Why is it so?

The Snapshot

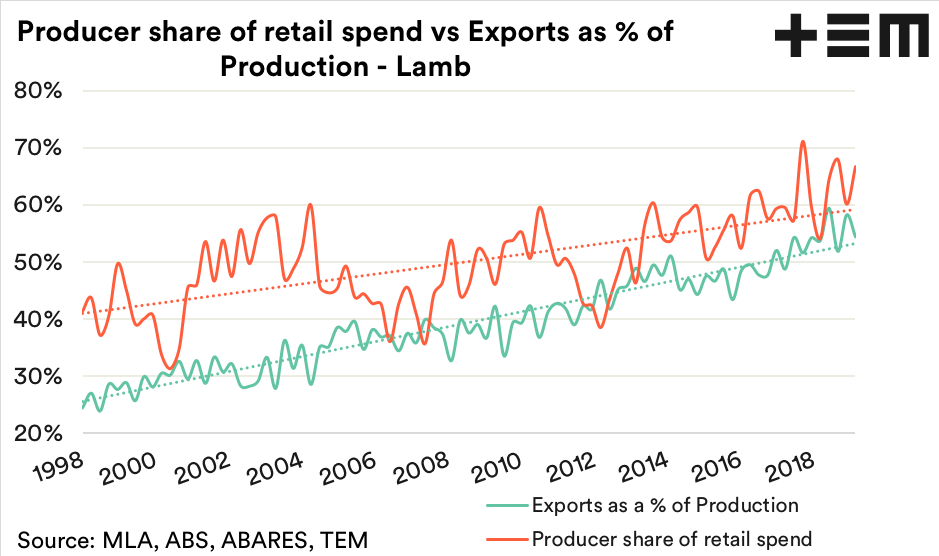

- For sheep producers, the strong performance of sale yard prices over the last two decades has meant that their share of the retail spend has increased from around 40% in the late 1990s to 65% in the recent years.

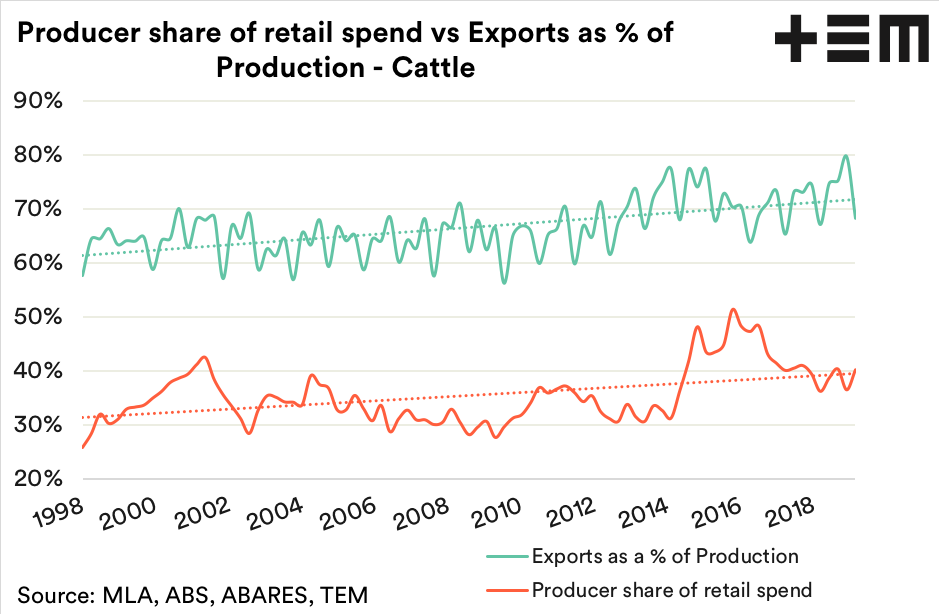

- Apart from short period during 2016/17 when sale yard cattle prices got ahead of the retail beef price the producer share has remained within 5 percentage points either side of 35%.

- Lamb exports as a percentage of lamb production have been on a steady growth trajectory from around 25% of production in the late 1990s to nudging 60% of production in recent years.

- A key driver of the benefit sheep producers have enjoyed by accessing a higher proportion of the retail spend has been the growth in export markets underpinning sale yard prices.

The Detail

I’m old enough to remember the TV science experiments conducted by Professor Julius Sumner Miller where he would pose the question “Why is it so?” then proceeded to explain, in fairly simple terms, some complex scientific answer.

Often when I’m confronted with an unexplained data trend, I hear the professor’s words ringing in my ears as I try to tease out the answers. Such has been the case with the growing red meat producer share of the retail spend over the last decade, particularly for sheep producers.

