Big Wheat Trouble in Big China

The Snapshot

- The Chinese ag minister has declared that the winter wheat crop will be the worst in history.

- >90% of the Chinese wheat crop is winter planted.

- China is a huge producer of grain but requires a large import program.

- Australia no longer sends barley, but we send wheat to China.

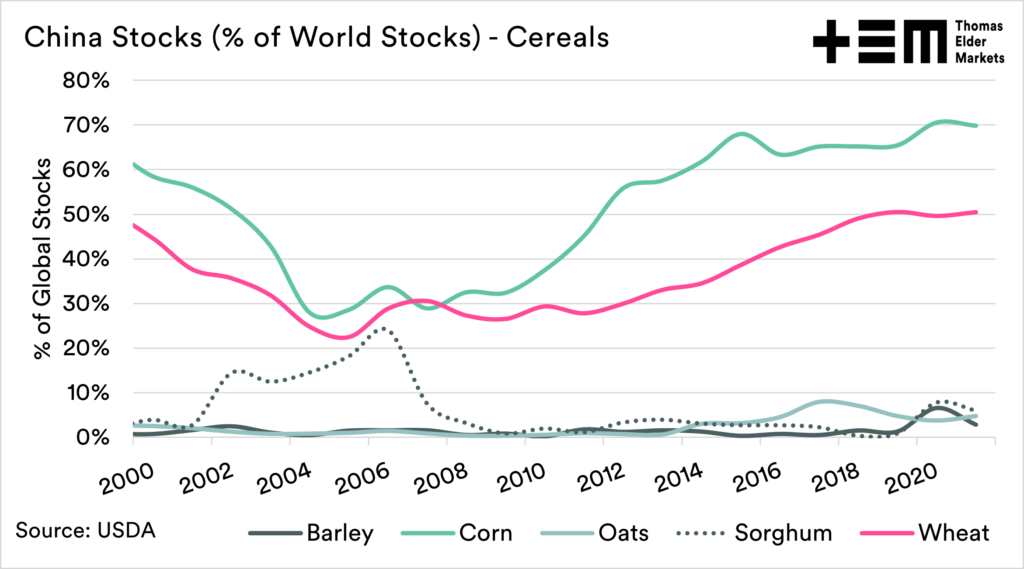

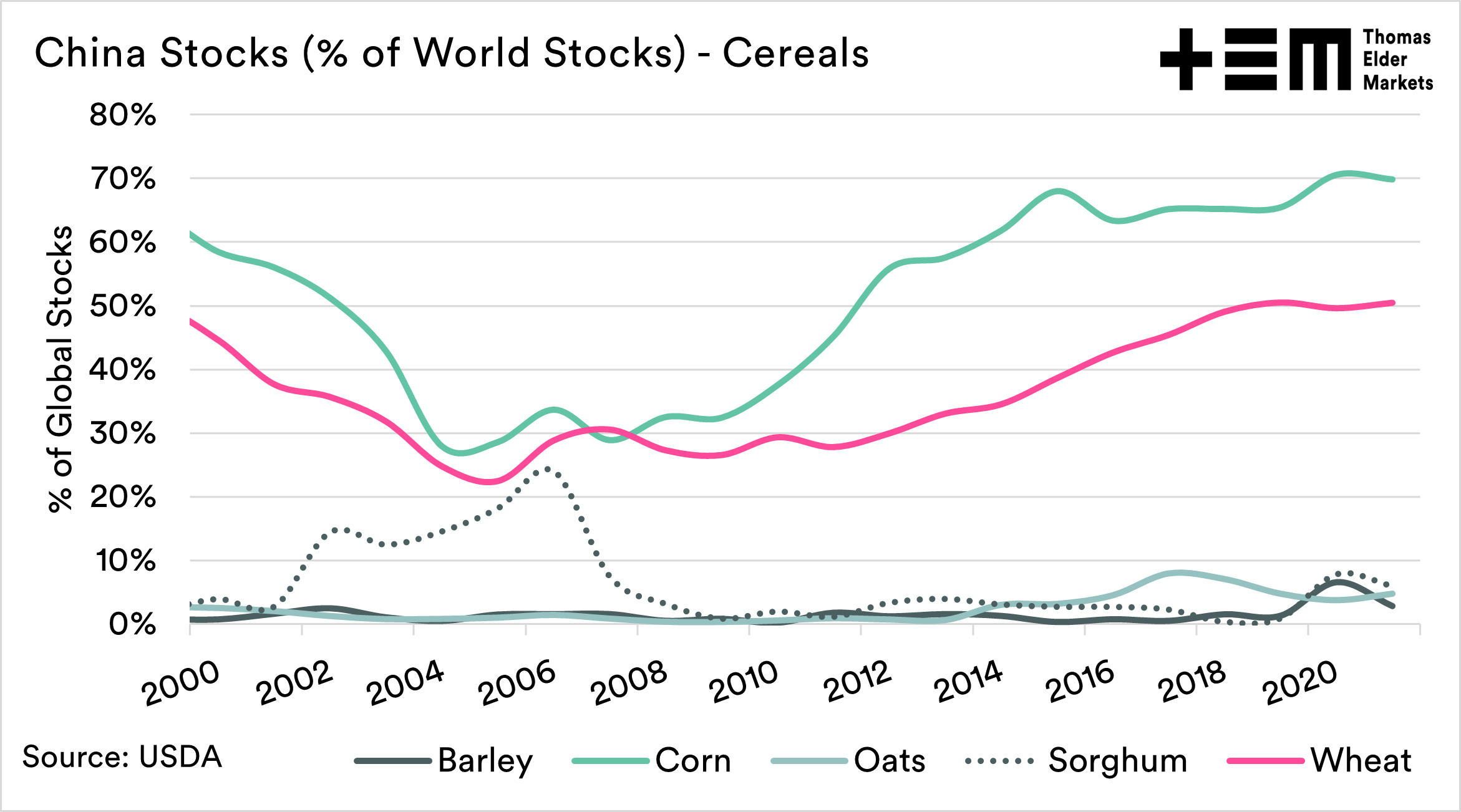

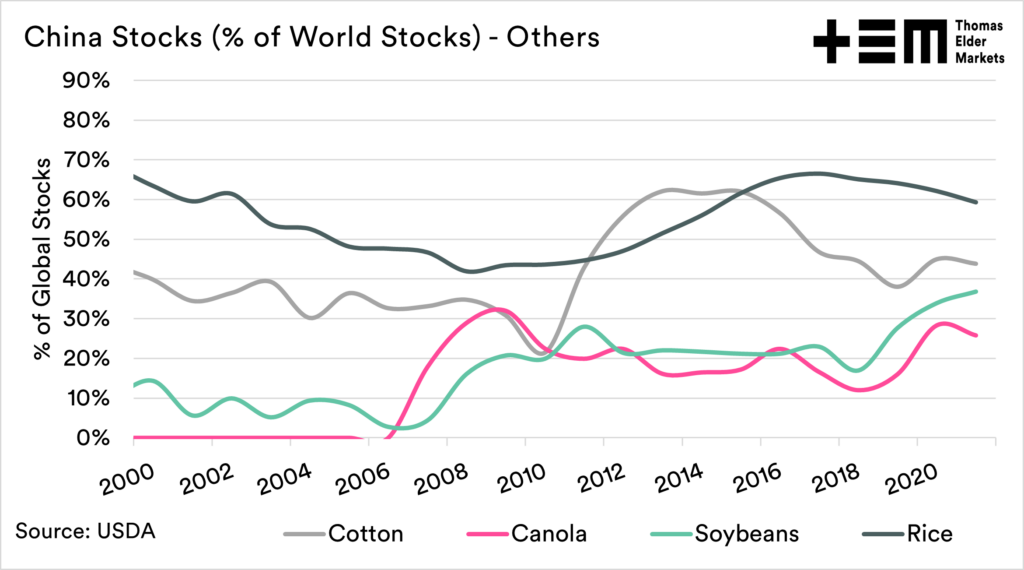

