Wheat futures jump to A$370/mt for harvest

The Snapshot

- Wheat and corn have been strongly linked in recent months.

- For a time, corn was trading at a premium to wheat.

- This has sharply corrected and is back to a discount – where it typically trades.

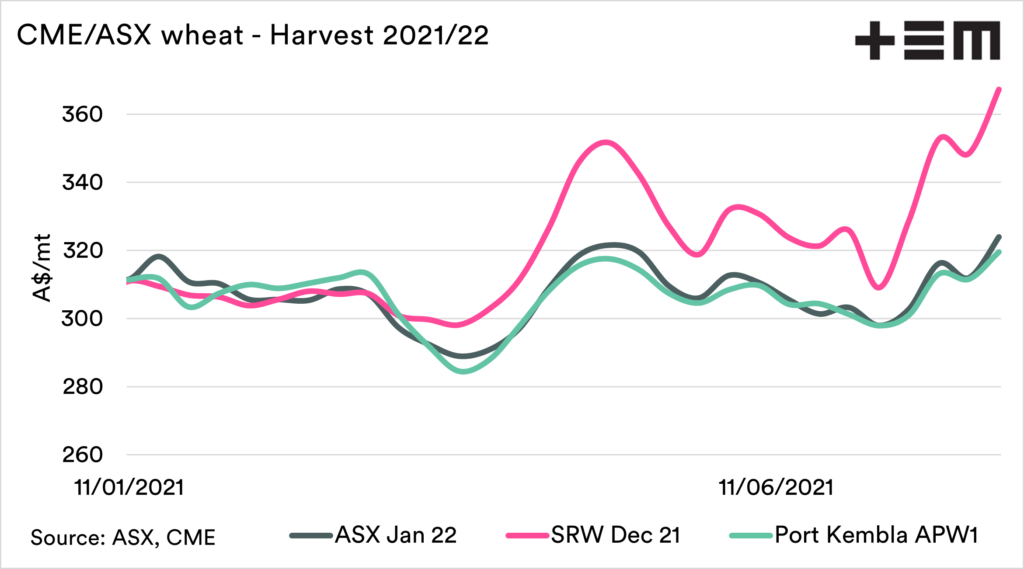

- CBOT wheat hit just below A$370 in recent days for the coming harvest.

- The spring wheat crop in the US & Canada is too far gone to recover.

- Russia wheat production has been downgraded.

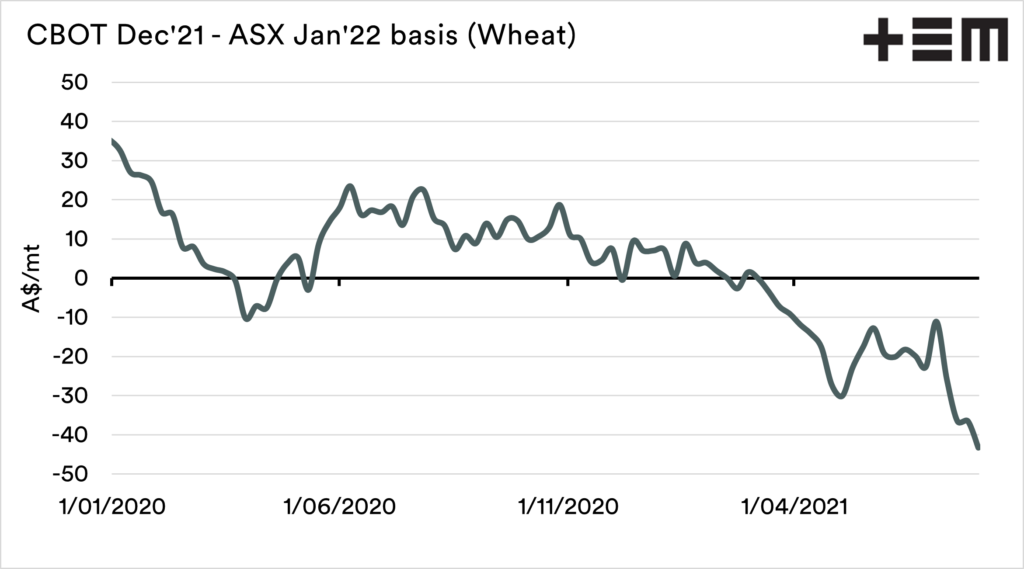

- Our basis level continues to trade at a discount to overseas values.

