Market Morsel: Canola does the can-can

Market Morsel

At the moment, we have been talking a lot about fertilizer, and how it has increased massively in price. The good news is that canola, the golden crop of 2021 has continued to show the goods.

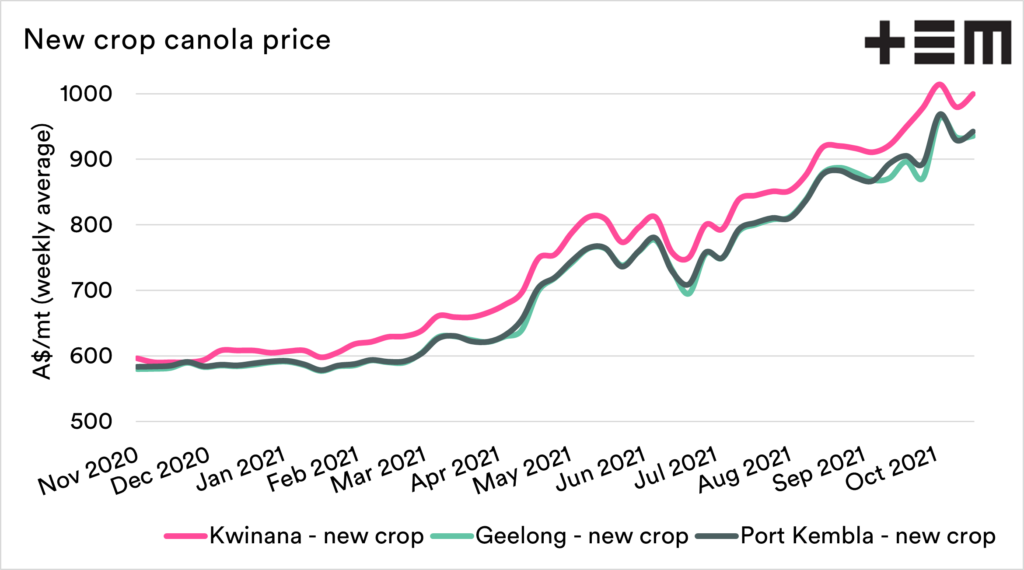

It’s remarkable to think that at seeding pricing was at a historically strong pricing level (A$700-800), we now have pricing that despite a huge crop is trading at between A$930-1015.

The majority of this is down to the downfall in production in Canada (see here), there loss is our gain. I have been mentioning for months that pricing this year is largely shorting itself out – there was nowhere else to replace Canadian canola but us.

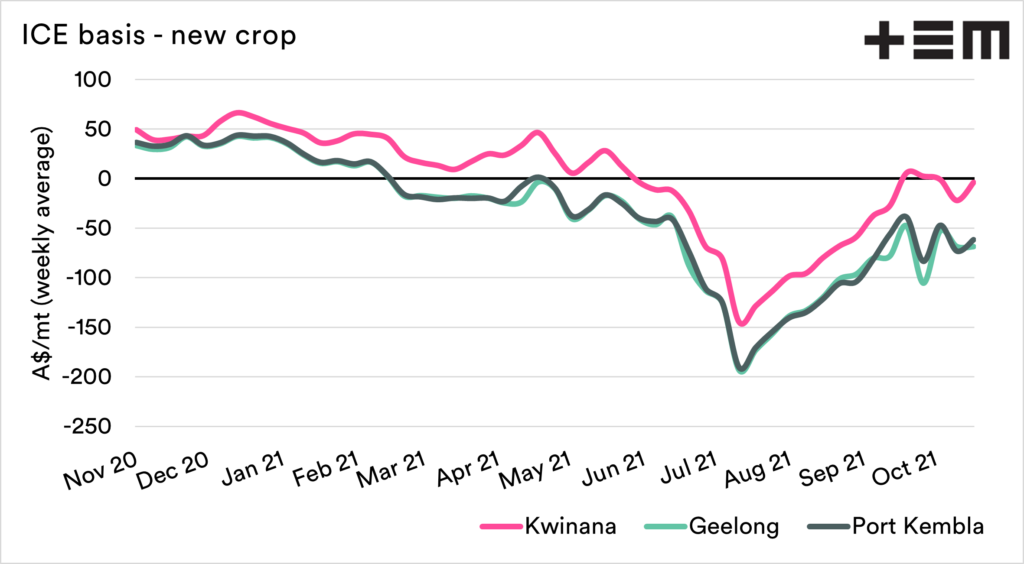

In recent times we have sen our basis level to ICE futures have improved. Normally we trade at a premium to Canadian futures, as scarcity hits in Canada they have been receiving a drought premium. In recent weeks we have moved closer to parity (especially in the West).

