The trick, with barley, is not minding that it hurts.

The Snapshot

- Australia has won in the first barley tender for 2021 delivery into Saudi Arabia.

- The volume is likely to be 730kmt from Australia.

- We have not exported this volume to Saudi Arabia since 2016. The highest volume in one year was 1.8mmt in 2011.

- The average tender price was A$320, delivered to Saudi Arabian ports.

- Australia has the most competitive barley price in the world.

- The first win of 2021 is a good sign, but our barley will have to remain ‘cheap’ in order to win business.

- It will be hard to replace all lost Chinese volume, and domestic stockpiles are likely to grow.

The Detail

Barley has been bleak for most of 2020. As the impact of the tariffs by China has impacted upon our markets, the main question has been where it will go?

Over the weekend, Saudi Arabia announced the first barley tender for 2021 delivery. Australian barley is in the mix.

In one of my early articles on EP3, I discussed the importance of ensuring that we got some business into Saudi Arabia (A battle ahead for barley).

The reason for this was that Saudi Arabia is the worlds largest barley importer, followed closely by China. After China, the importers drop in volume considerably. To export the volume of barley, we will produce this year will require Saudi Arabia.

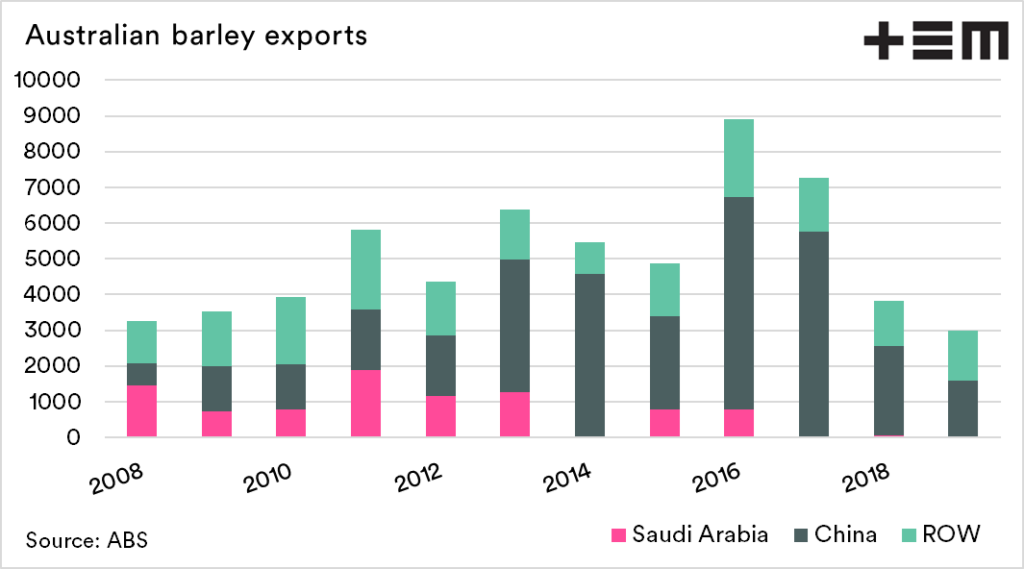

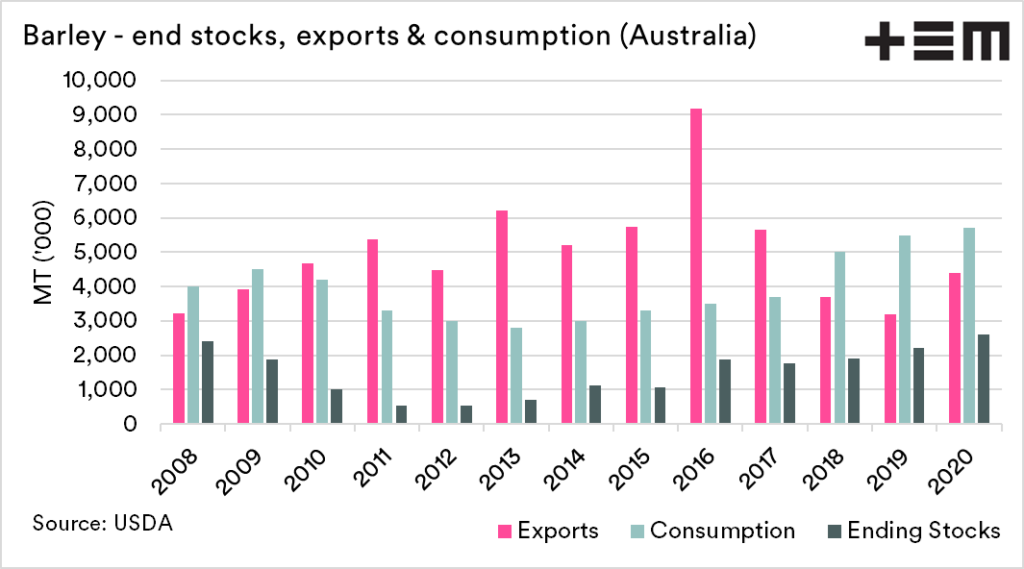

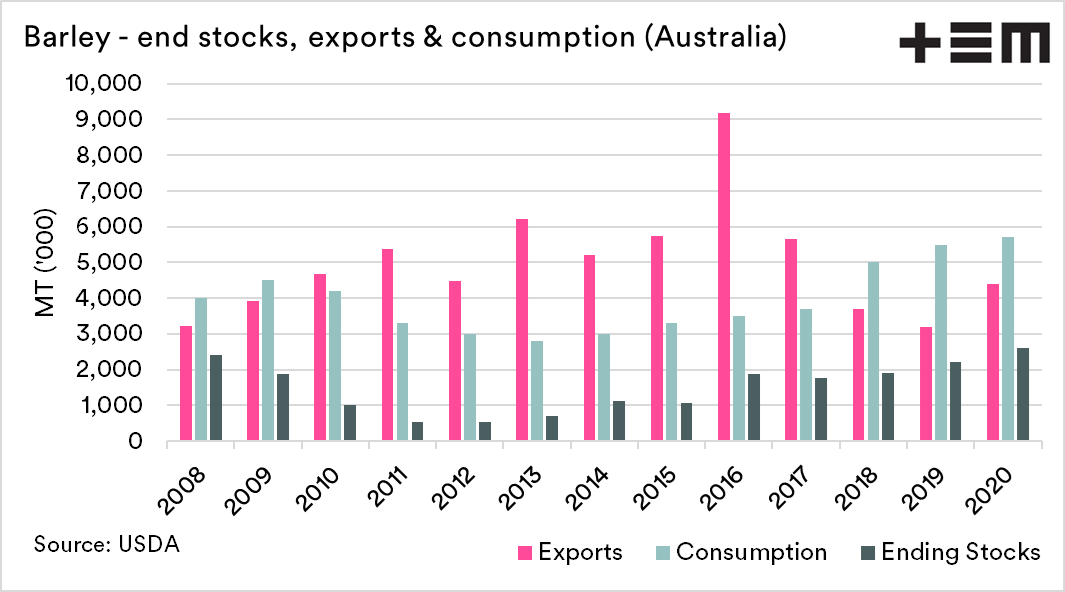

