Beyond China

The Snapshot

- Indonesia is the fourth most populated country in the world, with recent estimated placing their population size at 274 million, more than ten times the population of Australia.

- Their population is forecast to expand to 330 million by 2050 and the anticipated high rates of economic growth, along with falling levels of malnutrition and poverty, are set to see the country’s food consumption volumes expand significantly.

- It is estimated that by 2050 close to 75% of Indonesia’s food requirements will be supplied by imported food products.

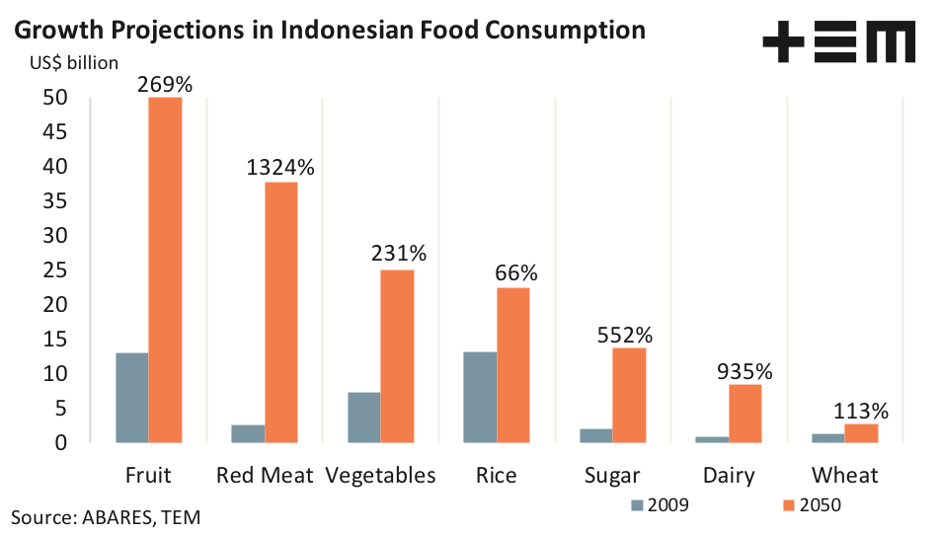

- In percentage terms, dairy and red meat consumption trends in Indonesia are expected to show the greatest growth prospects with a 935% and 1,324% increase in consumption value anticipated by 2050, respectively.

The Detail

There has been much pondering over the negative impacts to several agricultural industries caused by the ongoing trade disruptions and political argy-bargy seen between China and Australia in recent times.

While China remains a key agricultural export market, and a trade partner that we cannot or shouldn’t ignore. There are growth opportunities we can explore with other trading partners. Certainly, any media story that includes China grabs the audience’s attention as it sells newspapers and attracts web traffic.

Indonesia is the fourth most populated country in the world, with recent estimated placing their population size at 274 million, more than ten times the population of Australia. Additionally, the distribution of the Indonesian population shows that the working age group (citizens aged between 16-64) account for more than 70% of their population.

The population and wealth per capita of Indonesians is set to grow steadily over the coming decades. Indeed, the population is forecast to expand to 330 million by 2050 and the anticipated high rates of economic growth, along with falling levels of malnutrition and poverty, are set to see the country’s food consumption volumes expand significantly.

Domestically the Indonesian government have been keen to increase food security through encouraging programs to build self-sufficiency and food sovereignty. Since 2012 the value of food-based imports into Indonesia have plateaued at around US$25 billion, with Australian food exports accounting for around US$2-4 billion. However, it is unlikely that the desire for food self-sufficiency within Indonesia is consistent with being able to keep up with the forecast growth in demand for agri-food products.

It is anticipated that Indonesian regulators will have to rely more on food imports as limited land supply, agricultural resource limitations and competition between food and non-food cash crops will mean that by 2050 close to 75% of Indonesia’s food requirements will be supplied by imported food products.

Projections in Indonesian food consumption patterns outlined in a recent Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) report demonstrate significant levels of growth across key agricultural sectors where Australia holds the capacity to be a dominant supplier.

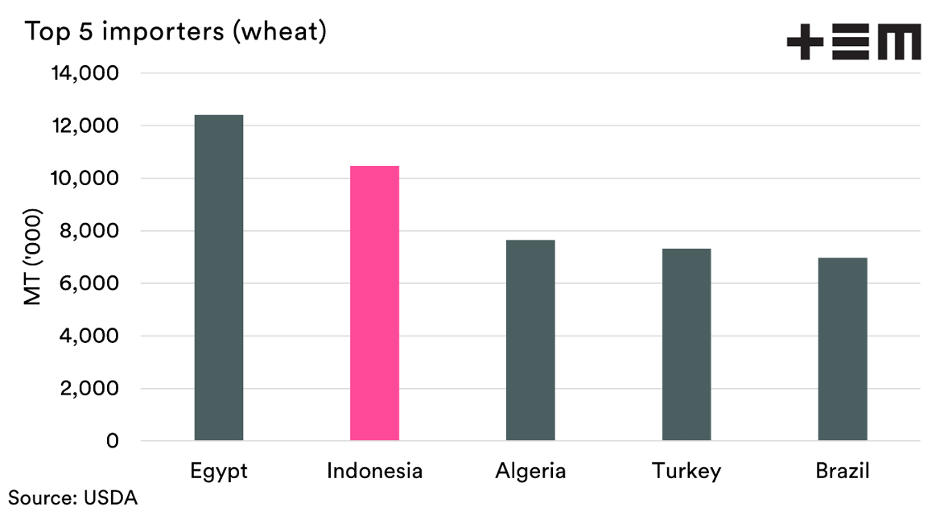

Indonesia is Australia’s largest market for wheat exports and their demand for wheat has been already on the rise. During the last half of the 2000s, Indonesia imported on average 5.6mmt of wheat per annum. During the past five years, this has jumped to 10.5mmt and places them as the second largest importer of wheat behind Egypt.

However, as the ABARES growth projections highlight, Indonesian wheat consumption is expected to perform relatively conservatively compared to other food commodities, rising by just 113% by 2050. In percentage terms, dairy and red meat consumption trends in Indonesia are expected to show the greatest growth prospects with a 935% and 1,324% increase in consumption value anticipated by 2050, respectively.

Indonesia is already Australia’s largest market for live cattle exports and for beef offal product. It is estimated that 25% of the total Indonesian beef consumption is supplied by Australian live cattle exported to Indonesian feedlots. Furthermore, in terms of chilled and frozen beef exports Indonesia is our fifth largest export destination. Indonesia manages to supply the bulk of their sheep and goat meat requirements domestically at present. However, almost all of the imported sheep meat entering Indonesia, circa 1,500 to 2,500 tonnes, is exclusively sourced from Australia.

Given the important trade relationships that already exist between Australia and Indonesia, along with our close geographic proximity and the recently formalised free trade agreement between the two nations, it seems a perfect fit for Australian agricultural producers to step forward and supply the growing food consumption requirements that will be created as Indonesian citizens become wealthier and the country becomes more populous.