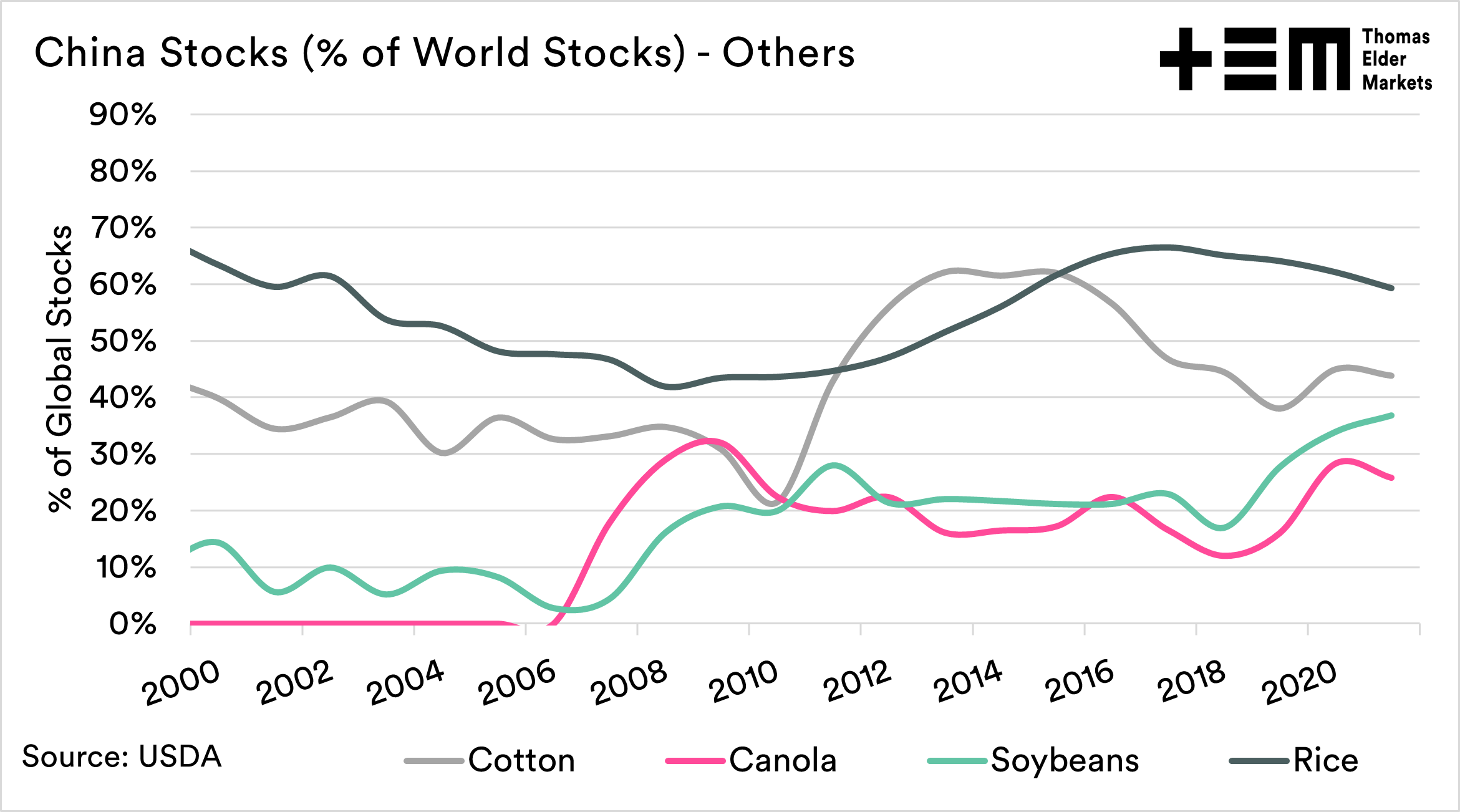

- China has huge stockpiles (on paper) but has increased the import volumes during the past two years.

- 2022 will test whether those stocks are as large as government sources suggest.

- This development will likely see imports remain strong.

The Detail

There are years where little happens; then there is 2022. Ukraine, drought creeping through the US, and now China is seemingly stuffed.

China is often quite reserved when it comes to reporting on its crops. A record crop in China is a bit of an in-joke within the industry. Last week, the Chinese Ag minister commented that the winter wheat crop could be the worst in history.

The Chinese government generally promotes a rosy view on domestic food production (see African Swine Fever). When the Chinese government say that conditions are bad, it’s something to take seriously.