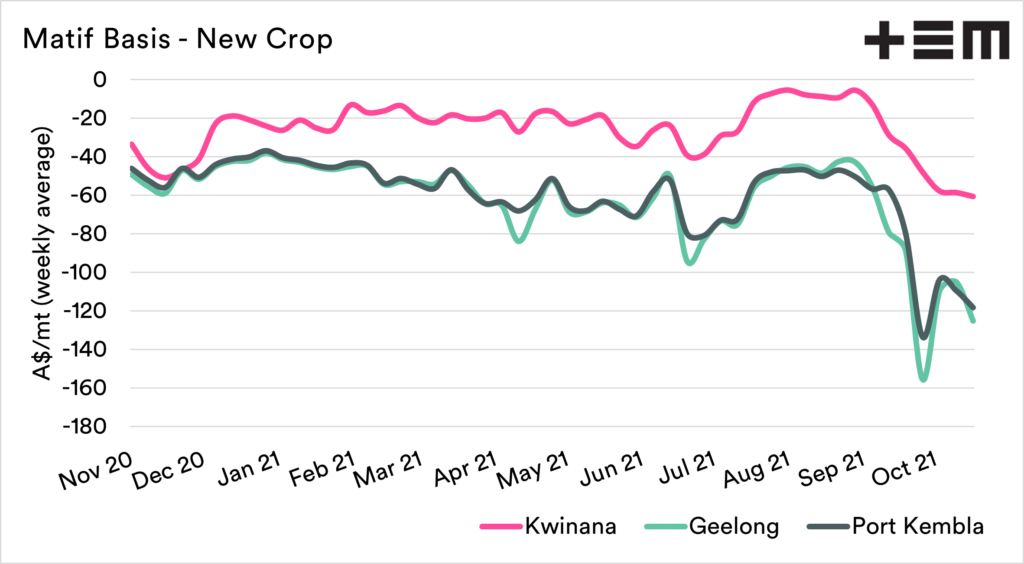

We normally trade at a discount to Matif, in recent weeks we have see our discount get worse. The discount is now incredibly large compared to history.

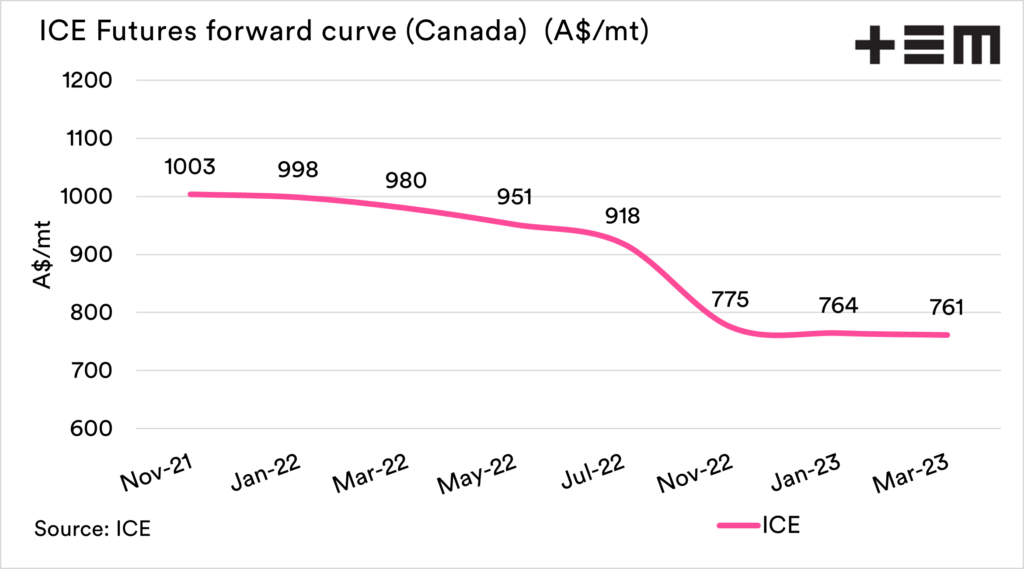

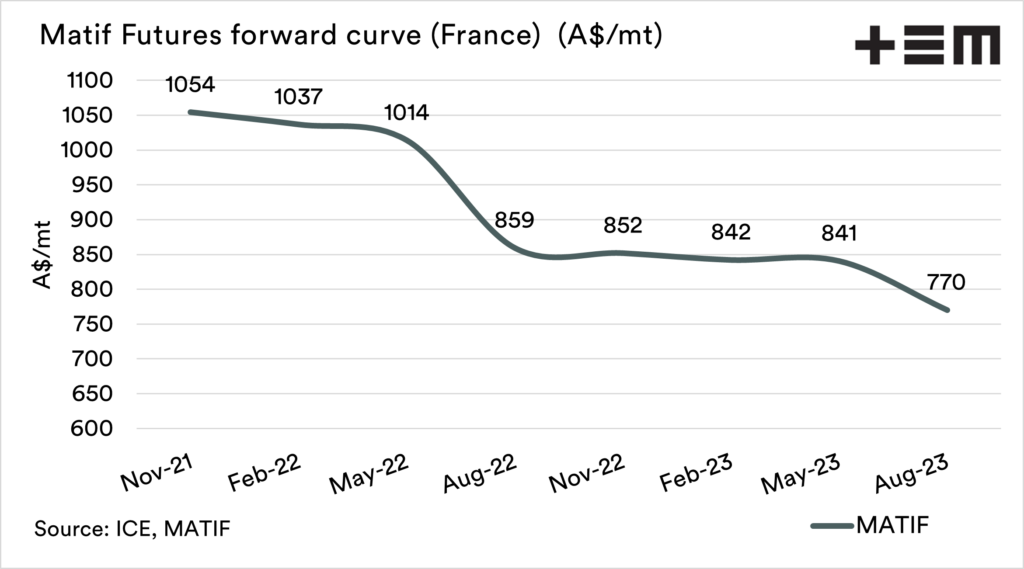

The good thing is that the forward curve remains attract for hedging for next year, as per our previous discussions on the forward curve (here & here). The prices for this year are in place, now its time to start thinking about the future, whilst obviously thinking about production.

All in all, a golden time for Canola.