Grinding down the premium

The Snapshot

- The 90CL to EYCI spread has gone from a 90% premium in November 2019 to a 15% discount in recent weeks.

- The normal range in spread fluctuation is between a 5% discount to a 40% premium.

- Meat and Livestock Australia anticipate the 2020 annual slaughter to be 7.0 million head, which places the 90CL to EYCI spread at an annual average basis to be nearer an 8% discount. Currently the annual average 90CL to EYCI spread sits at a 3% premium.

The Detail

The imported 90CL frozen cow indicator is a key price series that we keep an eye on when assessing global beef markets. It represents the ground lean beef product sent to the USA often mixed with fattier chemical lean (CL) meat product to create their famous 73CL burgers.

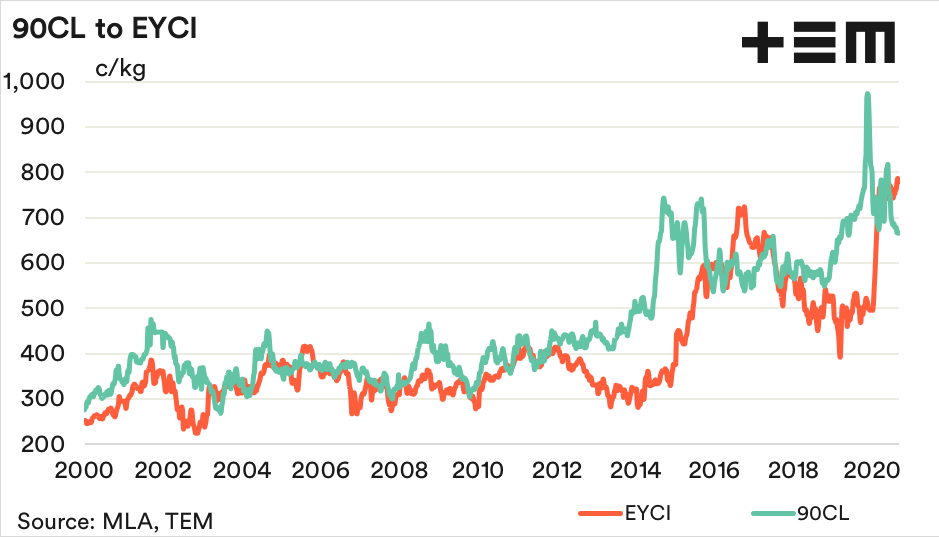

Historically the price behaviour of the 90CL and the Eastern Young Cattle Indicator (EYCI) tend to mirror each other, particularly over the longer term. However, during times of drought in Australia when slaughter levels are high or when there is significant restocking activity due to wetter conditions the two-price series can sometimes deviate.

During the 2014/15 drought the EYCI and 90Cl decoupled as high slaughter rates in Australia saw the 90Cl trade at a significant premium to the EYCI. Once the drought broke and the restocking activity kicked in during 2016/17 the 90CL traded at a discount to the EYCI.

The 2019 drought saw the 90CL run at a strong premium to the EYCI, but this narrowed sharply as we entered 2020. Indeed, the 90CL to EYCI spread has gone from a 90% premium in November 2019 to a 15% discount in recent weeks.

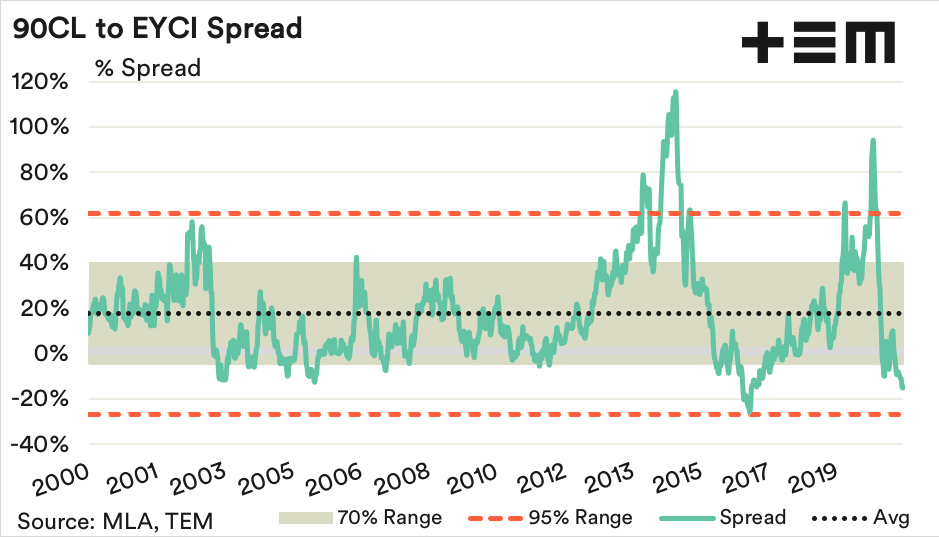

Analysis of the longer-term behaviour of the 90CL to EYCI spread shows that since 2000 the spread has averaged an 18% premium. The normal range in spread fluctuation is between a 5% discount to a 40% premium, as highlighted by the 70% range boundary. Meanwhile, movements in the spread beyond a 27% discount or a 62% premium would be considered extreme.

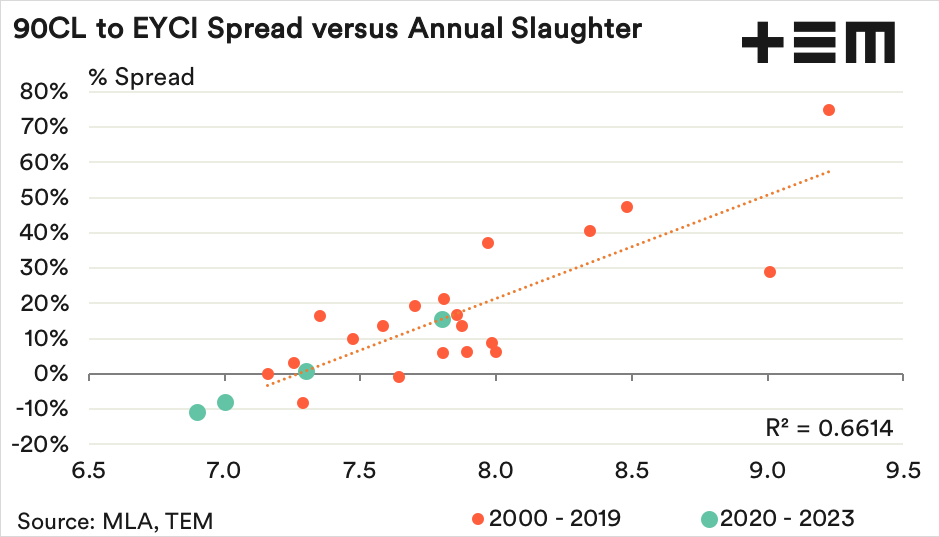

Mapping the annual average 90CL to EYCI spread against the annual cattle slaughter volumes shows that there is a moderate correlation, with an r2 of 0.6614. Cattle slaughter levels above 9.0 million head per annum suggest that the spread should be near a 60% premium, while slaughter below 7.3 million head starts to suggest the 90CL will run at a discount to the EYCI.

Meat and Livestock Australia anticipate the 2020 annual slaughter to be 7.0 million head, which places the 90CL to EYCI spread at an annual average basis to be nearer an 8% discount. Currently the annual average 90CL to EYCI spread sits at a 3% premium.

Given the low slaughter levels forecast for 2021 and the wet season anticipated in the final quarter of 2020 don’t expect the 90CL to EYCI spread to move back into a premium in the short term.