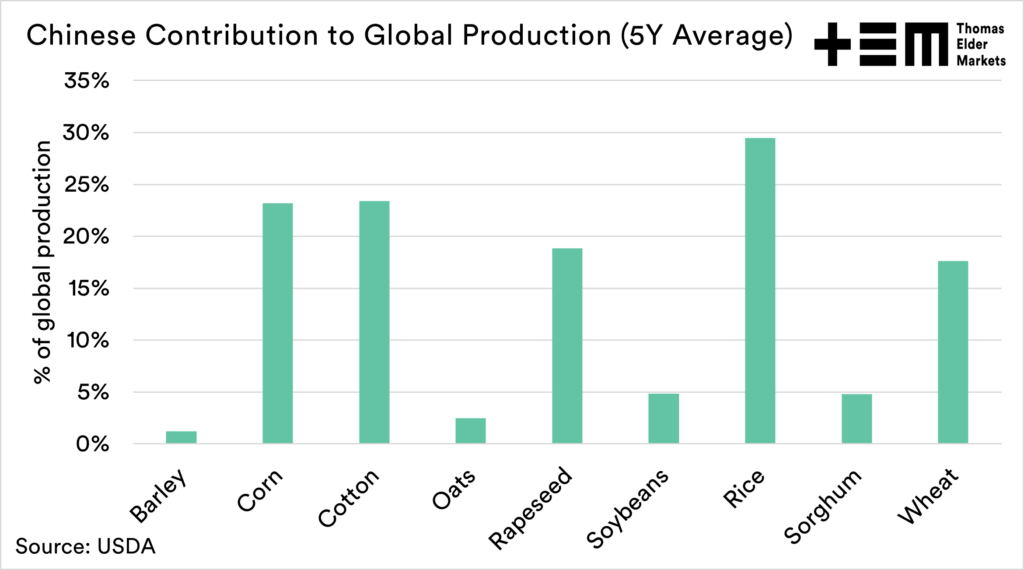

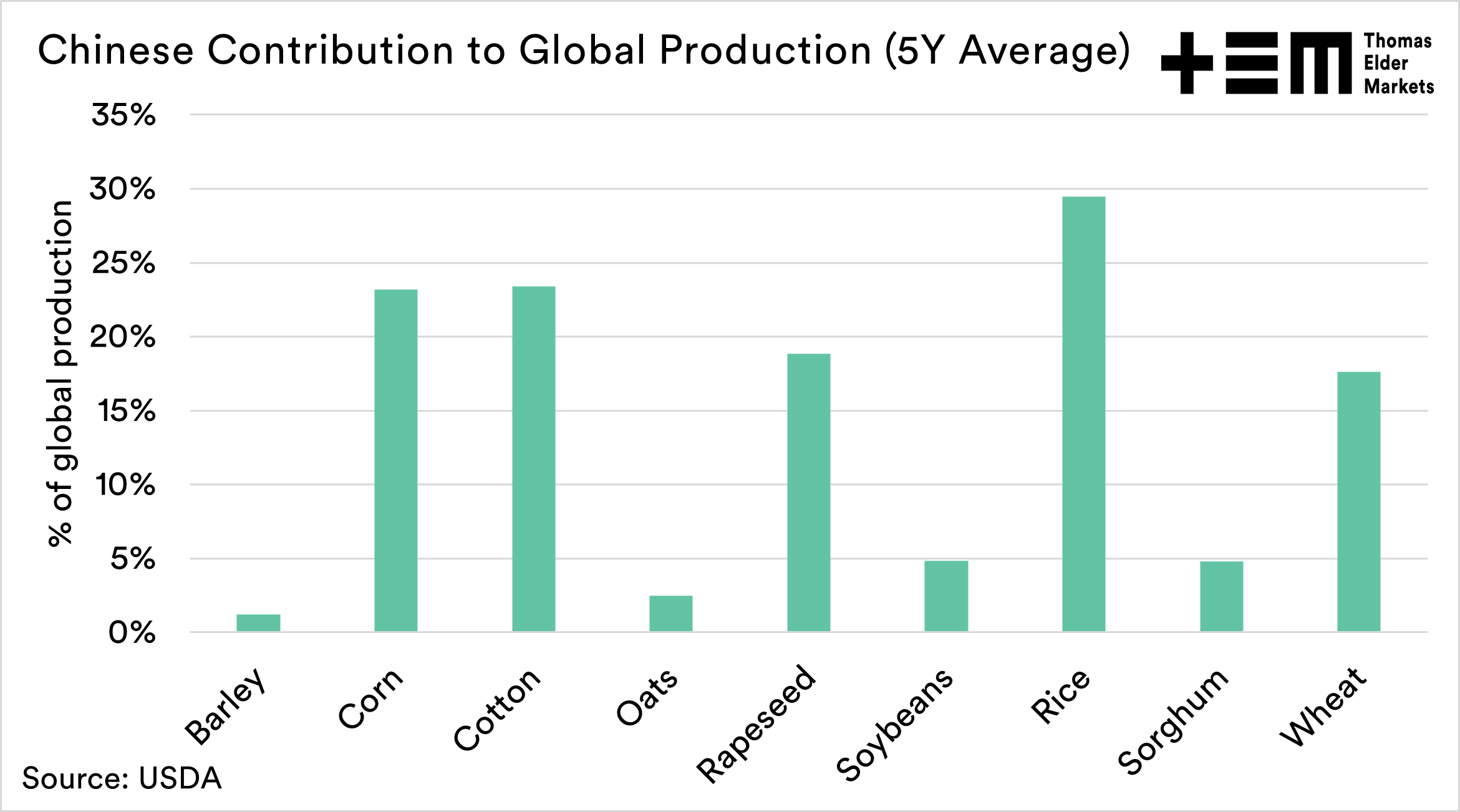

So I thought it was worthwhile diving into the situation and some of the data around China and grains. Whilst we tend to think of China largely in space as a large buyer, they are a very large producer of grains.

The chart below shows the extent of their production. During the past five years, China has produced on average 18% of the global wheat crop or 134mmt (5.5x our average production).

The majority of the Chinese wheat crop is winter planted (>90%). Therefore a disaster in the winter wheat crop bodes very poorly for overall production.

Through our contacts, it is expected that acreage will be substantially down. The lateness of planting is likely to result in yield reductions. This could lead to a substantial downgrade and a move from the ‘record’ levels that we typically hear.