The barley exports for Australia with China, Saudi Arabia and the rest of the world are displayed in the chart below. As we can see, China has been a significant buyer since 2013. In the same time, our trade into Saudi Arabia has diminished, due in part to the recent droughts and competitiveness from other origins.

The tender

This tender has been long-anticipated in Australia, as it signals the first period which new crop barley could be realistically delivered. In the tender process, 730kmt was purchased, which is a substantial volume, albeit below the average tender purchase volume of 1mmt.

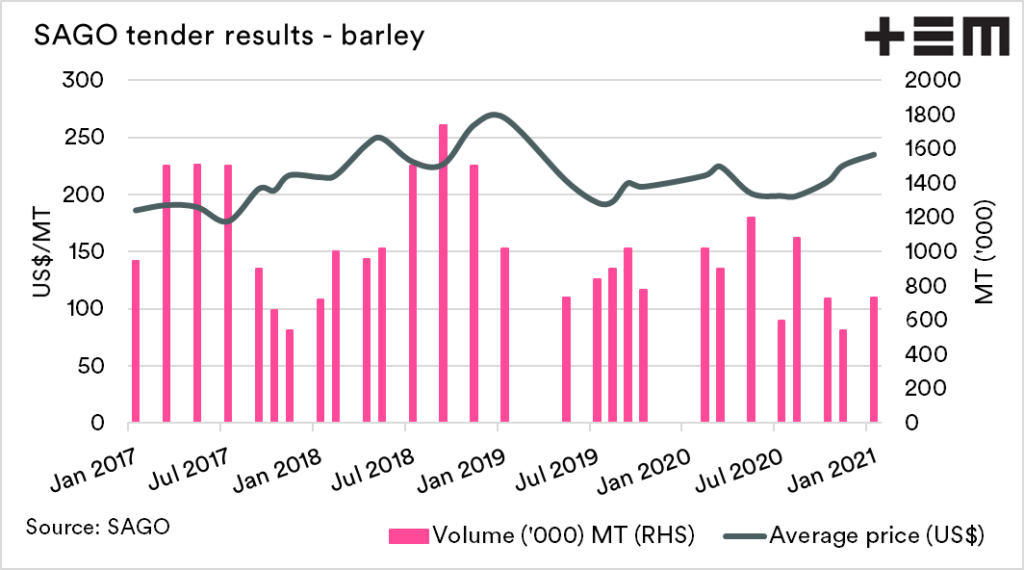

The average price was A$320 CIF (delivered) Saudi Arabian ports (Red sea/Arabian Gulf). The buyers were Glencore, GrainCorp and CBH. The price was 4% higher than the previous tender for November/December delivery, and the highest level since late 2019 (in US$ terms).

The permitted origins are Australia, EU, Black Sea, South/North America (ex Canada). It is highly likely that this volume will come from Australia.

Where to from here?

It is good news that Australia has some Saudi Arabian business on the books. It will be a big task for Australia to win every tender into Saudi Arabia over the next year. Still, at present, our barley is price competitive.

In order to continue to win tenders, we will have to continue offering ‘cheap’ barley.

In reality, we have not exported this volume of barley to Saudi Arabia since 2016, and the highest volume was 1.8mmt in 2011. It is, however, a good sign for the coming year.

In all likelihood, we are unlikely to be able to completely replace all our volume lost into China, which will result in larger stockpiles as we move into the 2021/22 harvest.