I spy with my little eye, something beginning with C

Cattle

It’s fair to say 2020 was an “out of the box” season. As we head to the year’s end the EP3 team thought it appropriate to cover off on a few key items to keep an eye on for cattle markets.

Updated cattle price modelling for the 2021 season will be published in the new year. However, preliminary estimates have the annual average Australian heavy cattle prices coming off 5%-10% from the 2020 levels.

Three key factors to watch during the 2021 season include:

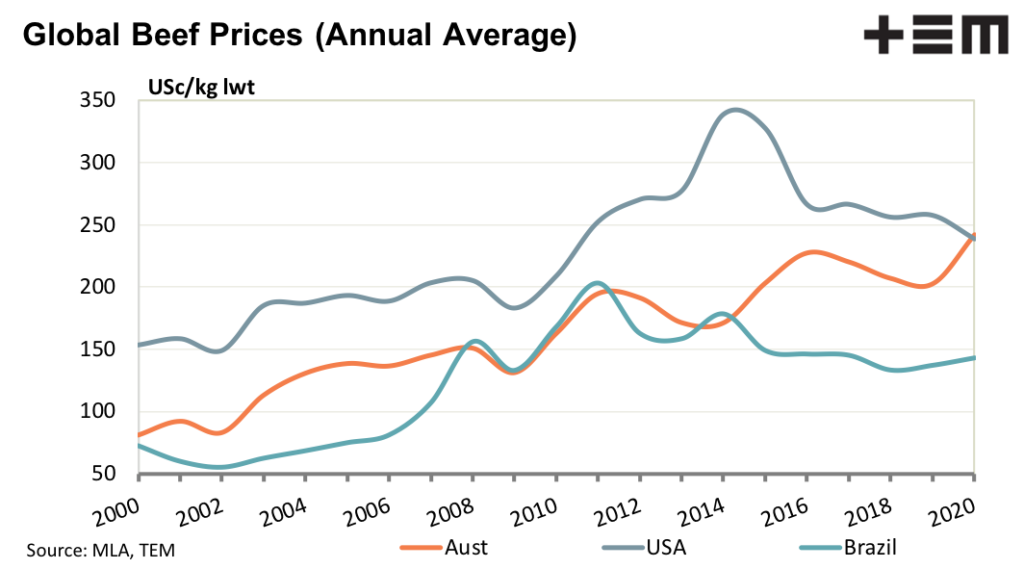

1 – Global cattle vs domestic cattle prices.

Tight supply and more favourable seasonal conditions have seen Australian cattle prices reach for the stars during 2020, eliminating the normal premium spread held by US cattle. Further to the strong domestic cattle prices, the Australian dollar has appreciated significantly, eroding our international competitiveness in global beef markets.

The prospect of an Australian dollar into the high 70US cent region, or even above 80US cents into 2021 will act as an additional headwind on cattle prices in the coming season.

Australian beef processors have been battling with negative profit margins for much of the 2020 season. This tough trading environment for beef processors is not expected to ease into 2021, given the forecast for the lowest beef herd in nearly thirty years. Therefore, there will be limited opportunity for Aussie finished cattle prices to continue to climb higher into 2021. Despite the strong desire to restock, young cattle prices will also be limited as to how far they can extend higher too, without finished cattle prices moving higher.

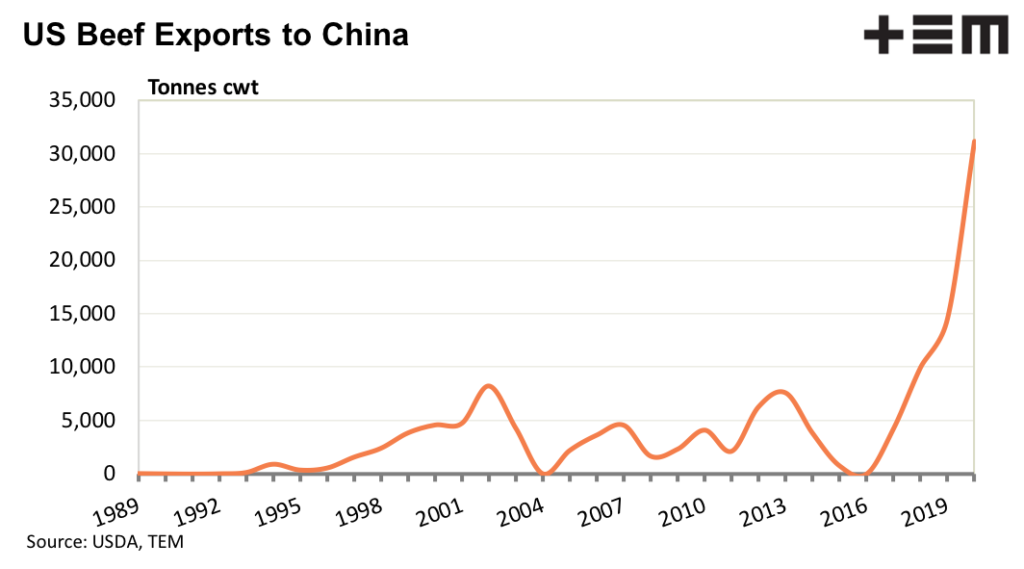

2 – Ongoing trade tensions and the growth of US beef exports to China

Don’t expect the Chinese Australian trade tensions to fade into 2021. The incoming Biden administration in the USA are committed to keeping the Trump Phase One trade deal with China, which has already seen a significant increase in US beef flows to China during the 2020 season at the expense of Australian beef exporters.

Australia’s frosty relations with China appear unlikely to thaw out anytime soon. In 2010 China put Norway in the trade “sin bin”, cutting off their salmon exports and the trade spat between them lasted for about six years. Expect China to continue to make an example of Australia in 2021 with beef exports remaining in Chinese sights as one of several trade targets to punish us.

3 – Slow herd rebuild and the return of drought

The female slaughter ratio has been slow to return to levels consistent with a herd rebuild, despite some obvious restocker activity in southern regions. A prolonged herd rebuild is a concern given the potential for the Australian climate to switch back into drought mode.

Analysis of the last century of rainfall indicates that much wetter than normal seasons (like what is being experienced currently) don’t last very long, often switching back to drought conditions within a two-to-four-year period. Missing the current opportunity to rebuild the herd (off of nearly thirty-year lows) poses the risk that a return of drought by, or before, 2025.

This could see the herd sink to even lower historic levels should the current rebuild phase stall. While the low supply will be good for prices, it won’t be great for maintaining our export market share in key destinations and risks the long-term viability of the industry.