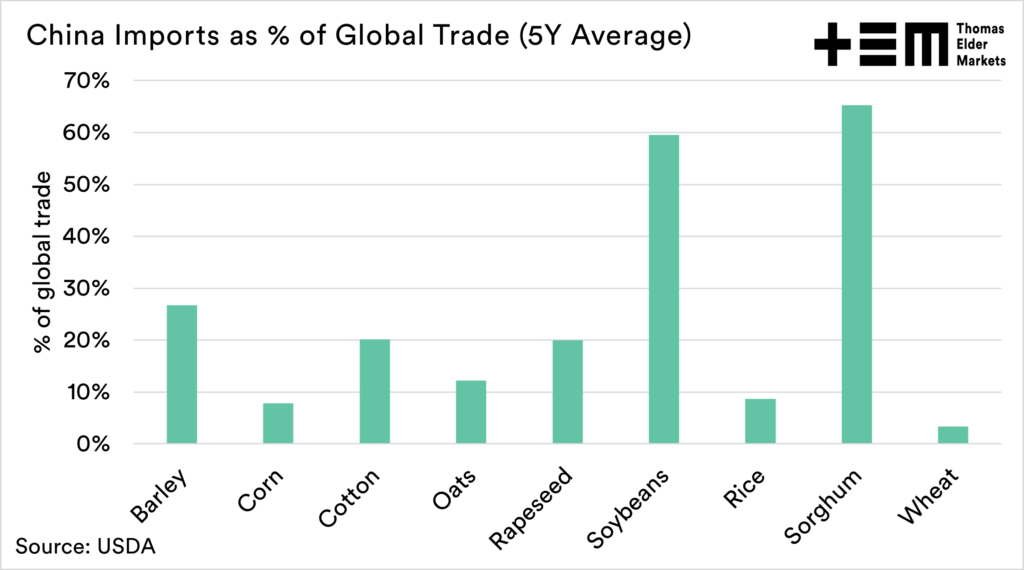

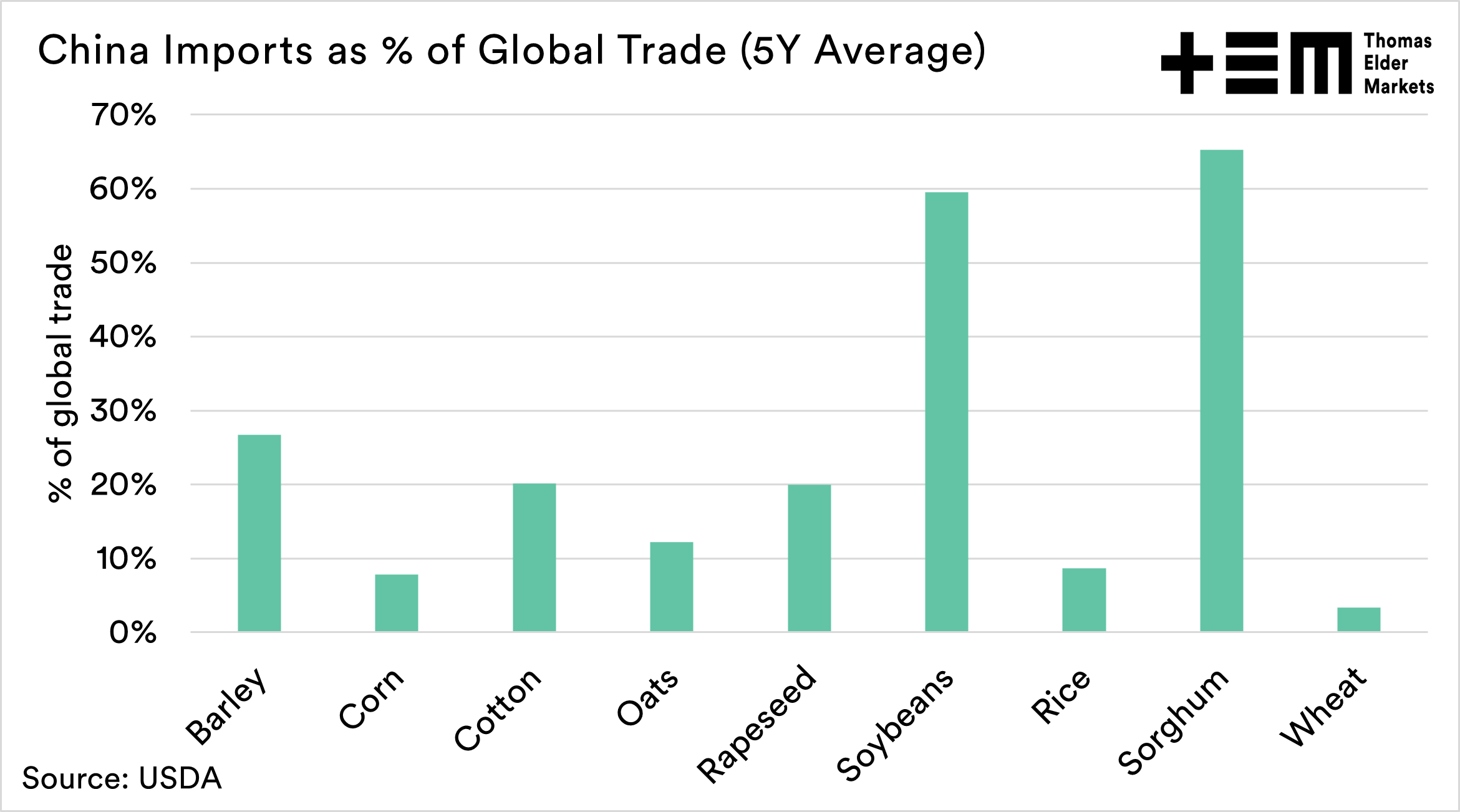

Whilst they are a huge producer of grain, they do not export any substantial volumes except rice at 5% of global trade. They are the mouth of the world.

