Red Meat 2025 – Round 3

Round 3 - The Trump Factor & Chinese Reliance

This is the final article in a series of three published over the last few weeks. The first article highlighted the tightening global beef supply in 2025, positioning Australia as a key beneficiary amid herd reductions in major exporting nations, while the second article showcased Australia’s growing success in diversifying red meat exports through strategic Free Trade Agreements. This third instalment examines how external forces, particularly the shifting trade policies of a potential second Trump administration and China’s economic fragility, pose significant risks to Australia’s reliance on China as a dominant export market.

The contrasting approaches between the first and second Trump administrations offer a significant lens through which to assess broader geopolitical and economic impacts, particularly on global trade. During Trump’s first term, the administration emphasised populist “America First” policies but often balanced loyalty with the technical expertise of seasoned advisors, such as economic adviser Gary Cohn and trade negotiator Robert Lighthizer. Cohn, a former investment banker, contributed a pragmatic perspective on global markets, mitigating some of Trump’s more extreme impulses.

Lighthizer, though a strong advocate of trade protectionism, brought decades of experience in trade policy. However, Trump’s second term, based on his rhetoric and leadership shifts, seems poised to deepen loyalty-driven appointments over technical knowledge, with figures like Peter Navarro, known for unrelenting anti-China views, gaining prominence. This shift signals a more rigid and ideologically protectionist administration with far less emphasis on policy nuance.

Trump’s proposed increase in tariffs on Chinese imports has broader implications for the already fragile Chinese economy. Recent data indicates that China’s GDP growth is slowing, with the IMF forecasting sub-5% growth for 2024-2025. This slowdown stems from a combination of weak domestic demand, sluggish consumer sentiment, and troubling trends in the manufacturing sector, evidenced by China’s Purchasing Managers’ Index (PMI) dipping below 50, a signal of contraction. Persistent property sector woes, epitomised by the collapse of major firms like Evergrande, have exacerbated economic uncertainty. Should Trump implement another tariff hike, it would pressure Chinese exports and further weaken domestic confidence. This downturn would reduce China’s capacity to act as a primary growth engine for global trade, including its role as a critical importer of agricultural commodities.