The Detail

Over the past year, we have written at length about how the wheat market has really been a corn market (see here, here & here). This was due to the fact that it was bullish factors within the corn supply and demand picture which were producing the force behind our wheat moves.

CBOT wheat for the coming harvest hit just below A$370/t in recent days. An attractive pricing level.

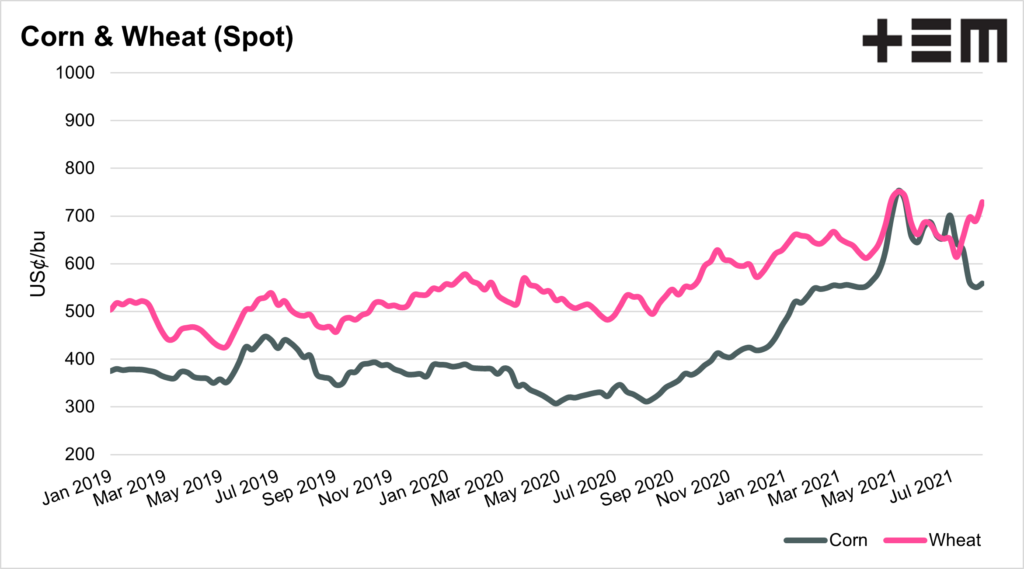

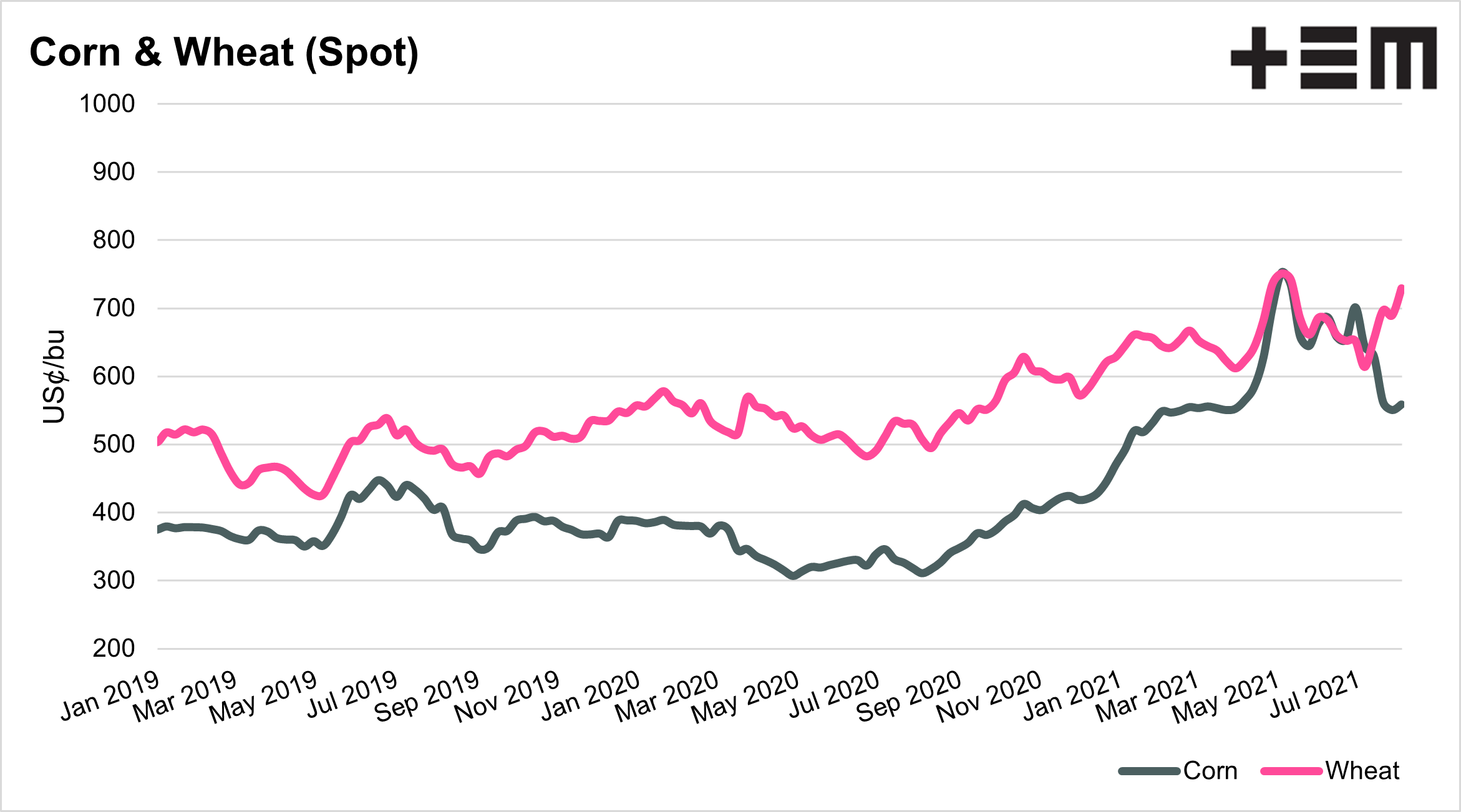

