Market Morsel: Fertilizer pricing – some hope?

Market Morsel

It’s coming to crunch time on fertilizer; time is ticking down to seeding. I have received a bunch of calls in the last couple of days asking about what is happening to price, and whether we will see a collapse in the pricing levels.

At the start of the month, I provided a quick update, which showed that the overseas pricing for Urea was falling (see here). I thought it was time now to update our replacement/cost and freight model for Australia.

EP3 was the first organization to publicly publish the CFR+ model. Over time, we hope it helps farmers and the broader industry get better insights into pricing levels for one of their most essential inputs.

The CFR+ utilizes data from two independent data sources – CRU & AgFlow

The CFR+ model sounds more complex than it is. It is basically a simple addition of factors* that drive the price:

- The cost of purchase at origin – loaded onto the boat.

- The freight cost to destination (Australia).

- The cost of discharging

- Conversion from US dollars to Australian dollars.

The purpose of the model is to show the trend of pricing as an average in lieu of any transparent pricing information from the industry. This is the cost that it would be purchase now and deliver on the spot.

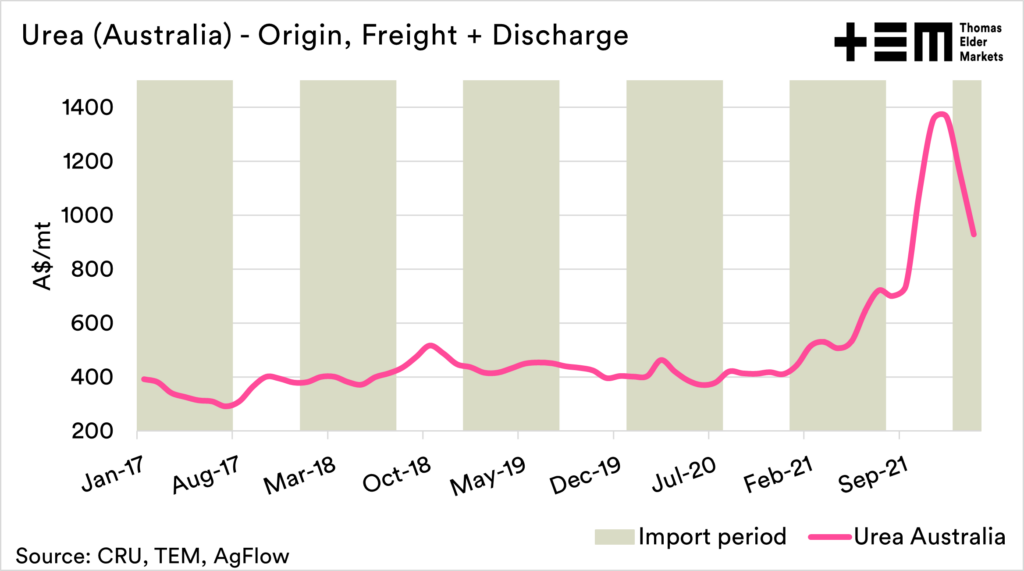

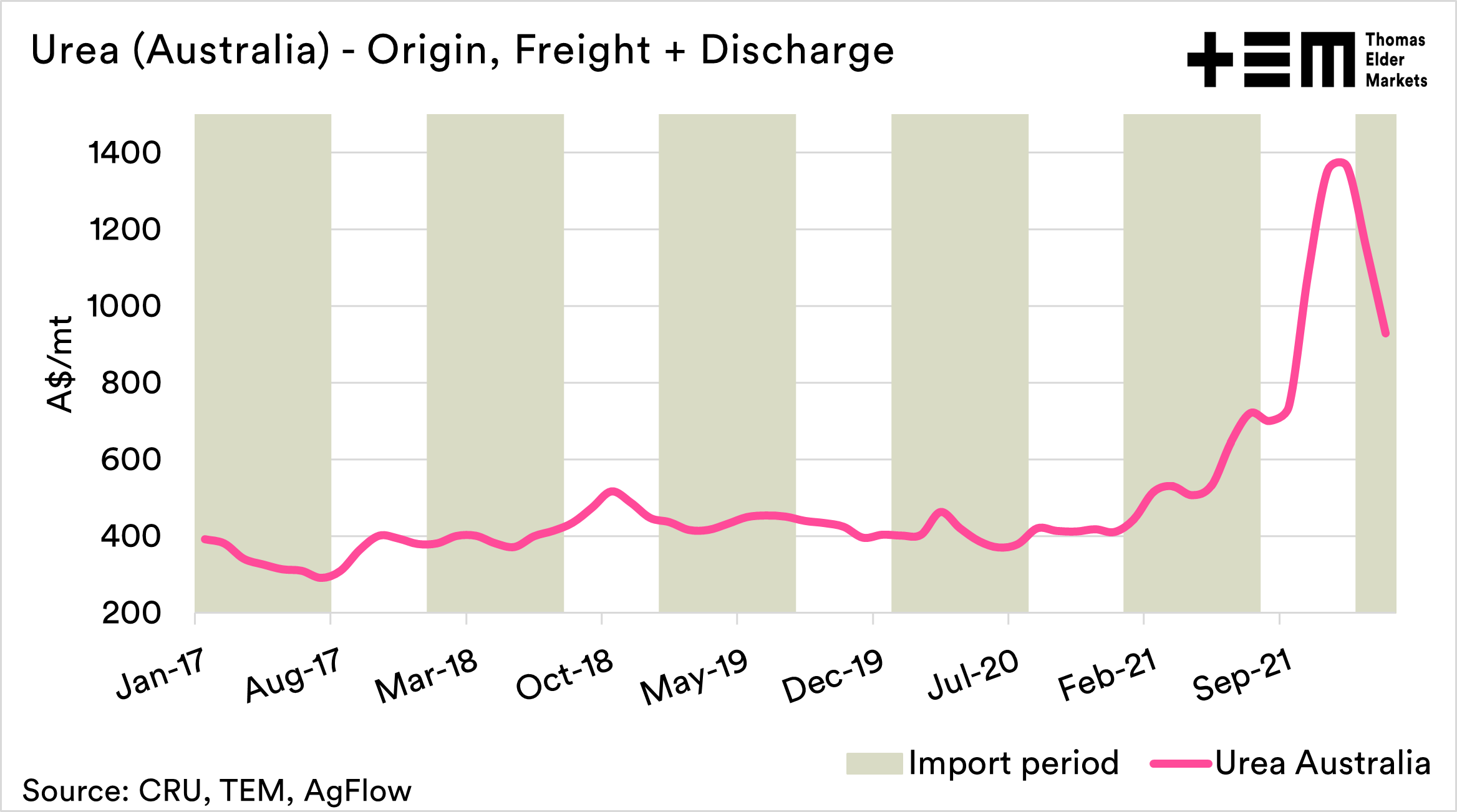

As expected, the biggest move has been to Urea, which has seen a fall from 1300+ during December to the low 900’s.