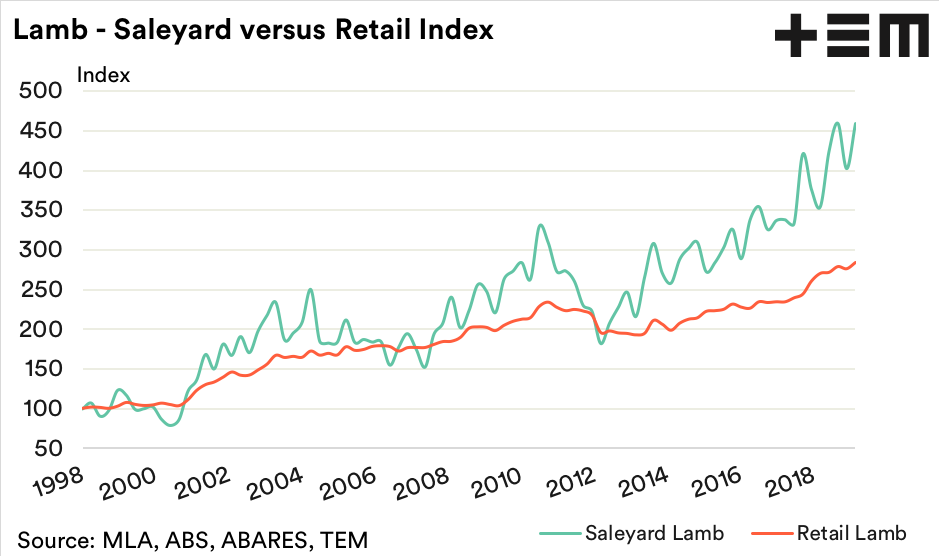

An index of sale yard lamb and retail lamb prices over the past two decades shows that since 2012 sale yard lamb prices have lifted significantly while the retail price of lamb has lagged behind. Indeed, using 1998 as a base year we can see that during the middle of 2012 both sale yard and retail lamb prices were double the 1998 base levels. However, since then sale yard lamb prices more than doubled yet again while the retail price has only increased by a third.

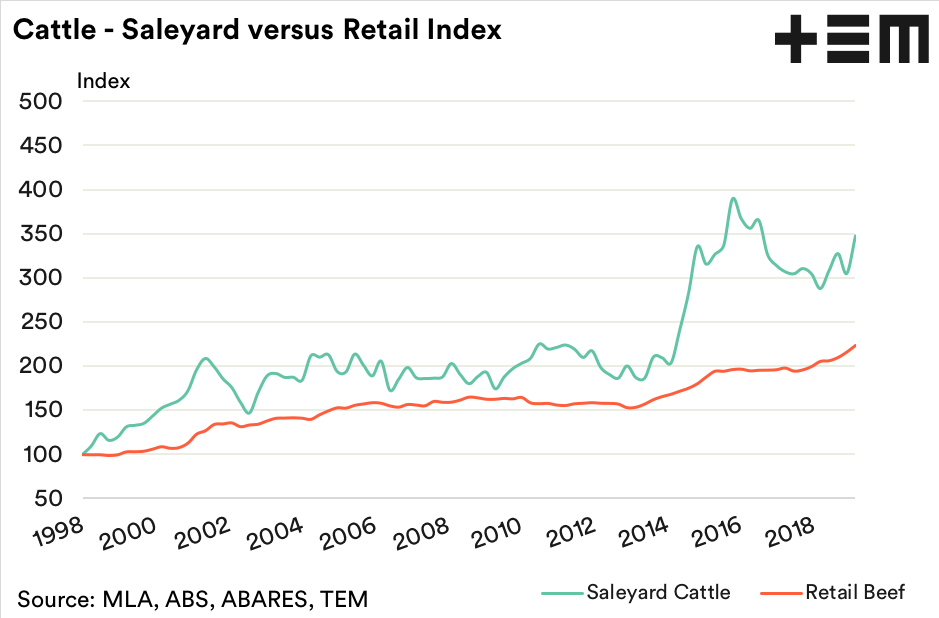

A comparison to the sale yard and retail price of cattle/beef shows that the big leap in sale yard prices didn’t eventuate until the breaking of the 2014/15 drought. Indeed, for the 1998 to 2014 period sale yard cattle prices were not much more than 50 index points ahead of the retail beef price.

For sheep producers, the strong performance of sale yard prices over the last two decades has meant that their share of the retail spend has increased from around 40% in the late 1990s to 65% in the recent years.

Part of the success story here has been the steady growth in sheep meat export markets. Lamb exports as a percentage of lamb production have been on a steady growth trajectory from around 25% of production in the late 1990s to nudging 60% of production in recent years.

It has been a somewhat different experience for cattle producers with the bulk of their share of the retail dollar ranging between 30-40% for much of the last two decades. Indeed, apart from short period during 2016/17 when sale yard cattle prices got ahead of the retail beef price the producer share has remained within 5 percentage points either side of 35%.

Compared to the sheep meat export sector the Australian beef export market is a much more mature marketplace. Australia has been exporting more than 60% of the beef it produces for many decades. During 1998 to 2014 beef export share of production mostly ranged between 60-70% and since 2014 this range has lifted to 65-75%.

Meat and Livestock Australia (MLA) can be commended for their contribution in supporting the growth of these markets. However, this is not the full story.

Given the more moderate increases at the retail price level for both lamb and beef it is likely some supply chain efficiency gains have acted as a buffer to higher livestock prices, allowing affordable red meat product to be delivered to the end consumer.

One such efficiency gain has been the introduction of the Dual Energy X-Ray Absorptiometry (DEXA) technology and robotic cutting tools at meatworks across the country. While industry sources estimate across beef and sheep meat abattoirs the rollout of a combination of DEXA and robotic cutting is between 10-20% of throughput the efficiency gains they are achieving, particularly in terms of cut accuracy/technique and increased throughput are significant.

This is another area where MLA and representative bodies such as AMPC, AMIC and industry are working together for the benefit of the producer, the supply chain and the consumer.