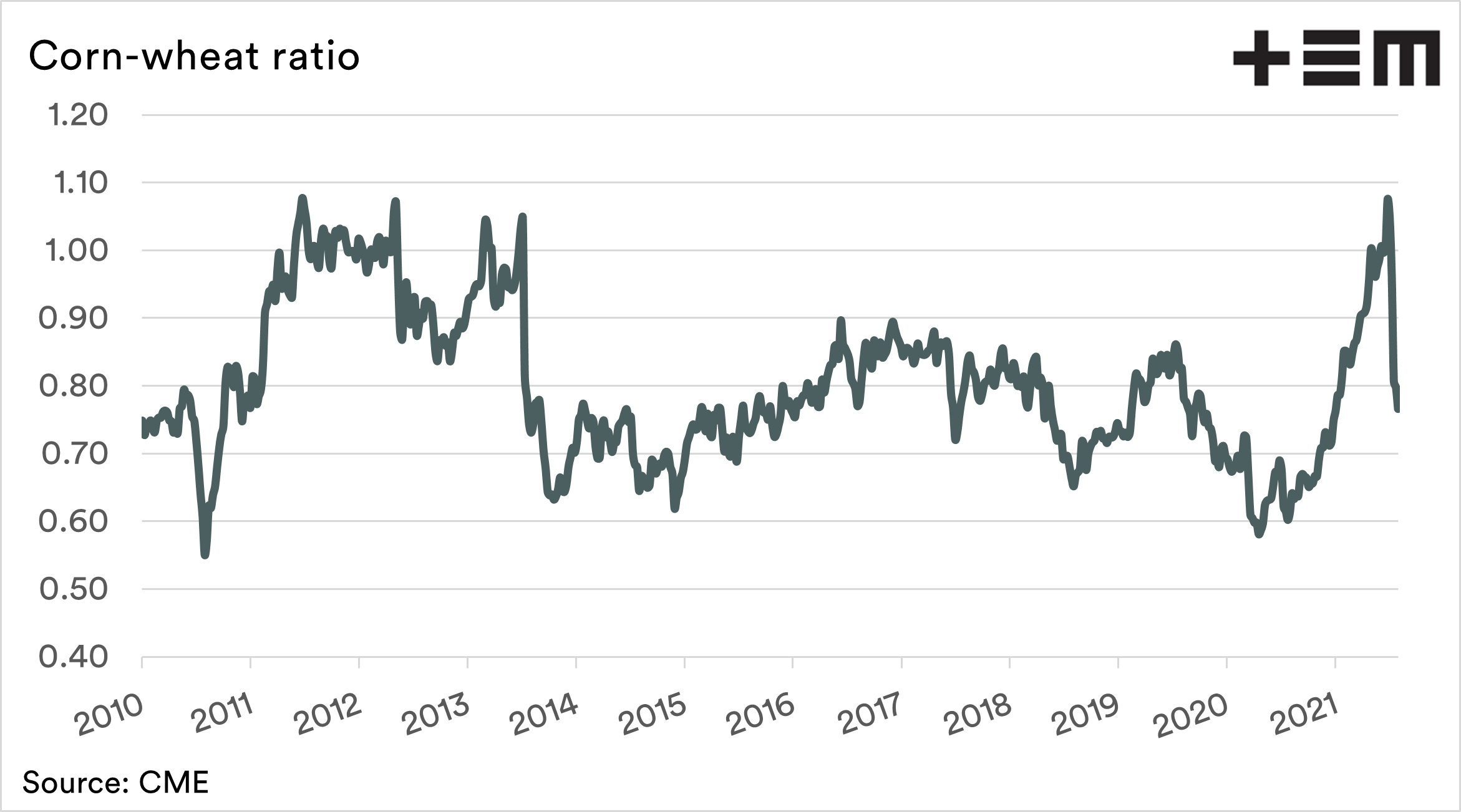

The market is starting to get a little more focus on what is happening in wheat. The chart below shows the corn and wheat futures price. The spread between corn and wheat has started to narrow in 2021 to the point that they were at parity.

This makes corn expensive from a feeding point of view, as it doesn’t hold the same nutritional benefits as wheat.

During July, the spread has started to widen compared to recent months.

