Market Morsel: Gravity weighs on oilseeds

The Snapshot

- Oilseed markets have taken a downward trend this week.

- Rainfall in the US is beneficial for the crop.

- Canola futures overseas have dropped in line with the move south in soybeans.

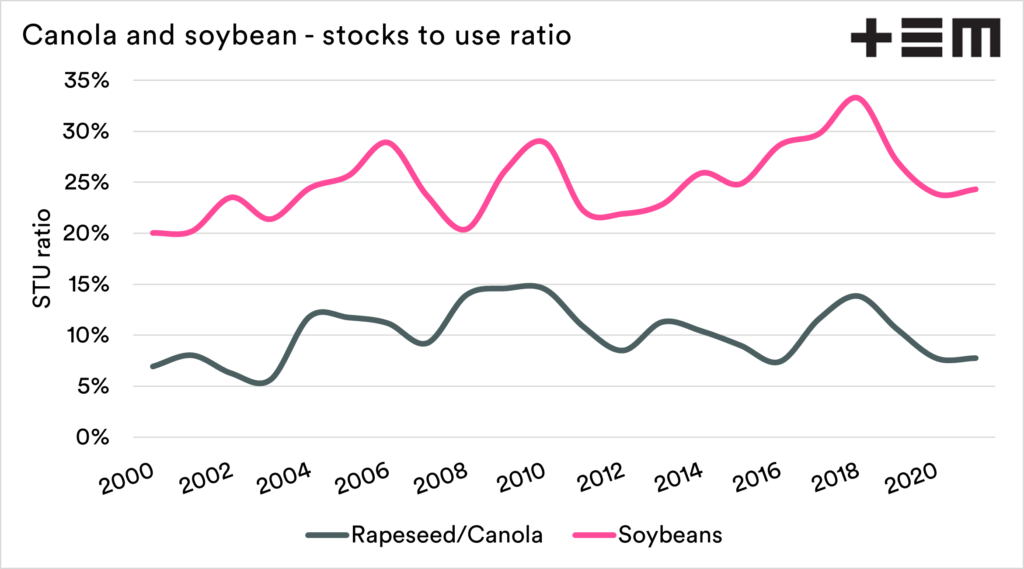

- Overall stocks for canola and soybeans are on the tighter side compared to recent years.