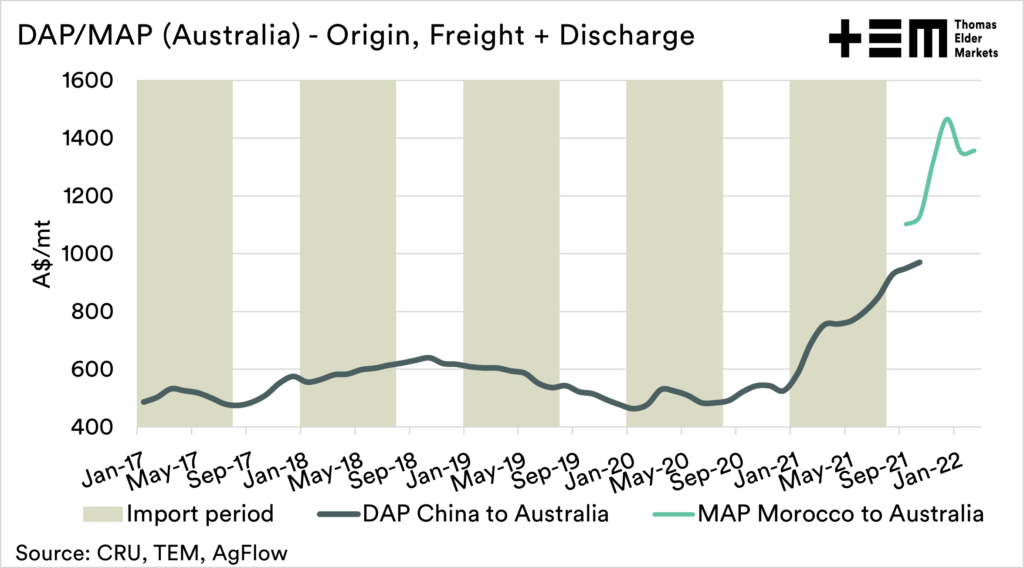

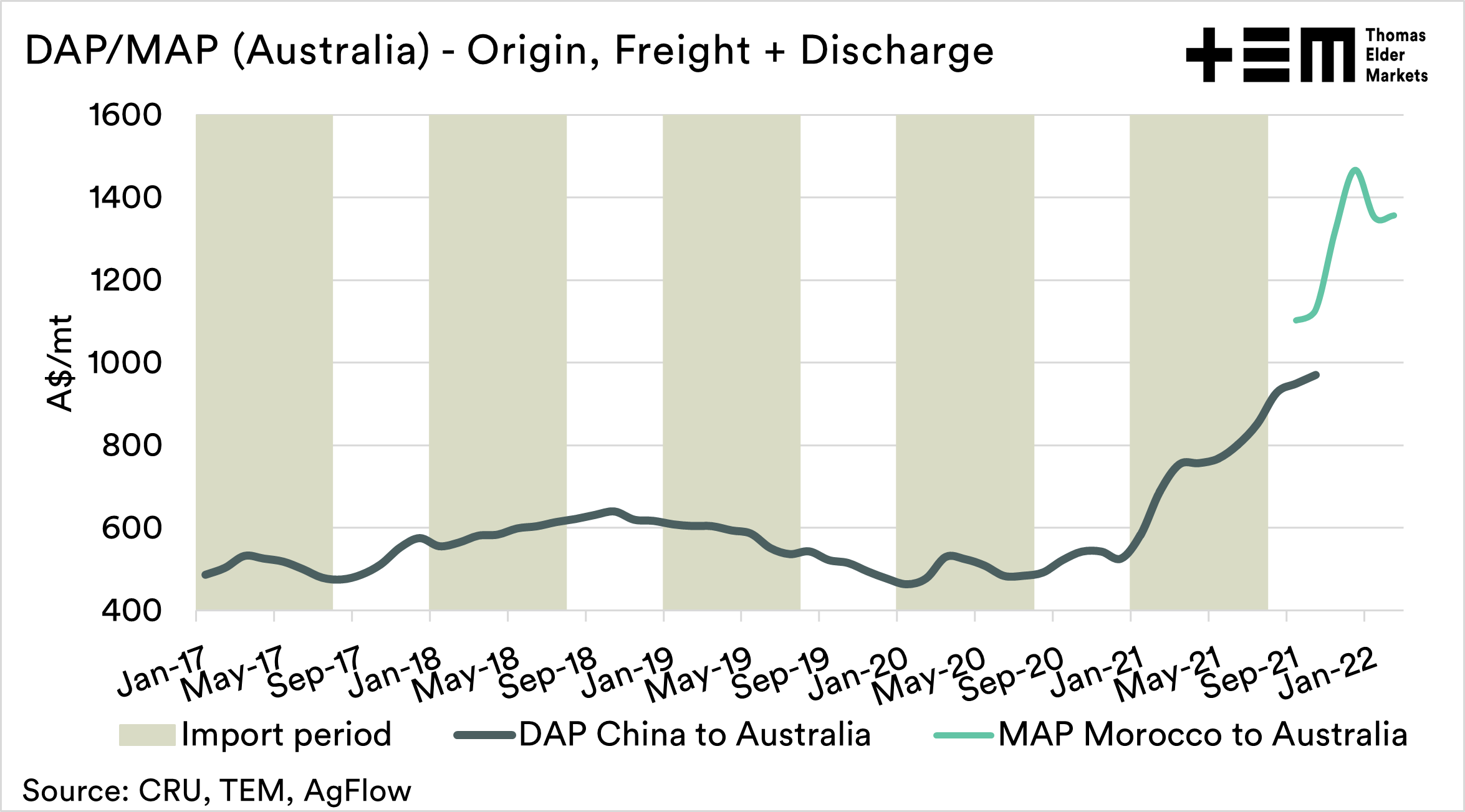

DAP/MAP has seen a fall from the mid-1400s to the mid-1300s. The reason for the more subdued decline is that China is still out of the picture (See here).

The fertilizer charts are frankly still a scary sight to behold. Urea is 80% higher than this month last year, and DAP/MAP up 96%.

The unfortunate factor is that the price falls overseas may not be reflected in Australia in time to reduce the costs farmers are facing this year. Even with the falls flowing through on a 1 for 1 basis, it is still high prices compared to recent years.