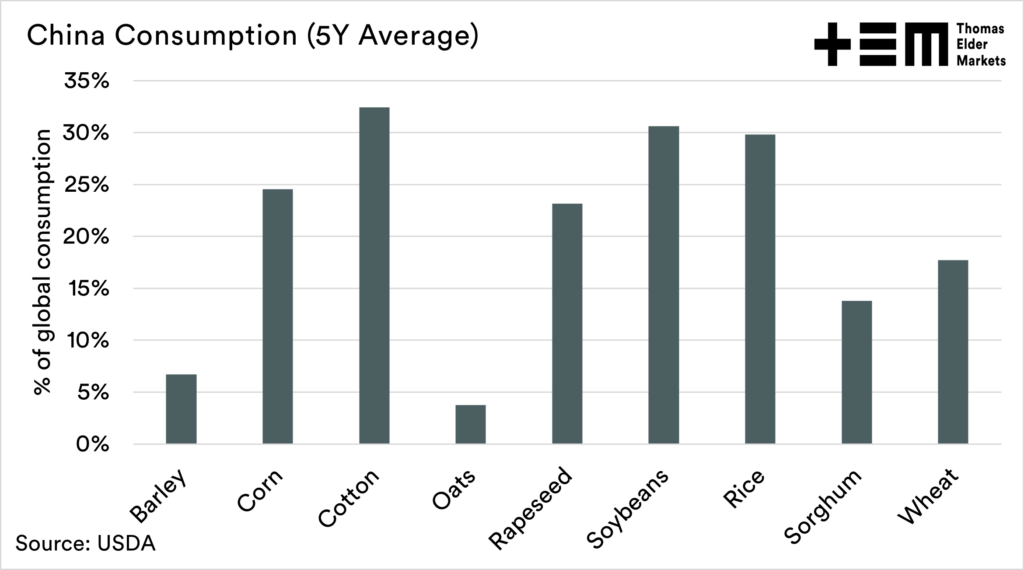

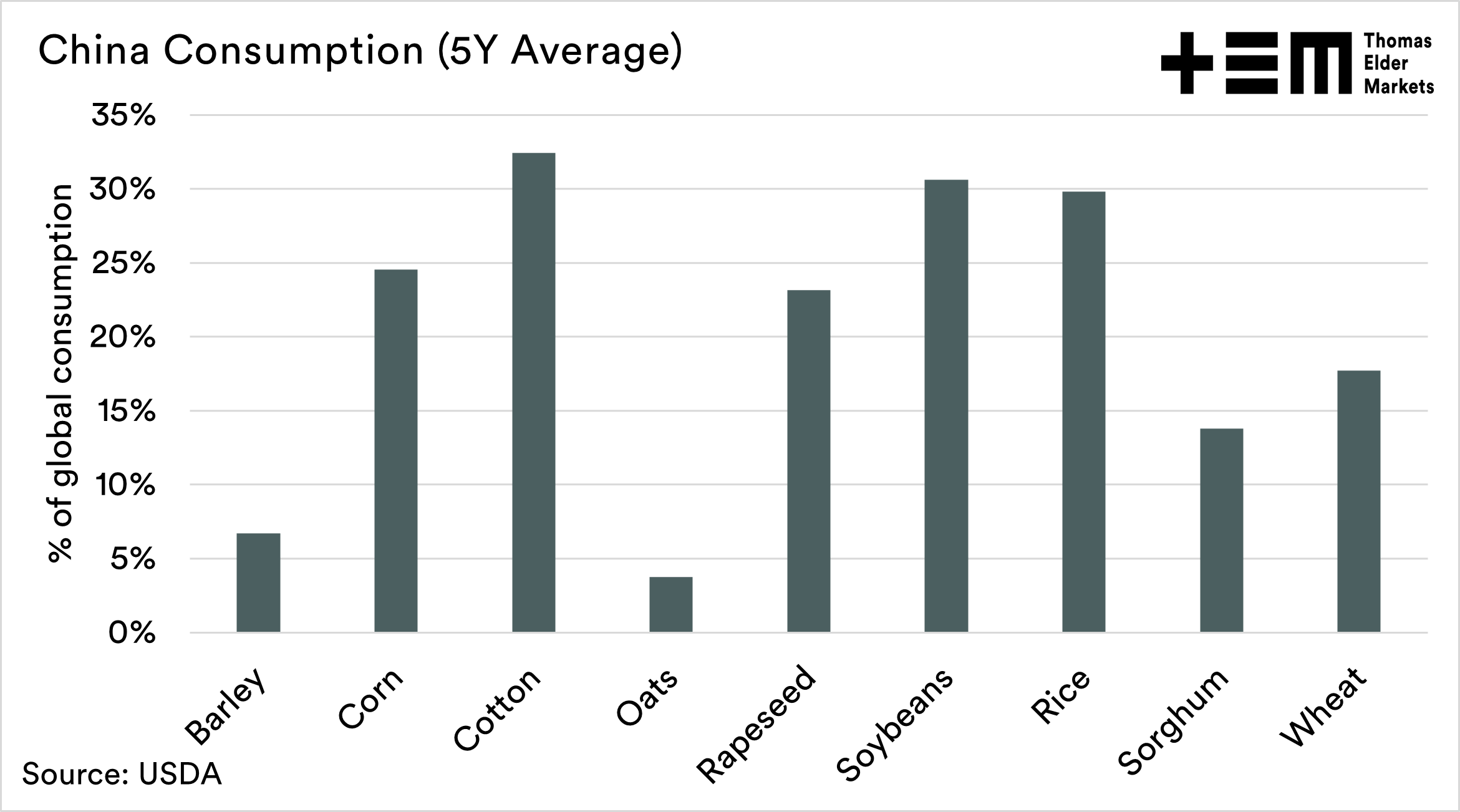

A huge population now eating a diverse diet has seen China as a huge proportion of the consumption of the world.

While they are a large grower, to meet their consumption demand takes large volumes of imports.

China is one of the world’s most significant importer across various commodities. The list below shows the average volume imported by China over the past five years.