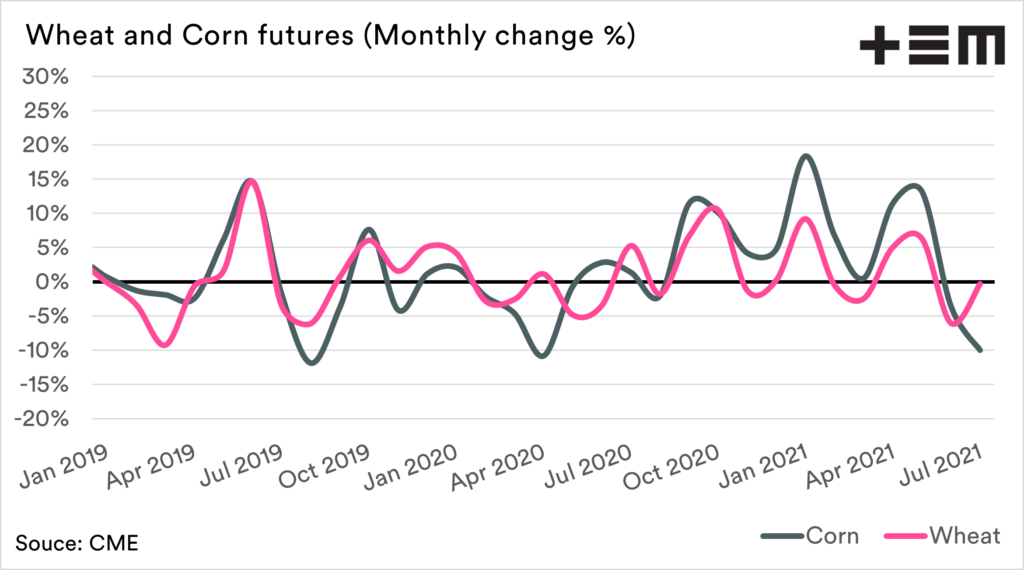

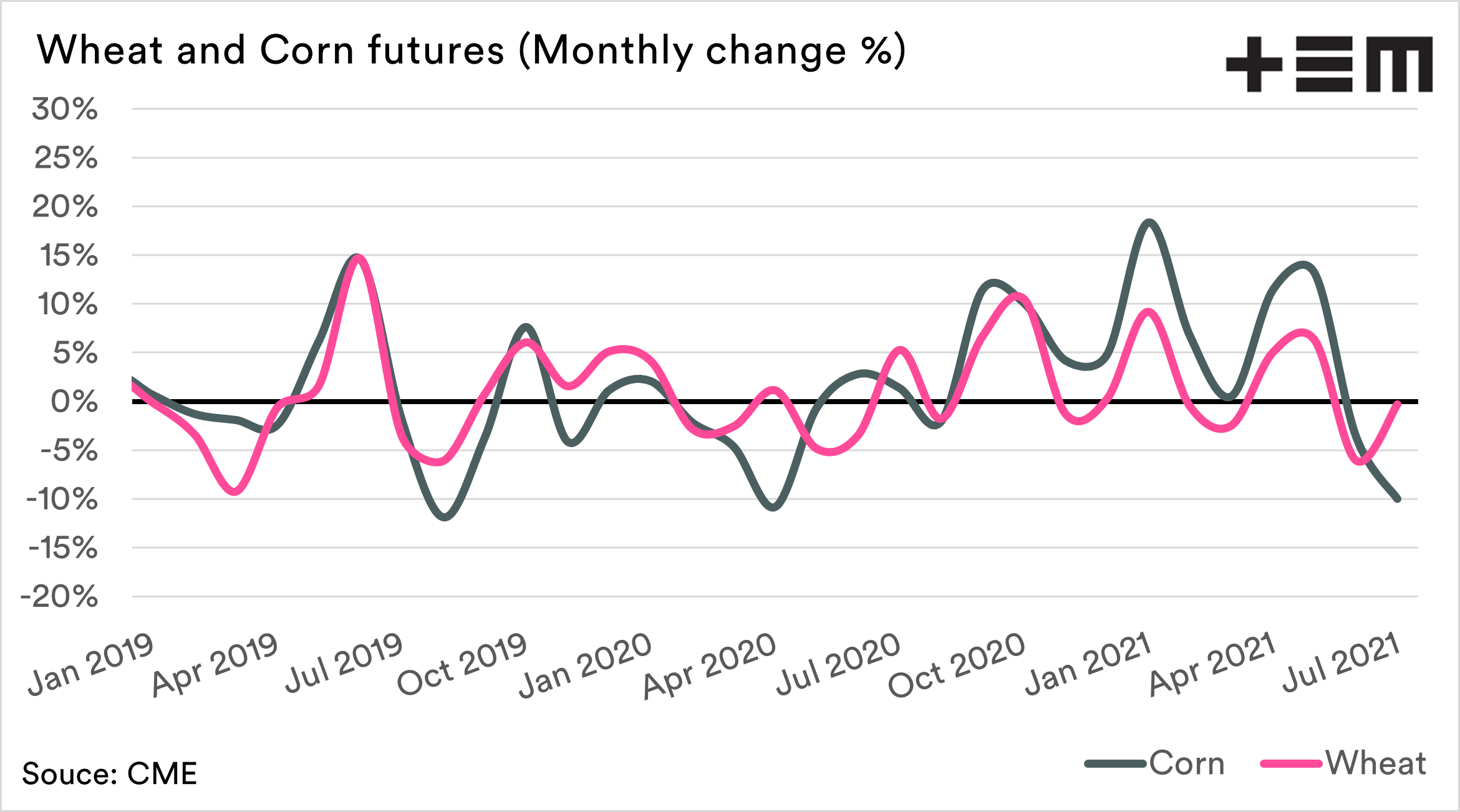

The chart below shows the percentage change in price on a monthly average basis. During July corn fell 10%, whilst wheat pricing on average was unchanged.

The result has been that the ratio of corn to wheat has dropped significantly. A quick downward movement, one which has been experienced in the past when corn gets too expensive.

The wheat market is taking the front seat at the moment, as concerns continue to be elevated about the US spring wheat crop, and conditions in Canada. Concerns which we have been raising for months in numerous articles.

The next pillar is Russia; they have crashed out. The wheat crop was estimated at 82.3mmt in July but has subsequently been reduced to 76.4mmt by our contact in Russia (read here). This points to a situation where supplies are starting to get a little thin on the ground.

What does it all mean for Australian prices? Our market is heavily influenced by events overseas, especially in times of surplus production. The market is pricing in a big crop in Australia, and this has meant that our basis (premium/discount) to overseas futures has diminished further in recent weeks.

The good thing is that prices overseas are keeping everything attractive at a flat price level whilst basis remains very low.