Send the Americans on long road trips.

The Snapshot

- Wheat and corn have a strong relationship with each other. When corn rises, wheat rises.

- A large proportion of US corn is used to make ethanol.

- If demand for road fuel drops so does ethanol.

- If ethanol demand drops, then demand for corn drops.

- This can reduce the price of corn, and that can flow through to wheat pricing.

- A slowdown in the economy could lead to reduced demand for fuel.

The Detail

Cars, corn and wheat. They are all connected.

Corn is the most important driver of grain pricing, and we should always be keeping a close eye on it. However, it is not just corn that is important; we’ll get into that in a bit.

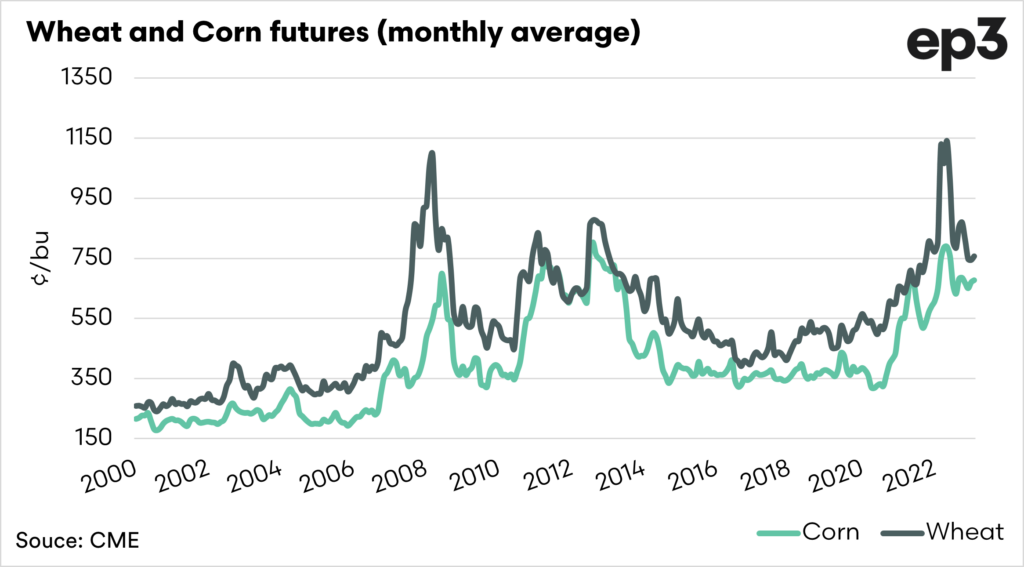

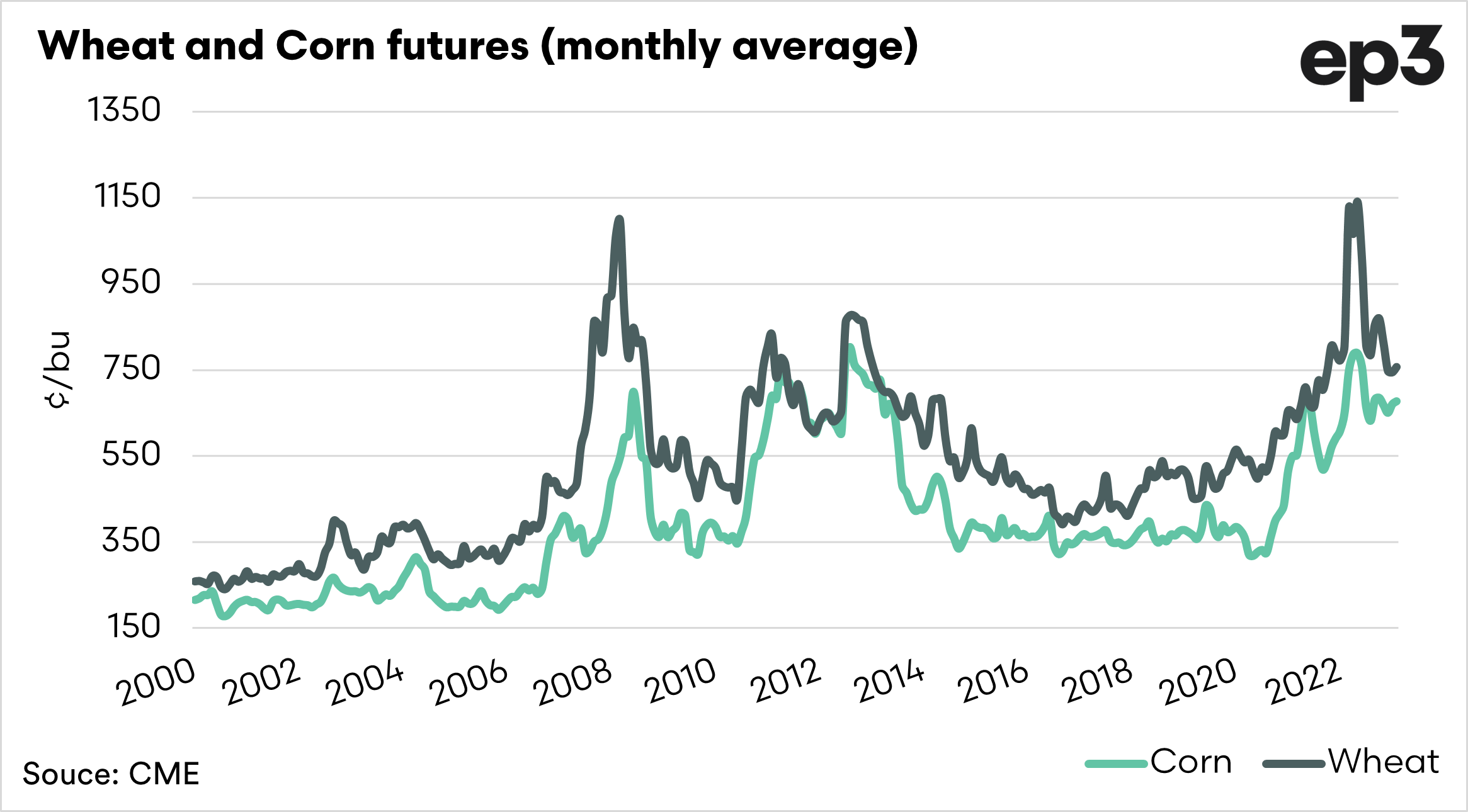

The chart below shows the monthly average price of wheat and corn for the past 23 years. What we can see in this chart is that the movement trend between the two commodities is very similar. When one goes up, so does the other.