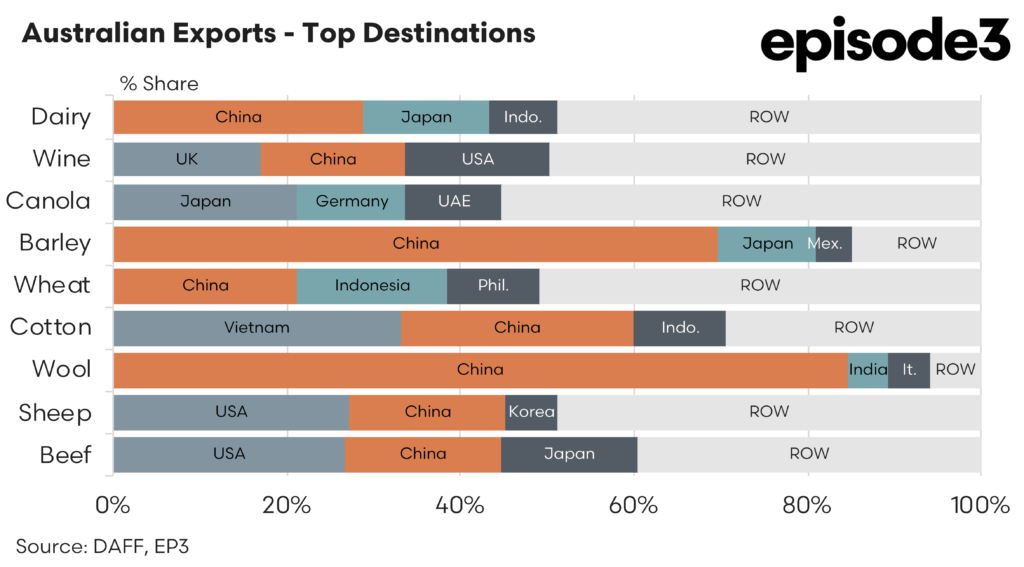

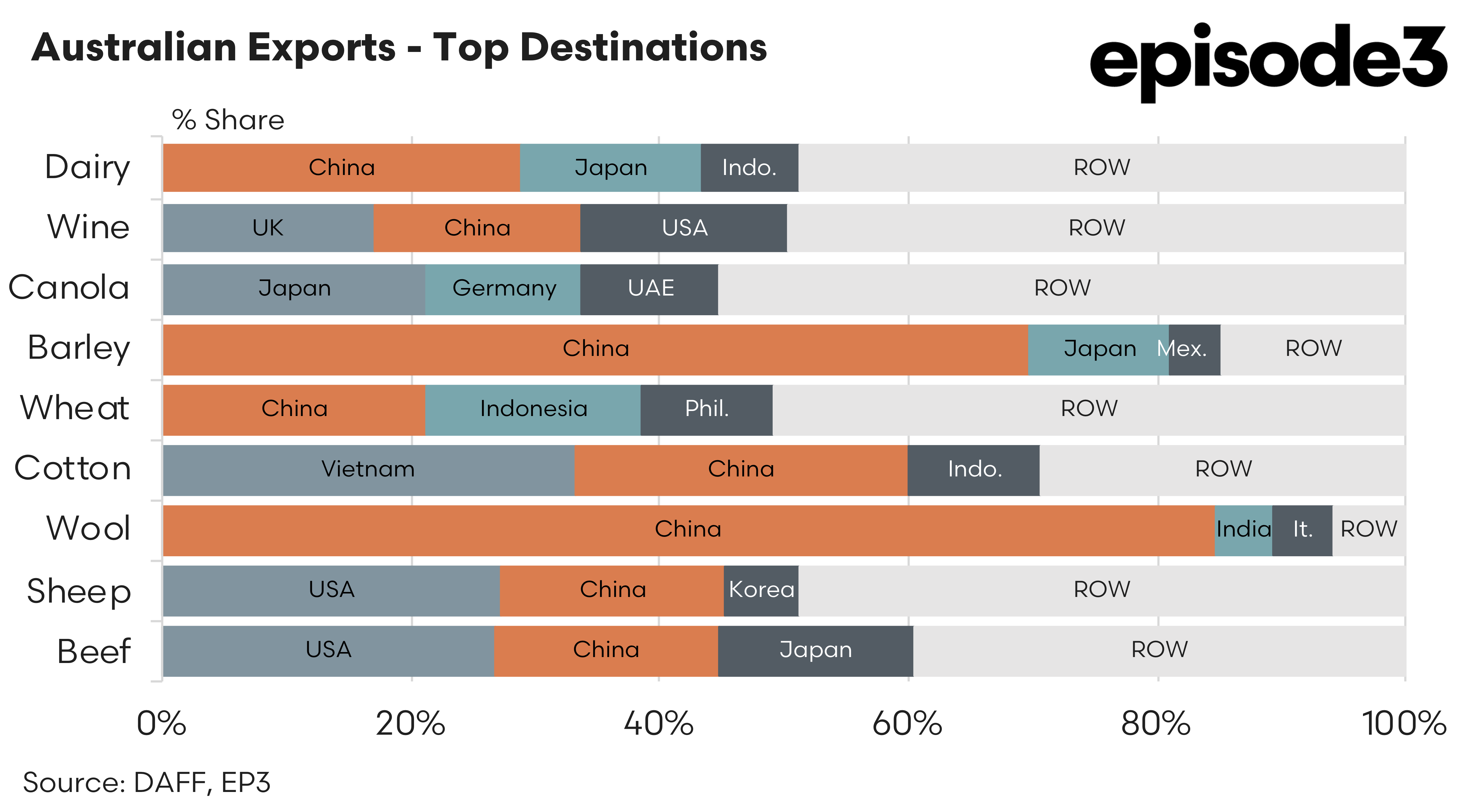

For Australia, the implications of a weakened Chinese economy are particularly pronounced given its heavy reliance on China for agricultural exports. As illustrated by the trade share data, China remains Australia’s top export destination for wool, cotton, dairy, barley, and beef. In wool, for instance, China dominates over 80% of Australian exports, reflecting its pivotal role in the textile and garment manufacturing sectors. Likewise, China is Australia’s largest market for cotton, a product that aligns with its vast textile industry. The same dependency is visible in barley, where China accounts for a significant share, driven by its brewing and livestock feed demand. Should Chinese economic troubles persist, demand for these products could falter, impacting Australian producers’ revenue and profitability.

Similarly, Australian beef exports, though more diversified, remain highly exposed. China’s market is critical for Australia’s red meat sector, as noted in the first two parts of this analysis. While new free trade agreements with countries like India, Indonesia, and the UAE have opened opportunities, none match China’s sheer scale of demand. Any contraction in Chinese consumer confidence or import capabilities could exacerbate pressures in an already constrained global beef supply market. Australian beef producers may find themselves squeezed between reduced Chinese demand and competition from other major exporters, such as Brazil.

For other sectors like dairy and barley, the risks are similar. Chinese economic troubles may disrupt Australia’s growth trajectory, particularly as the global trade environment remains tense. In dairy, where China and Japan are prominent importers, Australia’s producers would likely feel a sharp demand contraction, further exacerbated by domestic market oversupply. Barley, meanwhile, remains subject to China’s demand for beer brewing and animal feed production. With Chinese manufacturing sectors and consumer sentiment weakening, orders for Australian barley may stagnate, necessitating strategic diversification toward Southeast Asian or Middle Eastern markets.

The second Trump administration’s anticipated trade protectionism, coupled with China’s economic fragility, poses a significant risk for Australia’s agricultural export industries. Trump’s rigid stance on tariffs could destabilise global trade flows and intensify China’s economic slowdown, creating cascading impacts on Australian beef, wool, cotton, barley, and dairy sectors. Australia’s overreliance on China leaves it vulnerable to these macroeconomic shocks. To mitigate risks, Australian producers must double down on diversifying trade partnerships through FTAs, particularly in India, Indonesia, the UK, and Southeast Asia.