Producer pressure

Market Morsel

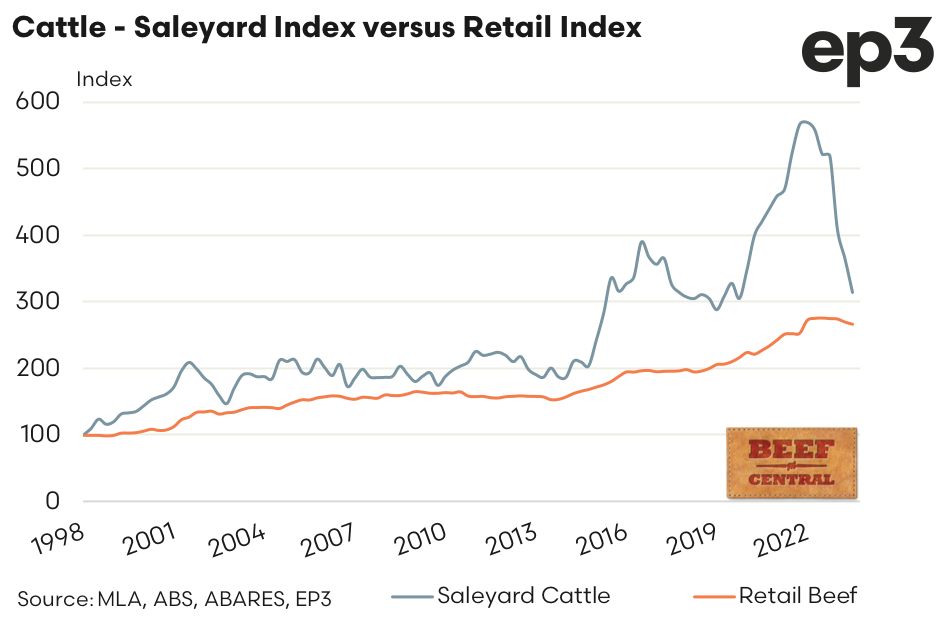

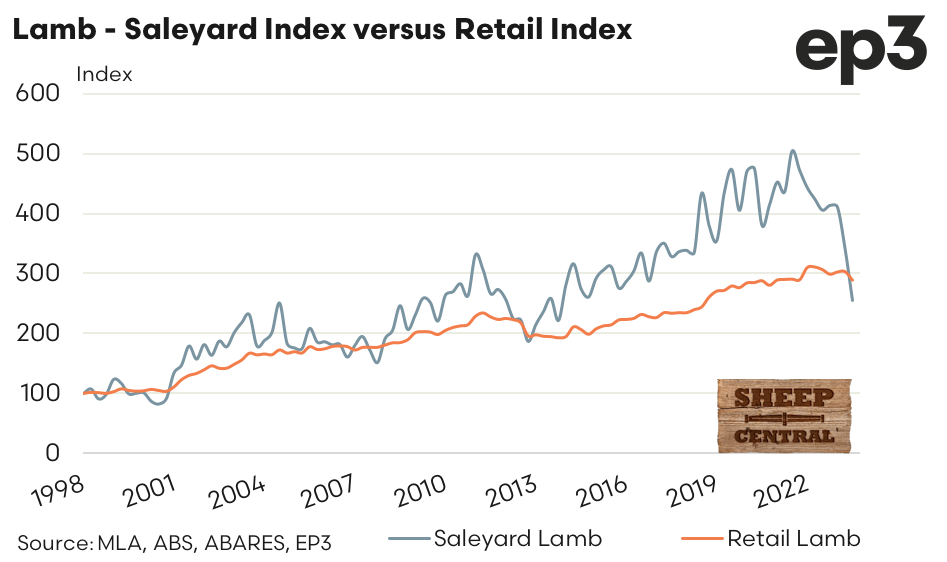

The release last week of the quarterly consumer price indicators for beef and lamb allows us to update average retail pricing levels and compare how sale yard price trends for cattle and lamb compare to price trends for beef and sheep meat in the butcher shop & supermarket.

Since our last update (from the June quarter 2023) the cattle saleyard index has dropped a further 14% from 365 to 314, meanwhile at the retail level the beef index has eased just 1.2% from 269 to 266. Lamb prices at the saleyard have dropped 25.5% over the September quarter with the lamb index down from 343 to 255. At a retail level, average sheep meat prices declined by 4.7% with the index moving from 303 in June to 289 in September.

In terms of retail dollars per kilo average beef prices have eased from $26.51 to $26.19 and average retail lamb prices have dropped from $19.40 to $18.49.