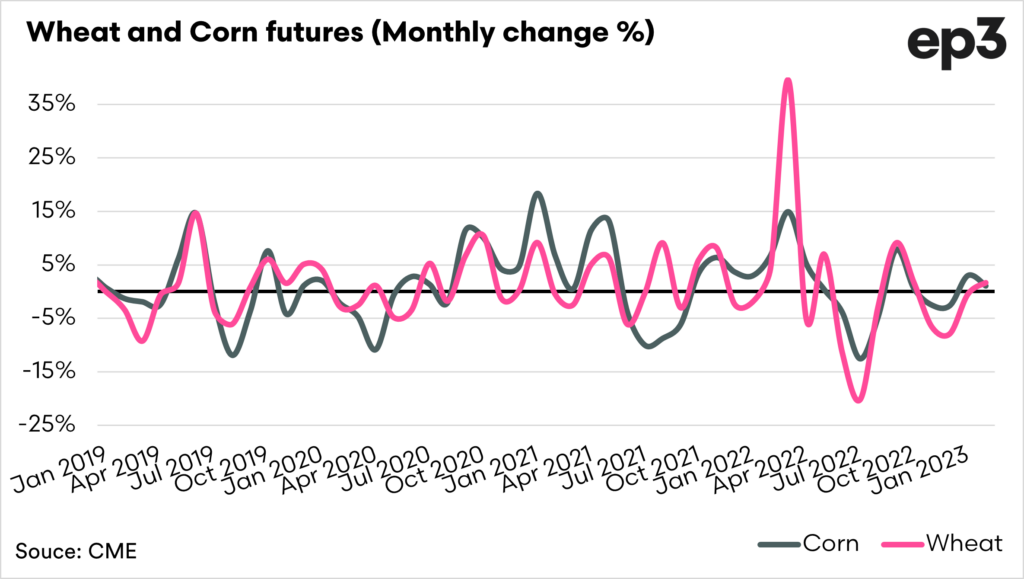

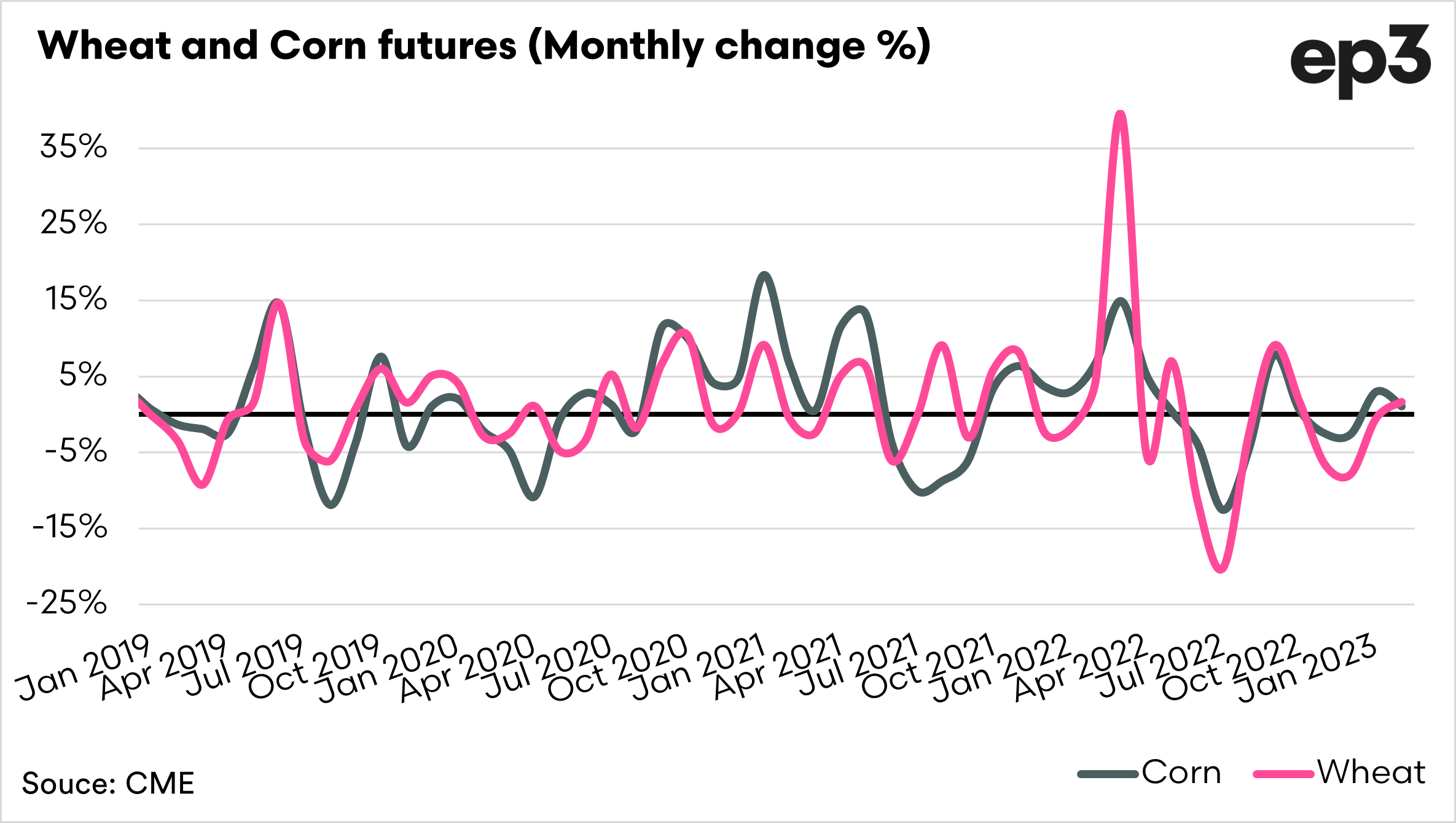

The relationship between the two can be seen in the monthly changes in price. The percentage change (or return) for corn and wheat has shown similar changes in recent years.

The correlation of returns since 2019 has been 0.63, and the correlation of price has been 0.91. A perfect correlation is 1, and no correlation is 0.

The high correlation of both proves a strong relationship between the two.