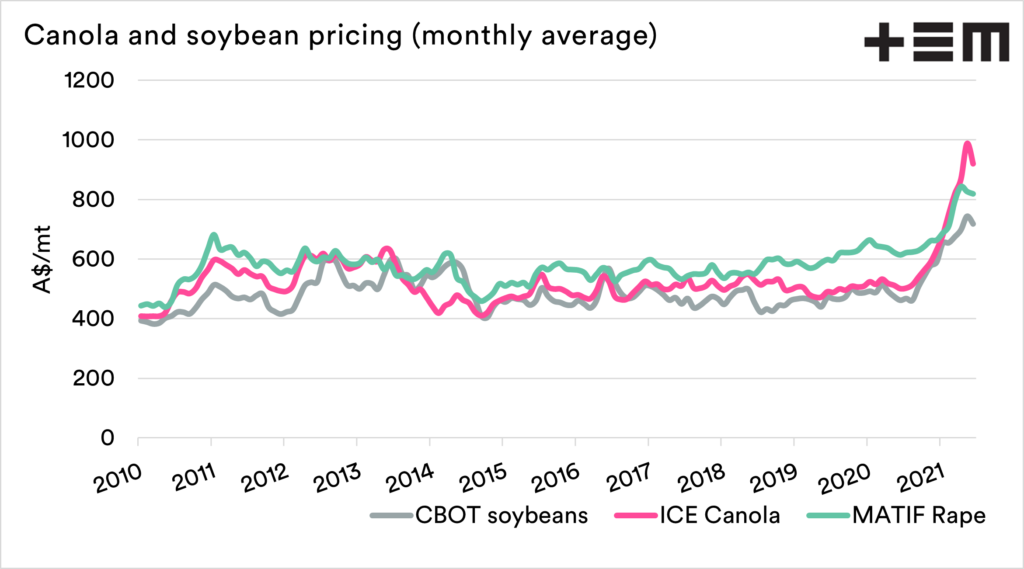

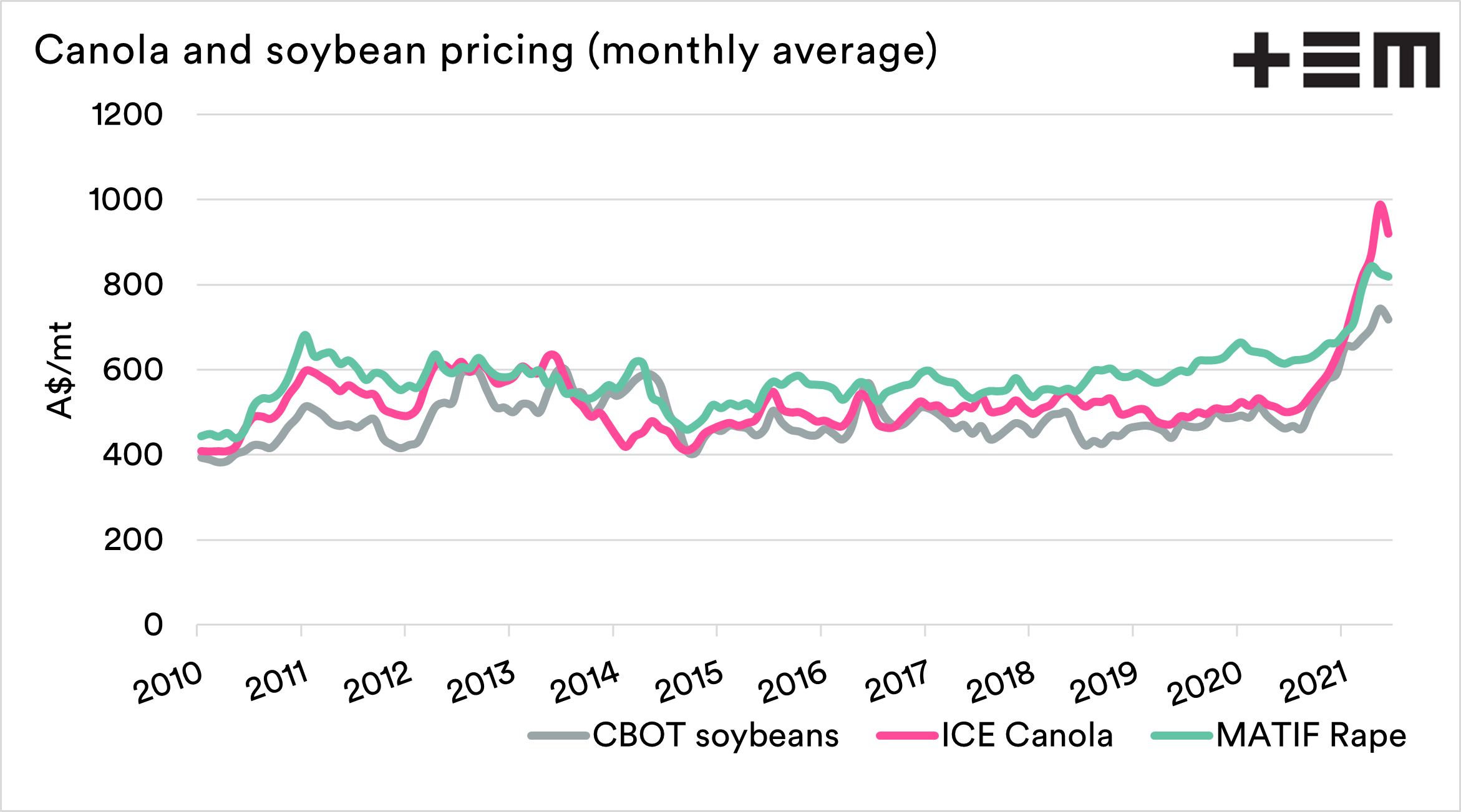

- At present canola prices are still strong in Australia compared to recent years.

The Detail

The oilseeds market has been on fire in recent months. In the past week, the market has started to give back some of its gains.

The chart below shows the monthly average price for CBOT soybeans, ICE canola and Matif rapeseed converted to A$/mt from 2010 to the present.

As we can see the current levels are well above the range typically experienced. This is providing the impetus for growers to plant as much canola as possible (see here & here).