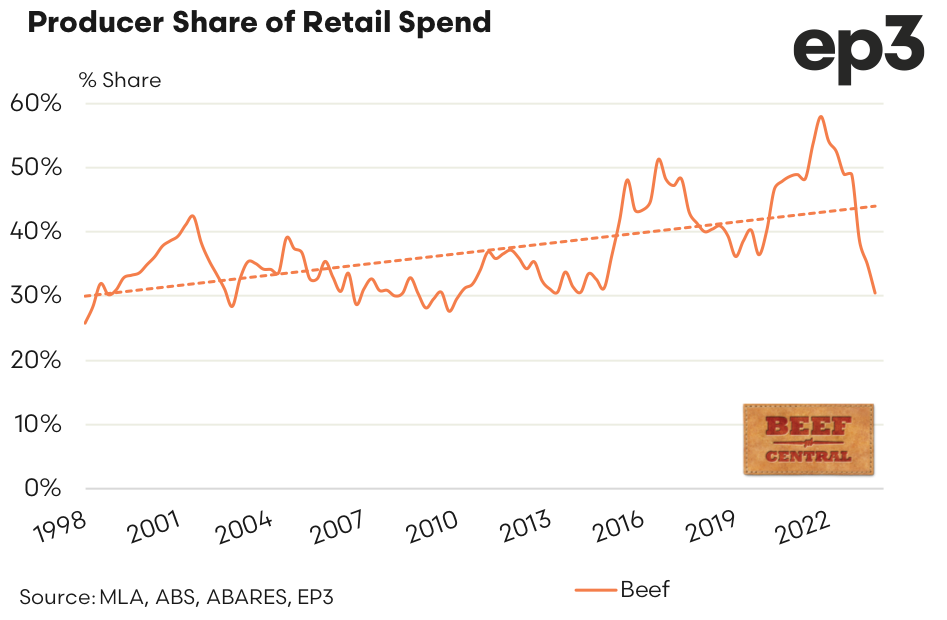

As saleyard price falls continue to outweigh retail price declines the producer share of the retail spend continues to test lower too. The producer share of the retail spend on beef has dropped from 35.0% in Q2 2023 to 30.5% for the September 2023 quarter. This represents the lowest the producer share of the retail spend on beef has been since the first quarter of 2010 when it dropped to 29.6%. However, there were a few times this low was nearly breached, in Q1 2014 and Q2 2013, when the share got to 30.6%.

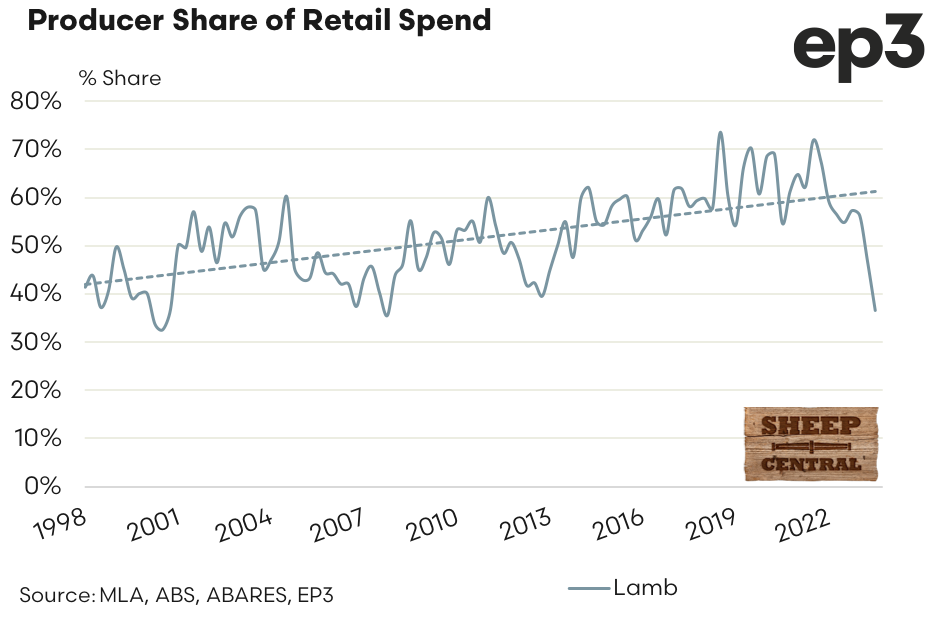

Meanwhile the producer share for the retail spend on lamb has dropped to the lowest level seen since the final quarter of 2007 when it dropped to 35.4%. The September quarter of 2023 saw the share of the retail lamb spend eased from 46.7% in Q3 to 36.5%.

This analysis is released in conjunction with Beef Central and Sheep Central. To view the earlier June quarter release of the producer share of the retail beef and retail lamb spend click the links below.