One of the big reasons we look at corn is due to ethanol. A huge proportion of US corn (39%) is converted to ethanol, equating to around 12% of global corn production.

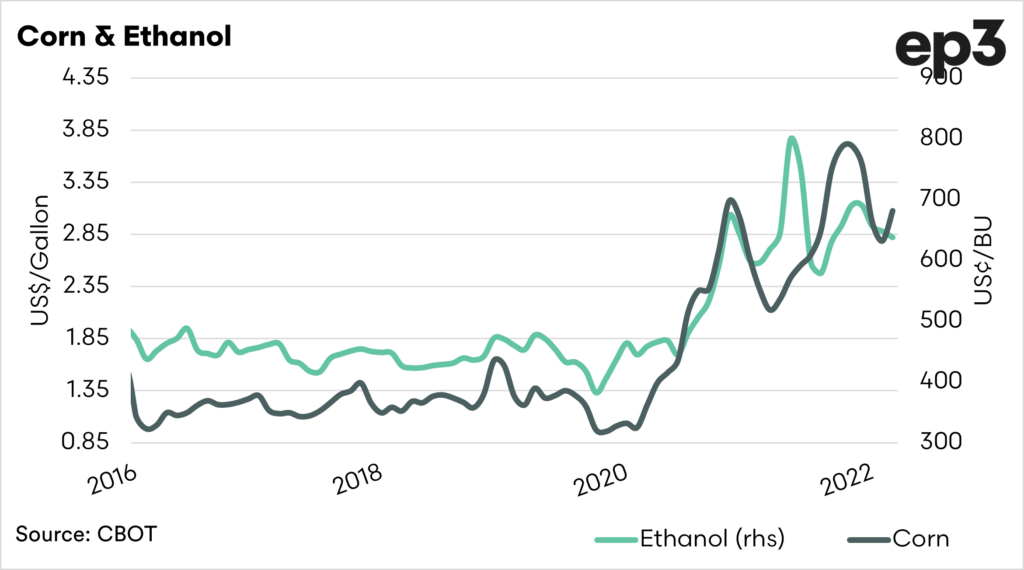

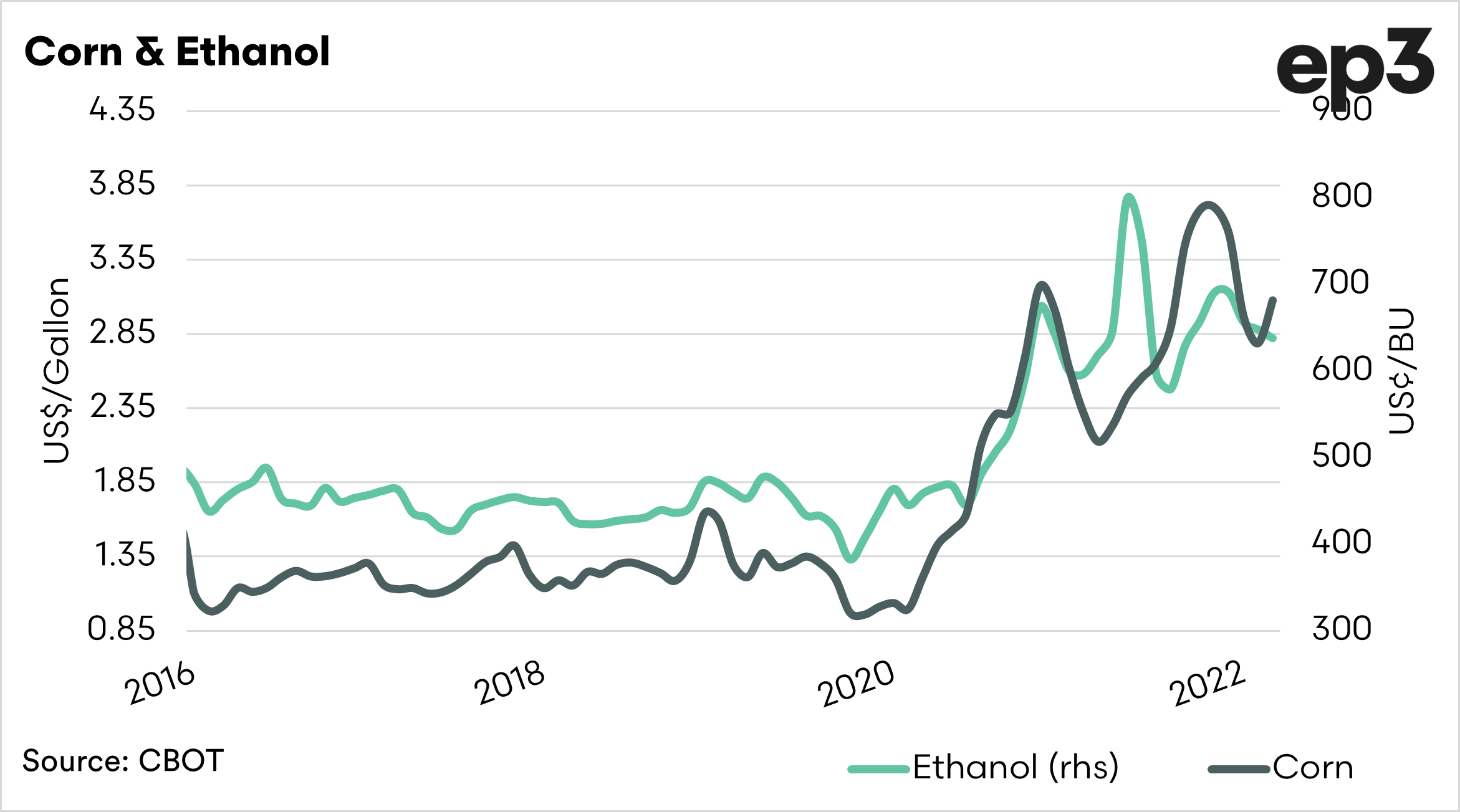

The ethanol is then mixed with fossil fuel and is then fed to vehicles around the US. We can see the relationship between corn pricing in the chart below.

The correlation between the two for returns is 0.49 , and the correlation for price is 0.89. Whilst returns are low, this is still a strong correlation.