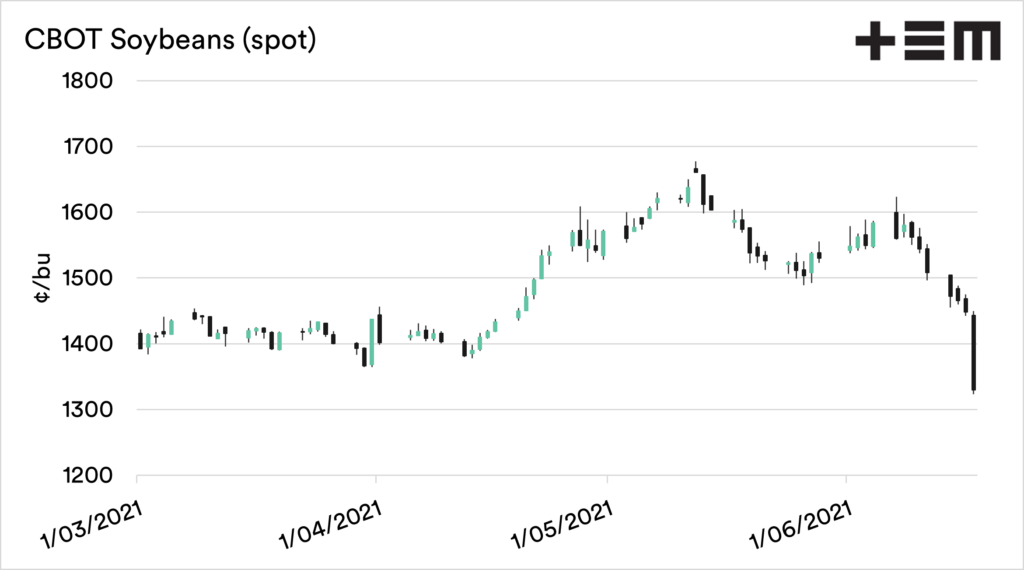

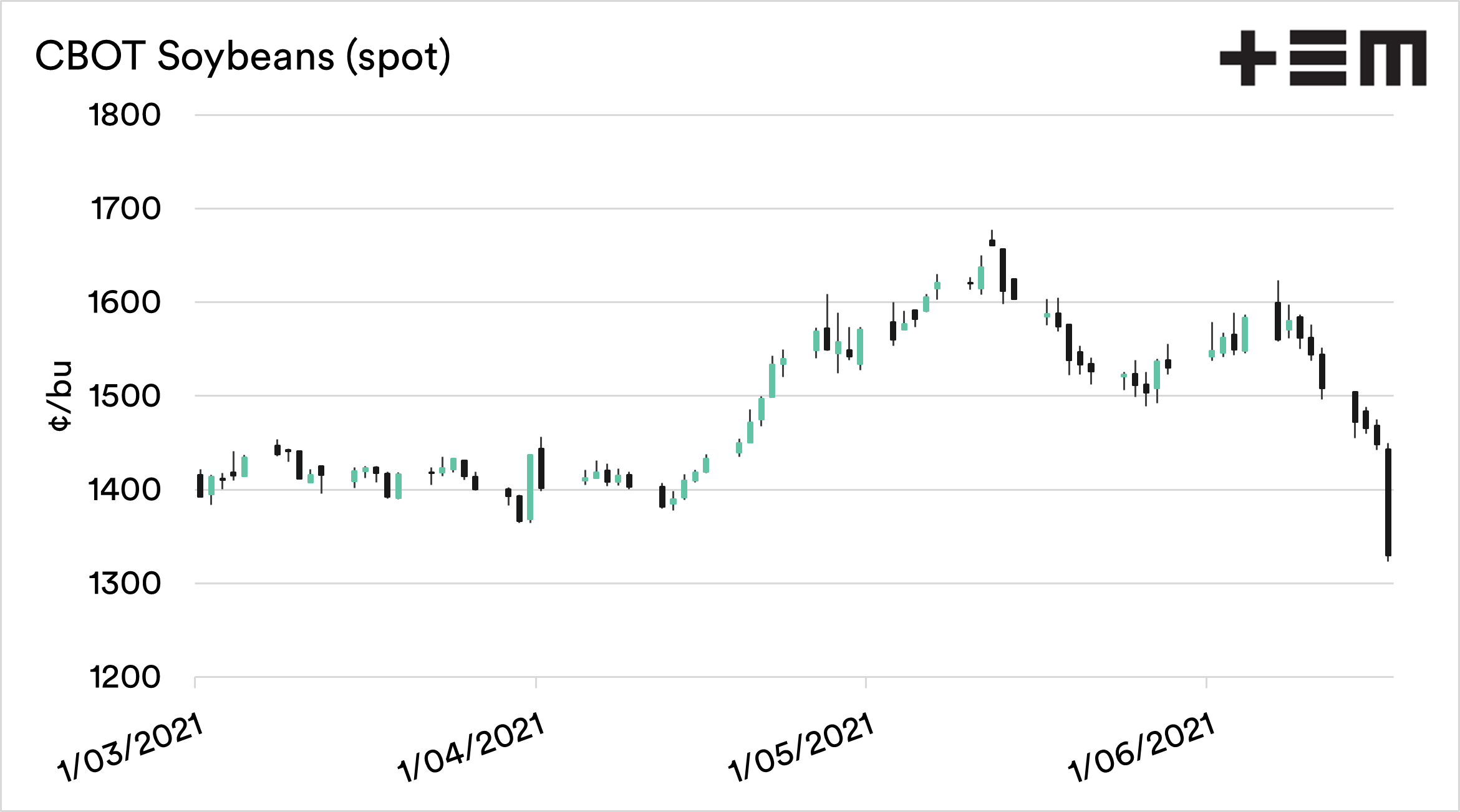

The oilseed market took a tanking in recent days. The most important oilseed – soybeans, have lost 14% since the start of the month on the spot contract.

This is concerning as even though we don’t produce large volumes of soybeans, the oilseeds act in a close relationship with one another.

