Somewhere over the grainbow……..

Market Morsel

Marketing grain is all about having a strategy and about taking the opportunities where they land. It’s always worthwhile having one eye on what is in front of you with the coming harvest, but one beyond and down the horizon.

At the moment, wheat futures for the coming harvest are pretty attractive. In the past week, they have been trading in a range of A$360-370. Whilst basis remains unattractive historically, the overall flat price remains decent considering the production potential locally (see here).

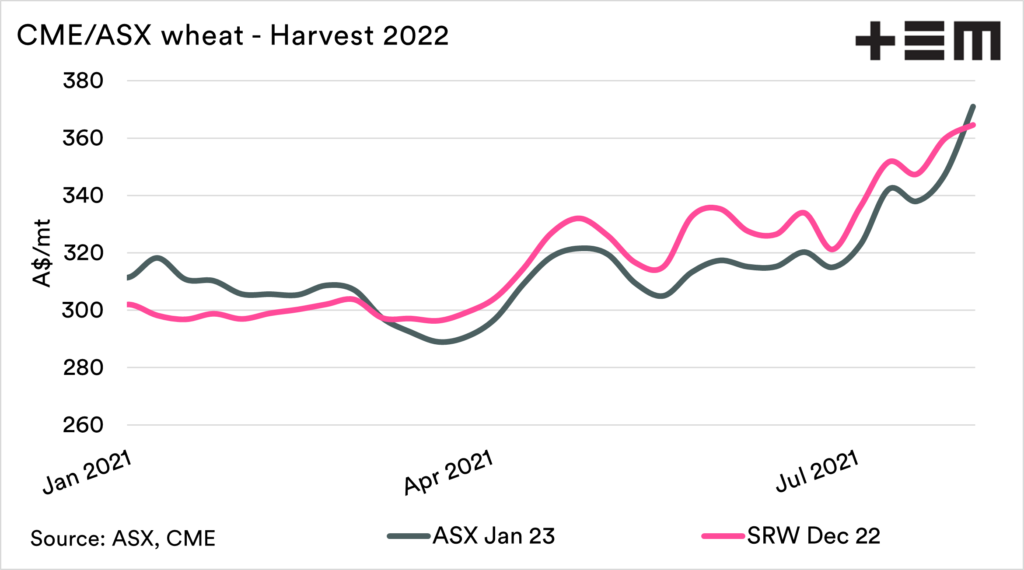

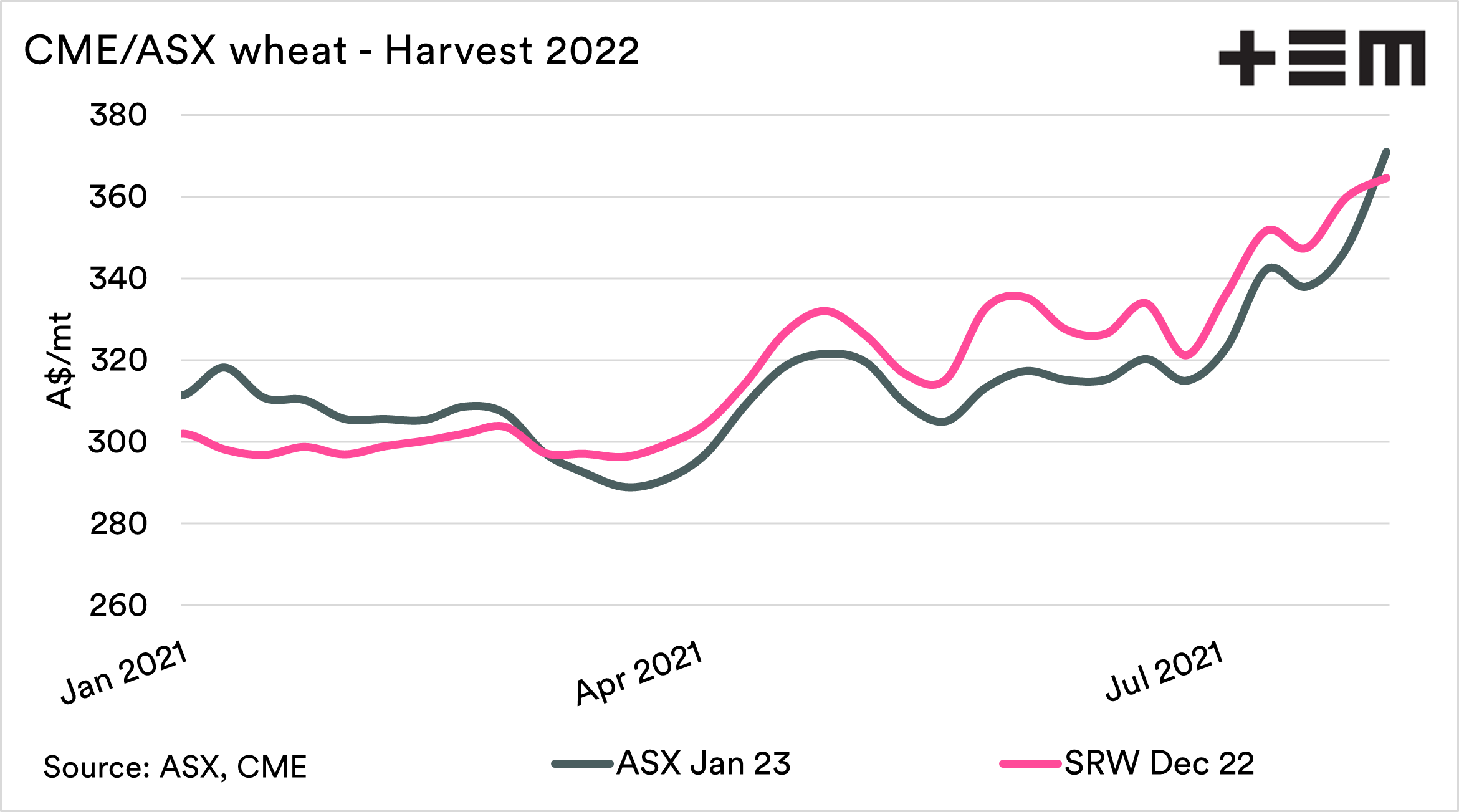

What about the next harvest? The chart below shows the ASX and CBOT wheat contracts which correspond with our 2022/23 harvest.

The contracts are indicated at A$364/371 respectively for this week so far. These are historically very good numbers. It is essential to understand that trading that far out is a little more difficult as volume is lower.