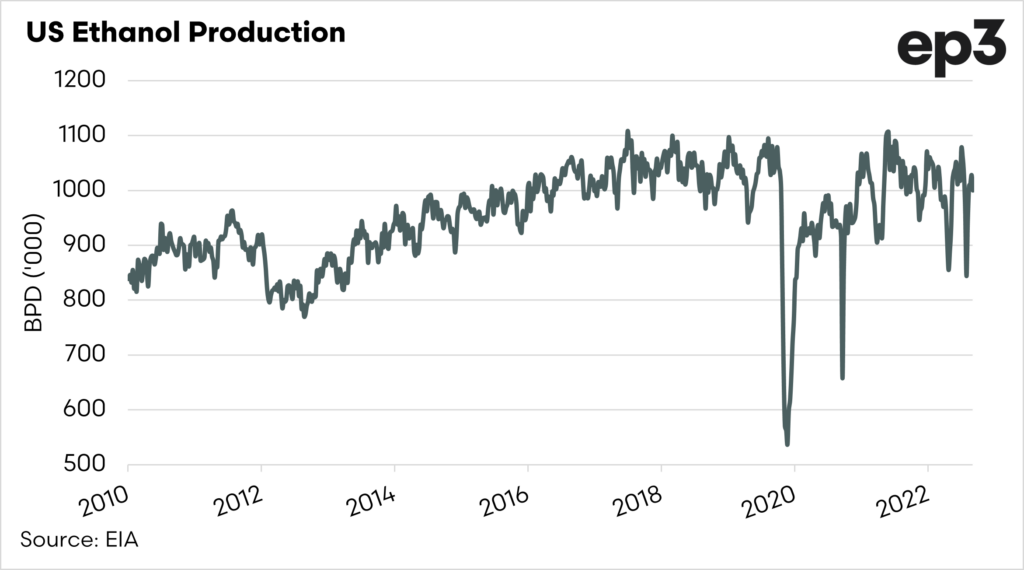

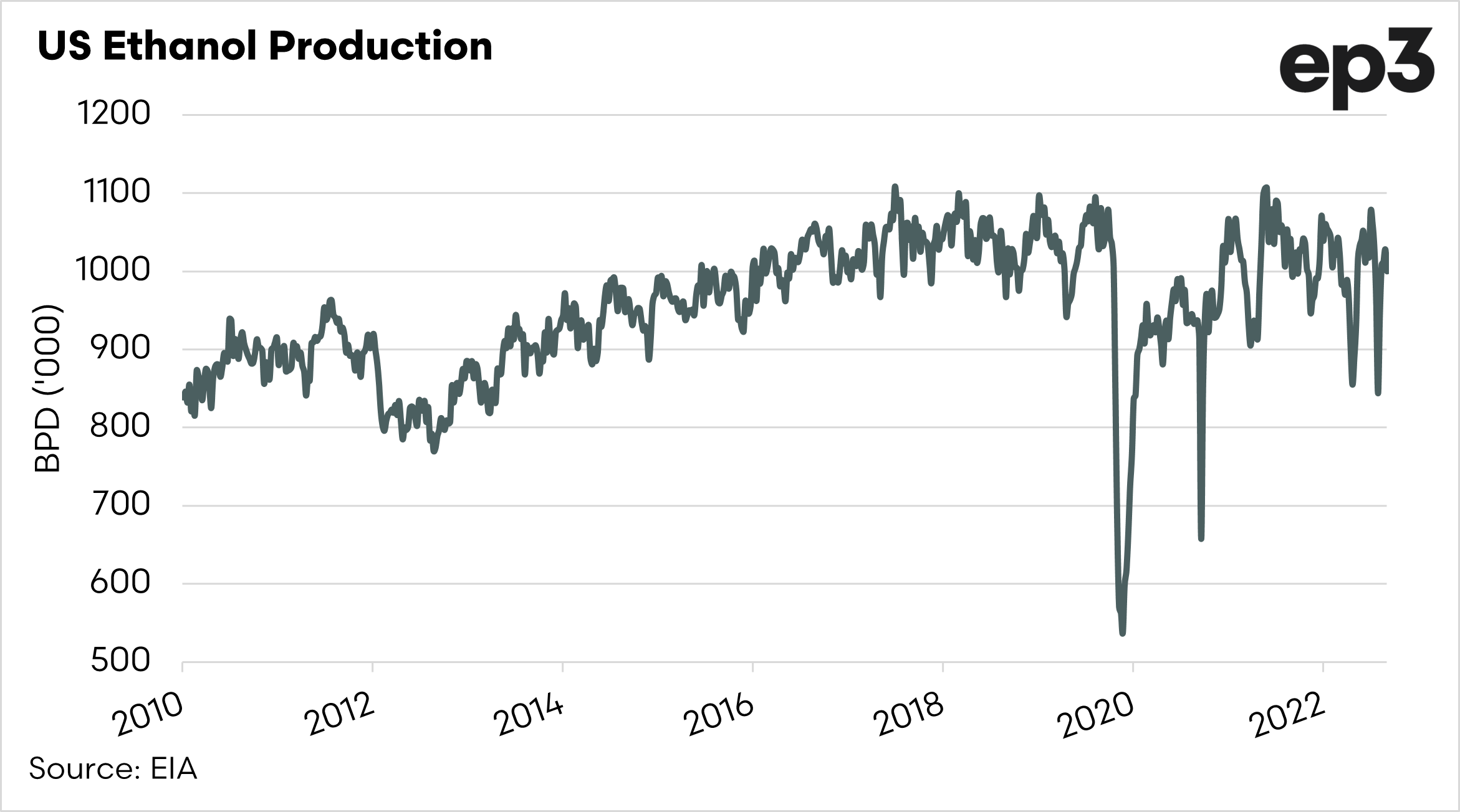

US ethanol production has been growing steadily over the past decade. However it can be choppy. Production is predicated on demand, if demand for fuel drops then clearly ethanol for mixing with fossil fuels drops.

This can be seen in the chart below. During the dreaded lockdowns of 2020, people were driving less. This caused a drop in demand for road fuel.

At the moment, the global economy is quite precarious, with some viewing a recession as likely and others expecting a recovery.

If we see a global shock in confidence, we could see a reduction in spending. One of those spending is fewer road trips, especially with fuel pricing at high pricing levels (see here).

Americans driving their cars and going on long road trips is beneficial for corn pricing through its relationship with ethanol. It is also a factor that will flow through to our local wheat pricing. A rising tide lifts all boats (and vice versa).

So let’s see what the global economy does over the next couple of months ahead of both the US corn harvest and the US holiday season.