- Barley 8.3mmt

- Corn 14mmt

- Oats 297kmt

- Rapeseed/canola 3mmt

- Soybean 93mmt

- Rice 4mmt

- Sorghum 5.6mmt

- Wheat 6.5mmt

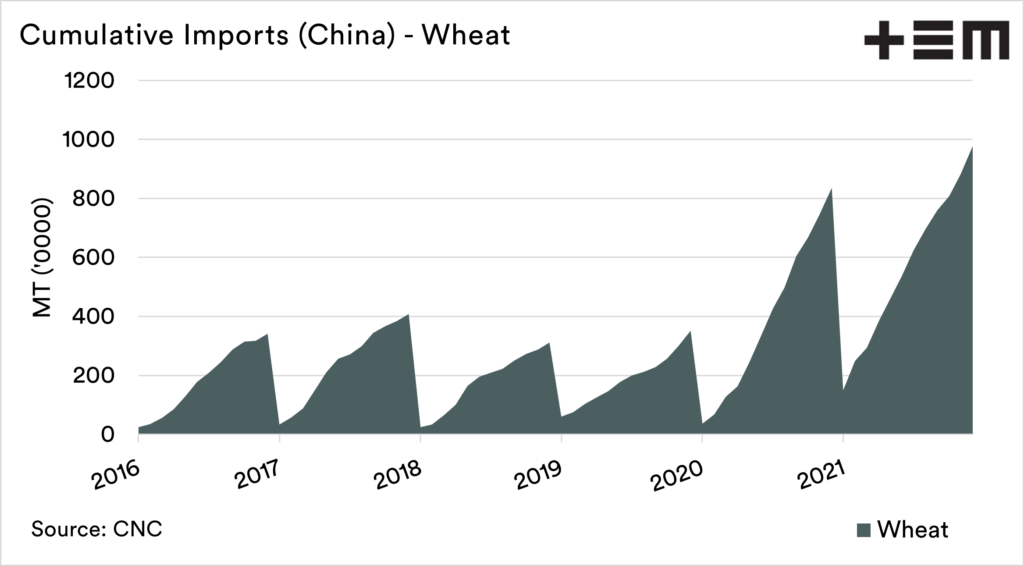

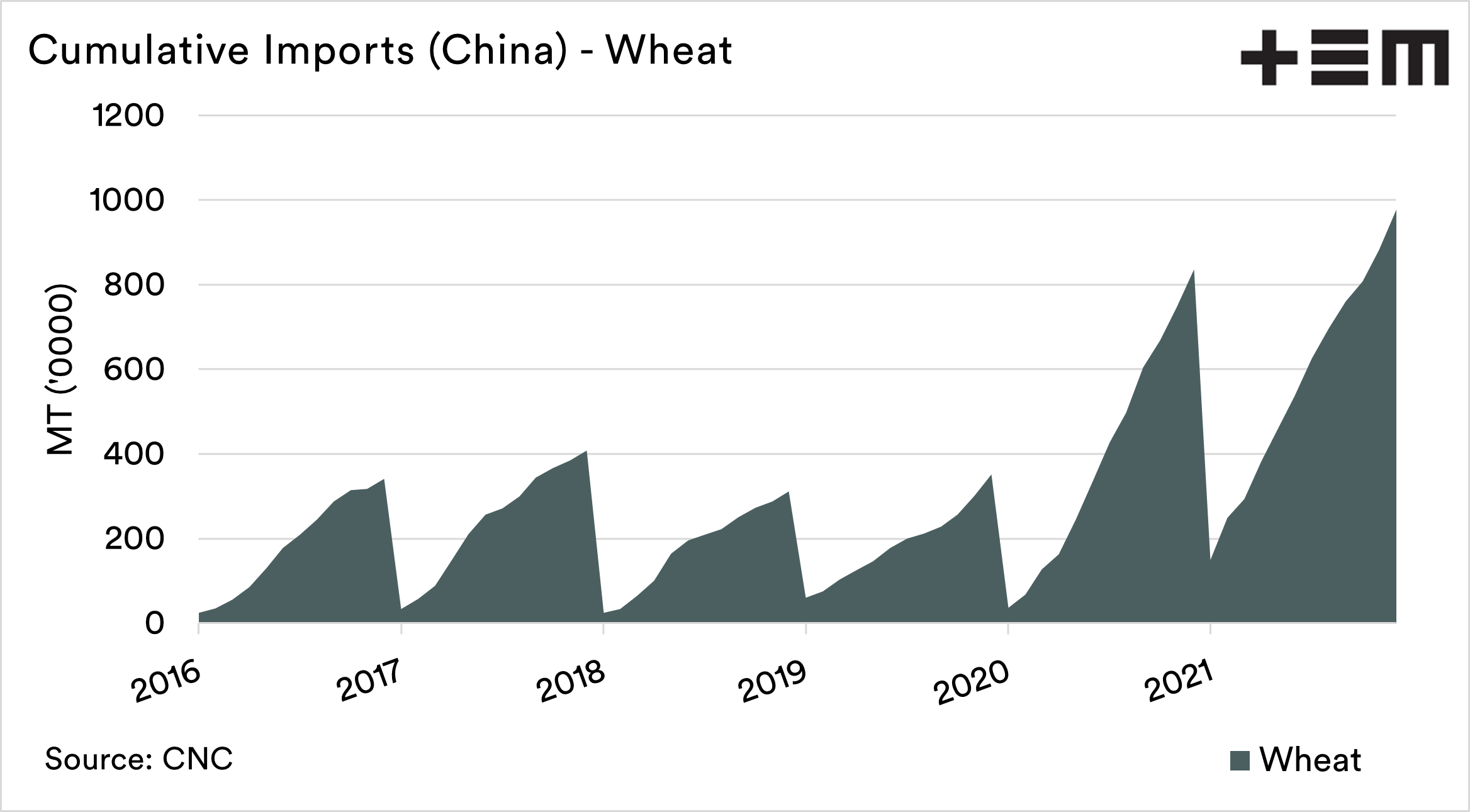

Whilst those numbers in the previous section are large, they are the average over five years, and something has changed in China. The chart below shows the huge increase in wheat imports during the past two years compared to the previous years.

We regularly update on the import volumes into China, as they are an important nation for Australian grains. In 2021, they imported huge volumes of grains. Whilst they didn’t import Australian barley, they have been willing buyers of Australian wheat (see here).

China has always been an enigma, with solid data on agricultural production being relegated to rumours and whispers. I had some concerns in the back of my head about the risk of China reverting back to prior import levels. A major problem with the winter crop will likely lead to continued strong imports.

If their crop is in a terrible state, then they will have to start eating into the nation’s stockpiles. On paper, China holds 51% of the world wheat stockpile.

China has been hoarding a lot of grain (see our March 2021 article). I use the term on paper, as recent import programs may suggest that stocks are not as high as the Chinese government or USDA’s data suggest.

If, as many suspect, the stocks are lower than government numbers suggest, this could point to another year of large imports. If the import program continues, then Australia is currently set to be in the front seat, provided Russia doesn’t steal our trade. Let’s hope they come back for some barley as well (China has barley any options).

If you liked reading this article and you haven’t already done so, make sure to sign up to the free Episode3 email update here and to follow us on Twitter. You will get notified when there are new analysis pieces available and you won’t be bothered for any other reason, we promise. If you like our offering please remember to share it with your network too – the more the merrier.