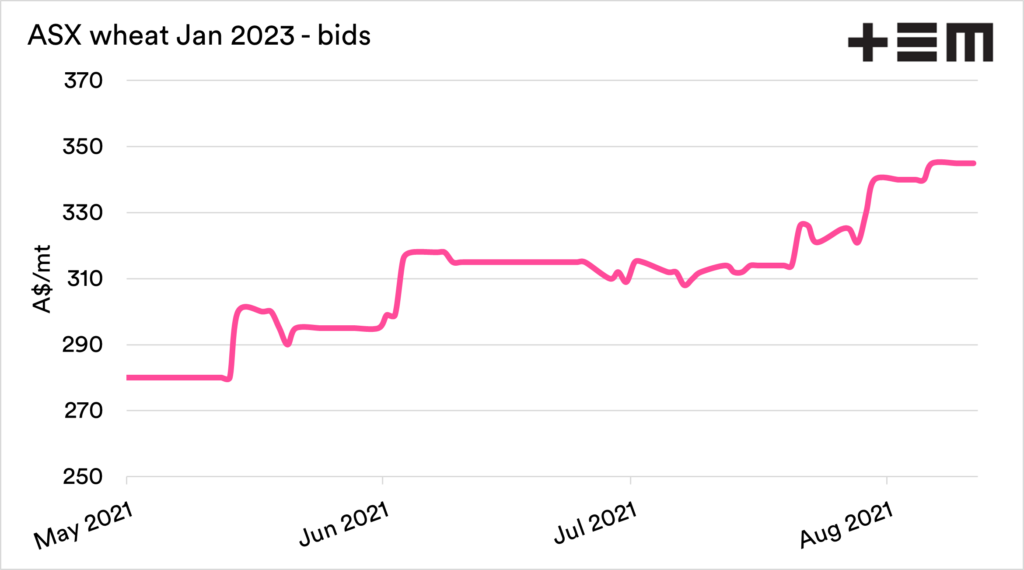

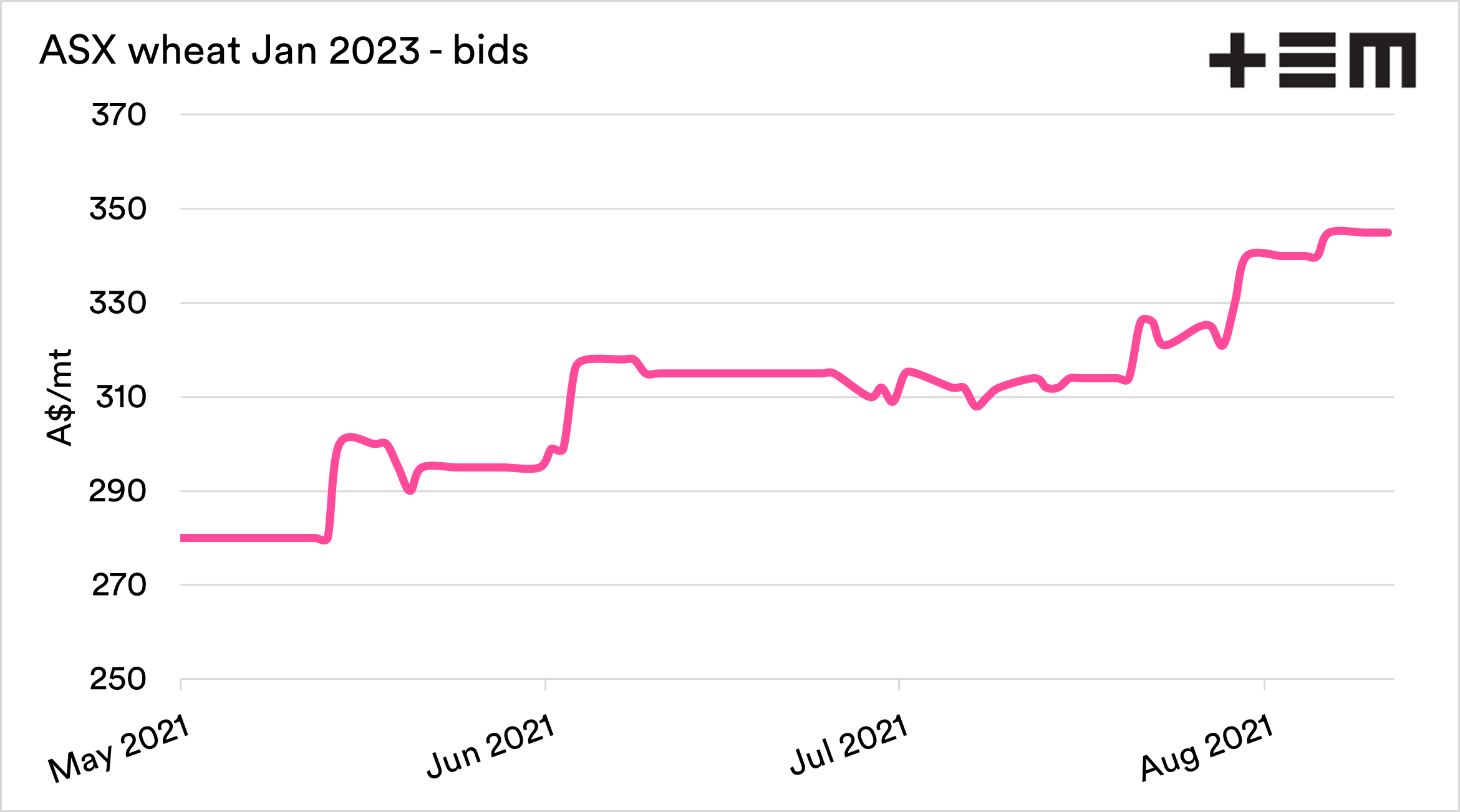

The actual trading level on ASX is likely to be lower. The second chart shows the actual bids over the past three months, which buyers are willing to pay. Still, it might be worthwhile placing an offering out there and seeing if any buyers bite.

Why would you sell at these levels so far into the future? The reality is that we do not know what is going to happen over the following season. We do know that pricing levels are attractive for farmers around the world. If northern hemisphere conditions improve and big acres are planted, we could see a reversal in pricing.

Conversely, things could all go wrong production-wise around the world.

No-one knows. However, starting sales at these historically high levels isn’t a bad place to start your marketing.