Market Morsel: Pigs might fly.

Market Morsel

Whilst the world is concerned mainly with disruptions caused by coronavirus, the disease which has caused the most significant impact on meat remains African Swine Fever (ASF). The illness and the subsequent cull has resulted in China having a protein gap of 25mmt during 2020 (see here).

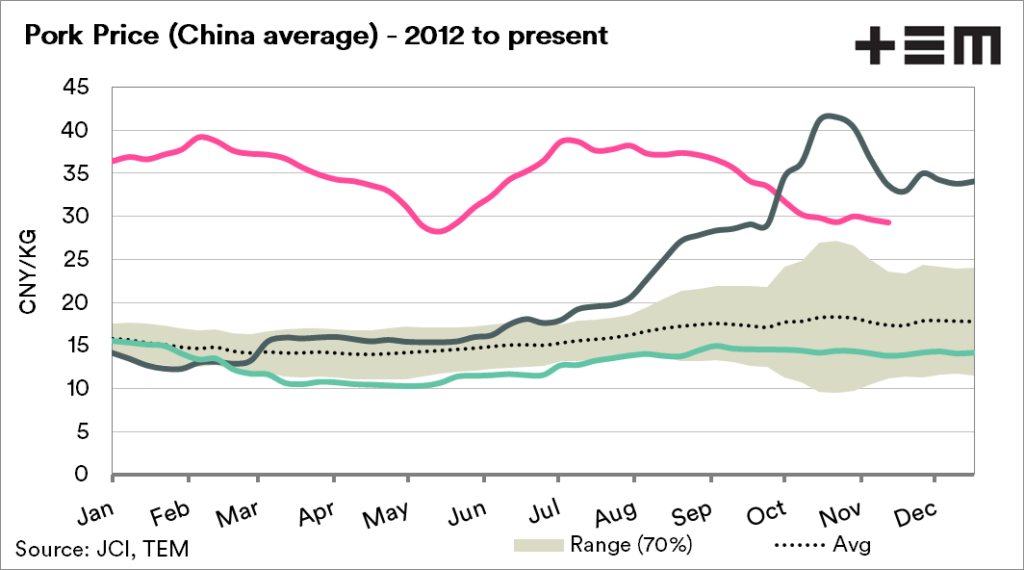

In recent days there has been a lot of talk from analysts that Chinese pork prices have crashed, due to the comparison year on year. Chinese pork prices on average for last week were down 23% from the same time the previous year.

This is a fact, but its worthwhile delving further back. The reality is that pork prices remain 112% higher than in the same period in 2018.

Whilst China rebuilds its swineherd, there remains a considerable premium to pre-ASF levels. This flows through to the prices they pay for imported protein.

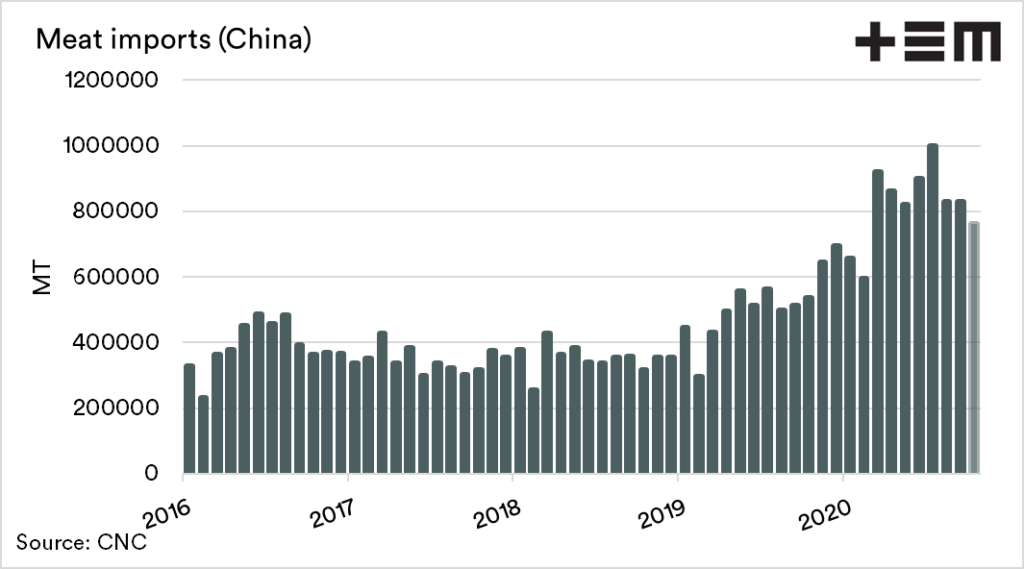

China is still running a substantial meat import program. The provisional meat imports for October were down to 761kmt from 830kmt in September. Whilst a large drop, the import levels remain more than double the monthly average for the pre-ASF period.

The herd is rebuilding, but there is a very big question mark on the efficacy of the program. The continued high imports and high prices compared to pre-ASF times points to supply not back to prior levels despite any ‘pig hotels’.

ASF is likely to continue propping up protein for some time.