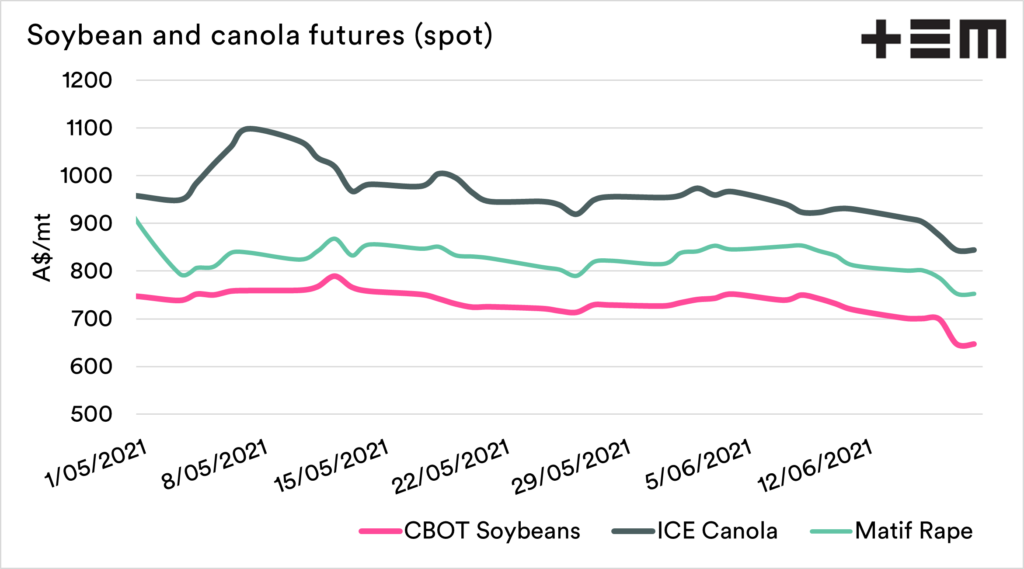

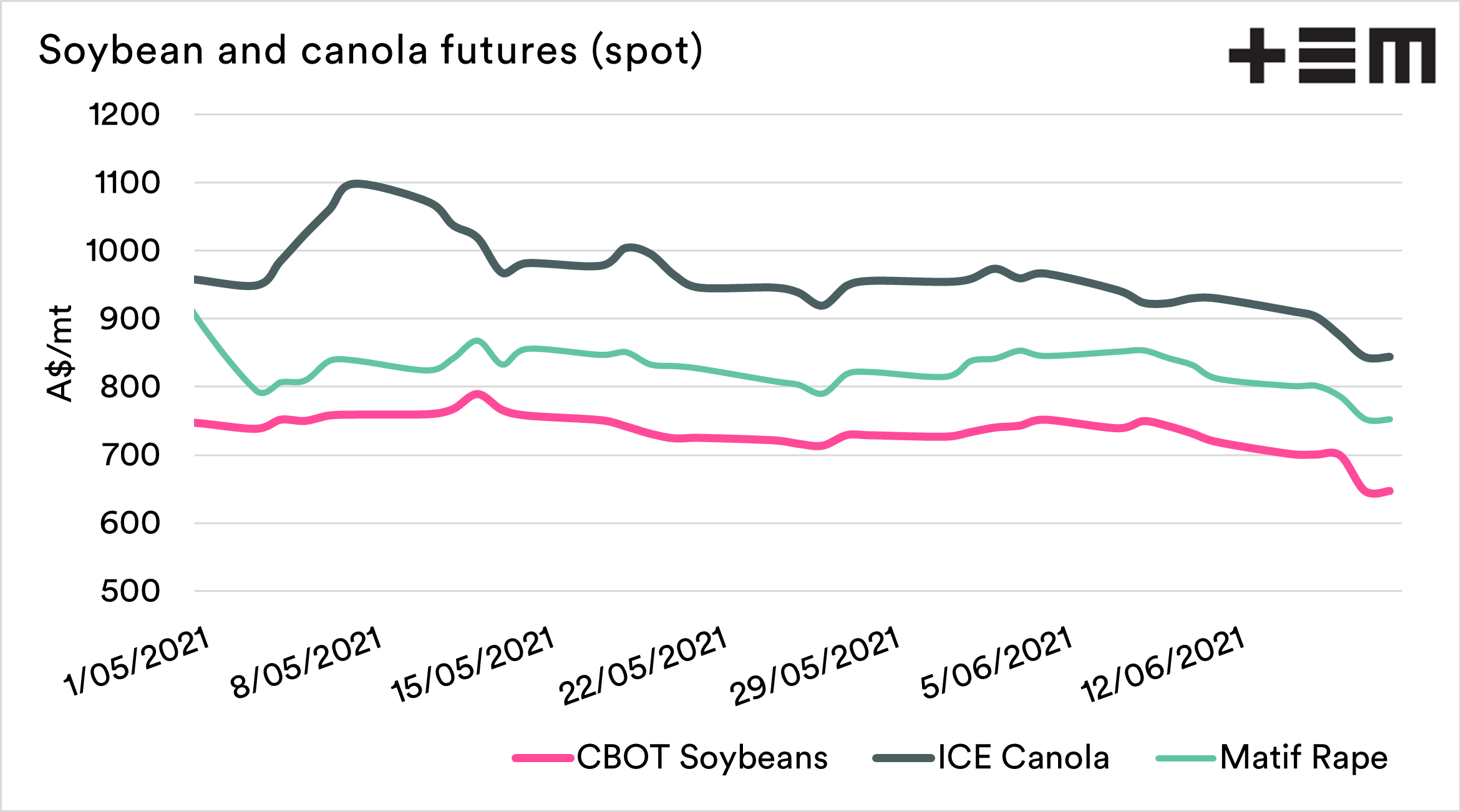

The chart below shows the daily price (in A$/mt) for canola/rape and soybeans since the start of May. There is a clear relationship between the two. In recent days the values of the overseas futures have started to come under the same pressure as soybeans.

This is a concern as we still have a considerable period of time before we have full certainty on the canola crop to make larger sales. However, the conditions in Western Australia can allow for a little more selling.

What is driving the fall?

High prices are the cure for high prices. Almost all commodities have been on the way up in recent months, in the past couple of sessions there has been a bit of a sell off in commodities.

The old chestnut of speculators taking profits are likely part of the recent downward trends. We will see further reductions in speculators net long in a range of commodities this week.

As I frequently discuss (see here & here), the period June-August is when most of the world’s crops are produced. This leads to a more volatile environment.

During this period, the market is on tenterhooks, a rainfall event in the US will drop prices, and a hail storm in France will boost them.

This week weather forecasts are beneficial for the US crop, which has been a bearish factor. It is going to be a really interesting few weeks, as whilst prices have fallen – the reality is that stocks are still tight for both canola and soybeans.