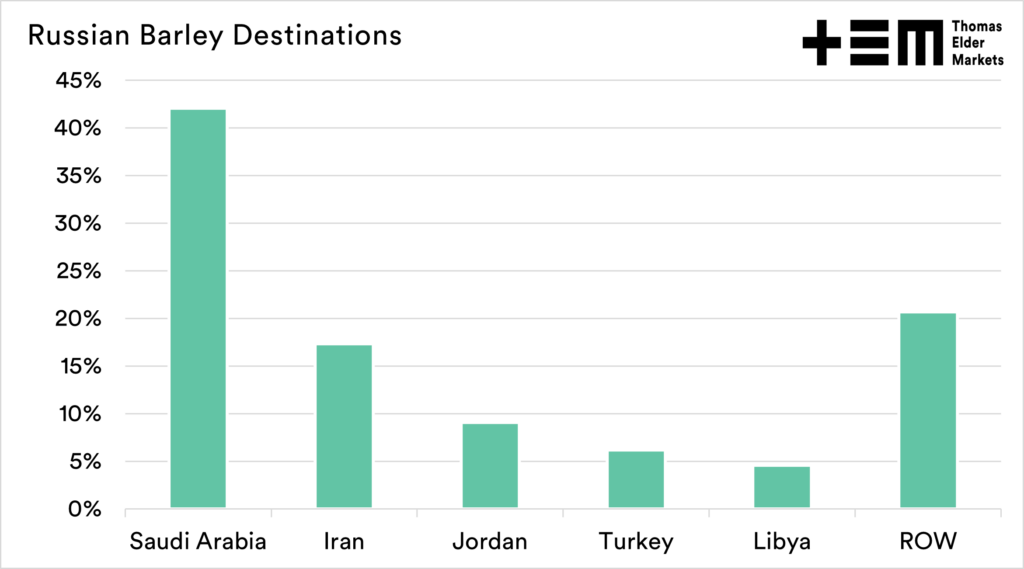

Let’s firstly get an insight into barley. Russian barley exports are dominated by five major destinations, which over the period 2016 to 2020 made up 79% of annual exports. The remaining 49 nations make up very small volumes.

The other remaining 21% is comprised of 49 nations. The interesting point to note about these destinations is that Asian countries only represent a small proportion of the volume (<0.5%). This potentially points to Russian barley being less competitive price-wise than other origins.

What about wheat?

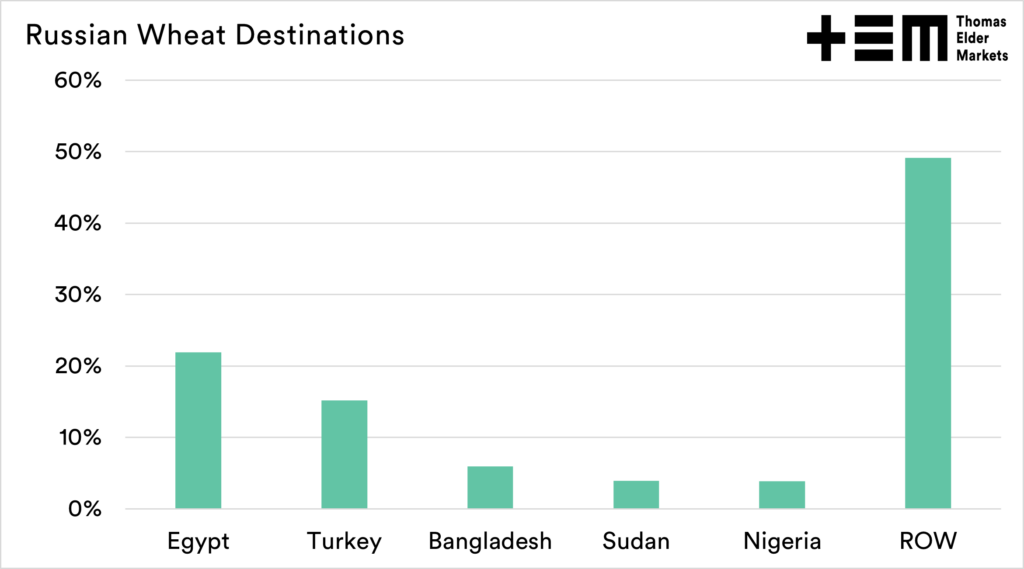

The wheat trade is a lot less concentrated than barley. The wheat trade from Russia is still heavily focused towards the top five, with 51% of volume.

There is a larger volume of wheat headed to Asia than Barley, at 7.3%. This signals that pricing has worked well into Asia, at times.

The majority of the barley and wheat traded by Russia goes to those where they have a geographic advantage. This is likely to continue.

Will they eat into our share? YES and NO

Tradeflows are about opportunity, and they are largely based on price. In recent times, China has been importing huge amounts of grains. It makes sense from their perspective to open up to the world and have as many doors open as possible.

The reality is that Russia has been doing volume into Asia, but not huge volumes. I would expect that whilst Russian trade into China may grow, it will be opportune and seasonal. While Australia is locked out of the barley trade, I would expect Russia to increase market share into China.

During the drought, our export volumes decreased, and we were frankly too expensive. These are the times that Russian grain will work well to China. We are currently far more competitive than Russia into China, therefore more likely to pick up trade.

If we look at the nations that Russia exports to, they tend to be those with a relative geographic advantage. Russia is still likely to be focused on the nations in their neighbourhood.

The reality is that Russia has large volumes that it can place onto the market and can compete with us. The trader in China now has more options, but it will still be down to price.

Australia has to remain competitive to get sales onto China – but that is always the case. It is important to note it is a flow of trades. If more volume from Russia goes into China, then that opens up different opportunities for competing origins.